Cryptocurrency enthusiasts widely believe that DeFi, or decentralized finance, is the greatest potential use case of blockchain technology. It takes Satoshi Nakamoto’s original idea for a revolutionary new financial system and brings it to the next level on Ethereum (ETH) and other blockchain networks.

Decentralized finance is a blockchain-based movement that aims to bank the unbanked and give individuals greater control over their digital assets. DeFi products offer a new world of opportunity for those who might have been denied access to financial services in the past, putting everyone on a level playing field.

What is DeFi exactly? Can DeFi protocols and smart contracts replace traditional financial institutions and services, or is it all a speculative bubble waiting to burst?

What Is DeFi?

DeFi is a term used to identify financial products and services built on a blockchain. These protocols aim to eradicate unnecessary intermediaries and central authorities to offer everyone with a crypto wallet fair access to financial services.

Through decentralized applications or dApps, users can make the most of their crypto assets in a permissionless, trustless environment. But what does that mean exactly?

Why Do We Need DeFi?

In traditional financial transactions, everything is overseen by central bodies that govern who can and cannot access financial tools. This leaves room for biased decision-making and gives middlemen a platform to charge high fees for simple services.

DeFi aims to democratize these services, streamline them, and bring renewed efficiency to the financial world. Anyone with an internet connection and a crypto wallet can access these applications.

For example, imagine you want to take out a loan from your bank, using your house as collateral. This is a time-consuming process, and the final decision ultimately rests on the banker who is liable to be influenced by personal bias.

As we’ve seen with the slew of banking collapses in 2023, insolvency is rife in the industry. There’s no guarantee that the funds in your bank account are truly safe.

What’s more, a bank will charge you additional fees and high-interest rates. In decentralized finance, all these steps are handled almost instantly by open-source smart contracts that offer transparent, minimal fees.

This is particularly important in developing nations worldwide, where people may not have access to common financial services, like borrowing, that might help them long-term.

The blockchain provides an immutable, eternal record of financial history and transactions, so data is incorruptible and cannot be falsified.

Principles of Decentralized Finance

Perhaps the most important thing to remember about Defi apps is that they should be permissionless and trustless. That means we don’t need to ask for anyone’s permission to use these services, nor do we need to place our trust and our funds in a centralized authority.

Another fundamental principle at the heart of decentralized finance is self-custody. This means you always have full control of your funds. Smart contracts facilitate these financial transactions without needing to hold over control of funds to intermediaries.

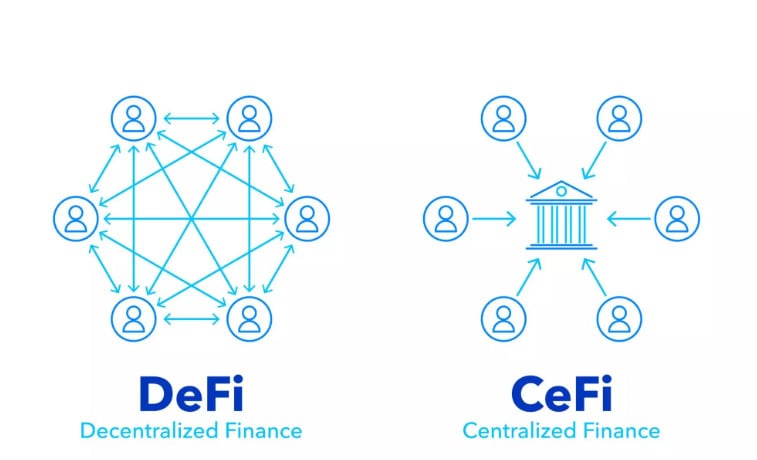

Traditional Finance vs. Decentralized Finance

Source: SmartValor

Source: SmartValor

With these key principles in mind, let’s see how DeFi stacks up against traditional finance:

- In DeFi, you are the master of your funds. You alone have complete control over how they are used. In Tradfi, you’re entrusting your funds to centralized bodies liable to mismanagement or commingling.

- Blockchain transactions are executed in seconds, and markets are open 24 hours a day, seven days a week. Comparatively, traditional markets are only open on scheduled hours. Moreover, moving funds can be expensive and take days to complete.

