- Crypto fund inflows have hit a ten-week streak.

- The recent run is the largest since the peak of the last bull run.

- Bitcoin and Ethereum funds continue to dominate.

Hopes that the U.S. SEC will approve a spot Bitcoin and Ethereum ETF offering continue to be the leading crypto market narrative in recent weeks. Amid the speculation, inflows into crypto investment funds have continued to hit one milestone after another. Last week, the recent run of inflows marked the highest since the peak of the last bull run.

Crypto Inflows Streak Hits $1.76B

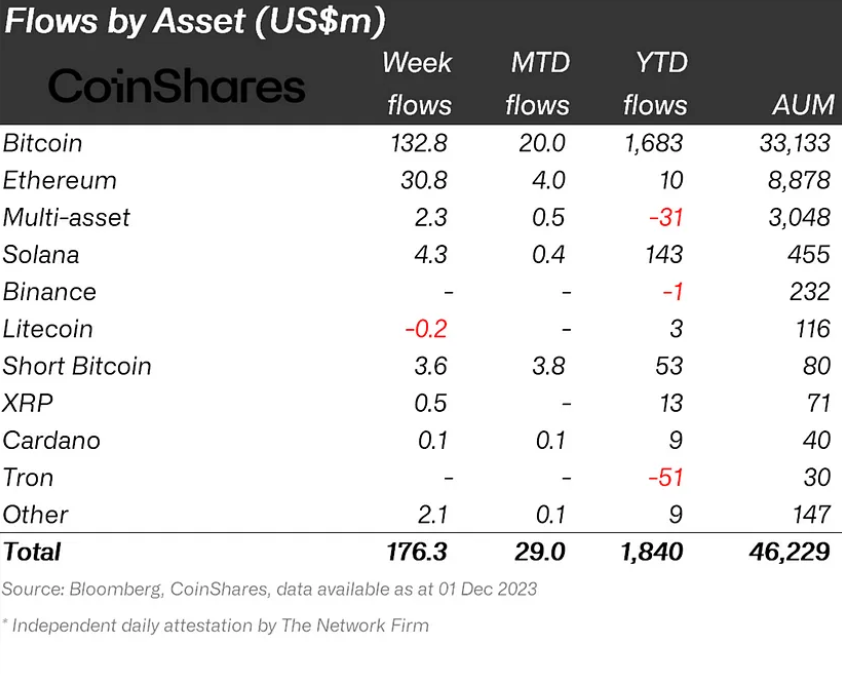

Inflows to crypto investment funds continued for a tenth consecutive week last week, with net inflows totaling $176 million, bringing inflows during the ten-week streak to $1.76 billion—the largest run of inflows since the peak of the last crypto bull run in October 2021, when futures-based crypto ETFs launched in the U.S., according to CoinShares latest report published on Monday, December 4.

Last week’s inflows also brought crypto investment products assets under management (AuM) to $46.2 billion, representing a 107% increase in 2023.

Crypto fund flows by asset. Source: CoinShares

Crypto fund flows by asset. Source: CoinShares

As is typically the case, Bitcoin-related funds dominated inflows last week with $133 million. Investors anticipate a potential wave of spot Bitcoin ETF approvals in the U.S. in the coming months. The significant inflows, however, did not end with Bitcoin.

Ethereum funds recorded inflows totaling $31 million, continuing a five-week net inflows totaling $134 million fueled by BlackRock’s spot Ethereum ETF filing. After last week, Ethereum fund inflows are now net positive at $10 million for the first time since 2023.

Regionally, Canada and Germany maintained their place as the largest contributors to crypto fund inflows, with $79 million and $56.9 million, respectively. U.S. investors also pitched in $53.5 million.

On the Flipside

- According to CoinShares’ report, short Bitcoin investment products recorded inflows of $3.6 million last week.

- Crypto investment fund AuM remains well below its peak of $86.6 billion in 2021.

Why This Matters

Crypto fund flows provide insight into investor sentiment. The recent fund flow report suggests that sentiment remains positive.

Read this to learn more about the recent record run of inflows to crypto funds:

Crypto Inflows Smash 2-Year Milestone in ETF-Inspired Run

Learn more about the Bridged USDC Standard adopted by Polygon zkEVM:

What Is the Bridged USDC Standard on Polygon zkEVM?

Related articles

UBS Embarks on Crypto ETF Trading Frontier in Hong Kong

Bitcoin Miners Go Into Overdrive, Hash Rate Sets New ATH