In Todays Headline TV CryptoDaily News:

FTX’s former Engineering Chief Nishad Singh looking for deal from feds.

Another one of Sam Bankman-Fried’s former confidants and roommates is said to be engaging with the U.S. Attorney’s Office with the hope of getting a plea agreement. Nishad Singh, FTX’s former director of engineering, and a housemate of Bankman-Fried, is said to have met with prosecutors in a “proffer session.”

CFTC sues trader

The US Commodity Futures Trading Commission filed a lawsuit against crypto trader Avraham Eisenberg for allegedly manipulating the price of swaps contracts offered by Mango Markets, as part of a scam to steal $114 million.

Nepal orders ISPs to block crypto website.

Nepal’s authorities have once again taken steps to block cryptocurrency related activities. Nepal’s Telecommunications Authority instructed all internet service providers to prevent operating and managing crypto-related “websites, apps or online networks.”

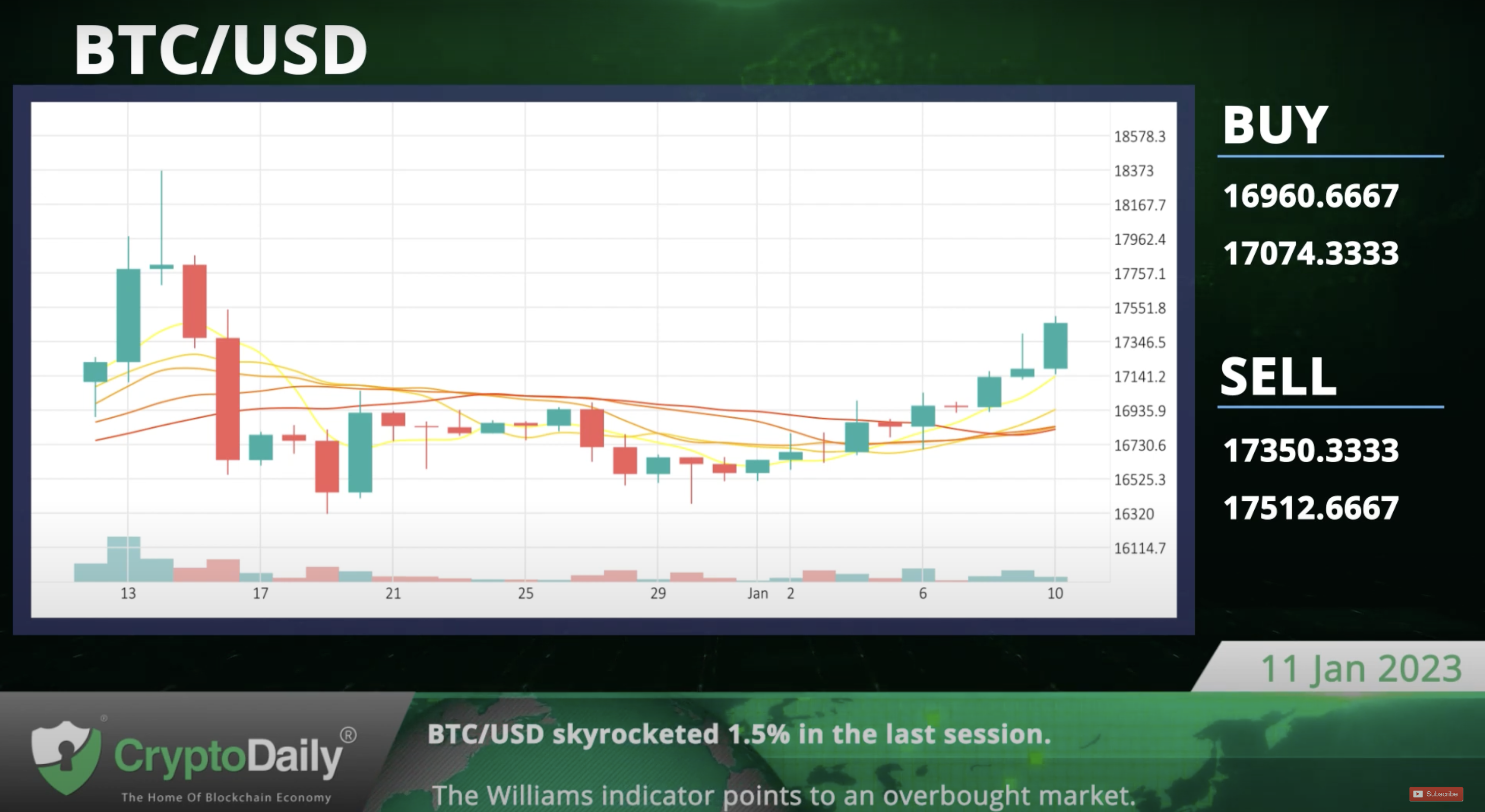

BTC/USD skyrocketed 1.5% in the last session.

The Bitcoin-Dollar pair exploded 1.5% in the last session. According to the Williams indicator, we are in an overbought market. Support is at 16960.6667 and resistance at 17512.6667.

The Williams indicator points to an overbought market.

ETH/USD skyrocketed 1.4% in the last session.

The Ethereum-Dollar pair skyrocketed 1.4% in the last session. The Stochastic-RSI indicates an overbought market. Support is at 1258.4967 and resistance at 1375.3767.

The Stochastic-RSI points to an overbought market.

XRP/USD exploded 1.1% in the last session.

The Ripple-Dollar pair gained 1.1% in the last session after rising as much as 1.5% during the session. The Stochastic-RSI indicates an overbought market. Support is at 0.3363 and resistance at 0.3635.