- Decentralized finance is fully pseudonymous and open to anyone with an internet connection. Meanwhile, traditional finance is strictly regulated and only available to approved users.

- DeFi relies on open-source contracts and absolute transparency, enabling users to explore the codebase of their favorite applications. On the other hand, centralized financial institutions keep their ledgers and transaction history securely under lock and key.

DeFi Applications

The world of decentralized finance is vast, with new projects and creative use cases being discovered daily. The Ethereum blockchain is undoubtedly the home of decentralized finance, hosting hundreds of unique dApps within its ecosystem.

Decentralized Exchanges (DEX)

Decentralized exchanges, like Uniswap, are the most frequently used dApps in the industry. On a DEX, traders can instantly swap any cryptocurrency through liquidity pools. While centralized exchanges like Coinbase have strict vetting processes for listing tokens, anyone can create a crypto token and make a liquidity pool on a DEX.

This is great for emerging crypto startups who want to market their tokens but can’t afford the expensive listing fees of top centralized exchanges.

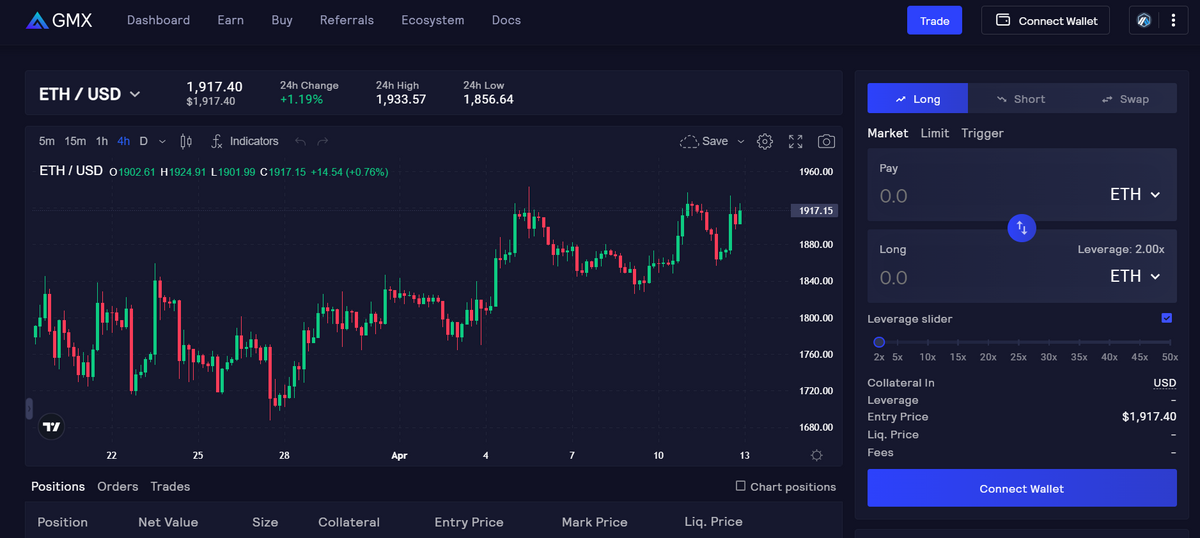

With time, decentralized exchanges are only improving. Through DeFi projects like GMX or dydx, users can trade perpetual futures and derivatives contracts on-chain. This means they’re always in complete control of their digital currency and don’t need to go through potentially invasive KYC (Know Your Customer) procedures.

Another variety of decentralized exchanges is what’s called an aggregator. These DeFi platforms scour the blockchain to find the best prices for specific assets. They automatically route token swaps through the liquidity pools, giving users the best possible value in their trades.

Digital Asset Lending

Lending protocols like AAVE and Compound enable crypto holders to either borrow crypto against their collateral or earn passive income by lending out their digital assets. Anyone with Ether in their crypto wallet can instantly take out a loan against their holdings, which can be helpful for traders who need instant liquidity but don’t necessarily want to sell their investment at the time.

Digital asset lending isn’t limited to cryptocurrencies alone. As the NFT market evolves, applications like BendDAO or JPEGfi let NFT collectors borrow crypto against their digital collectibles, like Yuga Labs’ Bored Ape Yacht Club.

