Nayib Bukele said the country’s Bitcoin investments are making a profit; Brazil’s largest bank Itau Unibanco launches Bitcoin transactions; NFT marketplace Blur dominated about 80 per cent of the total transaction volume.

Nayib Bukele said the country’s Bitcoin investments are making a profit

Nayib Bukele, who recently resigned to focus on the presidential race, spoke about the country’s Bitcoin investments on X.

Pointing out that El Salvador’s Bitcoin investments have made a profit, Bukele emphasised the cynical comments made in the past.

“After thousands of articles mocking our losses and written according to the price of Bitcoin at that time …If we sell our Bitcoins at current prices, we will not only earn 100 per cent of our investments, but also make a profit of 3,620,277.13 USD as of now.”

Bukele emphasised that they have no intention of selling their assets, they know that volatility will continue in the coming periods, and finally, none of these factors will affect their long-term investment strategies.

Bukele also said that dissidents who mocked the issue should apologise and admit that El Salvador is making a profit.

Bitcoin surpassed $42,000

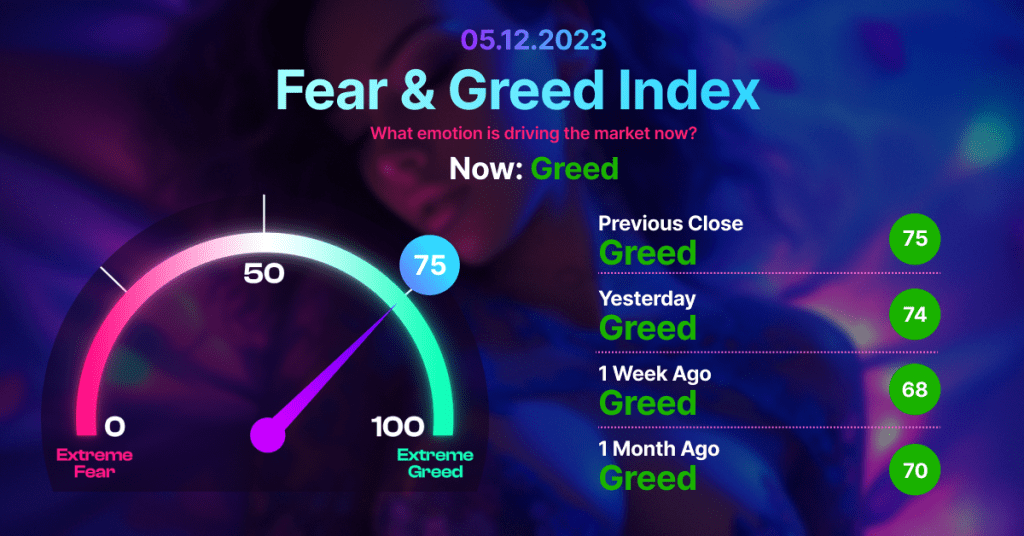

Bitcoin, the leading cryptocurrency, managed to reach its highest level in the last 18 months at $ 42,165.

Bitcoin continued to exceed important psychological limits at a time when rumours about the approval of spot Bitcoin ETFs increased.

Some analysts have warned that this rise could be a bull trap, but this is Bitcoin, you are never sure about what price movement gonna do!

Brazil’s largest bank Itau Unibanco launches Bitcoin transactions

Brazilian bank Itau Unibanco announced that it has launched a cryptocurrency trading service for its customers as part of its investment platform, Reuters reported on 4 December.

Guto Antunes, head of digital assets, announced that Itau, Brazil’s largest bank and one of the leading credit institutions in Latin America, has entered the cryptocurrency market with Bitcoin, adding that the bank plans to add more cryptocurrencies in the future.

“We are starting with Bitcoin for now, but with our inclusive strategic plan, we will expand to other crypto assets in the future,” Antunes said, emphasising that the expansion will depend on regulatory developments.

This move reportedly came about a month after two local players announced that they were leaving the crypto market. According to Reuters, brokerage and investment company XP recently terminated its crypto services without specifying the reason, while PicPay, a financial services firm belonging to the J&F holding, which also includes JBS, terminated its activities, citing uncertainties in market regulations.

NFT marketplace Blur dominated about 80% of the total transaction volume

According to data from The Block, $ 605 million was traded in Ethereum-based NFTs last November. This showed an increase of approximately 100% compared to $ 306 million in October.

With the first four days of December behind us, NFT transaction volume has already approached $ 90 million. About $ 70 million of these transactions took place on Blur.

OpenSea took a big hit

The NFT sector has been shifting from OpenSea to Blur since last February. Blur has managed to increase its dominance day by day, approaching 80 per cent. OpenSea, which once dominated a large part of the NFT market, currently represents only 17 per cent of the NFT trade volume.

Similarly, Solana-based NFT marketplaces also recorded an increase in transactions. On 30 November, total trading volume reached $9.3 million, a level not seen since last April. Most of this volume took place on Tensor.

The Blur marketplace, which launched in October 2022, has continued its progress as a zero-transaction fee NFT marketplace, attracting a lot of interest from the community.