Understanding Solana and Polygon

In the fast-paced world of cryptocurrency, two platforms have emerged as significant players in the battle for blockchain supremacy: Solana and Polygon. Each offers unique solutions to the limitations faced by earlier blockchains, such as Bitcoin and Ethereum, specifically concerning transaction speed and scalability.

Introduction to Solana

Solana is a high-performance layer-1 blockchain renowned for its remarkable transaction speed and impressive scalability. It accomplishes these feats through a unique consensus mechanism that combines Proof of History (PoH) with Proof of Stake (PoS). This hybrid protocol enables the network to process transactions rapidly, with Solana boasting the capability to handle up to 65,000 transactions per second, a stark contrast to Ethereum’s 30 transactions per second. This speed makes Solana an attractive platform for users and developers alike who are interested in fast and efficient blockchain services. For more in-depth comparisons, see Solana vs Ethereum.

Solana’s ecosystem is rapidly expanding, with developments such as Solana Mobile 2 and the Solana Phone indicating a commitment to integrating blockchain technology into everyday devices and enhancing the user experience.

Introduction to Polygon

On the other hand, Polygon, formerly known as Matic Network, operates as a layer-2 scaling solution for Ethereum. It augments the Ethereum blockchain by drastically enhancing its scalability and reducing transaction costs. This platform is particularly well-suited for developers who aim to create decentralized applications (dApps) that require high efficiency and low operational expenses.

Polygon’s framework provides multiple tools for constructing and connecting Ethereum-compatible blockchain networks, thus fostering a multi-chain Ethereum ecosystem. By addressing the key issues of high fees and slow transaction speeds on the Ethereum network, Polygon has positioned itself as a facilitator of the blockchain’s mass adoption.

Both Solana and Polygon are equipped to support smart contracts, offering robust platforms for deploying these automated agreements. Their capabilities in this area are drawing a growing community of developers interested in harnessing the advantages of blockchain technology to build cutting-edge solutions.

As the cryptocurrency landscape continues to evolve, understanding the technicalities and innovations of platforms like Solana and Polygon is essential for anyone looking to navigate the complex world of digital assets. The ensuing comparison between these two blockchain titans, “Polygon vs Solana,” will shed light on their respective strengths and potential for shaping the future of decentralized technology.

