BlackRock’s spot Ethereum ETF plan confirmed by Nasdaq; Miners sold more BTC than they produced; Cathie Wood’s ARK bags 1.1M Robinhood shares in one day!

BlackRock’s spot Ether ETF plan has been confirmed according to a Form 19b-4 filing with the SEC on November 9.

Nasdaq filed a Form 19b-4 with the SEC for the ETF called “iShares Ethereum Trust”.

This move showed that BlackRock’s ETF ambitions are bigger.

BlackRock’s registration of the iShares Ethereum Trust in Delaware was an important clue that an application for an Ether ETF would be filed.

ETFs will decide the fate of the crypto market

BlackRock and other financial firms have made their intentions for cryptocurrency-backed ETFs clear.

Bloomberg’s ETF analyst James Seyffart said that at least five companies are vying for the SEC’s spot Ether ETF approval.

These include VanEck, ARK 21Shares, Invesco, Grayscale and Hashdex.

Following the news, Ether rose 8.9 percent to $2080, according to CoinGecko.

The price increase helped Ether regain some of its market dominance over Bitcoin.

Miners sold more BTC than they produced

Cryptocurrency miners sold more Bitcoin than they produced in October.

According to Bloomberg, the 13 largest cryptocurrency mining companies increased their BTC sales. The uptrend in the asset’s price was also among the important catalysts.

According to data from TheMinerMag, the liquidation-to-production ratio of companies such as Core Scientific and Marathon Digital Holdings was about 105 percent. This data showed that more BTC was sold than produced. This ratio was 64 percent, 77 percent and 77 percent in July, August and September, respectively.

This rate reached 390 percent last June due to the collapse in the crypto market and rising energy costs.

BTC sales took place as the asset hit an 18-month high in October. According to the latest updates from mining companies, sales of the leading crypto have increased. Hut 8 was among the companies that announced it sold more than it produced.

Bitcoin mining is an energy-intensive process in which miners verify blockchain transactions and then earn rewards in BTC.

Bitcoin’s rise continues

The leading cryptocurrency has risen 28 percent in the past month, hitting the $35,000 level. This allowed it to see a 100 percent increase since the beginning of the year.

Although the asset’s price is well below the $69,000 ATH level in November 2021, the anticipation of a potential spot Bitcoin ETF is keeping the crypto community optimistic.

Bloomberg’s ETF analyst James Seyffart claimed that there is a 90 percent chance that a spot Bitcoin ETF will be approved by January 10, 2024.

However, the Bitcoin halving, which takes place every four years, is expected to take place in April 2024.

Renowned investor Cathie Wood’s ARK Invest buys 1.1 million Robinhood shares in one day

ARK Invest, the investment firm founded by major Bitcoin investors, has been actively accumulating shares of Robinhood (HOOD).

