In Todays Headline TV CryptoDaily News:

Crypto bank Silvergate stock tumbles.

Shares of crypto-friendly lender Silvergate Capital plunged 45% early on questions about its survival due to losses and numerous regulatory issues that have arisen following November’s FTX exchange collapse.

Australia’s DIY pension funds lose millions on crypto bets.

Thousands of Australians who used do-it-yourself pension funds to bet on cryptocurrencies face hundreds of millions of dollars in losses, jeopardizing their savings in a scheme originally set up to ensure adequate retirement income.

NFT trading volumes hit $2B in February.

According to Web3 data platform DappRadar’s latest industry report, NFT trading volumes reached $2 billion in February – the highest number since before the meteoric crash of Terra and its UST and LUNA tokens in May 2022.

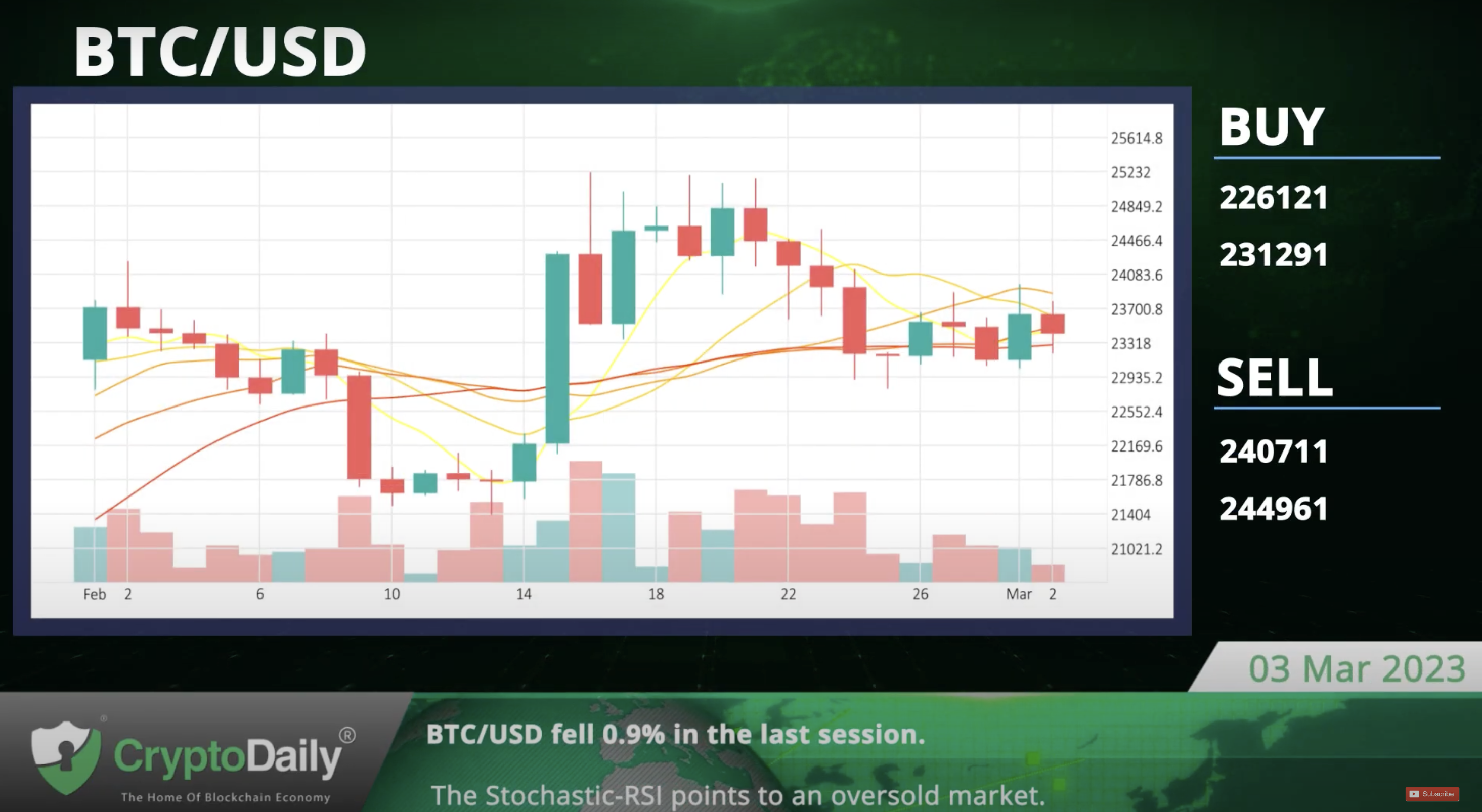

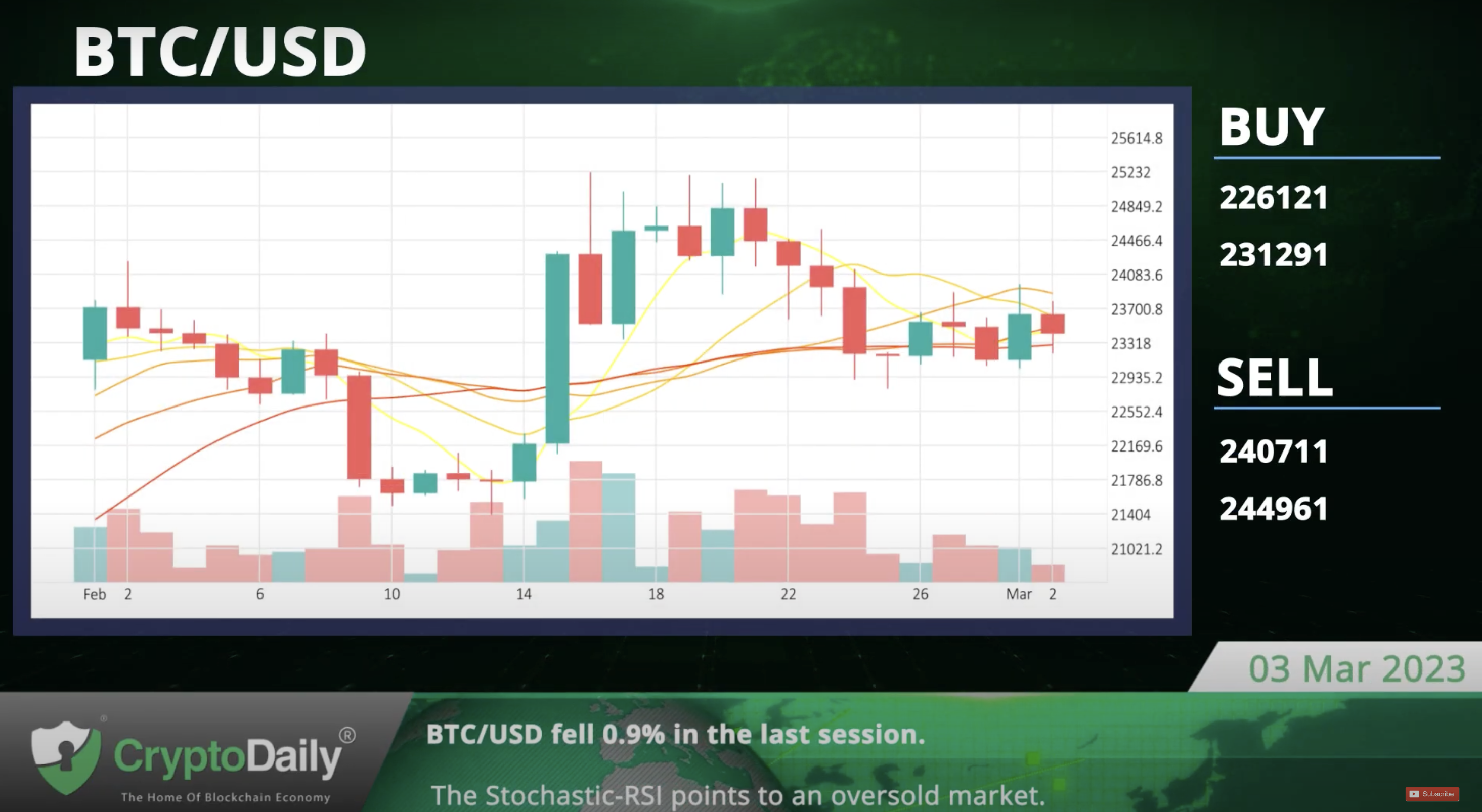

BTC/USD fell 0.9% in the last session.

The Bitcoin dropped 0.9% against the Dollar in the last session. According to the Stochastic-RSI, we are in an oversold market. Support is at 226121 and resistance at 244961.

The Stochastic-RSI points to an oversold market.

ETH/USD dove 1.3% in the last session.

The Ethereum-Dollar pair plummeted 1.3% in the last session. The Stochastic indicator is giving a positive signal. Support is at 1570.1033 and resistance at 1716.5433.

The Stochastic indicator is giving a positive signal.

XRP/USD plummeted 1.3% in the last session.

The Ripple-Dollar pair dove 1.3% in the last session. The Stochastic indicator is giving a negative signal, which matches our overall technical analysis. Support is at 0.3686 and resistance at 0.392.

The Stochastic indicator is currently in negative territory.

LTC/USD plummeted 2.7% in the last session.

