Bitcoin Market Sentiment Hits ‘Extreme Greed’ Ahead of Anticipated ETF Approval; Former SEC Chair Predicts Inevitable Approval of Bitcoin ETF; CleanSpark Eyes Acquisition of 160,000 Bitcoin Miners by 2025

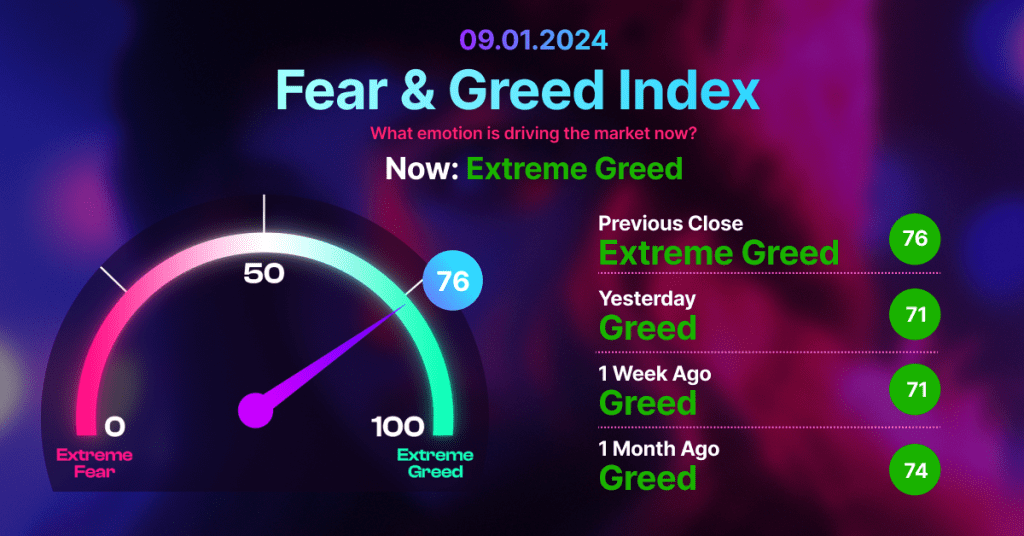

The Crypto Fear and Greed Index have entered the “extreme greed” zone with a score of 76 as the crypto community eagerly awaits the approval of a spot Bitcoin exchange-traded fund (ETF). This sentiment level is the highest since mid-November 2021 when Bitcoin was around its peak price of $69,000.

The index briefly touched “extreme greed” on December 5 with a score of 75, coinciding with Bitcoin breaking the $40,000 barrier on December 4 and surging to $44,000 the next day. The last occurrence of “extreme greed” was on November 11, 2021, with a score of 77, just after Bitcoin reached its all-time high.

The Crypto Fear and Greed Index consider factors such as volatility, market momentum, social media, surveys, Bitcoin dominance, and trends to evaluate market sentiment. When BlackRock filed for a spot Bitcoin ETF on June 15, the sentiment score was 41 (in the “Fear” zone), but it jumped to 59 (the “Greed” zone) as other asset managers followed suit. As the market holds its breath for potential ETF approvals, Bitcoin’s price surged to $47,175 on January 8, cooling off to $46,850 at the time of writing.

Former SEC Chair Predicts Inevitable Approval of Bitcoin ETF

Jay Clayton, former chairman of the United States Securities and Exchange Commission (SEC), expressed his belief that the approval of a spot Bitcoin exchange-traded fund (ETF) is “inevitable.” In a recent interview with CNBC on January 8, Clayton stated that there is “nothing left to decide” and that the approval is imminent.

Clayton, who served as the SEC chair for ten years, acknowledged the regulatory concerns over market manipulation and fraud that led to the denial of previous Bitcoin ETF applications. However, he noted a significant improvement in the underlying market dynamics of Bitcoin over the past five years, contributing to the changing landscape.

The former SEC chair commended the regulator for reaching a point where it is comfortable with the disclosures from firms like BlackRock and Fidelity regarding Bitcoin ETFs. Clayton highlighted the growth in infrastructure, making it possible to custody and secure Bitcoin in a manner accessible to traditional financial market participants.

Beyond the impact on crypto markets, Clayton emphasized the broader potential of blockchain technology to tokenize and trade real-world assets, foreseeing a significant change in finance overall.

As amended filings from prospective Bitcoin ETF issuers flood the SEC, experts suggest an accelerated process, with a high probability of a spot Bitcoin ETF approval by January 10. Analysts, including Bloomberg’s James Seyffart, anticipate further amendments in the coming days but consider them unlikely to signal a delay in the approval process.

CleanSpark Eyes Acquisition of 160,000 Bitcoin Miners by 2025

CleanSpark Inc., a United States-based Bitcoin miner, has unveiled a strategic agreement that opens the possibility of acquiring up to 160,000 miners by the end of 2024. The company has already purchased 60,000 Bitmain S21 units for $193.2 million, and delivery is expected between April and June 2024. CleanSpark also holds a strategic call option to acquire an additional 100,000 machines for $16 per terahash before the close of 2024.

If all 160,000 miners are deployed, CleanSpark anticipates a hash rate of 50 exahashes per second (EH/s), marking a 400% increase from its current 10 EH/s. CEO Zachary Bradford views the strategic call option as a “hedge” against potential surges in machine prices during bullish markets. He emphasized the company’s readiness for the next bull market without concerns about rising machine costs.

Bradford explained that during previous bull markets, machine prices increased three to five times, and the strategic agreement positions CleanSpark to expand seamlessly in the next bull market. This approach enables the company to manage its capital more efficiently by controlling various variables and provides flexibility to align infrastructure growth with macro events while ensuring cost certainty on miners.

CleanSpark’s move follows the footsteps of other Bitcoin miners like Marathon Digital Holdings, Riot Platforms, and Cipher Mining, which have recently increased their machine holdings in preparation for the upcoming Bitcoin halving event expected in April. CleanSpark reported mining 720 BTC in December, boosting its Bitcoin holdings to 3,002, valued at $140.9 million at current prices. The company’s share price rose by 5% to $10.72 on January 8, marking a 385% increase over the last 12 months, according to Google Finance.