Shopify to accept USDC payments through Solana Pay; Bitstamp ends Ether staking in the US; Bitcoin difficulty reached an all-time high, breaking a new record.

Shopify to accept USDC payments through Solana Pay

Shopify will leverage Solana Pay for USDC payments.

Solana Labs’ payment protocol Solana Pay will integrate with Shopify, enabling millions of businesses on the platform to benefit from the app, TechCrunch reported.

Launched in February 2022, Solana Pay is built on the Solana blockchain. Josh Fried of the Solana Foundation told Tech Crunch that the first payment option to be added for this integration will be Circle’s stablecoin USDC.

USDC was chosen largely because, as a stablecoin, its value is fixed. Many businesses are likely to trust a crypto asset whose value is indexed to the US dollar. However, USDC is also seen as a reliable option as it is more regulated than many other altcoins.

The advantages of paying with crypto

Shopify accounts for 10% of total e-commerce in the US. The Solana ecosystem has more than 11.5 million active accounts.

Regarding crypto payments, Fried said:

“Some people claim that a great app for crypto still hasn’t arrived, but it has.”

Fried emphasized that credit card transaction fees cost a business approximately 1.5% to 3.5% per transaction, but payments with Solana Pay are virtually free.

Bitstamp ends Ether staking in the US

Cryptocurrency exchange Bitstamp has decided to terminate its staking services for US customers.

Bobby Zagotta, CEO of Bitstamp US, said:

“Customers will continue to earn staking rewards until September 25, 2023, after which all staked assets will be removed. Rewards, along with the principal, will be transferred to users’ balances on the exchange.”

According to Bitstamp’s website, the exchange takes a 15% commission on all staking rewards. The monthly reward rate for staking Ether on the exchange is 4.5%. With this move, the US joins Canada, Japan, Singapore and the UK as countries where Bitstamp does not offer staking services.

The decision appears to be driven by recent legal developments in the US. The exchange announced in early August that seven altcoins would no longer be offered in the US. These were the altcoins AXS, CHZ, MANA, MATIC, NEAR, SAND and SOL. However, the company did not disclose the reason for the tokens’ delisting.

Ether is the native cryptocurrency of the Ethereum blockchain. The main issues with the regulatory framework in the US center on whether Ether should be classified as a commodity or a security. SEC Chairman Gensler has stated that Bitcoin is a commodity, while refraining from making a definitive judgment on Ether.

Bitcoin difficulty reached an all-time high – Breaking a new record!

According to the latest on-chain data, Bitcoin difficulty reached an all-time high, setting a new peak record.