The Litecoin-Dollar pair dove 2.7% in the last session. The Stochastic indicator’s positive signal is in line with the overall technical analysis. Support is at 92.011 and resistance at 101.111.

The Stochastic indicator is currently in the positive zone.

Daily Economic Calendar:

JP Jibun Bank Services PMI

The Jibun Bank Services Purchasing Managers Index (PMI) captures the business conditions in the services sector. The services PMI is an important indicator of the overall economic conditions. Japan’s Jibun Bank Services PMI will be released at 00:30 GMT, the US ISM Services Employment Index at 15:00 GMT, and Japan’s CFTC JPY NC Net Positions at 20:30 GMT.

US ISM Services Employment Index

The ISM Services Employment Index estimates the labour market in the services sector, taking into account expectations for future production, new orders, inventories, employment and deliveries.

JP CFTC JPY NC Net Positions

The weekly Commitments of Traders (COT) report provides information on the size and the direction of the positions taken. The report focuses on speculative positions.

US ISM Services PMI

The ISM Services PMI shows the business conditions outside of the manufacturing sector, taking into account expectations for future production, new orders, inventories, employment and deliveries. The US ISM Services PMI will be released at 15:00 GMT, Germany’s Trade Balance at 07:00 GMT, the UK’s CFTC GBP NC Net Positions at 20:30 GMT.

DE Trade Balance

The Trade Balance is the total difference between exports and imports of goods and services. A positive value shows a trade surplus, while a negative value represents a trade deficit.

UK CFTC GBP NC Net Positions

The weekly Commitments of Traders (COT) report provides information on the size and the direction of the positions taken. The report focuses on speculative positions.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.