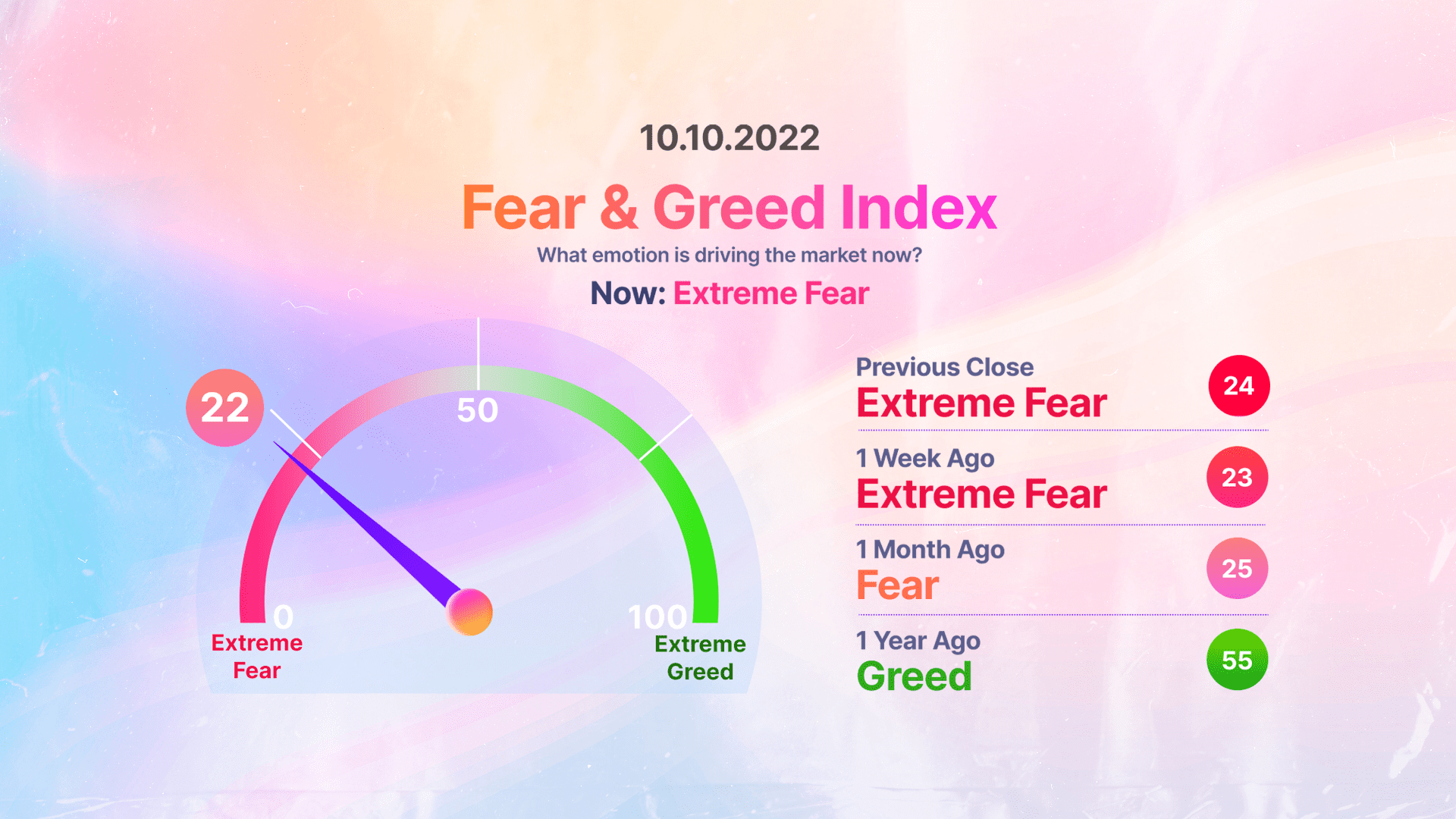

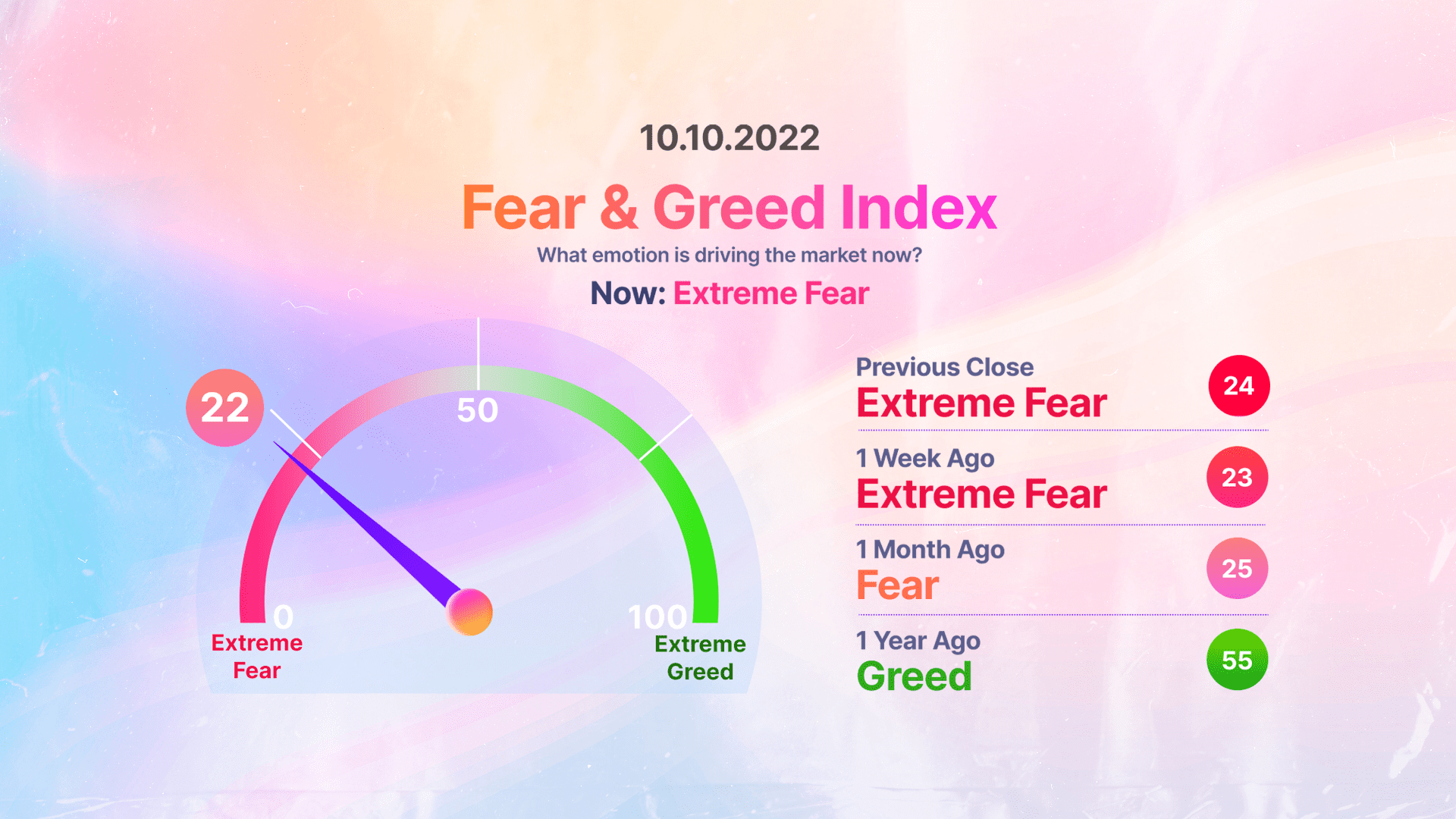

Crypto firm Blockwater Technologies failed to make a payment on a $3.4M loan to TrueFi on DeFi Loan

On 9 October, South Korean blockchain investment firm Blockwater Technologies announced that they default to make a payment on a loan from TrueFi, a decentralized lending protocol.

After it failed payment on a $3.4 million loan in Binance USD (BUSD) stablecoin TrueFi, they shared a “notice of default” with Blockwater.

After Terra’s situation, high-profile crypto firms Three Arrows Capital (3AC), crypto lender Celsius Network, digital asset broker Voyager Digital, and crypto-mining data center operator Compute North had problems with payments.

In August, Blockwater wanted to delay on DeFi loan. It managed to repay $654,000 out of nearly $3 million. If Blockwater cannot make a payment on the DeFi loan, TrueFi may suffer significantly.

Over 12,000 Brazil companies declare crypto holdings

Brazil’s tax authority revealed over 12,000 companies own cryptocurrency, which is the largest amount ever recorded.

In Brazil, inflation is on the rise with inflation rates and trust in crypto showing a direct correlation. People see crypto as salvation from inflation. In August, the number of companies holding cryptocurrency in Brazil reached a new record.

Receita Federal do Brasil (RFB) recorded 12,053 unique organizations declaring crypto on their balance sheets in August 2022.

In July, Brazil had only 11,360 companies holding any crypto. The new data suggest a 6% increase.

Brazil’s inflation rate hit a 26-year high of 12.1% in April but has since cooled slightly to 8.7% in late August.

The Reserve Bank of India (RBI) will soon launch pilot tests for a CBDC

On Friday, the Reserve Bank of India announced that the digital rupee will be available for specific use cases during a pilot run that would seek to create awareness around the planned features of the country’s digital currency.

The RBI has released a concept note for the digital rupee, which is about the pros and cons of CBDCs, including the technology and design, potential use cases, issuance mechanisms, and more.

The country’s Finance Minister Nirmala Sitharaman had previously announced the launch of the digital rupee in her 2022-23 budget speech earlier this year.

Addressing the Indian parliament, Sitharaman said the digital rupee will “lead to a more efficient and cheaper currency management system. It is therefore proposed to introduce the digital rupee using blockchain and other technology to be issued by the Reserve Bank of India.”