Solana’s Technology and Features

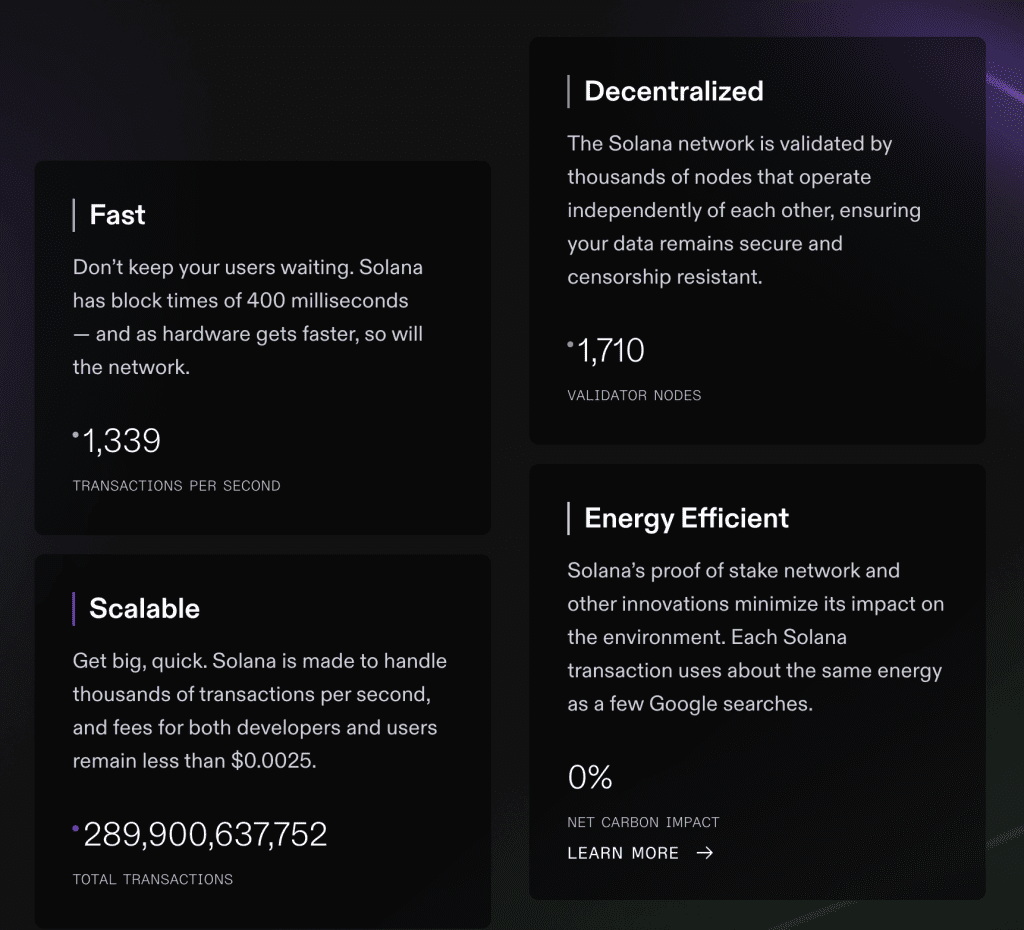

Solana has emerged as one of the leading blockchains in the cryptocurrency space, known for its native scalability, rapid transaction speed, and minimal transaction fees. Its technological innovations have made it a strong contender in the market, especially when compared with other cryptocurrencies like Ethereum. For those considering solana vs ethereum, understanding Solana’s technical advantages is essential.

Solana’s Transaction Speed

One of the most notable features of Solana is its exceptionally high transaction speed. The design of Solana’s network theoretically allows for a limit of 710,000 transactions per second (TPS) on a standard gigabit network, which can be scaled up to 28.4 million TPS on a 40 gigabit network. As of December 12, 2023, Solana had processed over 253 billion transactions with an average cost of just $0.00025 per transaction, showcasing its efficiency and cost-effectiveness.

| Transaction Speed | Solana’s TPS |

|---|---|

| Standard Gigabit Network | 710,000 |

| 40 Gigabit Network | 28,400,000 |

| Average Transaction Cost | $0.00025 |

Solana’s Scalability

Scalability is a fundamental aspect of Solana’s architecture. Its native scalability ensures that the network can handle an increasing load of transactions without compromising on speed or cost. Unlike traditional blockchain networks that use validator nodes, Solana utilizes validator clusters which allows for more transactions to be processed simultaneously. This approach to scalability is part of what positions Solana as an efficient blockchain solution and makes it attractive to both developers and users alike.

In addition to its scalable network, Solana also features its own standard for tokenization, the SPL Token, which is analogous to Ethereum’s ERC-20 standard. This further enhances the blockchain’s versatility and its appeal to a broad range of applications.

Solana’s Consensus Mechanism

Solana operates on both a proof-of-history (PoH) and proof-of-stake (PoS) consensus model. Proof of History is a unique feature of Solana, enabling the network to create historical records that prove that an event has occurred at a specific moment in time. This is coupled with the Tower Byzantine Fault Tolerance (BFT) consensus algorithm, which allows the network to reach consensus even in the presence of malicious nodes, further ensuring the security and integrity of the transactions.

The combination of PoH and PoS consensus mechanisms provides Solana with the capability to process thousands of transactions per second while maintaining low transaction costs. It’s this innovative approach to consensus that contributes to Solana’s position as a highly efficient blockchain with a growing number of use cases and applications.

Polygon’s Technology and Features

Polygon, formerly known as the Matic Network, has established itself as a layer-2 scaling solution for Ethereum, focusing on enhancing the base layer’s capabilities by improving scalability and transaction efficiency. Its technology and features are designed to support a wide range of decentralized applications (dApps), making it an appealing platform for developers and users alike.

Polygon’s Transaction Speed

One of the key features of Polygon is its impressive transaction speed. As a layer-2 solution, it operates on top of the Ethereum blockchain, leveraging its security while offering a more efficient framework for processing transactions. This leads to faster confirmation times and increased throughput, which is especially beneficial for dApps that require high transaction volumes.

Polygon achieves this efficiency by batching multiple transactions together and processing them off-chain before finalizing them on the Ethereum blockchain. This method drastically reduces congestion and speeds up transactions, making the platform attractive for projects that demand quick interactions.

