Spot Bitcoin ETFs Record Over $4.5 Billion in Total Volume on Debut Trading Day; Stablecoin Issuer Circle Files Confidentially for IPO in the United States: Reports; Ethereum Foundation Introduces Major Changes to Account Abstraction for Gas Efficiency

Spot Bitcoin ETFs top $4.5B total volume on the first day of trading

The inaugural trading day for a set of new Bitcoin exchange-traded funds (ETFs) marked a robust start, with BlackRock, Grayscale, and Fidelity emerging as the top performers in total trading volumes. However, one issuer faced delays in commencing trading.

Aggregate data from Yahoo Finance indicates that the combined volume for ten spot Bitcoin ETFs surpassed $4.5 billion on their first day of trading. BlackRock’s iShares Bitcoin Trust (IBIT) took the lead among the newly-listed funds, overseeing over $1 billion in volume, constituting 22% of the total volume for the group, according to Yahoo Finance data.

Fidelity’s spot Bitcoin ETF (FBTC) closely followed, experiencing approximately $685 million in trading volume on its debut day. Grayscale’s Bitcoin ETF (GBTC) recorded a total volume of $2.2 billion. It’s worth noting that GBTC transitioned from Grayscale’s pre-existing Bitcoin Trust.

Hashdex, however, faced a setback as its spot Bitcoin ETF did not begin trading as anticipated. While the SEC approved Hashdex’s 19b-4 filing, enabling the listing of its spot ETF on U.S. stock exchanges, the S-1 form did not become effective. As a result, Hashdex’s “DEFI” fund continues to trade as a futures-based ETF.

Trading volume, which encompasses both inflows and outflows, offers insights into overall market activity but does not provide a comprehensive breakdown of buying versus selling. Analysts suggest that a substantial portion of GBTC’s trading activity may involve selling, as investors transition from the fund to newer, lower-fee alternatives like those offered by BlackRock and Fidelity.

The ProShares Futures Bitcoin ETF (BITO) also witnessed noteworthy trading activity, with a total volume exceeding $2 billion on its debut day. This surge is attributed to selling as investors pivot from futures-based Bitcoin exposure to more cost-effective and less volatile spot-based exposure.

Investment manager Timothy Peterson estimated that the cumulative buying activity across the ETFs would necessitate the purchase of approximately 47,000 Bitcoins, equivalent to $2.1 billion at current prices, on the spot market.

Bloomberg ETF analyst Eric Balchunas suggested that a more precise understanding of the impact of ETFs on underlying Bitcoin purchases may become clearer later on January 13 as spot inflows are assessed.

Stablecoin Issuer Circle Files Confidentially for IPO in the United States: Reports

Circle Internet Financial, the issuer of USD Coin (USDC), the second-largest stablecoin by market capitalization, has reportedly filed for an initial public offering (IPO) in the United States. According to reports on January 11, Circle submitted a confidential IPO filing as part of its strategy to become a publicly traded company. The filing has been made with the U.S. Securities and Exchange Commission (SEC), and Circle anticipates the IPO to proceed after the completion of the SEC review, pending market conditions.

While Circle has not disclosed specific details such as the proposed price range or the number of shares to be offered, the move marks a significant step for the stablecoin issuer. Talks of Circle going public surfaced in 2021 when it announced plans for a merger with Concord Acquisition Corp, initially valued at $4.5 billion and later reaching $9 billion in 2022. However, the merger was eventually called off.

In 2023, reports suggested that Circle was actively considering an IPO, with discussions taking place among the company’s advisers. Circle, known for issuing the USDC stablecoin pegged to the U.S. dollar, has expressed its long-standing strategic aspirations to be publicly listed in the U.S. The company’s decision to confidentially file for an IPO aligns with its ongoing efforts to navigate the evolving landscape of the digital asset industry.

USDC, with a market capitalization of $25 billion, continues to be one of the world’s largest stablecoins, and Circle’s move towards an IPO reflects broader trends in the cryptocurrency industry, with established players seeking greater exposure and legitimacy through public listings. The successful completion of the IPO would likely have significant implications for the mainstream acceptance and regulation of stablecoins and digital assets in the financial markets.

