In Todays Headline TV CryptoDaily News:

Tesla did not buy or sell any Bitcoin in Q4.

Electric car maker Tesla did not buy or sell any bitcoin in the fourth quarter for the second straight quarter, the company reported Wednesday in its latest earnings report.

The value of its digital assets at the end of the quarter was $184 million, down from $218 million at the end of the third quarter due to impairment charges from a decline in bitcoin’s price.

Ripple, Binance impersonators target XRP holders.

The cryptocurrency community has raised flags about a new scam targeting XRP investors through a fake staking program. Online fraudsters are impersonating major cryptocurrency firms like Ripple and Binance by creating fake websites and email imposters pretending to provide staking services for XRP.

Binance USD stablecoin sees $2B reduction in a month.

Crypto exchange giant Binance’s BUSD stablecoin has extended its recent declines, amid mismanagement issues involving the exchange’s pegged tokens that surfaced earlier this month, and other debacles. BUSD’s circulating supply fell to $15.4 billion, paring down $1 billion over the past week and $2 billion in a month.

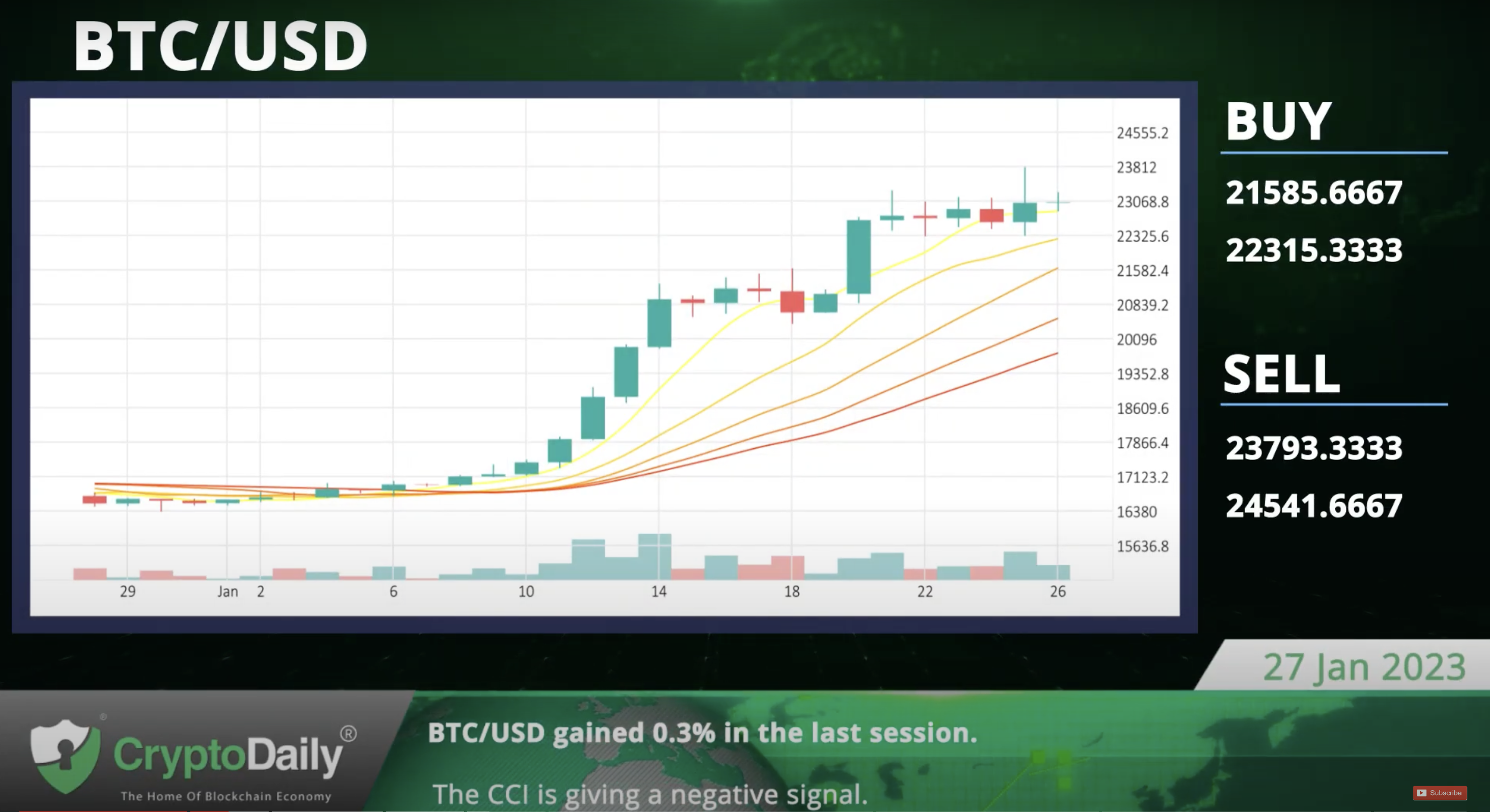

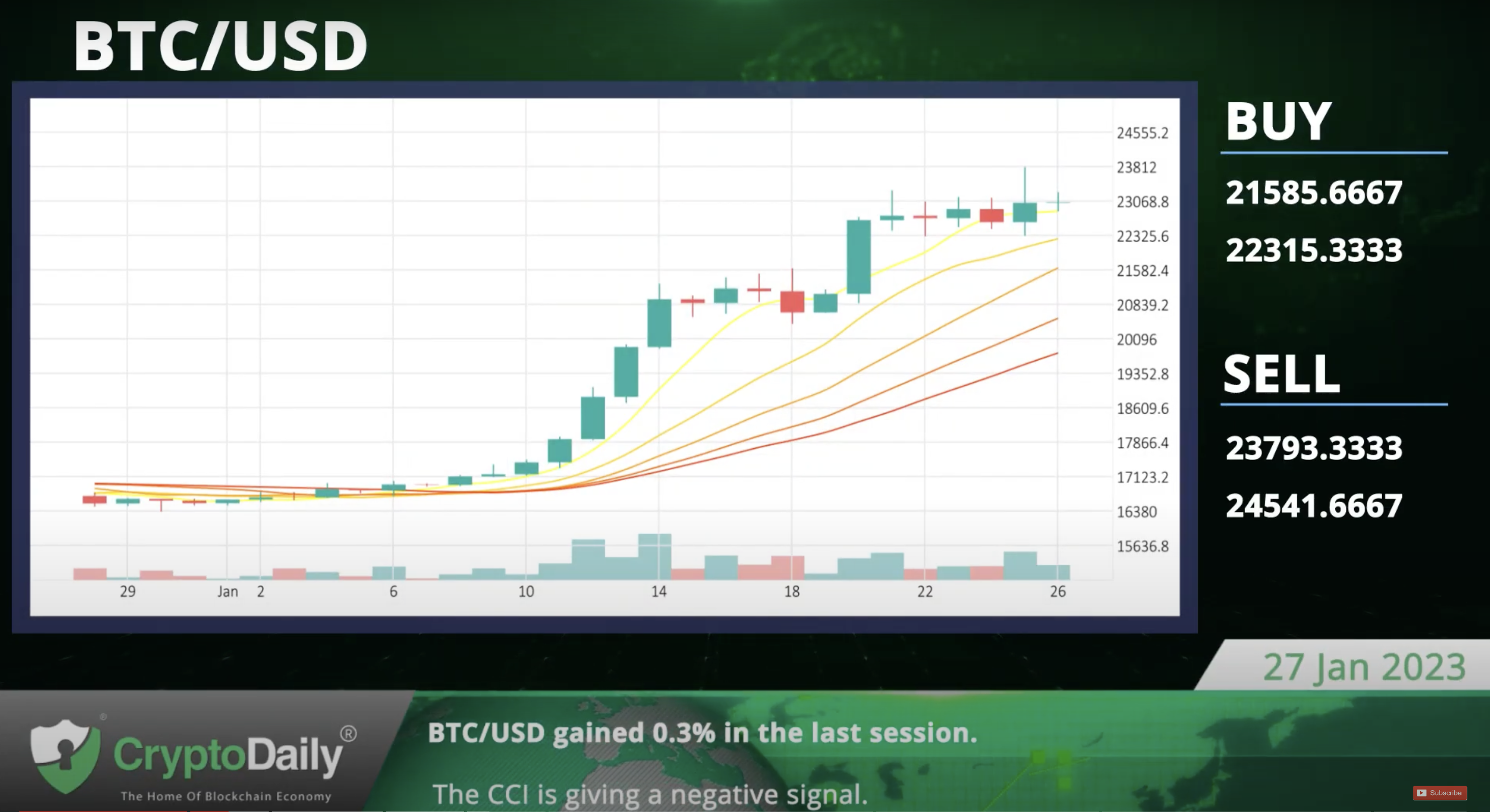

BTC/USD gained 0.3% in the last session.

Bitcoin gained 0.3% against the Dollar in the last session. The CCI is giving a negative signal. Support is at 21585.6667 and resistance at 24541.6667.

The CCI is giving a negative signal.

ETH fell 0.3% against USD in the last session.

The Ethereum-Dollar pair fell 0.3% in the last session after gaining as much as 1.0% during the session. The Stochastic indicator is giving a negative signal. Support is at 1476.021 and resistance at 1706.581.