Polygon’s Scalability

Scalability is a critical aspect of blockchain technology, particularly for platforms that host a variety of dApps and smart contracts. Polygon addresses this by providing a multi-chain system that can process a large number of transactions concurrently. The platform’s framework allows for the creation of ‘child’ blockchains that operate alongside the main Ethereum chain, contributing to a highly scalable ecosystem.

The scalability of Polygon ensures that even as the network grows and more dApps are built on it, the system can maintain its performance without suffering from the bottlenecks that can plague single-layer blockchains.

Polygon’s Consensus Mechanism

Polygon utilizes a modified proof-of-stake (PoS) consensus mechanism, which is more energy-efficient than the traditional proof-of-work (PoW) systems used by networks like Bitcoin. This PoS variant not only reduces the environmental impact but also contributes to the platform’s scalability and speed.

In Polygon’s consensus model, validators stake their MATIC tokens as collateral to participate in the network’s transaction validation process. This stake acts as a deterrent against malicious activities, as dishonest validators risk losing their stake. The PoS mechanism also allows for quicker block validation times compared to PoW, enhancing the network’s overall efficiency.

Solana vs. Polygon: A Comparative Analysis

In the rapidly evolving world of cryptocurrency, understanding the technical capabilities of different blockchains is key for investors and users. In this section, we delve into a comparative analysis of Solana and Polygon, focusing on their transaction speeds, scalability, and consensus mechanisms.

Transaction Speed Comparison

Solana has a block time of approximately 0.4 seconds compared to Polygon’s block time of around 2 seconds. This faster block time can result in a more responsive experience for Solana users.

Scalability and Throughput

Scalability is another critical factor to consider when evaluating blockchains. Solana is designed to maintain all operations on a single chain, which simplifies coordination and reduces latency. On the other hand, Polygon scales by adding more concurrent chains, known as sidechains, that periodically merge state. This approach allows Polygon to potentially handle more transactions in parallel.

Solana’s block size capacity is a substantial 128MB, which facilitates a high volume of transactions. Polygon’s block size on the Proof of Stake (PoS) chain ranges between 50-120KB. Larger block sizes, as seen with Solana, can result in lower transaction fees due to increased capacity.

| Blockchain | Block Size | Average Transaction Fee |

|---|---|---|

| Solana | 128MB | Lower |

| Polygon | 50-120KB | Higher |

Consensus Mechanisms

The consensus mechanism is at the core of any blockchain technology. It ensures that all transactions are verified and agreed upon by the network. Solana employs a unique consensus called Proof of History (PoH) combined with Proof of Stake (PoS), which allows for its high throughput and fast block times. Polygon uses a modified PoS consensus mechanism that provides a balance between security and efficiency.

The Nakamoto Coefficient (NC) is a metric that measures the decentralization and security of a blockchain network. A higher NC means a more secure network. Solana’s NC is 32, while Polygon’s is 4, indicating that Solana currently has a higher resistance to collusion among validators. However, both platforms would benefit from increasing their NC to enhance network security.

| Blockchain | Consensus Mechanism | Nakamoto Coefficient |

|---|---|---|

| Solana | PoH & PoS | 32 |

| Polygon | Modified PoS | 4 |

Understanding the nuances between Solana and Polygon’s technology can help users and investors make informed decisions about which platform might better serve their needs. For further insights on how Solana compares to other blockchains, read our article on solana vs ethereum.

Use Cases and Applications

The blockchain universe is vast, with each platform carving out its niche through specific use cases and applications. In the polygon vs solana debate, it is crucial to understand how each network is utilized in the real world. This section will delve into the practical applications of both Solana and Polygon, highlighting their strengths and contributions to the crypto ecosystem.

Solana’s Use Cases

Solana’s blockchain technology, known for its high throughput and low transaction costs, has attracted a wide range of use cases. With the ability to process up to 65,000 Transactions Per Second (TPS), Solana is a preferred platform for decentralized applications (dApps) that require real-time processing and scalability, such as:

- Decentralized Finance (DeFi): Solana’s ecosystem boasts a robust DeFi presence with a significant Total Value Locked (TVL), facilitating lending, borrowing, and trading at high speeds and low costs. The platform’s native tokenization standard, SPL Token, akin to Ethereum’s ERC-20, simplifies the creation and exchange of digital assets on the network.