Stablecoins

Due to crypto market volatility, cryptocurrencies like Bitcoin (BTC) and Ethereum are not reliable enough to be used as currencies of exchange. This is where stablecoins like DAI and Tether (USDT) come into play.

These digital currencies are pegged to the value of the US dollar, making them the ideal way to trade crypto for goods and services on a public blockchain. While USD-pegged stablecoins are the standard, plenty more stablecoins for other fiat currencies like the Euro and Canadian Dollars also exist.

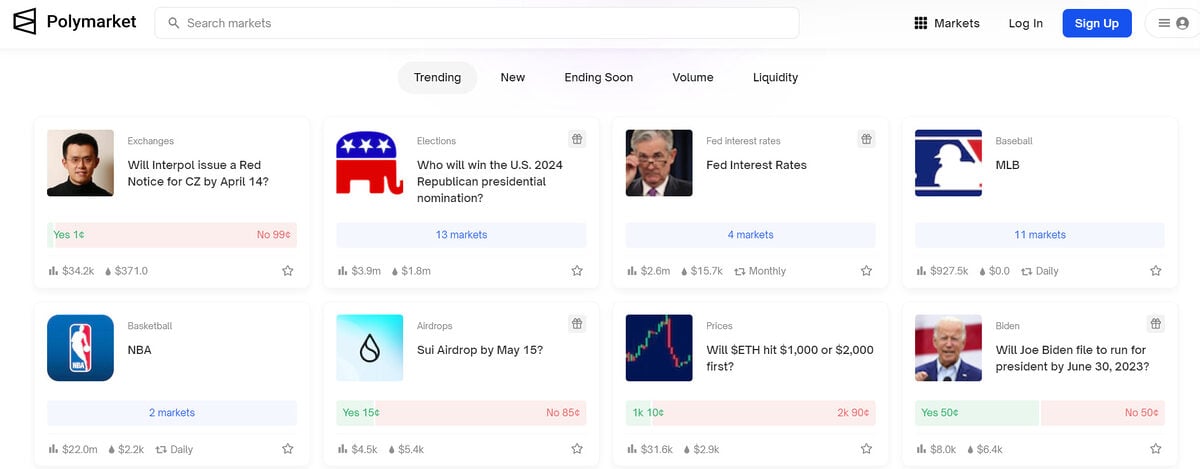

Prediction Markets

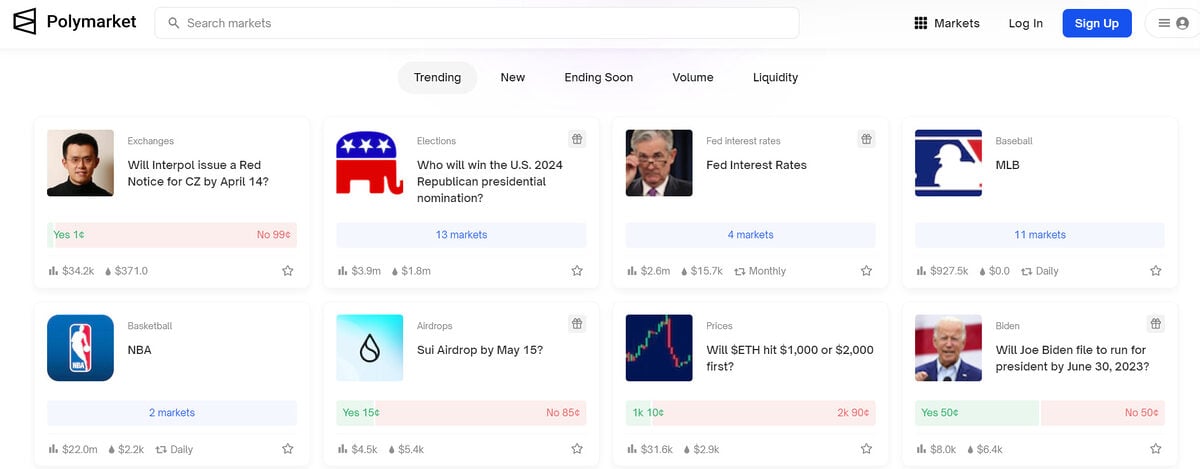

DeFi projects like PolyMarket give traders a limitless range of real-world markets. Future events like political elections and sports results can be traded in real-time, providing a fun new angle to trading with crypto.

