Bitcoin Experiences Over 2-Hour Block Production Delay; CoinShares CSO: Bitcoin ETF Approval Not a ‘Sell the News’ Event; $1.2M Sent to Satoshi’s Genesis Wallet Sparks Speculation

On January 7, the Bitcoin network encountered an unprecedented delay, surpassing two hours without producing a block—the longest delay in over two years.

Bitcoin explorer Mempool’s data reveals that between block heights 824717 and 824718, the network experienced a total interval of 122 minutes. Although Bitcoin typically generates a new block approximately every 10 minutes, variables such as mining difficulty and total hash rate can lead to variations of up to an hour or two.

Instances of the Bitcoin network failing to produce a new block for more than an hour have occurred in recent years. However, exceeding two hours places this delay at the lengthier end of the spectrum. According to the pseudonymous Bitcoin Ordinals developer Leonidas, such prolonged block gaps occur only every 179,872 blocks, approximately every three and a half years.

CoinShares CSO: Bitcoin ETF Approval Not a ‘Sell the News’ Event

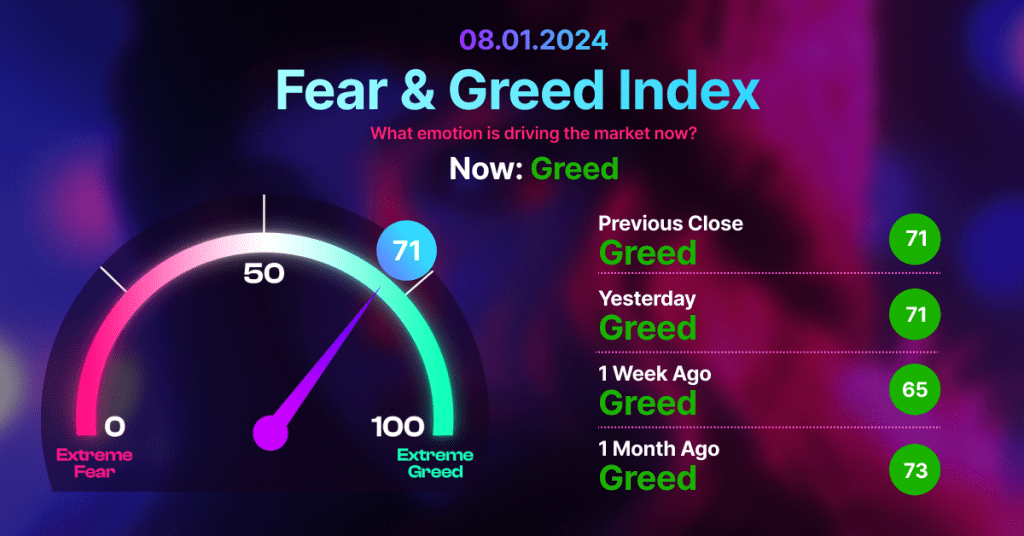

The anticipated approval of a spot Bitcoin exchange-traded fund (ETF) won’t trigger a ‘sell-the-news’ event, asserts CoinShares Chief Strategy Officer Meltem Demirors.

In a January 5 interview with CNBC, Demirors highlighted the substantial inflows into crypto exchange-traded products (ETPs) in the final weeks of 2023, indicating significant buying activity expected after the approval of a spot Bitcoin ETF.

Examining the last week of 2023, Demirors noted $243 million flowing into crypto ETPs, contributing to a yearly total of $2.2 billion. She anticipates the true battleground post-Bitcoin ETF approval will revolve around the fees associated with investing in these ETFs.

Fidelity offers a 0.39% fee on its Bitcoin ETF, which Demirors deems “quite low” for such a specialized product. In contrast, Inveso and Galaxy refrain from charging fees until their respective ETFs reach $5 billion in assets under management. Grayscale leads with a 2.5% fee on its ETF offering.

While BlackRock has not disclosed its Bitcoin ETF-associated fees, Demirors speculates it will announce a 0.8% fee, putting it in competition with Ark Invest, which declared a 0.8% fee in November.