Ethereum Foundation Introduces Major Changes to Account Abstraction for Gas Efficiency

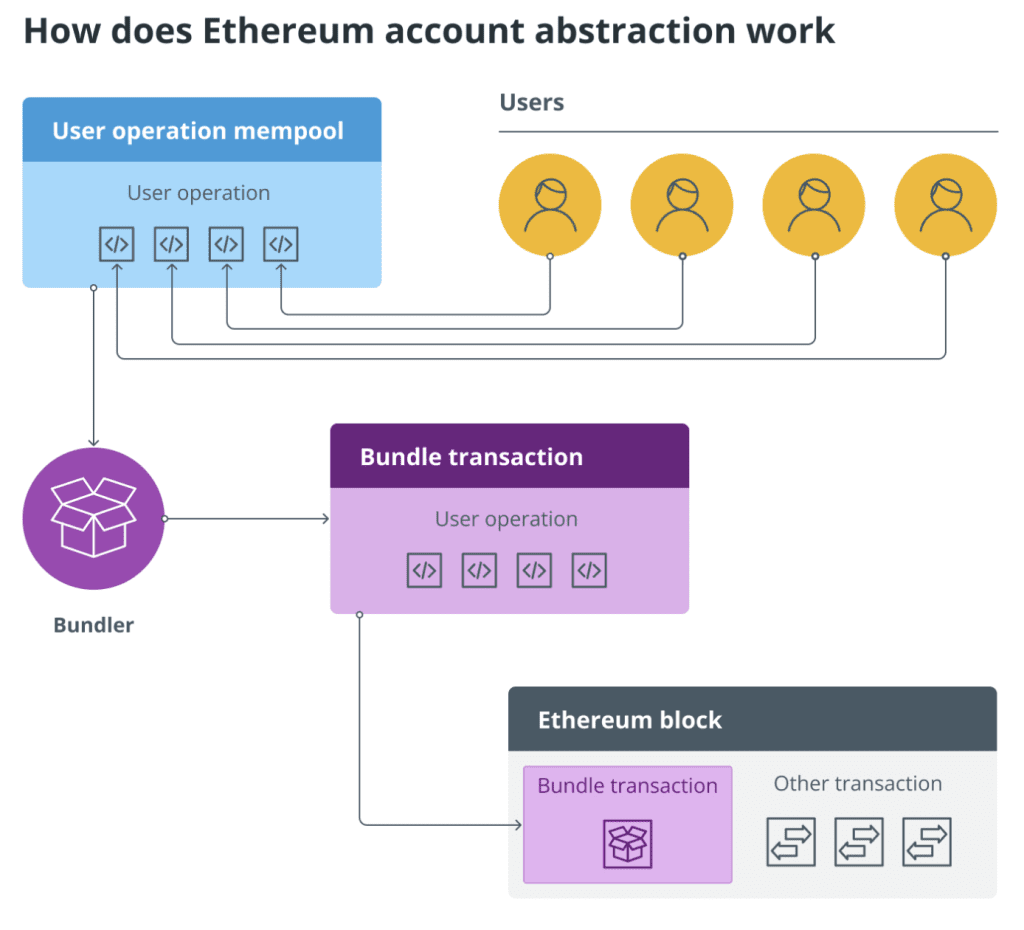

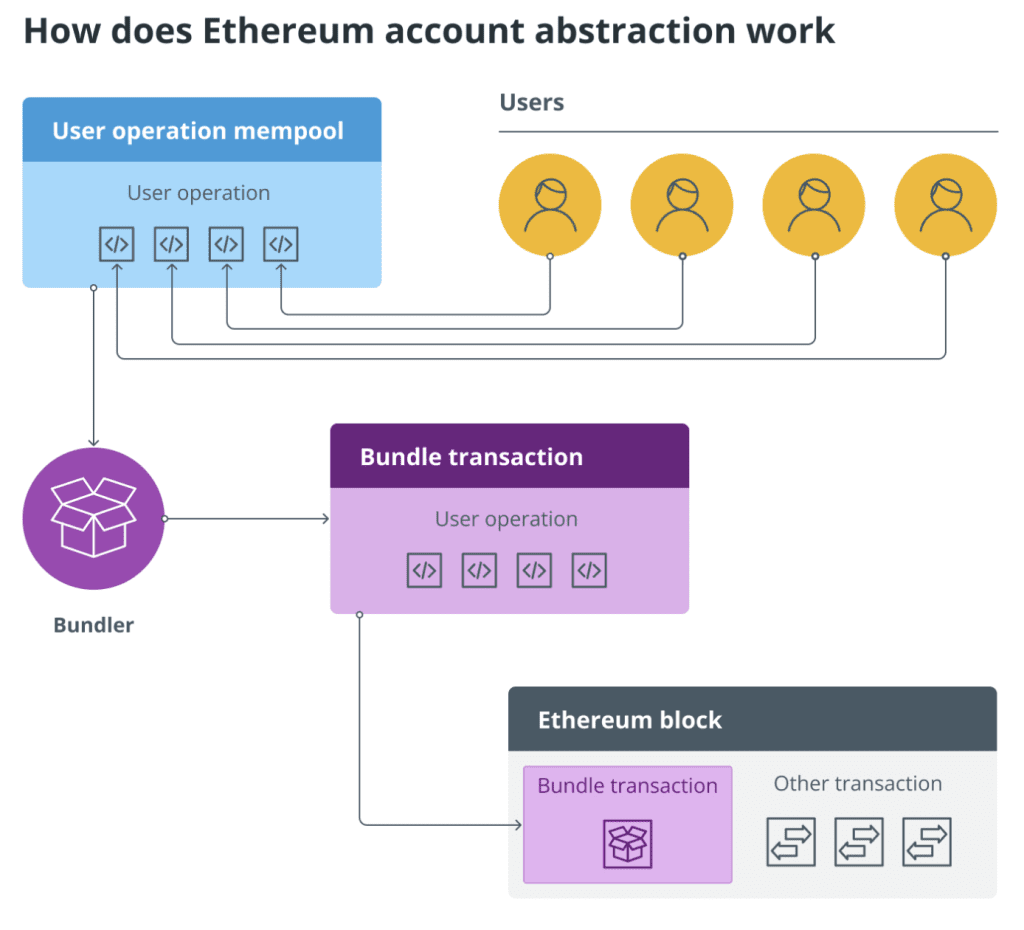

The Ethereum Foundation is implementing significant changes to the account abstraction standard, ERC-4337, in an effort to optimize gas consumption, particularly for layer-2 solutions.

On January 10, the Ethereum Foundation provided a preview of the substantial modifications to the ERC-4337 standard specification, which governs account abstraction, commonly referred to as smart accounts.

Version 0.7, the latest iteration, incorporates insights gained from nine months of utilizing ERC-4337, according to developer John Rising. The primary alteration involves the structure of account abstraction transactions, which are more intricate than standard Ethereum transactions. The new design necessitates specifying five gas values instead of just one.

Rising clarified that multiple gas values are required because an account can perform computations while its signature is being verified. Users now have to specify more than one gas value, considering the various types of signatures and payment methods associated with smart accounts.

This modification enhances gas estimation accuracy and reduces gas costs, particularly on layer-2 networks, by minimizing the data that needs to be published.

According to Rising, the primary user benefits of version 0.7 include reduced gas fees and improved efficiency in using transaction data, particularly advantageous for layer-2 blockchains.

In addition to these changes, the new specification imposes a 10% penalty on users for all unused gas in execution, preventing unnecessary high gas limits in transactions.

Account abstraction, or “smart accounts,” enables Ethereum accounts to have programmable logic and rules, expanding the range of use cases. Proposed in September 2021 by Ethereum co-founder Vitalik Buterin and other developers in EIP-4337, account abstraction transforms passive and static Ethereum accounts into active and programmable entities.

While the Ethereum Foundation has not provided a specific release date for version v0.7, it announced the commencement of the security audit, with expectations of finalizing everything by ETH Denver at the end of February.