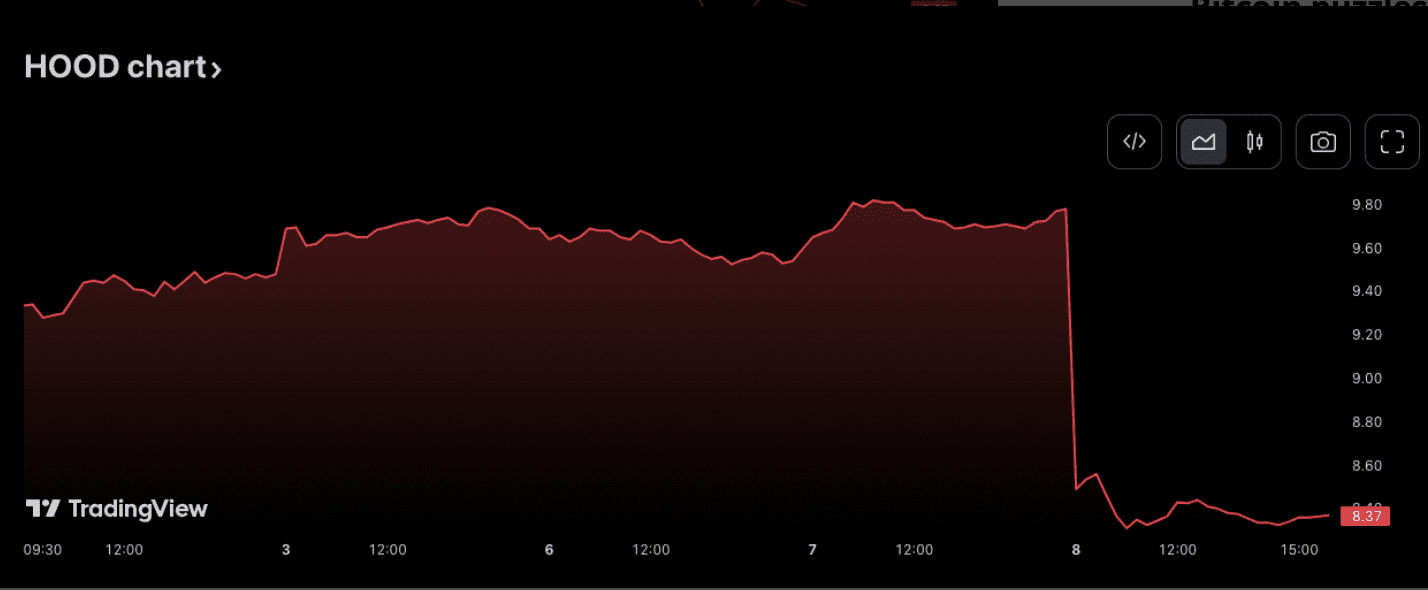

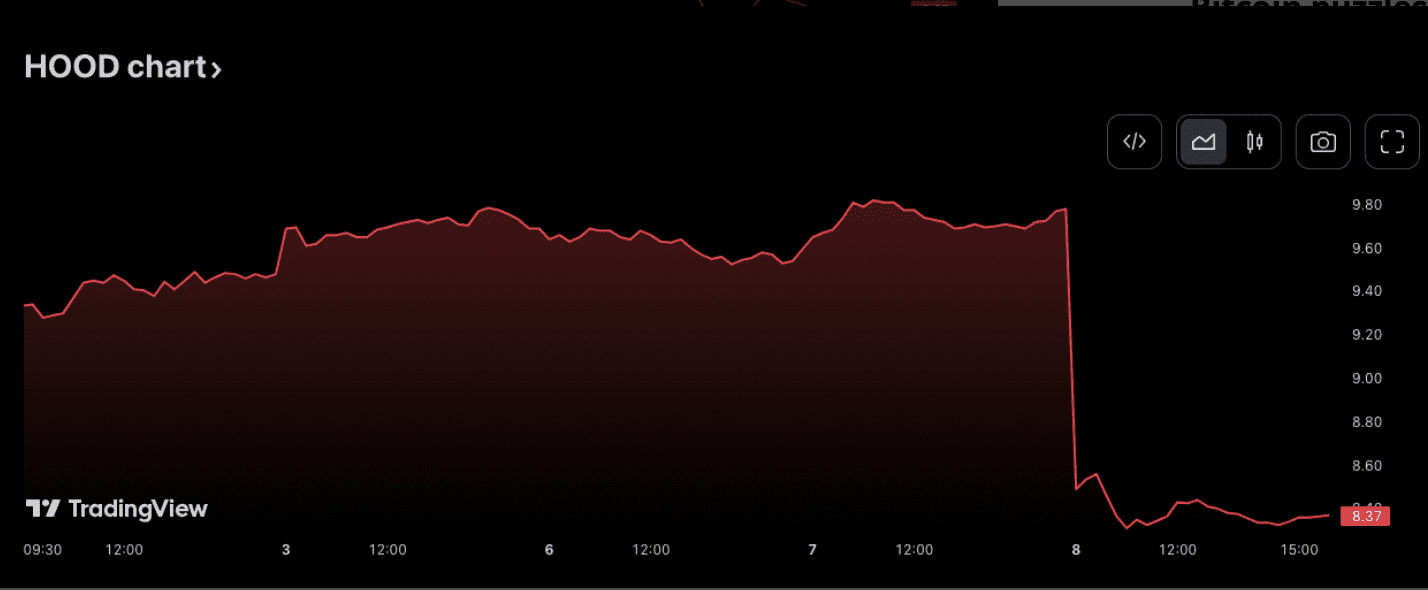

On November 8, ARK made a large purchase of Robinhood stock, buying a total of 1.1 million shares for about $9.5 million in one day.

ARKK acquired the largest amount of shares on purchase, buying 888,500 shares of HOOD (78 percent of all daily purchases). ARKW and ARKF allocated 152,849 and 99,697 shares, respectively.

ARK and Robinhood

The latest acquisition comes after Robinhood announced on November 8 that it plans to expand into Europe in the coming weeks, specifically setting up brokerage operations in the United Kingdom. The announcement coincided with HOOD shares falling more than 14 percent after Robinhood reported worse-than-expected financial results due to a decline in trading activity and users. Robinhood closed at $8.37 on November 8, according to TradingView data.

While actively acquiring Robinhood, ARK continued to unload shares of Grayscale Bitcoin Trust (GBTC), with ARKW selling another 48,477 GBTC for $1.4 million on November 8. On November 6, ARKW sold another large portion of GBTC, 139,506 shares, worth about $4 million.

After taking a year-long hiatus from dealing in GBTC shares, ARK began unloading them in late October 202. Since October 24, ARK has sold a total of 427,573 GBTC shares worth approximately $11.9 million at the time of writing. The purchase amount is quite close to the amount of GBTC shares sold by ARK in November 2022.