Friend.tech beats Uniswap and Bitcoin network; Binance allegedly limits withdrawals in Europe; Vitalik Buterin transfers Ethereum to Coinbase

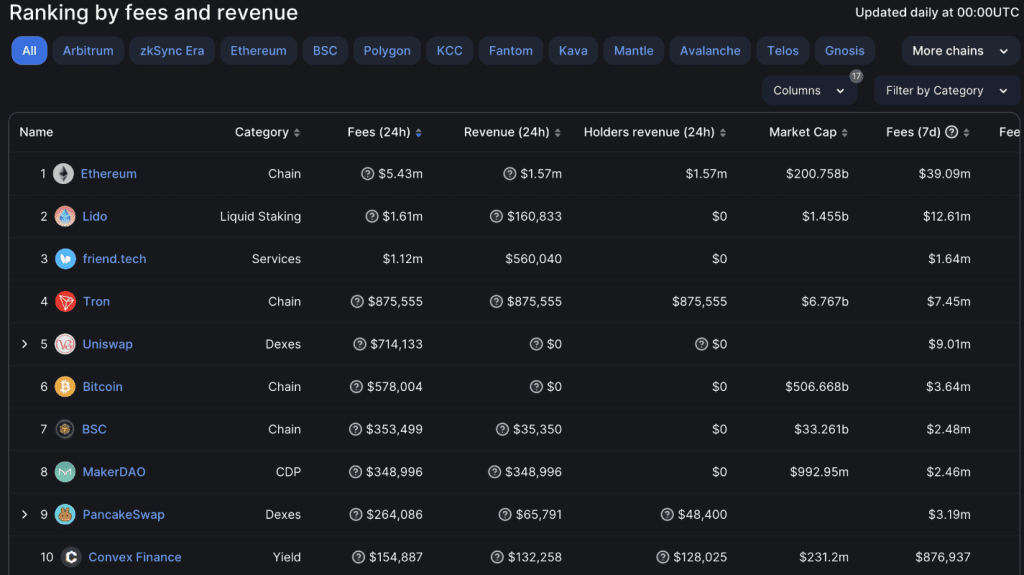

The recently launched decentralized social networking project Friend.tech generated over $1 million in transaction fees in 24 hours on August 19th. In terms of transaction fees, the recently popular project surpassed major players in the crypto ecosystem, including Uniswap and Bitcoin network.

The platform launched in beta on August 11th. Friend.tech allows users to tokenize their social networks by buying and selling shares of their connections. This allows a person who buys someone else’s shares to send private messages to each other. The protocol is known to charge 5 percent on transactions.

The platform, built on Coinbase’s layer-2 network Base, has seen remarkable activity. According to DefiLlama’s data, Friend.tech generated $1.12 million in transaction fees within 24 hours and $2.8 million since its launch. On its social platform, more than 650,000 transactions took place, involving more than 60,000 unique users. Total project revenue exceeded $800,000.

The pseudonymous developer Racer is believed to be behind the project. According to a senior software engineer at Coinbase, Racer previously created the TweetDAO and Stealcam social media networks, both based on NFTs. With this platform, Racer targets crypto content creators with a large fan base to earn royalties from trading fees. Racer also aims to bring venture capitalists and Web3 projects into its ecosystem.

The social platform’s emerging revenue model has also sparked analysis of the risks and the future of the project. Decentralized finance researcher Ignas noted that in Friend.tech’s current business model, revenue only comes from trading fees, not from having more shareholders.

Talk.Markets founder Lux Moreau also pointed out that as shares are sold, their price increases significantly, potentially incentivizing smaller groups or sub-group formations on the platform.

Binance allegedly limits withdrawals in Europe

Binance customers are allegedly having problems with fiat withdrawals in Europe due to problems with “Euro Payment Area” (SEPA) transfers.

In a message posted on X on August 20 (which has now been deleted), Binance’s customer service stated that the exchange had suspended euro withdrawals and deposits via SEPA.

In the now-deleted message, the exchange said there was no specific timeframe for reinstating SEPA transfers, adding that the payment provider “will no longer support these transactions.”

