SEC Clarifies: No Approval for Spot Bitcoin ETFs Yet; Uproar Ensues as SEC Faces Calls for Investigation Over False Bitcoin ETF Approval Post; MicroStrategy Rakes in Over $800 Million from Bitcoin in 2024

In a twist of events, the United States Securities and Exchange Commission (SEC) debunked widespread reports claiming approval for spot Bitcoin exchange-traded funds (ETFs). On January 9, the official SEC X (formerly Twitter) account posted a tweet suggesting approval, triggering market reactions. However, SEC Chair Gary Gensler clarified that the commission had not approved the listing and trading of spot Bitcoin ETFs.

The initial tweet, deemed an “unauthorized post,” presented a fabricated quote from Gensler, and the SEC promptly retracted it. Despite the false social media post, Gensler’s statement did not reveal the SEC’s stance on approving or denying spot Bitcoin ETFs. The market had anticipated a decision in the coming days, with applications from various asset managers reaching final stages.

While the incident caused a brief surge and subsequent drop in Bitcoin’s price, experts still expect potential approvals for spot BTC ETFs, with decisions expected on submissions from ARK Invest and 21Shares by January 10. Some speculated that the retracted tweet might have prematurely disclosed accurate information, adding an element of uncertainty to the unfolding situation.

Uproar Ensues as SEC Faces Calls for Investigation Over False Bitcoin ETF Approval Post

In a surprising turn of events, U.S. lawyers and senators are urging Congress to launch an investigation into the U.S. Securities and Exchange Commission (SEC) following a reported compromise of its X (formerly Twitter) account. The compromised account falsely claimed that spot Bitcoin exchange-traded funds (ETFs) had gained regulatory approval.

Senator Bill Hagerty expressed strong disapproval, stating, “Just like the SEC would demand accountability from a public company if they made such a colossal market-moving mistake, Congress needs answers on what just happened. This is unacceptable.”

Senator Cynthia Lummis echoed the sentiment, demanding transparency from the SEC regarding the circumstances that led to the misleading post.

Charles Gasparino of Fox Business revealed insights from securities lawyers, suggesting that the SEC might need to conduct an internal investigation into potential market manipulation.

U.S. Representative Ann Wagner labeled the incident as “clear market manipulation,” impacting millions of investors.

Bloomberg ETF analyst James Seyffart speculated on SEC Chair Gary Gensler’s potential reaction, predicting frustration with the staff member responsible for the security breach.

Expressing concern, U.S. lawyer James Murphy addressed Gensler directly, stating, “I’m not pointing fingers, but somebody’s negligence in your organization just wrecked some real live investors.”

Investigating the incident, X Safety, an account controlled by X, confirmed that the SEC’s account was compromised through control over a phone number associated with the SEC account via a third party. Notably, the SEC’s X account lacked two-factor authentication at the time of the breach.

Bitcoin advocate Layah Heilpern highlighted the severity of the situation, emphasizing that the false post remained visible for 20 minutes, accumulating at least 4.4 million views. Heilpern labeled the incident as “absolute market manipulation.”

Despite the SEC’s denial of staff involvement, details about the compromise remain undisclosed. Bloomberg ETF analyst Eric Balchunas, amidst the controversy, continues to anticipate the official approval of spot Bitcoin ETFs, expected between 4:00 pm to 5:00 pm Eastern Time (9:00 pm to 10:00 pm UTC) on Jan. 10.

MicroStrategy Rakes in Over $800 Million from Bitcoin in 2024

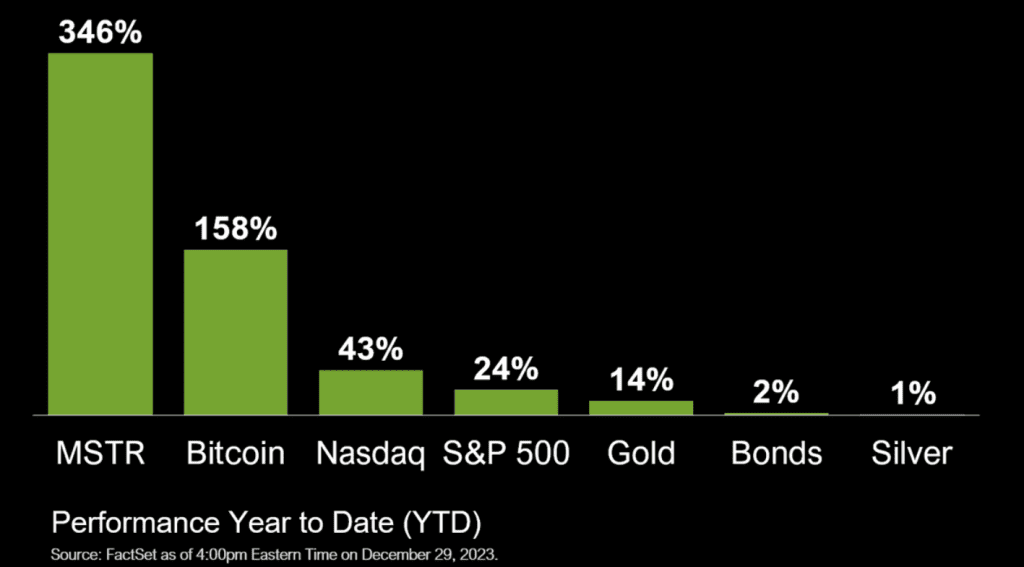

MicroStrategy, the American software technology firm and pioneering corporate investor in Bitcoin, has reaped more than $800 million in profits from the leading cryptocurrency in 2024, according to data from Bitcoin Treasuries. The firm, which holds the world’s largest corporate Bitcoin treasury, has seen substantial gains as Bitcoin experiences a resurgence in price.

With its Bitcoin holdings totaling 189,150 BTC as of Jan. 9, 2024, MicroStrategy’s investment is now valued at approximately $8.832 billion. This represents an increase of $840 million from the start of the year. Notably, the majority of these gains, around $600 million, were accrued on Jan. 8, a day marked by a significant $3,000 daily candle in the BTC/USD trading pair.

MicroStrategy initiated its Bitcoin investments in August 2020 when the cryptocurrency was priced just above $10,000. With its latest acquisition of 14,620 BTC, the firm’s cost basis per coin now stands at $31,168. MicroStrategy CEO Michael Saylor, who personally owns over 17,000 BTC, is also enjoying considerable success with his investment.

Despite the impressive returns from Bitcoin, MicroStrategy’s stock has faced headwinds, declining by more than 15% year-to-date. In a unique move, Saylor recently disclosed a $216 million sale of his company options, intending to use the proceeds to further increase his personal Bitcoin exposure. Saylor emphasized that, in the current year, Bitcoin has empowered MicroStrategy, outperforming stocks and gold.

It’s worth noting that MicroStrategy’s Bitcoin success story unfolds against the backdrop of a challenging stock performance, showcasing the potential divergences between traditional market dynamics and the evolving narrative surrounding digital assets.