When it comes to any financial market, trading is most often the easiest way to earn a profit. Investing concept may be easier to grasp, but it has its limitations that can be summarized as “It takes money to make money”. For instance, even if your thousand-dollar investment doubles, it will only secure $1,000 of profit.

Trading, on the other hand, allows making use of short-term price fluctuations and making a profit during both bullish and bearish cycles. There is no entry threshold, meaning you can start small and raise capital along the way due to successful deals. In case you are interested in crypto trading, but don’t know how to start — we have prepared a detailed beginner’s guide.

What Is Crypto Spot Trading?

Before moving to the step-by-step trading guide, we have to explain the basics of asset trading and financial markets.

A spot market is a financial ecosystem where instruments, such as commodities, currencies, and securities, are traded for immediate delivery. In simple terms, dealing on the spot market involves an instant execution of the deal.

Crypto spot trading is the process of buying and selling digital assets on the spot marketplace. As soon as you open the deal, the market will instantly ‘process’ it, resulting in the exchange of one asset into another.

Where Do People Trade Crypto?

Nowadays, there are hundreds of cryptocurrency platforms that offer trading features. It can be compared to a regular marketplace, where people buy and sell goods. The only thing that differs is the asset. A crypto exchange connects buyers and sellers, providing users with the functionality to transact. In return, it applies transaction fees for each executed deal on the platform.

CEX or DEX: what to choose?

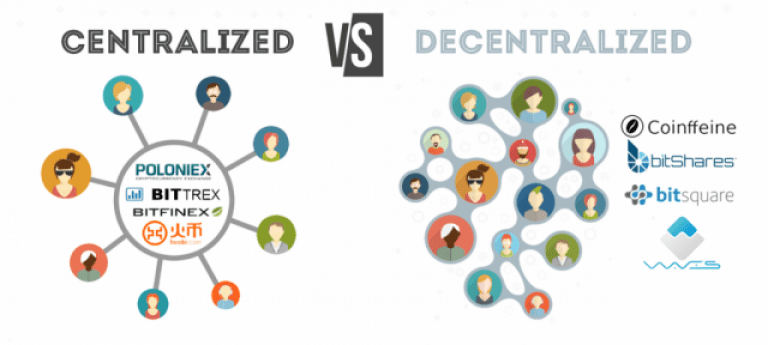

Although there are many aspects to selecting a suitable crypto exchange, the first question is “centralized or decentralized.”

A centralized exchange or CEX functions as a middleman between buyers and sellers, allowing them to transact while guaranteeing the security and transparency of the deals. They usually offer a convenient user interface, 24/7 customer support, and the ability to buy crypto with a bank card. However, you should also be aware of risks associated with CEXs, including the platform having access to your funds.

As for decentralized exchanges or DEXs, such projects don’t have any single controlling entity that oversees the trading operations. DEX exchange offers peer-to-peer deals, while smart contracts and computer algorithms are used to automate trades. The most significant advantage of decentralized crypto platforms is the ability to maintain full control over your funds. However, DEXs interfaces can be quite complex for a beginner.

| CEX | DEX | |

| Pros | Fiat gateways User-friendly interface password reset feature security and transparency | Lower fees No intermediaries Single control over funds anonymity |

| Cons | Mandatory verification platforms’ access to user’s private keys vulnerable to hacks | No fiat gateway complex interfaces possible liquidity issues |

| Top exchanges | Binance, Kraken, Coinbase, FTX, KuCoin | dYdX, Uniswap, SushiSwap, Curve Finance |

| CEX | DEX | |

| Pros | Fiat gateways User-friendly interface password reset feature security and transparency | Lower fees No intermediaries Single control over funds anonymity |

| Cons | Mandatory verification platforms’ access to user’s private keys vulnerable to hacks | No fiat gateway complex interfaces possible liquidity issues |

| Top exchanges | Binance, Kraken, Coinbase, FTX, KuCoin | dYdX, Uniswap, SushiSwap, Curve Finance |

| CEX | DEX | |

Pros | Fiat gateways User-friendly interface password reset feature security and transparency | Lower fees No intermediaries Single control over funds anonymity |

| Cons | Mandatory verification platforms’ access to user’s private keys vulnerable to hacks | No fiat gateway complex interfaces possible liquidity issues |

| Top exchanges | Binance, Kraken, Coinbase, FTX, KuCoin | dYdX, Uniswap, SushiSwap, Curve Finance |

Spot Crypto Trading Tutorial

The algorithm of any trading is standard and consists of

- Choosing an exchange

- Making an initial deposit

- Creating the first trade

- Analyzing the results

Let’s focus on each step in detail, so your crypto beginner’s journey is as smooth as possible.

Pick a crypto exchange

We would recommend sticking with proven platforms that already have a good track record, liquidity volumes, and a variety of payment options. CoinMarketCap website features an exchanges top based on daily volume and trust score — be sure to check it out as well. For the sake of this guide, we will use the biggest crypto platform in the world — Binance.

Register and verify

First, you have to create an account, which means an automatic creation of a crypto wallet to store your coins. The process usually involves a simple email verification and takes a few minutes.

As Binance is a centralized exchange, it does have a mandatory identity verification you need to pass before getting access to deposits, withdrawals, and trading. It requires providing personal information and multiple ID documents. Keep in mind that the review can take up to 10 days for some countries.

Make a deposit

The next step would be to make a fiat deposit and use these funds to buy crypto. Most CEXs offer fiat gateways via bank cards and transfers but also consider the fees. As soon as the money is credited to your account, you can move on to the fun part — making the first deal.

Create an order

To buy your first crypto, you need to use the primary tool of the exchange — an order. It is an instruction to the platform to buy or sell a specified amount of a chosen asset. Binance offers several order types for the convenience of traders, so let’s cover the three main ones.

- A market order is used to buy or sell an asset at a current market price. Such orders are executed instantly.

- A limit order is used to buy or sell an asset at a specified price. They will only be executed if the market rate reaches your desired price.

- A stop limit order is also used to buy or sell an asset at a specified rate, but it has a limit price and a stop price. When the stop price is reached, the limit order will be placed. If the limit price is reached in its turn, the order will be executed.

We went with a standard market order, allowing us to get the coins instantly. All we have to do is specify the amount we want to purchase and click “Buy BTC.” However, beware that the market price you see while creating an order may slightly differ from the execution price, as the rate changes each second.

Analyze the results

Most exchanges, including Binance, offer comprehensive order and account analytics, which is very useful while creating a working trading strategy. Once your order is filled, you can check its details in the Transaction history. The system will display all the necessary data, including the order amount, average price, etc.

We would also suggest keeping an eye on the wallet analytics page, which features a full review of your portfolio and its profitability. You can also check how the order impacted these metrics.

How much money can I make trading crypto?

It depends on your skills, initial investment, deal amount, and other factors. However, trading is a proven financial instrument that existed long before cryptocurrencies and can generate substantial profits. However, don’t get caught up in unrealistic fantasies of becoming a crypto millionaire overnight. Invest in your education, gain experience and focus on developing a long-term trading strategy that will provide you regular profits instead.