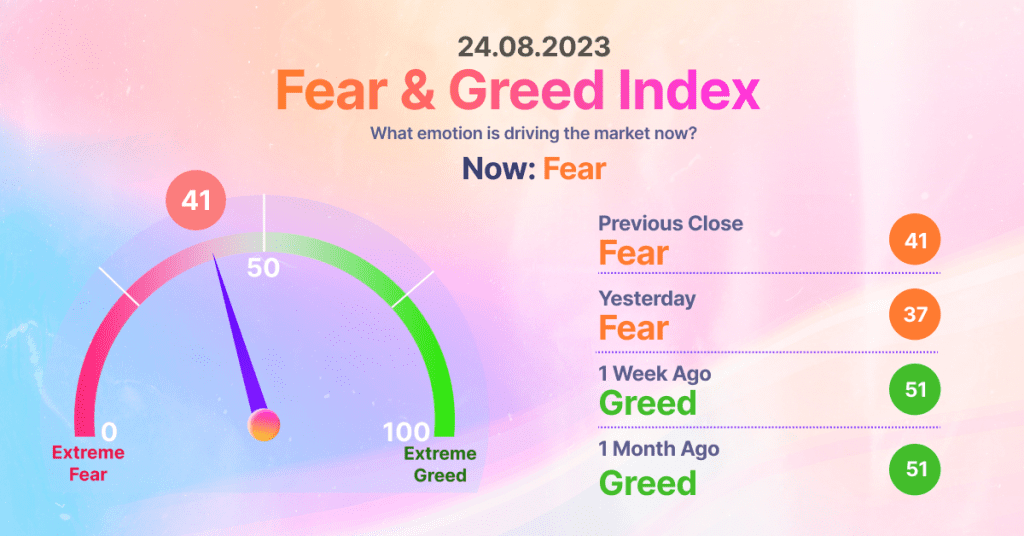

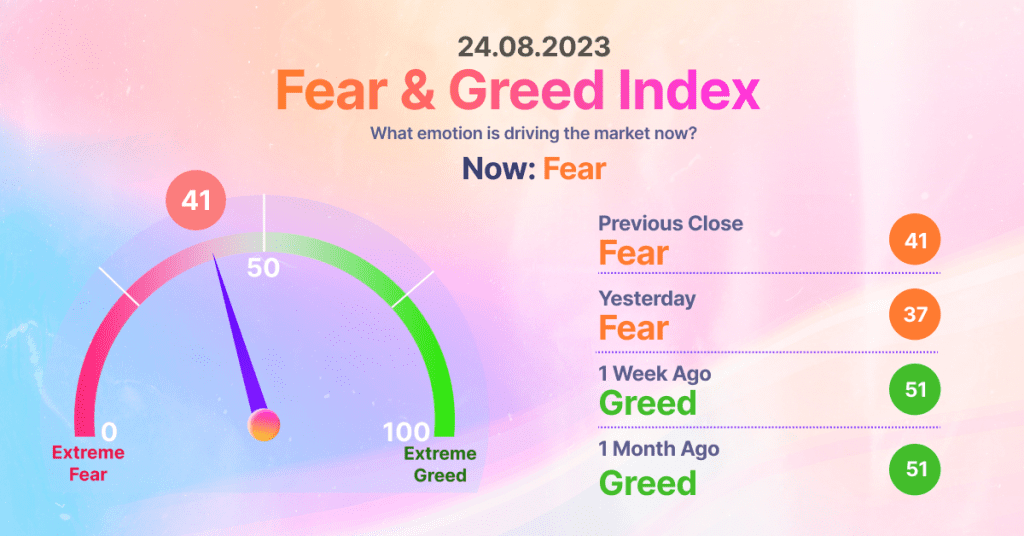

Bitcoin difficulty held the price drop

Despite the BTC/USD pair dropping 11 percent last week, Bitcoin miners have apparently gotten used to the downturn in prices.

This was also reflected in network activity on August 22, with the most recent bi-weekly automatic recalibration showing a 6.17 percent increase in difficulty.

This not only pushed the difficulty to new record highs, but also marked Bitcoin’s sixth-largest difficulty spike in 2023, according to figures from tracking source BTC.com.

The next automation, however, is expected to continue this trend, with the first difficulty increase of over 56 trillion.

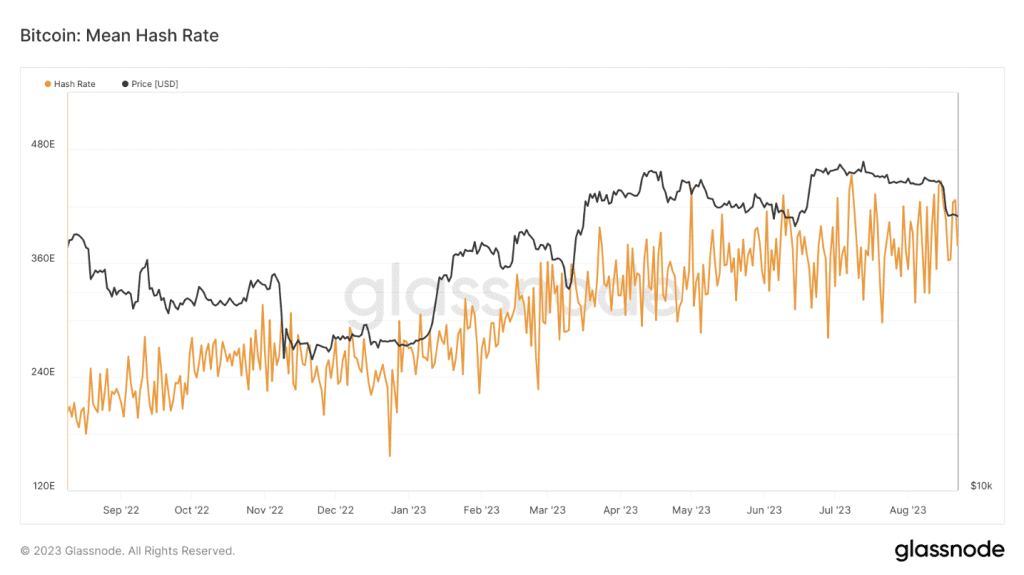

According to the published data, the hashish rate is already challenging current all-time highs of over 400 exahashes per second (EH/s), although an exact calculation is not possible depending on the source.