- Gaming and NFTs: Solana provides an ideal environment for gaming platforms and NFT marketplaces, thanks to its rapid transaction capabilities. It supports complex smart contracts and tokenized assets, enhancing the user experience in virtual worlds and digital collectibles.

- Decentralized Exchanges (DEXs): The platform’s speed and efficiency make it suitable for DEXs, where traders benefit from near-instant order execution and minimal slippage.

Solana’s commitment to growing its use cases is also evident in its ventures outside traditional blockchain applications, such as the solana mobile 2 and solana phone initiatives, aiming to integrate blockchain technology more deeply into mobile devices.

Polygon’s Use Cases

Polygon, on the other hand, offers an equally compelling array of use cases with its impressive transaction speed of around 72,000 TPS. Its commitment to scalability and user experience has led to widespread adoption in various sectors:

- DeFi Platforms: Polygon’s compatibility with Ethereum’s existing infrastructure has made it a hotspot for DeFi platforms like Curve, AAVE, Stargate, and QuickSwap. Users are drawn to Polygon for its enhanced user experience and the potential for substantial returns. The network’s ability to handle a large volume of transactions efficiently makes it a strong contender in the DeFi space.

- Gaming and NFTs: With its high-speed transactions and low fees, Polygon is an attractive option for game developers and NFT creators who want to provide a seamless experience to their users without the constraints of Ethereum’s network congestion and high gas fees.

- Cross-Chain Interoperability: Polygon’s architecture is designed to facilitate seamless interaction with other blockchains, enabling users to transfer assets across different networks without significant hurdles.

Both Solana and Polygon have carved out significant roles in the cryptocurrency landscape, each excelling in different domains. While Solana focuses on raw performance and minimal fees, Polygon emphasizes user experience and interoperability. As they continue to evolve and expand their capabilities, the applications of Solana and Polygon are likely to grow, further enriching the diverse tapestry of blockchain technology.

Future Prospects and Developments

The cryptocurrency landscape is ever-evolving, and both Solana and Polygon are at the forefront of innovation and growth. Let’s look into the future prospects and developments that each blockchain has on their roadmap.

Solana’s Roadmap

Solana’s development trajectory is focused on enhancing its already robust ecosystem. Key strategies in their roadmap include the implementation of advanced protocols such as Gulf Stream for mempool management, Turbine for block propagation, and Sealevel for simultaneous transaction processing. These protocols are expected to further contribute to Solana’s efficiency and performance, positioning it as a strong competitor within the blockchain space.

Moreover, Solana is looking to expand its reach by venturing into the mobile market with projects like Solana Mobile 2 and the Solana Phone. These initiatives aim to integrate blockchain technology into everyday mobile usage, potentially reaching a wider audience and creating new use cases for the Solana blockchain.

| Development Focus | Details |

|---|---|

| Advanced Protocols | Implementing Gulf Stream, Turbine, Sealevel |

| Mobile Market Expansion | Launch of Solana Mobile 2 and Solana Phone |

Polygon’s Roadmap

Polygon, on the other hand, is pushing boundaries with its scalability solutions and EVM compatibility. The platform is dedicated to maintaining its edge in transaction speed, which currently supports around 72,000 Transactions Per Second (TPS), outperforming Solana’s 65,000 TPS.

In addition to speed, Polygon is also working on further solidifying its user experience. Its EVM compatibility allows for efficient transactions without high fees, making it a user-friendly option for those looking to move funds between networks. Polygon’s focus on user experience is expected to continue as it seeks to simplify interactions and transactions for its users.

| Development Focus | Details |

|---|---|

| Scalability Solutions | Maintaining and enhancing transaction speeds |

| User Experience | Improving EVM compatibility and ease of use |

Both Solana and Polygon are making strides in their respective areas, and their roadmaps reflect their commitment to staying at the forefront of blockchain technology. While Solana is innovating with new protocols and entering the mobile space, Polygon is honing its scalability and user experience. Investors and users alike will be watching closely to see how these developments unfold and which blockchain will ultimately gain the upper hand in this dynamic market.

For a deeper dive into how Solana stacks up against other blockchains, such as Ethereum, check out our comparison of solana vs ethereum.