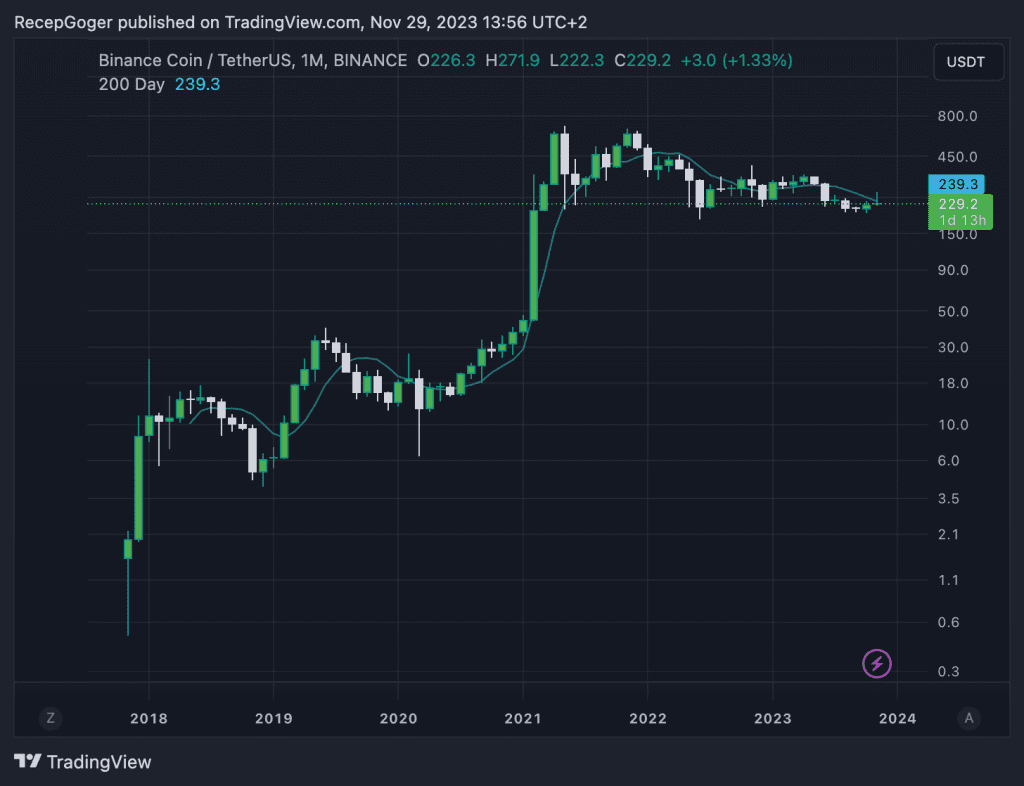

BNB coin, formerly Binance coin, is both the native service coin of the Binance platform and the native cryptocurrency of the BNB chain. BNB coin was launched via an initial coin offering (ICO) in 2017, 11 days before the Binance platform began its online operations.

BNB coin was initially issued as an ERC-20 token on the Ethereum network. BNB coin got its own chain structure in April 2019 with the launch of the BNB Beacon chain, and later the BNB Smart chain, powered by the Ethereum virtual machine.

What is BNB Coin (BNB) and BNB Smart Chain?

BNB Coin is both the service coin of the Binance platform and the native cryptocurrency of the BNB Smart Chain (BSC). Decentralized applications can be easily created on the BNB Smart Chain, which supports the Ethereum Virtual Machine. The BSC network uses the Proof of Stake consensus algorithm.

BNB Coin & BSC Network Benefits

In addition to the short transaction times on the BSC network, the low transaction fees allow many projects and protocols to be launched on the network. BNB Coin can be used for staking to pay transaction fees and run nodes within the BSC network.

In addition, BNB Coin holders can enjoy many benefits such as participation in special events and commission discounts through the Binance platform. Exchange users pay less trading fees on the platform if users hold BNB coin.

In this case, the BNB coin seems to be part of both centralized and decentralized finance, and there is no other example of this yet. Therefore, it may be difficult at first to understand that one coin is both the local coin of the BSC network and the local coin of the Binance exchange.

Who are the Founders of the Binance Platform and the BNB Coin?

The Binance platform and BNB Coin were founded in 2017 by Changpeng Zhao (CZ). BNB Coin made its first crypto money supply with a price of USD 0.11.

BNB Burning

The platform is burning BNB Coin up to 20% of its annual profit amount. This burning process will continue until the total supply remains at 100,000,000 units. This process is designed to reduce the supply of BNB Coin (BNB) in the market.

When BNB was first released, the total supply was 200 million units. Now the total supply is almost 150 million units. There are still 50 million BNB left!