Staking

Crypto staking is a popular way for DeFi enthusiasts to earn passive income and organically grow their holdings. By contributing their coins to validator nodes, stakers help to secure the blockchain and verify new transactions.

Crypto staking is often compared to a savings account in a traditional bank because they generally require ‘lock-in periods.’

The Pros and Cons of DeFi

Decentralized finance opens a world of opportunity for countless users around the world, however, there are still plenty of wrinkles that need to be smoothed over.

Pros

- Trustless and permissionless – Decentralized finance is open to everyone, regardless of background.

- Fast processing times – DeFi transactions are completed within seconds within an international market that is always open.

- Self-custodial – In DeFi, you’re always in total control of your funds. No one is able to control your access to your digital assets, and there is no risk of losing your funds if a centralized authority is exposed as insolvent.

- Innovative dApps – The ecosystem of decentralized applications is expanding, with creative applications being developed every day.

Cons

- Low liquidity – Financial institutions trading large sums of cryptocurrency still prefer to use centralized exchanges. Why? Because there is not enough liquidity in decentralized markets to meet the demand. Trading large amounts of digital currencies on DEX generally results in high slippage rates, meaning that big players can’t get maximum value from their trades.

- Hacks and Scams – Unfortunately, decentralized finance’s freedom and anonymity is also a solid foundation for the crooks and scammers of the internet. In 2022 alone, over $3 billion was stolen in hacks.

- Intimidating and poor UX – Just because self-custody offers a wealth of benefits for users doesn’t mean it’s right for everyone. Simple mistakes like misplacing a seed phrase mean you might lose access to your wallet.

- Gas Fees – On the Ethereum blockchain, in particular, gas fees can be prohibitively expensive. During periods of high traffic, a simple token swap can cost over $100. These high fees alienate users and dramatically limit DeFi’s accessibility.

On the Flipside

- Decentralized finance is still in its infancy, and despite its impressive growth, it still has a long way to go before it’s ready for widespread mass adoption.

Why You Should Care

All great technological innovations had to overcome speed bumps on their rise to prominence. There was once a time when people said the internet would never take off because we already had a telephone service.

Decentralized finance is definitely a work in progress, but you cannot deny its potential to reinvent how we interact with financial markets and services. Staying up to date on emerging trends and use cases within the DeFi space will help you better understand the growth and direction of the blockchain industry.

FAQs

Will DeFi replace banks?

It is extremely unlikely that DeFi will completely replace banks. When it comes to their finances, people like to stick to things that feel trustworthy and safe, like an insured central bank. The whole point of decentralized finance is that it allows you to be your own bank, but that doesn’t mean everyone wants that.

What are the risks of DeFi?

Unfortunately, the DeFi space is plagued with frequent hacks and scams. Inexperienced or unwary DeFi users can be caught in these events if they don’t take necessary precautions. Additionally, self-custody presents risks of its own. If you lose your seed phrase, all the digital assets in your wallet are at risk.

Is DeFi on Bitcoin or Ethereum?

Ethereum is the undisputed home of DeFi, with more dApps than any other network. The Bitcoin blockchain doesn’t support smart contracts; hence there is no DeFi on Bitcoin. However, some crypto projects like Stacks (STX) aim to build a DeFi-capable layer on top of the Bitcoin blockchain, bringing decentralized finance to the Bitcoin ecosystem.

What is the difference between staking and DeFi?

Staking is a feature of a Proof-of-Stake blockchain that fits under the DeFi umbrella. While staking is the process by which holders contribute their cryptocurrency to validator nodes to earn passive income rewards, DeFi is more of an idea and concept built on blockchain technology.

How do I start in DeFi?

To get started in DeFi, you only need a funded crypto wallet and a willingness to learn how DeFi applications work. It’s recommended always to ensure you thoroughly understand what you can expect from a dApp before using it, as any misunderstanding could result in a loss of funds.

Related articles

Polygon MATIC Optimism Returns as It Teases Bank Partnership

DeFi Protocol Gamma Strategies Suffers $3.4 Million Attack