Bitcoin rises to $44,000; CME exchange runs to a new record in futures trading; Crypto trading volume up 75% on Robinhood

Bitcoin saw further gains with the Wall Street opening on 5 December and rose to $44,000

Bears or Bulls?

Data from TradingView revealed a new rally as Bitcoin surpassed altcoins, reaching $44,400.

The 10% increase during the week enabled the highest level to be reached since April 2022.

As noted by renowned trader and analyst Rekt Capital, the $44,000 level is the highest point of the range, which has occurred several times since the beginning of 2021.

Derivatives took the lead in the markets along with spot products. According to CoinGlass data, liquidations have taken place step by step, and at the time of writing, more than $100 million in crypto short positions have been wiped out so far.

CoinGlass also showed the recent move that saw the lion’s share of potential short liquidation levels on Binance skyrocket.

Bitcoin is unlikely to fall to $30,000

Concerns among some popular market participants focused on potential manipulatory moves by large-volume traders.

As the analysis warned earlier, these could lead to a significant wave of selling to push profits to new highs.

Another commentator, Matthew Hyland, shared RSI data to show that the upside is still there.

The daily RSI was at 80 at the time of writing. 10 points above this range could signal overbought conditions.

Chicago Mercantile Exchange (CME) runs to a new record in futures trading

At the global derivatives market giant Chicago Mercantile Exchange (CME), the total value of open positions in Bitcoin futures reached $5.2 billion, just $200 million short of its all-time high in October 2021.

According to Coinglass data, the total value of open positions in CME’s Bitcoin futures increased from $3.63 billion to $5.20 billion in 30 days. The increase in open positions was in line with Bitcoin’s 26 per cent rise over the same period.

Between 1-21 October 2021, the sum of open positions in CME exchange Bitcoin futures increased from $1.46 billion to $5.45 billion.

The rapid increase in open positions was similar to Bitcoin’s movements as it rose from $45,000 to $66,000.

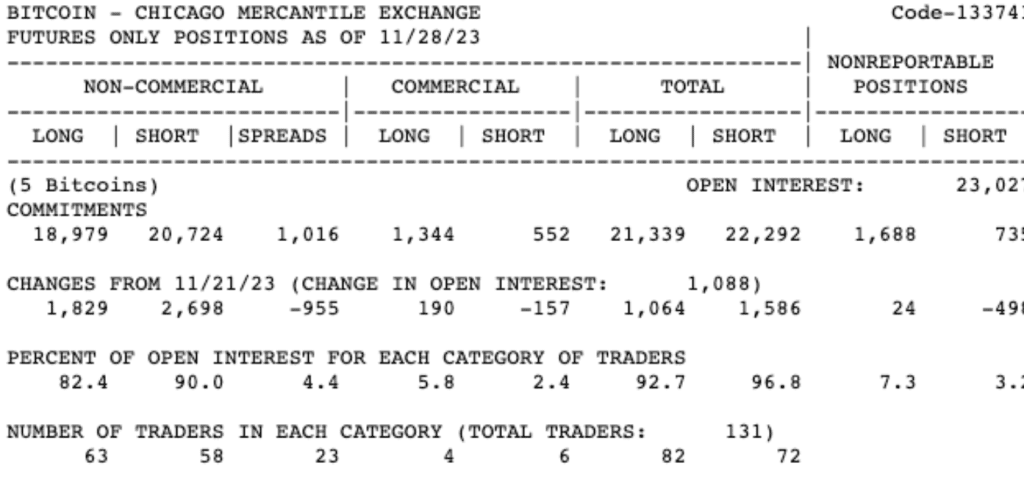

Sycamore pointed to the CME’s report to the Commodity Futures Trading Commission on 28 November, which showed that “major players” on its platform opened 20,724 short positions against 18,979 long positions.

Sycamore stated that investors will not know exactly how the players on the CME are positioned until the CME’s latest report is published on Tuesday 12 December.

However, Sycamore did not forget to add that the huge rise in the Bitcoin price was not only due to rumours about the SEC’s spot ETF approval and that there were other reasons. The decision on ETFs is expected to be finalised in early January.

Finally, Sycamore stated that the recent Bitcoin rally can be attributed more to macroeconomic events and that the US Federal Reserve’s interest rate cuts have become a more important driver for the price.

Crypto trading volume up 75% on Robinhood

Crypto-friendly trading platform Robinhood reported a 75% increase in digital asset trading volume in November compared to the previous month.

In its 8-K report filed with the United States Securities and Exchange Commission (SEC) on December 4, Robinhood noted that “November Crypto Trading Volumes were approximately 75% above the October 2023 level”.

The increase in trading volume was not reflected in stock and option contract trading volumes, which continued to remain flat compared to October.

The increase this month marked a reversal for Robinhood, which revealed in its third quarter report that there was a 55% decline in cryptocurrency volumes throughout the year.

Third-quarter revenue was $467 million, below analyst estimates. Transaction-based revenues decreased 11% year-on-year to $185 million in 2022 due to the decline in crypto transaction volumes.

Robinhood has increased its total capital by 40% in the last two months, reaching $ 1.6 trillion. Robinhood aims to have a more profitable fourth quarter in light of the recent crypto market rally.

Robinhood co-founder and CEO Vlad Tenev told investors in November that the platform’s annual revenue could reach “nine-digit figures”.

Speaking to Yahoo Finance on 4 December, Tenev said that individual investors are starting to show interest in crypto again:

“We see individual investors joining the rally and a breakthrough in crypto activities.”

“As we’ve seen in the past, as the Bitcoin price approaches all-time highs, media coverage and intensity increases. I think this also plays a role in the rise.”

In addition to stock transactions in the UK markets, Robinhood plans to carry out futures transactions in 2024 after receiving approval from regulatory authorities.

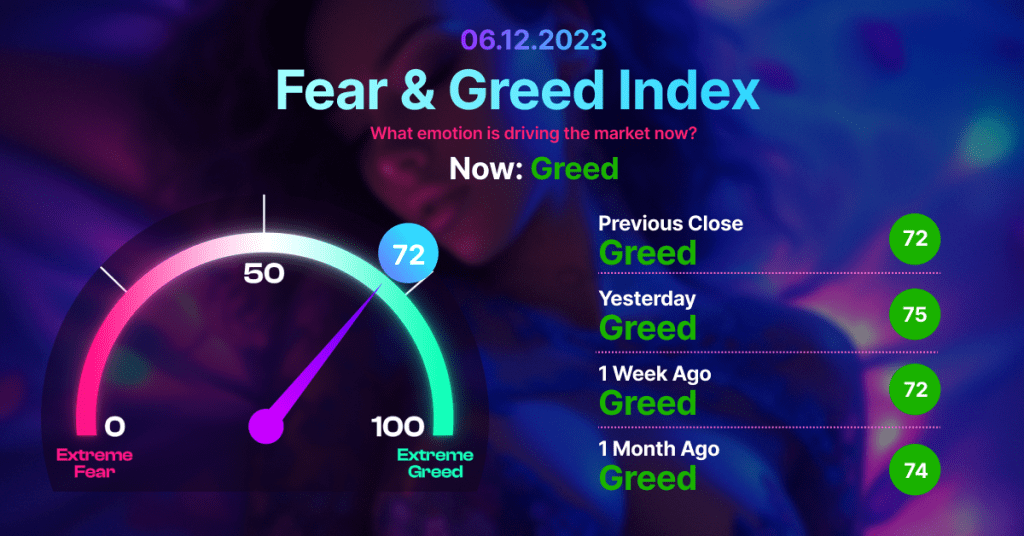

Fear & Greed Index