The Stochastic-RSI points to an overbought market.

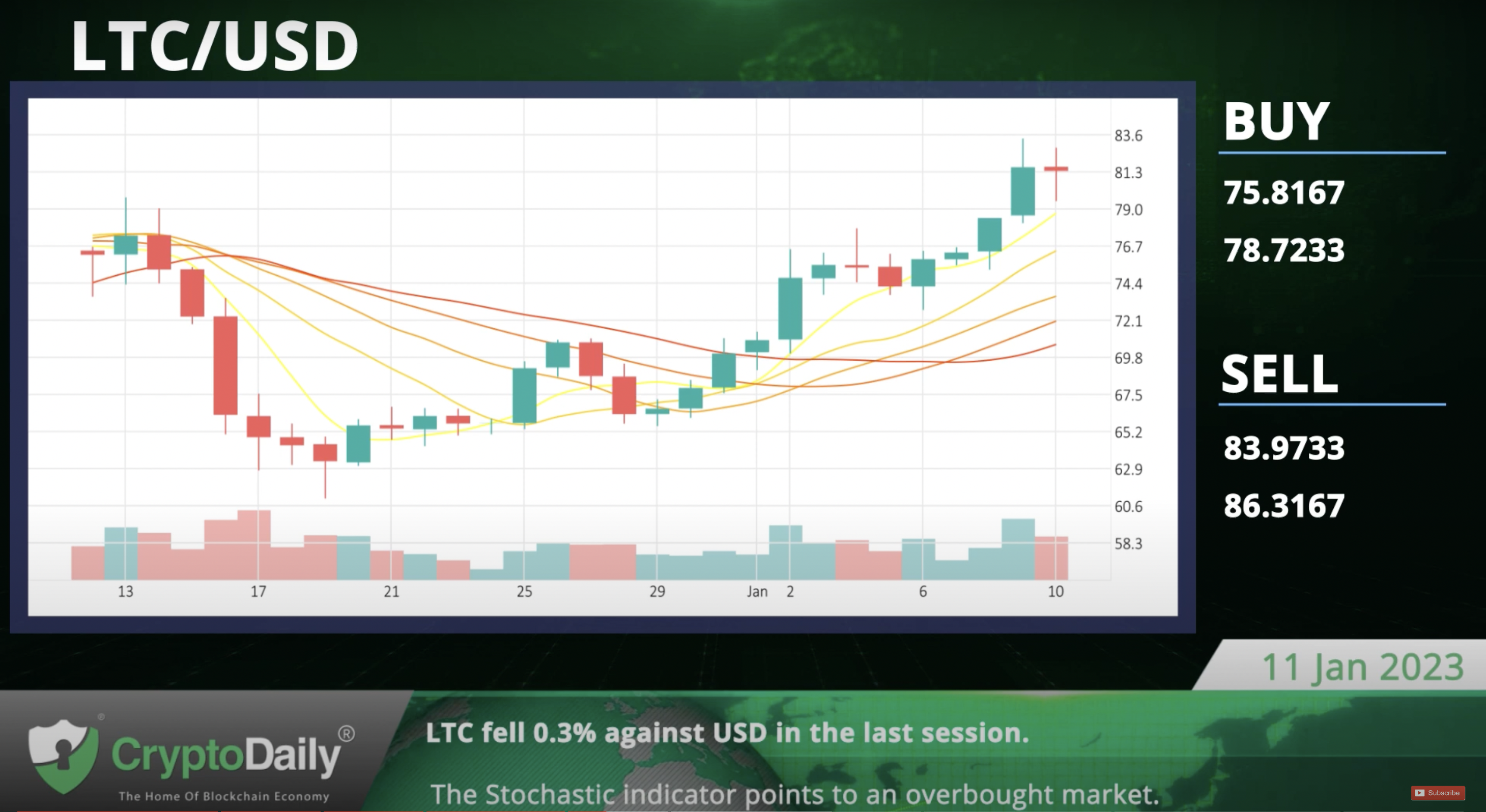

LTC fell 0.3% against USD in the last session.

The Litecoin-Dollar pair fell 0.3% in the last session. According to the Stochastic indicator, we are in an overbought market. Support is at 75.8167 and resistance at 86.3167.

The Stochastic indicator points to an overbought market.

Daily Economic Calendar:

US MBA Mortgage Applications

The MBA Mortgage Applications released by the Mortgage Bankers Association presents various mortgage applications. It is considered as a leading indicator of the U.S Housing Market. The US MBA Mortgage Applications will be released at 12:00 GMT, the US EIA Crude Oil Stocks Change at 15:30 GMT, Australia’s Retail Sales at 00:30 GMT.

US EIA Crude Oil Stocks Change

The EIA Crude Oil stockpiles report is a weekly measure of the change in the number of barrels in stock of crude oil and its derivates, released by the Energy Information Administration.

AU Retail Sales

The Retail Sales measures the total receipts of retail stores. Monthly percent changes reflect the rate of change of such sales.

JP Coincident Index

The Coincident Index released by the Cabinet Office is a single summary statistic that tracks the current state of the Japanese economy. Japan’s Coincident Index will be released at 05:00 GMT, Italy’s Retail Sales at 09:00 GMT, Germany’s 10-y Bond Auction at 10:30 GMT.

IT Retail Sales

The Retail Sales measures the total receipts of retail stores. Monthly percent changes reflect the rate of change of such sales.

DE 10-y Bond Auction

The auction sets the average yield on the bonds auctioned off. Yields are set by bond market investors, and therefore they can be used to estimate investors’ outlook on future interest rates.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.