Circle was allegedly working with Justin Sun: Circle denied the allegations; IOTA rises 43% after receiving approval in Abu Dhabi; Australians Embrace Cryptocurrency in DIY Retirement Portfolios

According to a statement shared by Circle, the company denied allegations of illegal financing and links to Tron founder Justin Sun. A non-profit watchdog organisation accused Circle of being linked to Sun.

The letter was addressed to US senators Elizabeth Warren and Sherrod Brown and signed by Circle CSO Dante Disparte.

Disparte said in the letter that they were aware of the allegations about USDC issuer. Disparte stated that Circle “does not directly or indirectly aid or finance Hamas (or any illegal actor)”. It also claimed that it does not “bank” or provide financial services to Justin Sun.

Disparte denied the allegation that financial services company facilitated “a large flow of funds to Hamas or Hezbollah”. In the letter, he stated that only $160 was transferred to illegal wallets, none of which was sent from Circle.

Disparte also claimed that Circle stopped providing services to Justin Sun in February 2023, saying:

“Neither Mr. Sun nor any entity owned or controlled by Mr. Sun (including the TRON Foundation or Huobi Global) currently has an account with Circle. To date, the US government has not designated Mr. Sun or his entities as Specially Designated Nationals. However, Circle terminated all accounts held by Mr. Sun and his affiliates in February 2023.”

Circle’s letter appears to have been sent in response to a 9 November letter from the non-profit Campaign for Accountability (CfA). CfA’s letter alleged that Circle had extensive ties to Justin Sun’s Tron Foundation and major Wall Street investors, and that Sun’s cross-chain protocol SunSwap was often used for money laundering.

IOTA rises 43% after receiving approval in Abu Dhabi

IOTA, an open-source distributed ledger and cryptocurrency focused on the Internet of Things (IoT), experienced a 43 percent increase on 29 November after the Iota Ecosystem DLT Foundation was established and approved in the UAE capital Abu Dhabi. IOTA thus became the first DLT organisation regulated by the Abu Dhabi Global Market (ADGM).

According to press releases by the project, the foundation was allocated $ 100 million of IOTA for a four-year period. These developments led investors to turn to the asset.

Historically, the ecosystem and developer incentives provided by blockchain and DeFi protocols tend to increase the sentiment of participants.

AVAX experienced a massive rally following the announcement of the Avalanche Rush DeFi incentive programme in August 2021. A similar phenomenon was seen in the Arbitrum project.

Is IOTA’s price action another sell-the-news?

Crypto derivatives data provider Coinalyze tweeted the following IOTA chart on 30 November, noting that IOTA’s “funding ratio and long/short ratio” are at “historic lows”.

Comparing Coinalyze’s chart to a standard candle daily chart seems to reflect this dynamic, particularly the high volume candle buying on 29 November.

Australians Embrace Cryptocurrency in DIY Retirement Portfolios

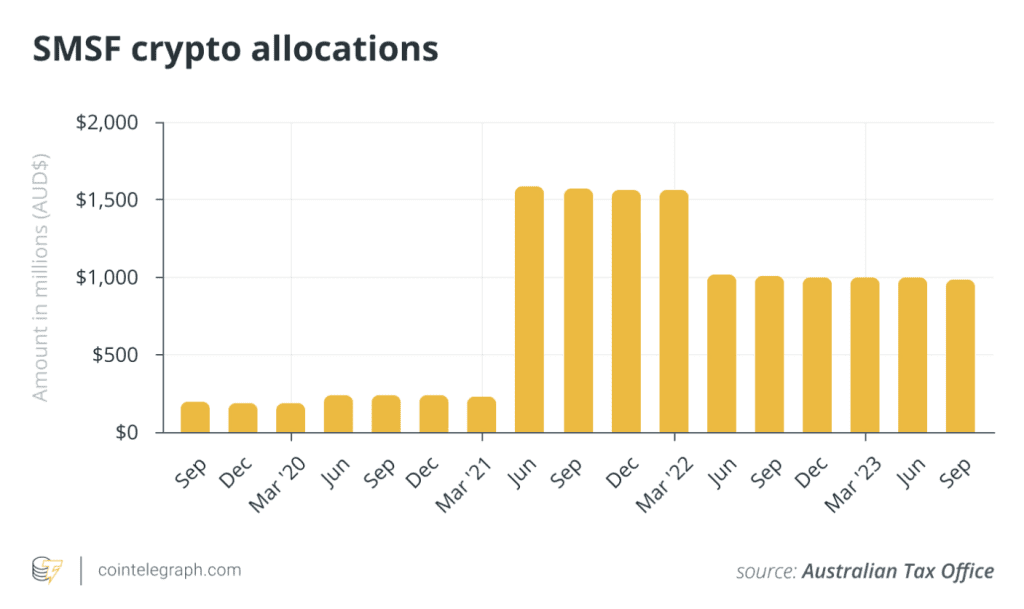

Recent data from the Australian Tax Office (ATO) reveals a noteworthy surge in Australians incorporating cryptocurrencies into their self-managed super funds (SMSFs) as a strategic move to safeguard their retirement financial landscape.

Australians are increasingly turning to cryptocurrencies to enhance their retirement prospects, witnessing a remarkable 400% surge in the allocation of self-managed retirement funds to this asset class over the past four years. Notably, this growth rate surpasses that of traditional stocks and bonds.

According to ATO statistics released on November 26, approximately 612,000 SMSFs, as of the quarter ending in September, collectively hold cryptocurrency assets valued at $658.6 million (992 million Australian dollars). This figure represents a substantial 400% increase from the corresponding quarter in 2019 when the total stood at just under $131.5 million (AU$198 million).

SMSFs and Crypto Allocation

In Australia, self-managed super funds, also referred to as private superannuation funds, grant individuals control over their superannuation fund investments. Oversight by the Australian Taxation Office ensures compliance with superannuation laws. Despite a slight 0.8% decline in total SMSF allocations to crypto from the June 2023 quarter, and a 2.4% dip from the previous year, the overall trend remains positive.

While the recent surge in crypto allocations is noteworthy, it is crucial to highlight that the current crypto holdings in self-managed funds are still 38% lower than the all-time high recorded in the quarter ending June 2021, which marked the peak of the last crypto bull cycle.

Insights from Experts

Financial analysts point out that cryptocurrency constitutes only 0.1% of total net assets held in Australian SMSFs at the close of the last quarter. Additionally, it is observed that smaller-scale SMSFs tend to exhibit a more substantial allocation to cryptocurrencies within their portfolios.

Cryptocurrency’s growing presence in super funds is expected to continue, with financial experts noting an increasing number of local crypto exchanges offering specialized crypto superannuation products. However, it’s crucial to navigate these waters cautiously, as strict rules govern holding crypto within a super fund, according to financial expert Talwar.

The Australian landscape is witnessing a paradigm shift as more individuals explore the potential of cryptocurrencies in securing their retirement futures. While the numbers reflect a positive trend, it’s imperative for investors to stay informed about regulatory nuances and adhere to the guidelines governing cryptocurrency holdings within super funds.