For investors, the increase in Bitcoin difficulty means an increase in the reliability of the BTC and ETH networks. The fact that the price has fallen despite the increase in the intrinsic value of the two assets means that they are undervalued and can be considered a time to actively accumulate assets.

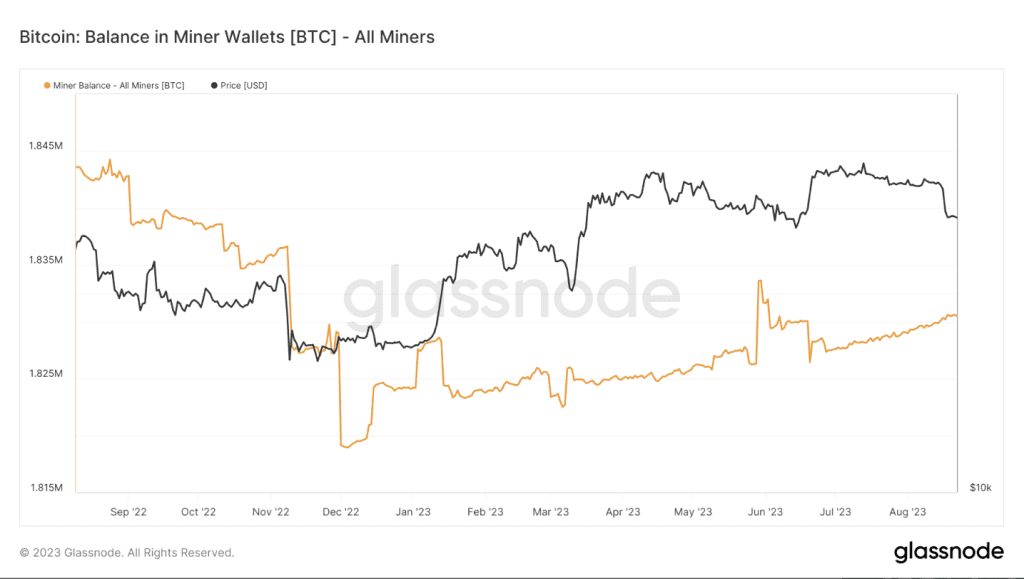

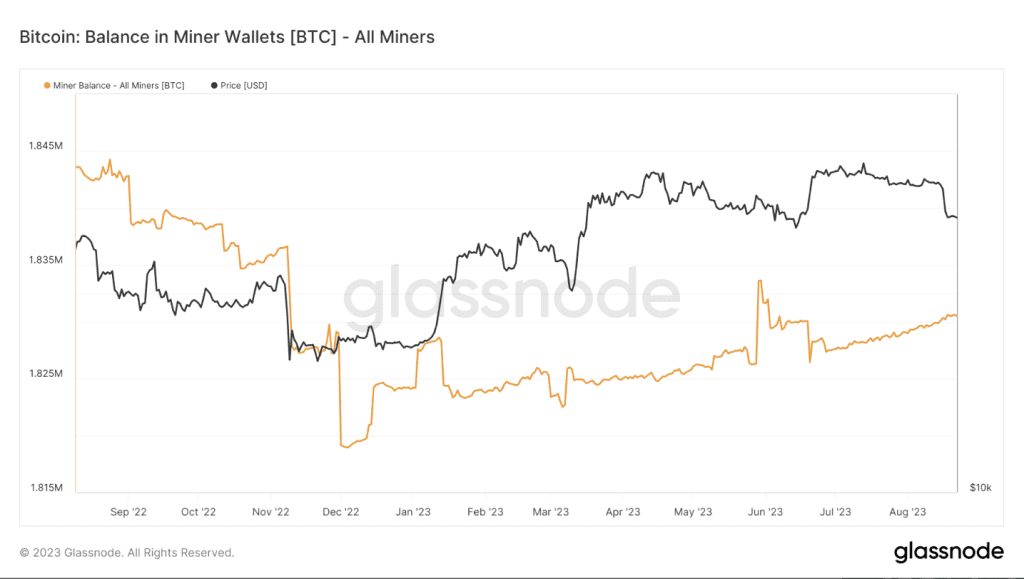

Separate data from on-chain analytics firm Glassnode also revealed little concrete change in the amount of BTC held by mining organizations.

It also stood at just over 1.83 million BTC as of August 22, a steady increase of 0.08 percent since the start of the month.