“We understand the inconvenience this has caused and are actively working to resolve this as soon as possible.”

Binance customer service’s response came in response to a customer complaint. The Binance user complained that due to the closure of his Paysafe account, he was unable to withdraw his euros to his bank account and sell them on Binance. The customer said the following:

According to customer support, there is nothing I can do but wait for Binance to find a new payment provider. What you would expect, not from Binance but from fraudulent exchanges, is to allow users to buy EUR to prevent them from accessing it immediately afterwards.

Binance’s current euro banking partner, Paysafe Payment Solutions, announced a few months ago that it would stop supporting the cryptocurrency exchange.

“Users will need to update the banking information they use to fund their Binance accounts and may need to accept new terms and conditions of use to continue using SEPA services after that date,”

In a written response to Cointelegraph, Binance said that the customer support message on X was sent in error and emphasized that SPA’s deposit and withdrawal service will continue until September 25, as originally reported.

Binance’s withdrawal problems in Europe have been ongoing for a long time. Last May, the exchange halted Bitcoin withdrawals due to a large backlog of withdrawals.

Vitalik Buterin transfers Ethereum to Coinbase

Ethereum co-founder Vitalik Buterin transferred a large amount of ETH to the Coinbase exchange during the day. It is not yet known why this transaction took place.

According to Etherscan, which uncovers transactions and data for the Ethereum network, ETH was transferred from Buterin’s wallet to Coinbase about 22 hours ago. 1 million dollars worth of ETH will be used for what purpose on the exchange is a matter of curiosity.

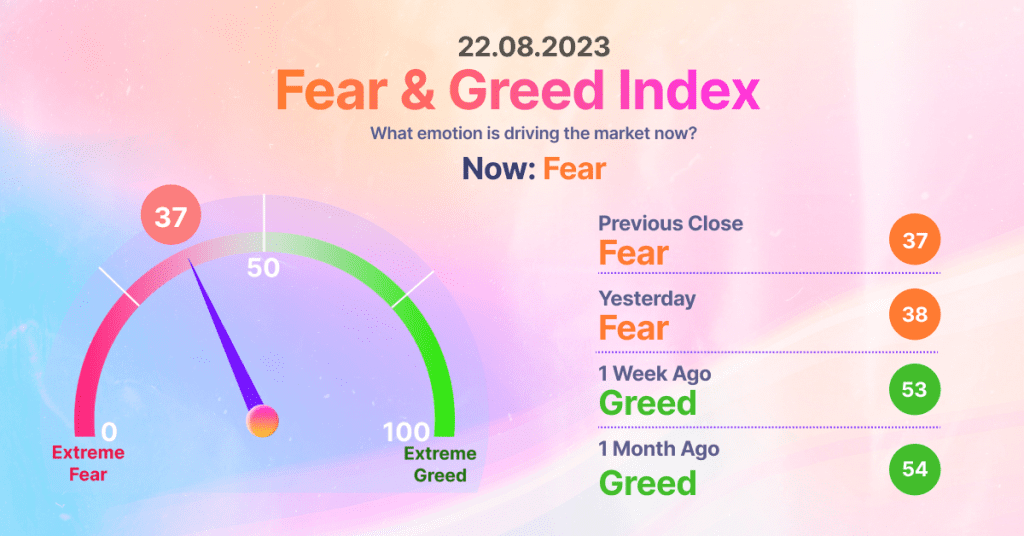

While the behind-the-scenes of the 600 ETH transfer has not yet come to light, it was noteworthy that the transfer came at a time when the crypto market was moving downward. As it is known, the crypto market has experienced strong declines in recent days. It was observed that there were money outflows from crypto exchanges and BTC fell close to 11 percent. Buterin’s transfer did not escape the attention of the crypto community.

ETH has fallen nearly 10 percent in the last week. ETH’s price during the day is moving at the level of $ 1,700. The decline in the volume of cryptocurrencies and the outflows of money from exchanges form the basis for the bad course of the market. Buterin may be aiming to support liquidity with the ETH he sent to Coinbase.