Bitcoin whales leave crypto exchanges; Bitcoin transaction fee revenues increase; Ripple partner Tranglo collaborates with Al Ansari Exchange.

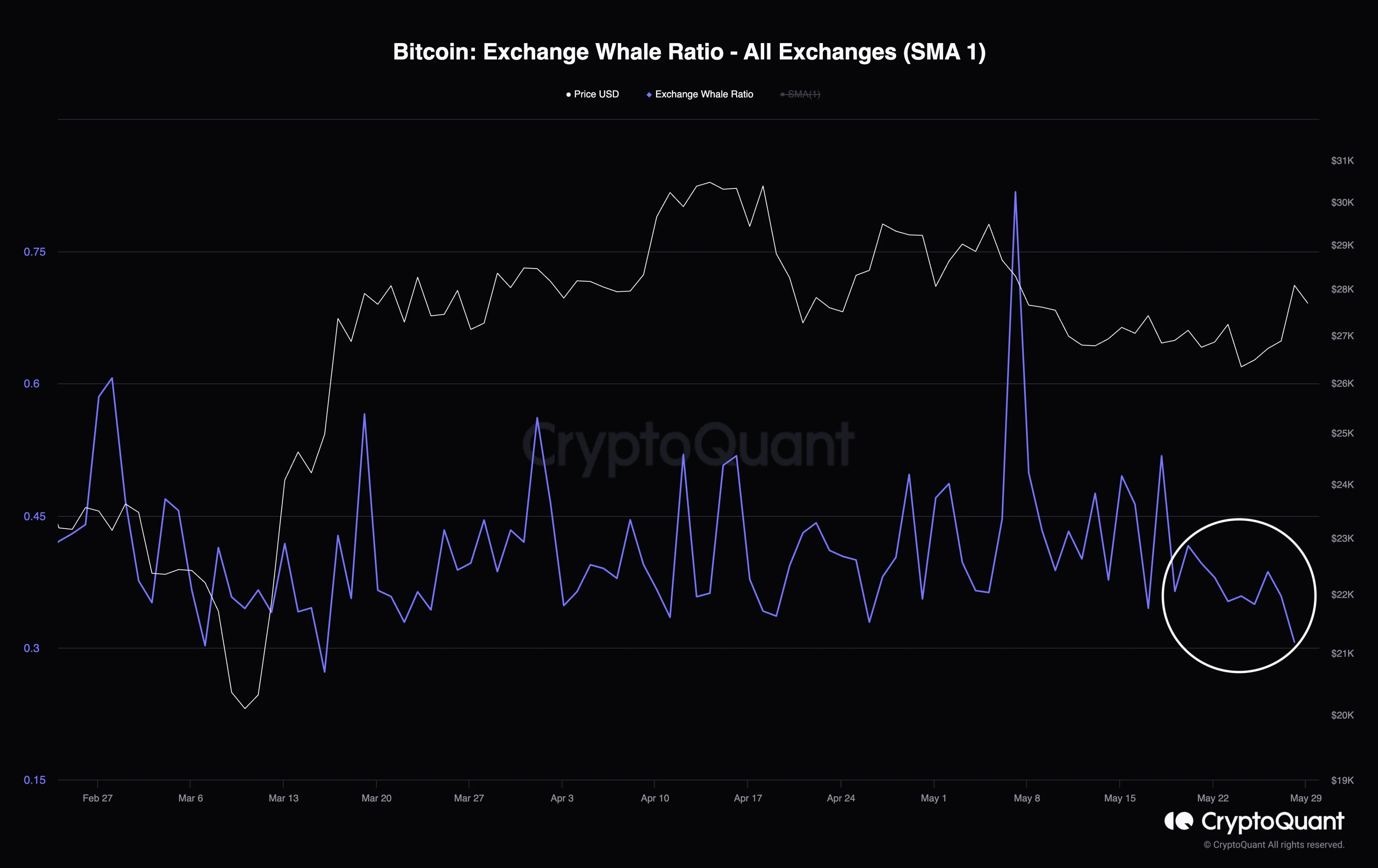

Large Bitcoin whales began to withdraw gradually from cryptocurrency exchanges.

This metric, which is created by dividing the total Bitcoin amount of the first 10 transactions by the amount of Bitcoin transferred to the exchanges, has decreased to the level of 0.3, which has not been seen since last March.

According to this data, Bitcoin whales either direct their assets to different investments or keep them in cold wallets.