What makes BNB Coin (BNB) special?

BNB Coin has a wide range of usage because it is the service token of the Binance platform and the native token of the BSC network. Used to access many cryptocurrencies within the BSC network, BNB Coin is also the network’s local cryptocurrency.

BNB Coin also offers its users benefits such as commission discounts and participation in special events on the Binance platform.

Binance and Regulation

After Binance began operations in 2017, it became one of the largest players in the crypto space, dominating the industry. By 2021, the exchange held more than 80% of the market share. However, in 2021, regulatory challenges against Binance emerged in a remarkable way. Binance faced regulatory action from a number of jurisdictions in 2021, including the Cayman Islands, Japan, Malta, the Netherlands, Malaysia, the UK and Thailand.

| Rank | Centralized Crypto Exchanges | Market Share (%) |

|---|---|---|

| 1 | Binance | 43.9% |

| 2 | Upbit | 11.5% |

| 3 | HTX | 7.8% |

| 4 | Coinbase | 6.8% |

| 5 | Bybit | 6.7% |

| 6 | OKX | 6.0% |

| 7 | MEXC | 5.0% |

| 8 | Gate | 4.7% |

| 9 | Bitget | 3.9% |

| 10 | Kraken | 3.8% |

For example, in June 2021, the UK Financial Conduct Authority ordered Binance to cease all regulated activities in the UK because it did not have the necessary authorisation, registration or license. Similarly, the Malaysian authorities responded the following month by filing a criminal complaint against Binance for operating as an unlicensed virtual asset service provider (VASP).

Binance vs SEC

The US government reported that Binance, the world’s largest cryptocurrency exchange, will pay a total of $ 4.3 billion in fines for violating anti-money laundering and sanctions laws.

In a statement from the US Treasury Department, it was noted that crypto exchange will pay a penalty of $ 3.4 billion under the agreement with the Financial Crimes Enforcement Unit (FinCEN) and $ 968 million under the agreement with the Office of Foreign Assets Control (OFAC).

Binance accepted the charges

US Attorney General Merrick Garland also stated that Binance admitted that crypto exchange deliberately committed the violations in question, emphasising that the approximately $ 4.3 billion that exchange will pay is one of the largest fines ever imposed.

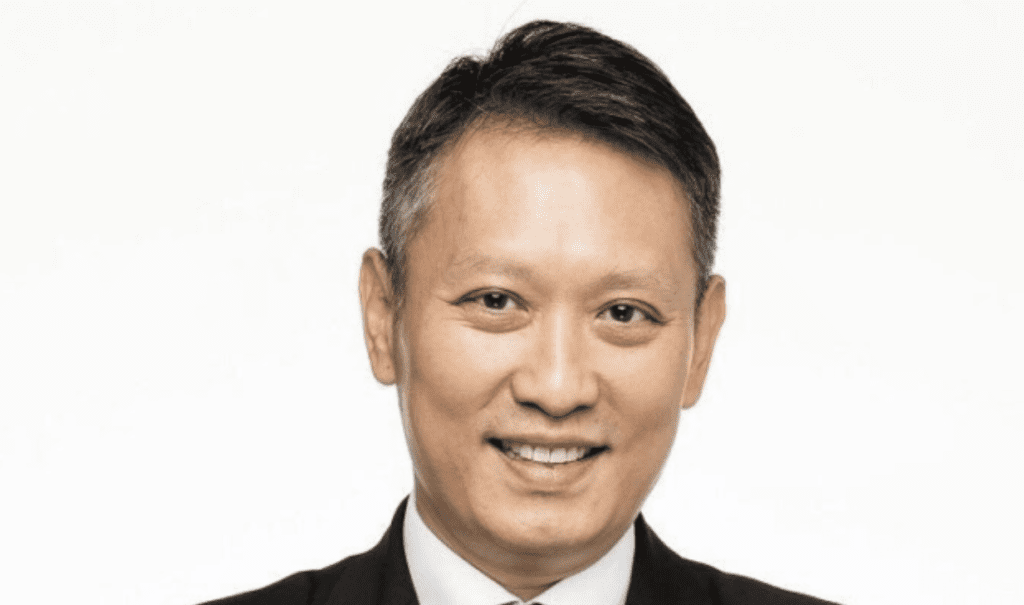

Binance’s new CEO is Richard Teng

On the other hand, Binance CEO Zhao, who was born in China and immigrated to Canada at the age of 12, agreed to resign under the agreement and pay a fine of $ 50 million.

In a post on his X account, Zhao announced that he left the company’s CEO in the best way for Binance and himself, stating that he made mistakes and should take responsibility.