“The fee game is going to be an interesting one. How much will brand matter, and how much of this will be about fees?”

$1.2M Sent to Satoshi’s Genesis Wallet Sparks Speculation

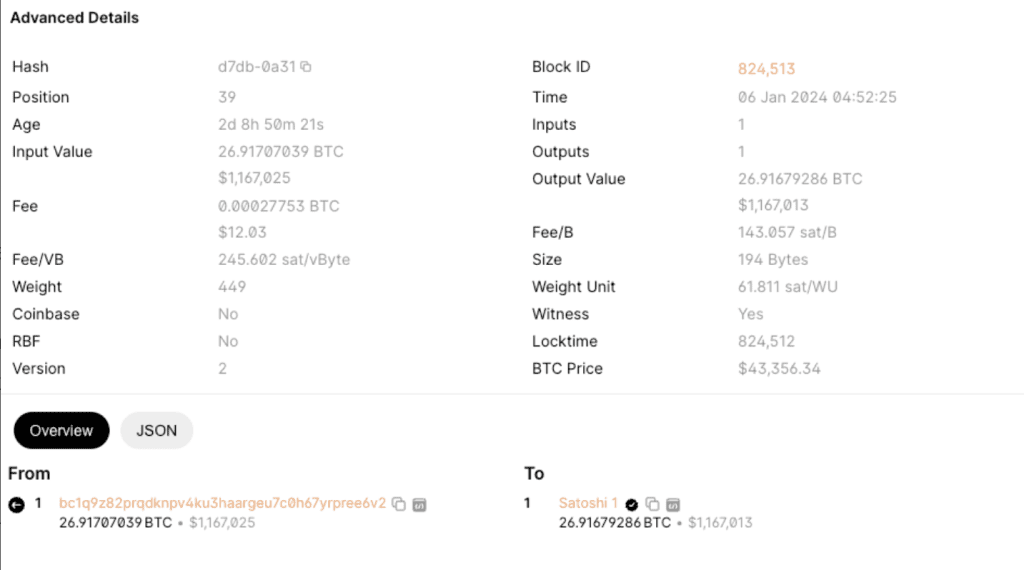

Crypto Twitter is abuzz with speculation after an anonymous Bitcoin holder transferred $1.2 million to the Genesis Wallet—an address on the Bitcoin network linked to the pseudonymous creator, Satoshi Nakamoto.

The 26.9 Bitcoin, valued at $1.17 million, was sent on January 5, incurring $12 in fees for the one-way transaction.

Transactions to a Satoshi-linked wallet are typically considered one-way, as Nakamoto has not accessed the holdings since Bitcoin’s inception over 15 years ago. The Genesis Wallet holds an unspendable 50 Bitcoin mined from the Genesis Block and currently contains 99.7 Bitcoin, valued at $4.4 million.

The move has triggered various theories on social media. Crypto attorney Jeremey Hogan speculates the transfer might be linked to revealing Nakamoto’s identity under new crypto tax laws in the United States. Others suggest that Satoshi has resurfaced, purchased $1.2 million worth of BTC on Binance, and sent it to the old wallet.

Other News

Digital Currency Group (DCG) Clears $700 Million Debt with Genesis

Digital Currency Group (DCG), a leading player in crypto capital markets, has successfully settled its $700 million debt with crypto lending platform Genesis. This move aligns DCG with its planned repayments, committing to clear all outstanding loans to Genesis by April 2024. The resolution of these short-term loans marks a significant step for DCG, reinforcing its financial stability within the crypto space.

BlackRock Set to Trim Global Workforce by 3%

BlackRock, the world’s largest asset manager, is poised to reduce its global workforce by approximately 3%. The decision, scheduled to take effect in the coming days, will see around 600 employees laid off as part of routine internal adjustments. As reported on December 6 by Fox Business, the staff reductions are based on individual performance evaluations over the last 12 months. This strategic move reflects BlackRock’s ongoing efforts to adapt to evolving market conditions and maintain operational efficiency.