Whales are drawn

This ratio between the whale and the exchanges is used to determine the crypto currency exchanges preferred by the whales. Analysis of the top 10 initiatives provides indications of where and how active large whales are.

Gemini is known as a cryptocurrency exchange, which is usually attracted by whale users. For this reason, dramatic price fluctuations are seen in the stock market. The fluctuations experienced bring various risks for the users in the stock market.

This being the case, the reason why whales are withdrawing from exchanges cannot be pinpointed. One reason may be that whales are pulling their assets into cold wallets to HODL.

Another potential reason is seen as whales turning to other cryptoassets to diversify portfolios.

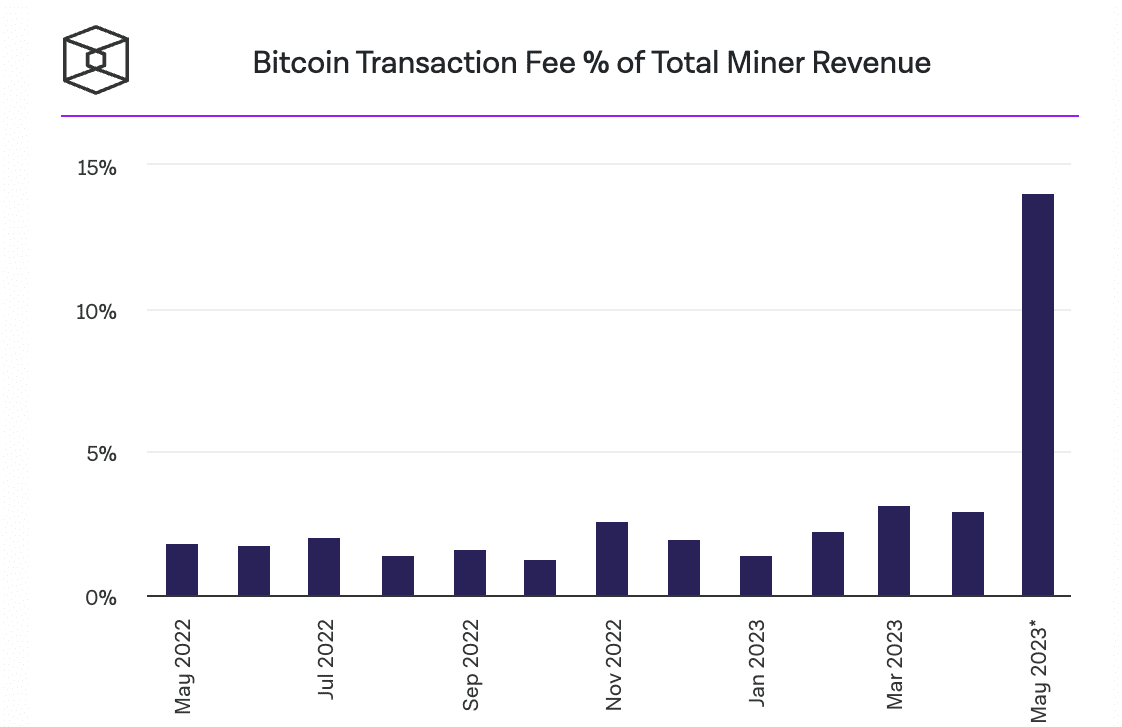

Bitcoin transaction fee revenues increase

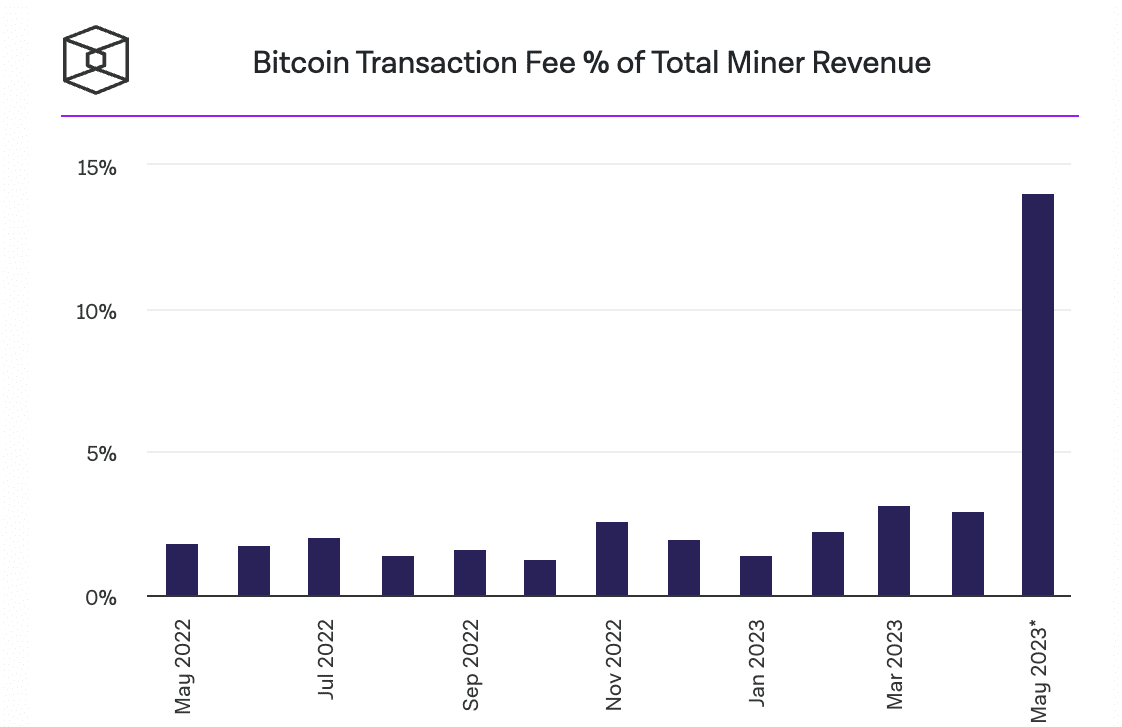

Transaction fee revenues obtained by Bitcoin miners rose in May, reaching the highest level of the last two years.

According to the data provided by The Block’s Data Dashboard, the share of mining revenues in transaction fees on the Bitcoin network is 14.3% based on May 29.

This reveals an increase of more than 11% compared to April. In addition, this means the biggest increase since April 2021.

Users are gaining interest in the method of creating on-chain artworks tied to satoshi, the smallest unit of account in the Bitcoin network.

The Bitcoin network has stood out as the network with the highest volume for NFTs after the Ethereum network for the past few weeks.

Transaction traffic on the Bitcoin network similarly reached an all-time high in May and reached 14.9 million. The total mining revenues reached in May reached 840 million dollars as of 29 May.

Network congestion has occurred

The increase in activity in the Bitcoin network caused various bottlenecks in the network. Binance, the world’s largest cryptocurrency exchange, had to stop Bitcoin withdrawals for a short time.

