BlackRock meets SEC and Nasdaq for spot Bitcoin ETF; New step from FTX for insolvency proceedings; Coinbase shares overtake tech giants and Bitcoin

BlackRock, Nasdaq and the United States Securities and Exchange Commission (SEC) met for the second time in December to discuss the spot Bitcoin exchange-traded fund (ETF) application.

According to the SEC note, representatives of the three organisations discussed the rule changes necessary to list the spot Bitcoin ETF. The SEC note said:

“The discussion concerned the NASDAQ Exchange’s proposed rule change to list and trade iShares Bitcoin Trust shares under NASDAQ Rule 5711(d).”

Rule 5711(d), discussed during the meeting, sets out the requirements for the initial and continuous listing of Commodity-Based Trust Shares on Nasdaq. The rule sets forth regulatory guidelines and specific criteria for the listing, including compliance measures and oversight mechanisms designed to ensure market integrity and protect users against fraud.

This was not the first time that the rules regarding the listing of spot Bitcoin ETF on exchanges were discussed. BlackRock and Nasdaq met with the SEC on 20 November to discuss the proposed rule for the listing of spot Bitcoin ETF. BlackRock shared a presentation detailing how the company could use the in-kind or cash redemption model for the iShares Bitcoin Trust.

On 14 December, the SEC held another meeting with asset managers proposing a spot Bitcoin ETF. SEC Chairman Gary Gensler’s officials attended the meeting to discuss the rule change that allows major exchanges to list the spot Bitcoin ETF.

New step from FTX for insolvency proceedings

Failed cryptocurrency exchange FTX has announced a global agreement with Joint Official Liquidators for the Bahamian arm of the firm as part of its bankruptcy proceedings.

In a 19 December announcement, FTX debtors said they plan to pool assets with FTX Digital Markets as part of efforts to repay users of the defunct cryptocurrency exchange. The firms emphasised that the agreement is a “new and mutually beneficial solution” to cross-border legal issues arising from the collapse of FTX in November 2022.

Under the terms of the agreement, subject to the approval of the Bankruptcy Court for the District of Delaware and the Supreme Court of the Bahamas, all FTX users with no other claims pending in court will be paid in US dollars for their losses on all assets, except nonfungible tokens (NFTs). Eligible users with claims will be able to vote on the repayment plan in the second quarter of 2024.

In November 2023, Bankman-Fried pleaded guilty to seven charges related to the misappropriation of FTX and Alameda Research funds. Fried is scheduled to be sentenced in March.

FTX debtors regularly file with the Delaware Bankruptcy Court in an attempt to sell company assets and repay creditors. So far, the judge has approved the sale of LedgerX, $873 million in trust assets, $3.4 billion in digital assets, and a settlement between FTX and Genesis.

Coinbase shares overtake tech giants and Bitcoin: 400%

Bitcoin exchange Coinbase set a new record as COIN’s 2023 gains exceeded 400%.

COIN is the best crypto pick of 2023

Shares of Coinbase, the largest crypto trading platform in the United States, reached a 20-month high this week.

While Coinbase and Bitcoin rose together in 2023, Coinbase’s performance became increasingly prominent as the year drew to a close.

The company’s COIN shares reached $162 on 19 December.

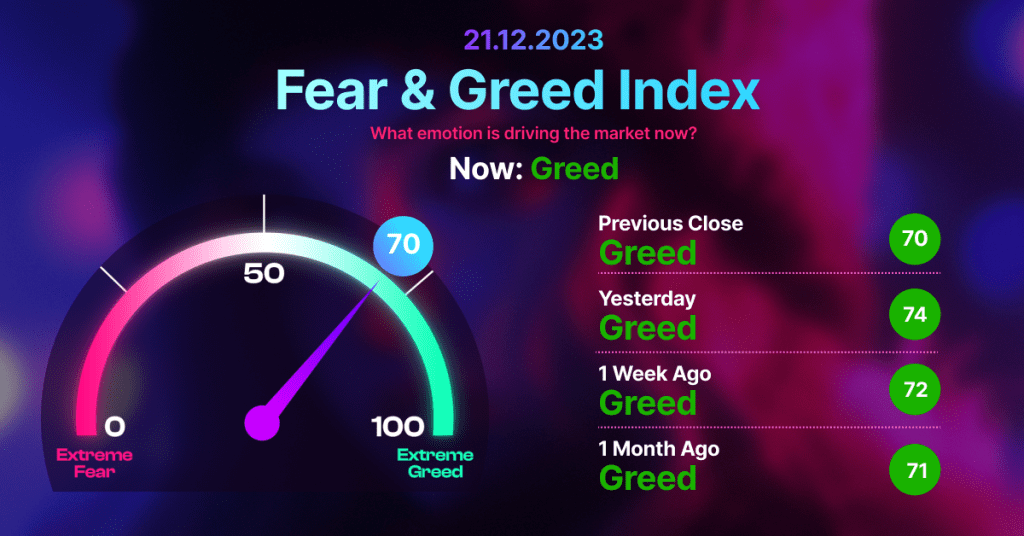

Investors expect the upward movement to continue as markets begin the countdown to the approval of the first US spot Bitcoin exchange-traded fund (ETF).

Coinbase shares also performed better than the largest altcoin Ethereum. The ETH/USD pair has increased by about 85% since the beginning of the year.

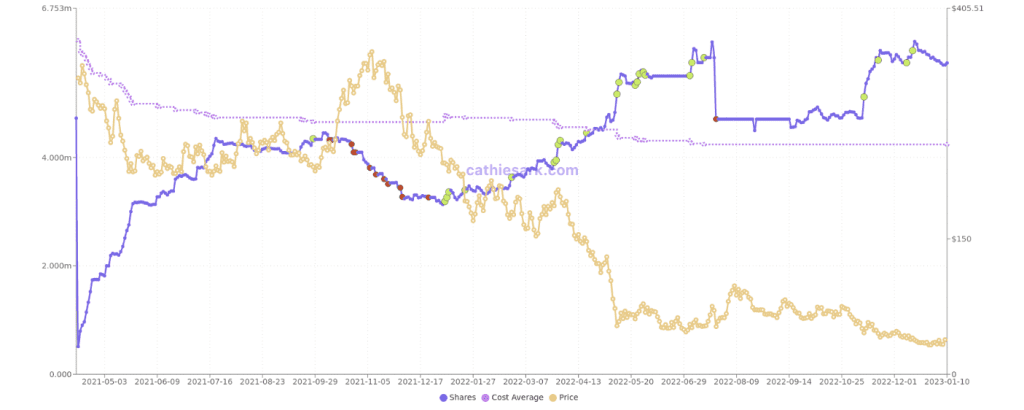

Some investors, especially investment giant ARK Invest, have reduced risk as the price of COIN shares has risen. According to data on ARK CEO Cathie Wood’s official website, COIN holdings in the firm’s ARK Innovation (ARKK) ETF fell nearly 11% in December alone.

Assets, while still the biggest component of ARKK, remain significantly below its total cost base of just under $255.

Coinbase CEO Brian Armstrong emphasised that cryptocurrencies will continue to rise in 2024.

This week, Coinbase was one of the companies participating in an $80 million donation to support “pro-crypto” US presidential candidates.