- Data shows Ethereum was the most exploited DeFi chain in 2023 by the amount lost.

- BNB Chain was also heavily exploited by hackers this year.

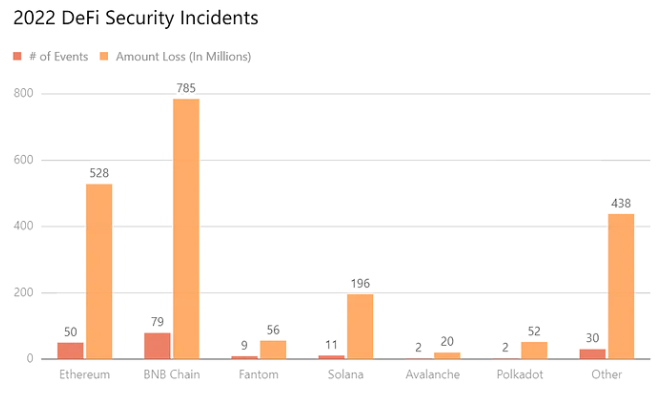

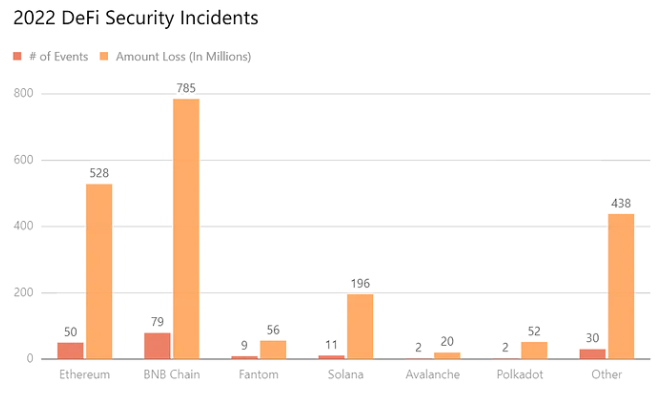

- Prior year data shows that BNB Chain suffered the biggest dollar losses.

Decentralized finance (DeFi) has changed the game by opening access to financial services without an intermediary. However, a recent tweet from Casa co-founder Jameson Lopp stated that $1.95 billion was lost to DeFi exploits in 2023, down slightly from 2022, which put total DeFi losses for that year at $2.075 billion, according to security firm SlowMist.

DeFi protocols are vulnerable to loss due to the open and immutable nature of the smart contracts that underpin DeFi. However, different protocols seem more susceptible to attack than others, as evidenced by 70% of 2023’s DeFi losses occurring on the Ethereum blockchain.

Cybercriminals Favor Ethereum

According to Lopp’s uncited data source, 2023 DeFi losses occurred mostly on the Ethereum and Binance Smart Chain (BSC) blockchains, totaling $1.35 billion and $110.1 million, respectively.

Although the biggest total dollar loss was attributed to Ethereum, which accounted for nearly 70% of the $1.95 billion total loss in 2023, the highest number of incidents occurred on BSC at 213. This indicates attackers exploit BSC more frequently but can extract less money on average than the DeFi market leader.

Ethereum and Binance Smart Chain experienced the most DeFi security incidents by far in 2023. pic.twitter.com/ZS9ZqNKBww

— Jameson Lopp (@lopp) December 28, 2023

According to DeFiLlama, 2023’s biggest single DeFi hack was a database attack on Mixin, netting hackers $200 million in September. The Mixin Network is a trading network that connects different blockchains to its own multi-chain network. It was noted that Mixin was not mentioned in Lopp’s data source.

While 2023 was damaging to Ethereum’s reputation, BSC DeFi protocols were heavily targeted by hackers in 2022.

2022 DeFi Hacks

Data on DeFi hacks compiled by SlowMist showed 183 security incidents last year, totaling a loss of $2.075 billion. Unlike the current year, BNB Chain held the highest number of breaches at 79 and the biggest loss of any chain at $785 million.

Binance rebranded Binance Smart Chain to BNB Chain in February 2022, but many still interchange the two names.

On the Flipside

- Lopp did not attribute the 2023 DeFi hack data source, making it difficult to review the methodology.

- Different sources may use varying standards and criteria to calculate data on DeFi losses.

- Ethereum’s 2023 $1.35 billion DeFi loss represents around 4.6% of the blockchain’s current value locked in ETH DeFi protocols.

Why This Matters

Although the majority of DeFi losses in 2023 occurred on Ethereum, the issue of DeFi security spans the entire crypto industry. Failure to address the issue jeopardizes future growth until trust can be established through better practices such as stricter oversight and improved code auditing.

Read about Arthur Hayes’ recent Ethereum price prediction here:

Hayes Ditches Solana for Ethereum, Citing $5K “Prophecy”

Find out more on the evidence that supports Craig Wright’s Satoshi claim here:

Bitcoin SV Pumps as Wright Boosts Satoshi Legitimacy Claims

Related articles

DeFi TVL Continues 2023 Recovery to Hit 16-Month High

Hayes Ditches Solana for Ethereum, Citing $5K “Prophecy”