Ripple partner Tranglo collaborates with Al Ansari Exchange

Ripple continues multiplying its partners amid its legal battle with the US Securities and Exchange Commission (SEC). Tranglo, Ripple’s On-Demand Liquidity (ODL) partner, which has been fighting the SEC for a long time, has partnered with Al Ansari Exchange, the largest personal remittance company in the United Arab Emirates (UAE).

Tranglo is trying to secure its presence in the UAE as part of its policy of enlargement in the Middle East. With this work, the company made a strategic cooperation with AI Ensari Exchange.

According to the statement made as of May 29, both companies will have the opportunity to improve their customers’ remittance experiences within the scope of the partnership.

Jacky Lee, CEO of Tranglo Group, made statements regarding the partnership. Expressing his excitement over this development, Lee said the move will strengthen both the GCC region and the UAE’s cross-border payment experience.

Welcome to Al Ansari and Tranglo Connect. We empower your growth with our technology, infrastructure and payment solution from Ripple.

As it is known, the UAE is currently the second largest market for outgoing remittances globally. The partnership between Tranglo and AI Ansari Exchange is expected to play a major role in the growth of the payments industry in the UAE.

The UAE’s outbound remittances totaled $47.54 billion in 2021, according to World Bank data. This figure has achieved an increase of 9.7 percent compared to the previous year. It is also worth noting that the outgoing remittance sector in the country also recorded an impressive double-digit increase in 2022.

According to the statements made, Al Ansari Exchange expanded its partnership with Ripple by leveraging RippleNet to connect with MoneyWatch in October 2021.

On the other hand, Ripple bought 40 percent of Tranglo shares in 2021. Since the acquisition, tranglo has been using Ripple’s On-Demand Liquidity (ODL) solution for cross-border payments in Asia.