Bitcoin price reached $30,000; Winklevoss brothers transfer $100 million to Gemini; FTX’s lawyers and consultants earned $32.5 million in February.

The fact that Bitcoin, the largest cryptocurrency by market value, reached $30,000, set a new peak for 2023. With these developments BTC hit the highest prices not seen since mid-2022.

According to data from CoinGecko, Bitcoin just surpassed $30,000 and its price continues to hover above $30,000 for now. Bitcoin last reached $30,000 in June 2022.

Over the past 30 days, BTC has increased by about 46 percent, hitting a ten-month high on April 11th.

Some analysts had predicted that Bitcoin would regain the $30,000 level as traders await the US Consumer Price Index (CPI) report on April 12, which will give insight into the Federal Reserve’s fight against inflation.

Crypto fear and greed index

Since last week, the Crypto Fear and Greed Index has remained firmly in the “Greed” region, with the latest April 11 update showing a score of 68 out of 100 possible totals.

According to the index, crypto market sentiment reflected “Greed” on April 11. The Crypto Fear and Greed Index aims to numerically present the current “feelings and thoughts” towards Bitcoin and the cryptocurrency market, with a maximum score of 100.

The index hit 68 on March 21, its highest level since Bitcoin recorded a score of over 66 on November 16, 2021, just days after hitting its all-time high of $69,000 on November 10, 2021.

Winklevoss brothers transfer $100 million to Gemini

Billionaire twins Tyler and Cameron Winklevoss transferred $100 million to the Gemini stock market, which has faced many setbacks this year.

According to anonymous Bloomberg sources, the twins recently lent Gemini $100 million. According to sources, Gemini has been seeking to raise funds from investors for a long time.

Tyler and Cameron Winklevoss have not responded to requests for comment.

Gemini is going through tough times

Venture funds earmarked for crypto companies fell by 80% from the same period last year to $2.4 billion, according to data provided by research firm PitchBook. Gemini, on the other hand, faced great difficulties with the bear market after raising $400 million in funds in November 2021 and reaching a valuation of $7.1 billion.

The troubles that came with the collapse of FTX caused Genesis to go bankrupt, which plunged Gemini into a crisis. Genesis was a partner of Gemini in the Gemini Earn program. With Genesis stopping withdrawals, Gemini was unable to pay Earn users. Doubts have arisen over the fate of Gemini customers’ $900 million in assets. Following the events, Cameron Winklevoss targeted Barry Silbert, CEO of Genesis parent company DCG, quite harshly.

While Gemini was experiencing all these troubles, it also took a blow from the regulators. The SEC sued and claimed that Gemini and Genesis broke securities laws because of the Earn program. Similarly, the CFTC announced that it is suing Gemini for allegedly misleading the regulator.

FTX’s lawyers and consultants earned $32.5 million in February

Cryptocurrency exchange FTX, which went bankrupt in November last year, announced its legal expenses for February.

Fee statements for February from law firms dealing with the bankruptcy proceedings of the FTX exchange totaled $32.5 million.

It’s worth noting that this figure does not include compensation from restructuring manager and CEO John J. Ray III, who pocketed $305,000 in February.

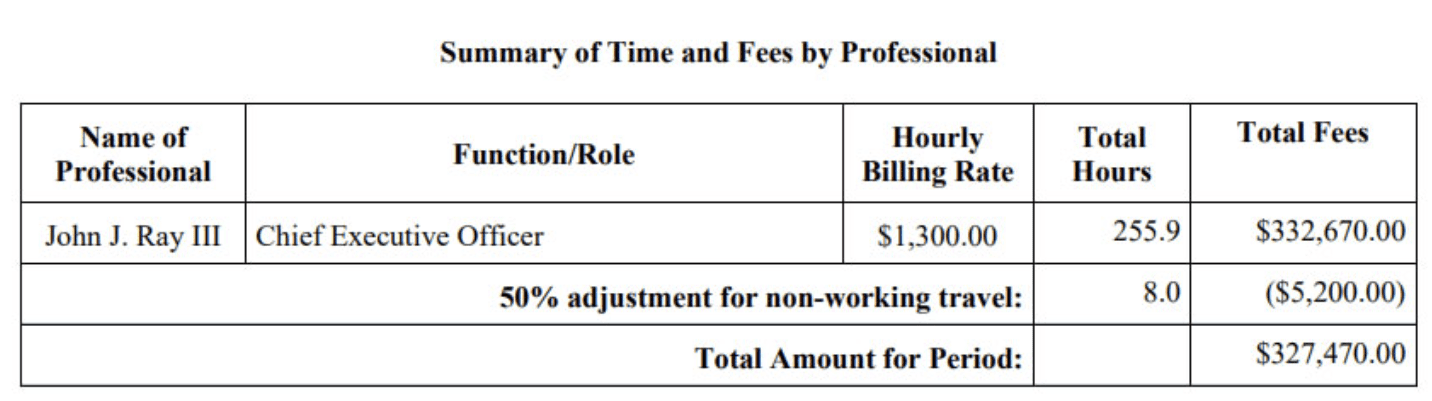

Ray’s pay in March reached a similar figure, with a total of $329,173 in fees and expenses, according to an application filed April 10.

The FTX CEO’s hourly income is $1,300, and he reportedly worked 255.9 hours from March 1 to March 31. This reveals that Ray earned $327,470 at the end of the month. The remaining $1,703 was used for accommodation, transportation, meals and other expenses.

However, the remuneration, reimbursement and expenses that FTX has paid to its staff of lawyers, partners, legal counsel, accountants, auditors, directors, and executives remain indigestible for clients still awaiting compensation.

As it is known, bankruptcy is still not over and Sullivan and Cromwell alone is thought to make hundreds of millions of dollars before the bankruptcy investigation is completed.