- Staked Ethereum (ETH) withdrawals hit a record high last week.

- The surge appears to be heavily linked to Celsius’ bankruptcy proceedings.

- Despite the mass-staked ETH withdrawals, the network impact is expected to be minimal.

Over the past two weeks, the Ethereum (ETH) network has experienced a spike in validator exits. Capping off this trend last week, this surge in validator exits culminated in the network recording over 650,000 ETH in staked ETH withdrawals, the largest amount of redemption in a single week since withdrawals were enabled with the Shanghai upgrade. The record withdrawal begs the question of what is driving this surge.

Celsius Bankruptcy Proceedings at the Helm?

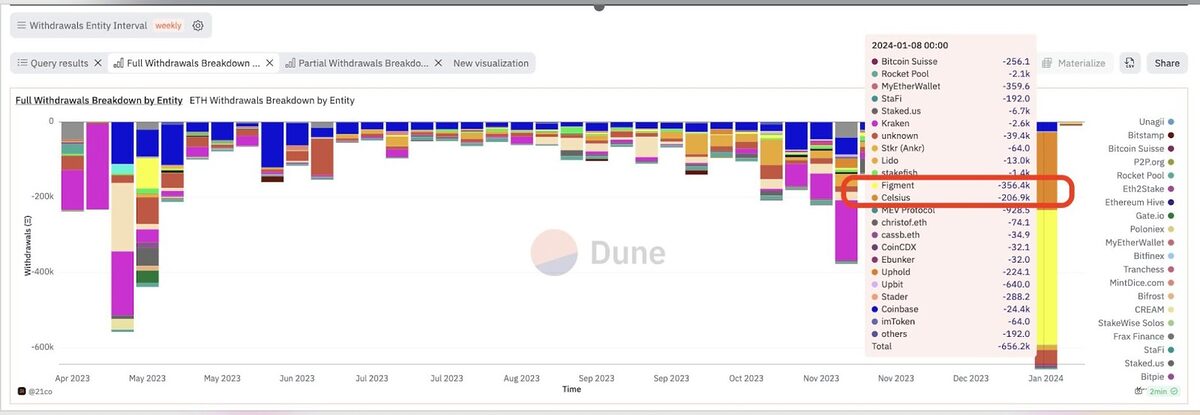

Disclosing last week’s record-staked ETH outflows on Monday, January 15, 21.co researcher Tom Wan shared Dune Analytics data showing that bankrupt crypto lender Celsius and staking service provider Figment were the largest contributors to the withdrawal spike in the past week. Specifically, withdrawals directly attributed to Celsius and Figment accounted for over 85% of staked ETH withdrawals, with 206.9k ETH and 356.4k ETH, respectively.

Chart showing staked ETH withdrawals by entity. Source: Tom Wan

Chart showing staked ETH withdrawals by entity. Source: Tom Wan

While the data on face value suggests Figment clients and not Celsius are the primary drivers of the recent surge in staked ETH withdrawals, Wan has previously suggested that the reverse is more likely the case. Wan had noted that Celsius was also a Figment client with at least 197,000 ETH staked through the platform. As such, the analyst suggested that it was likely that the bulk of the ETH being withdrawn by Figment belongs to Celsius.

The move follows plans revealed by the bankrupt lender earlier in the month to unstake ETH to offset restructuring costs and settle creditors. At the time of writing, Arkham Intelligence data suggests that Celsius holds over 580,000 ETH worth a staggering $1.4 billion at current rates.

Understanding The Impact of Celsius’ Staking Withdrawals on Ethereum

Celsius’s staked ETH withdrawals are unlikely to cause dire consequences for the Ethereum network aside from increasing the unstaking wait time due to Ethereum’s “churn limit,” which limits the number of validators that can exit or enter the network to 2,925 per day.

Despite technically reducing the validator count and amount of ETH securing the network, the Ethereum staking contract still holds over 36 million ETH, per Etherscan data at the time of writing.

At the same time, while Celsius’ bankruptcy proceedings place selling pressure on the price of ETH, the firm is unlikely to unload its holdings all at once as it would also impact the value of its holdings.

Amid the looming selling pressure, ETH’s price continues to hold steady. ETH is trading over $2,500 at the time of writing, up over 10% in the past seven days per CoinMarketCap data.

The asset has seen increased attention as market participants speculate that the U.S. SEC is set to approve spot Ethereum ETFs after issuing approvals for similar products backed by Bitcoin. Amid the asset’s strong showing, analysts like “IncomeSharks” have tipped ETH to surge above the $3,500 price point.

On the Flipside

- Despite last week’s record withdrawal, the Ethereum staking contract still holds over 36 million ETH.

- Due to potential adverse price effects, Celsius will unlikely dump all its ETH holdings at once.

- Celsius is not the only bankrupt crypto firm putting selling pressure on the price of ETH. FTX and Alameda have also unloaded ETH holdings to settle creditors in the past week.

Why This Matters

With staked ETH withdrawals reaching record highs, it is necessary to understand what is driving the surge and whether it is a cause for panic.

Read this for more on the recent surge in Ethereum validator exits and its impact on the network:

Ethereum Validator Exit Leads to Backlogged Queue on Network

Learn more about the recent allegations facing the Polygon Foundation:

Polygon Foundation Faces 400M MATIC Misappropriation Claims

Related articles

SEC Raises Concerns Over Coinbase’s Role in Celsius’ Bankruptcy Plan

Ex-Celsius Exec Pleads Guilty, Cooperates Against Mashinsky