The Stochastic indicator is giving a negative signal.

XRP/USD dove 1.2% in the last session.

The Ripple-Dollar pair plummeted 1.2% in the last session. The CCI is giving a negative signal. Support is at 0.3855 and resistance at 0.4399.

The CCI is currently in negative territory.

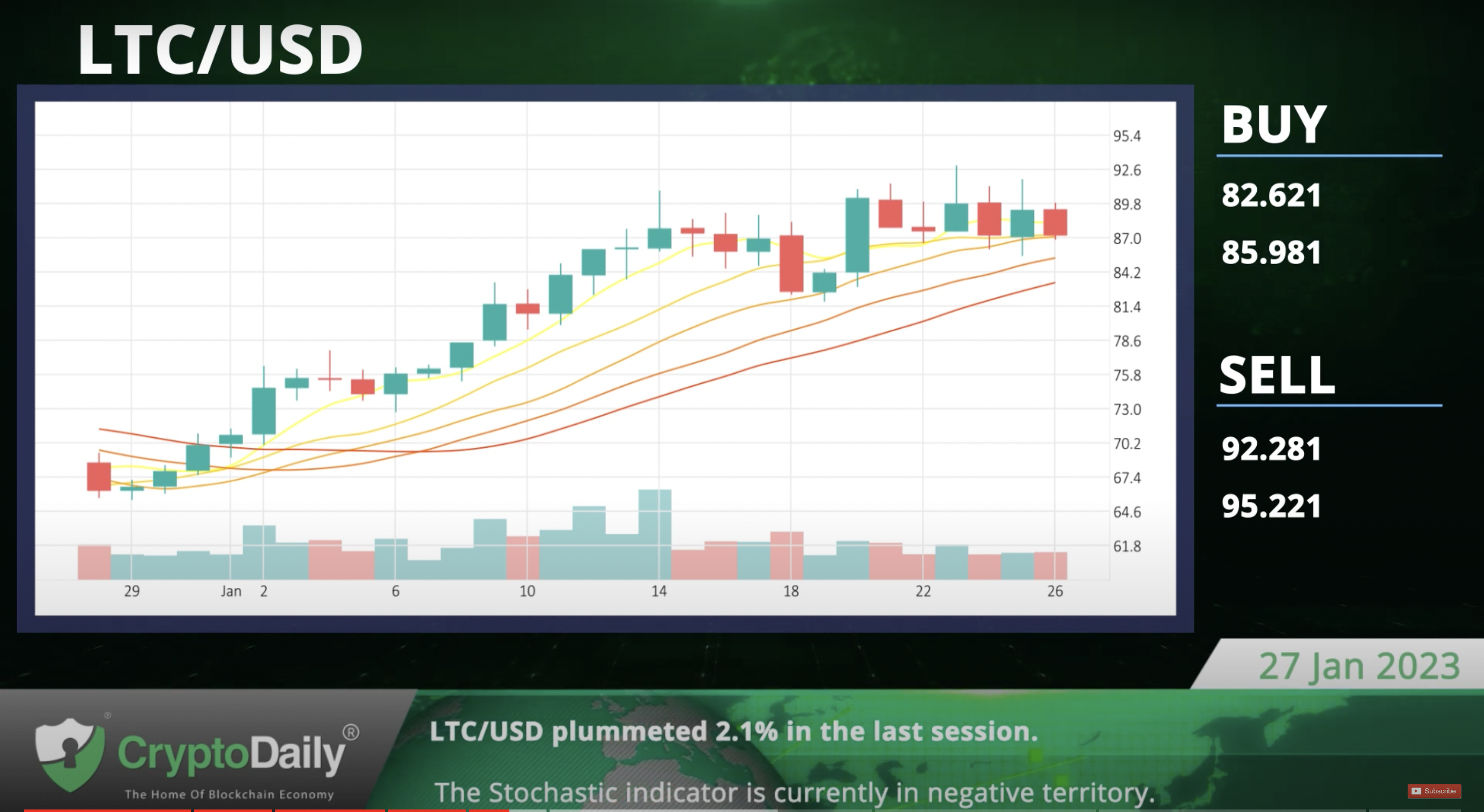

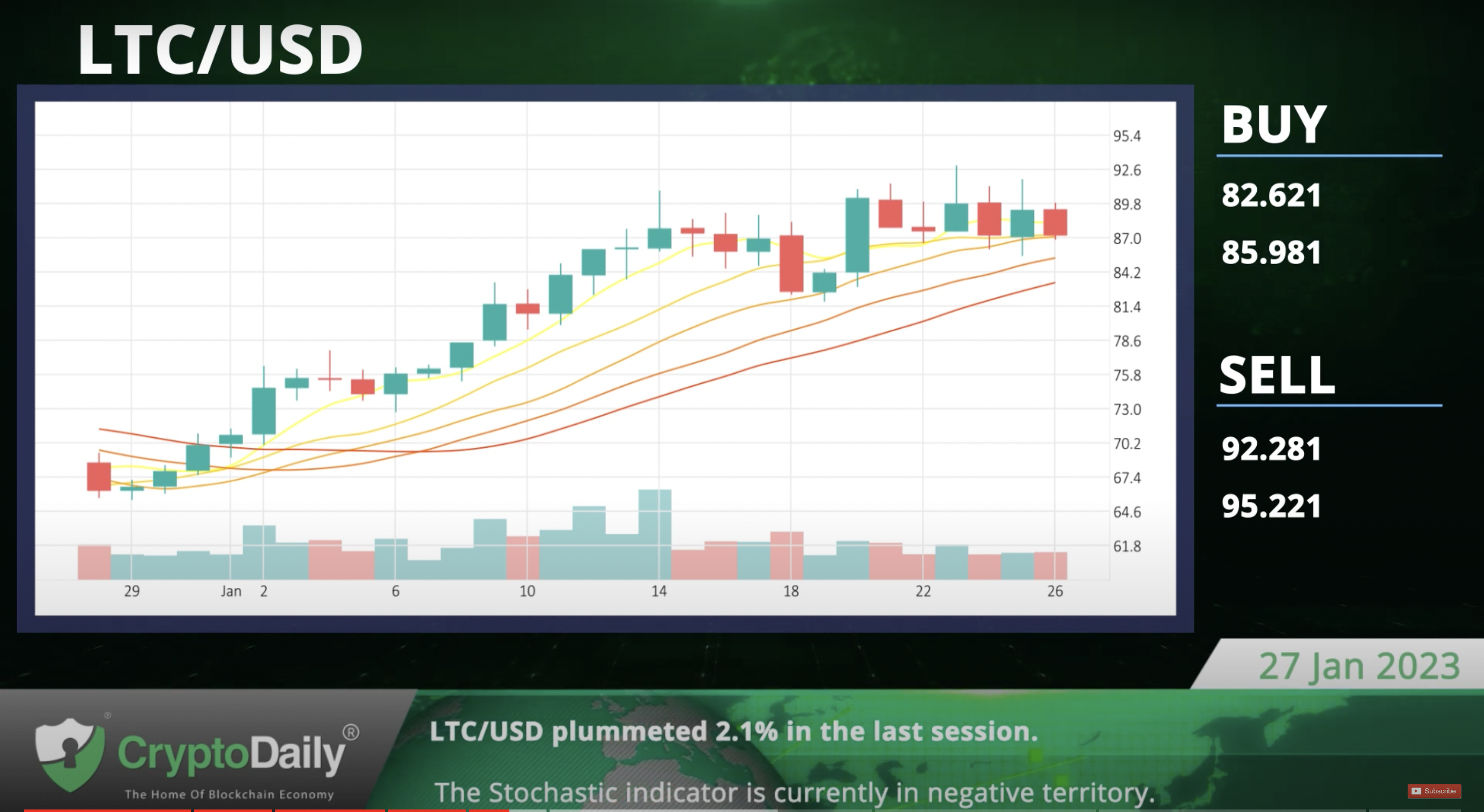

LTC/USD plummeted 2.1% in the last session.

The Litecoin-Dollar pair dove 2.1% in the last session. The Stochastic indicator is giving a negative signal. Support is at 82.621 and resistance at 95.221.

The Stochastic indicator is currently in negative territory.

Daily Economic Calendar:

FI Unemployment Rate

The Unemployment Rate measures the percentage of unemployed people in the country. A high percentage indicates weakness in the labor market. Finland’s Unemployment Rate will be released at 06:00 GMT, the US Personal Spending at 13:30 GMT, and the Irish Retail Sales at 11:00 GMT.

US Personal Spending

Personal Spending measures purchases of goods and services by households and by nonprofit institutions that serve households from the private sector.

IE Retail Sales

The Retail Sales measures the total receipts of retail stores. Monthly percent changes reflect the rate of change of such sales.

AU Import Price Index

The Import Price Index measures changes in the prices of imported products. High prices for imports carry inflationary pressure. Australia’s Import Price Index will be released at 00:30 GMT, the US Personal Income at 13:30 GMT, Australia’s Export Price Index at 00:30 GMT.

US Personal Income

The Personal Income measures the total income received by individuals, from all sources including wages and salaries, interest, dividends, rent, workers’ compensation, proprietors’ earnings, and transfer payments.

AU Export Price Index

The Export Price Index measures the changes in the prices of exported goods and services.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.