The crypto market currently consists of 20k+ assets, with new projects appearing daily. Creating a token does not require technical skills — some websites let you make your Ethereum-standard tokens for free in a matter of minutes.

Still, it is not enough to make the project a success. To gain popularity and an audience, a crypto startup should offer a unique vision, a clear roadmap, and a business plan. All those things require a team, equipment, and promotion, which at the end of the day, still translates to money.

This article explores the most popular ways of crypto projects’ funding — token sales. Let’s see what rounds it can consist of and what types of sales are there.

What is a token sale?

A token sale is a fundraising mechanism the crypto companies use to attract investors and fund their projects. Token sales are usually held in multiple stages, allowing the project team to obtain money portion-wise and throughout the sale duration. In case the project is a gem, not a shilling, such an approach benefits all participants:

- The crypto startup receives funding for developing and promoting the token, which increases its worth in the long run.

- Investors benefit from getting in early and purchasing a good asset for the lowest possible price.

What are the token sale stages?

As a rule, a token sale consists of three stages: seed, private sale, and public sale. At each stage, the token’s price will be higher, providing the most favorable terms for the initial investors.

| Seed round | Private sale | Public sale |

| The project attracts its first money. At this point, it is just an idea in the form of a business plan. Usually, the obtained funds are used to create a website, tokenomics, and marketing plan. | This round is for the startup’s closest backers, employees, and institutional investors. A private sale usually has a set funding goal. Once it’s reached, the sale is over. | Usually, this round involves token listing on a public crypto exchange. Retail investors have the opportunity to buy tokens cheaply, while early sale participants can take profits and sell. |

What are the token sale types?

ICO (Initial Coin Offering)

The most common type of token sale. The project creators obtain funding, while the investors get to buy on the lows. The ICO is usually held on the project’s website.

IEO (Initial Exchange Offering)

Very similar to the previous type with one key difference: IEO is held on a cryptocurrency exchange, such as Binance or Coinbase.

IDO (Initial DEX Offering)

Very similar to the previous type with one key difference: IDO is held on a decentralized cryptocurrency exchange such as Uniswap or 1inch. This sale type is often used in DeFi.

IGO (Initial Game Offering)

The latest crypto market trend refers to the sale of NFT tokens used in the blockchain gaming industry.

SHO (Strong Holder Offering)

A fundraising mechanism where investors are chosen based on their on-chain activities. Typical requirements include holding a competitor coin for six months or being an active liquidity provider on a decentralized exchange.

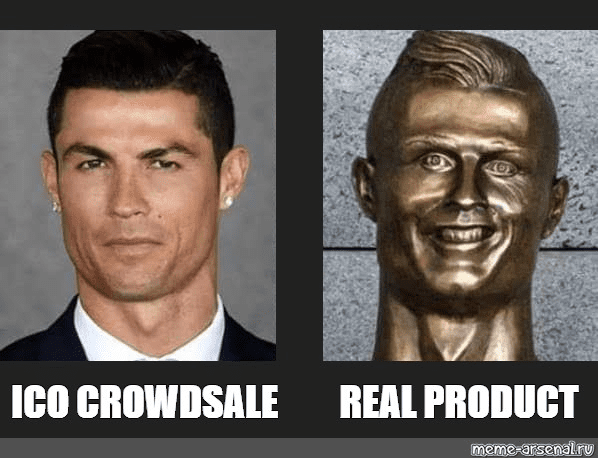

Token sale risks

The main risk of any investing type is choosing a loss-making asset. You should also be mindful of scams in crypto, as fraudulent ICOs fooled thousands during the 2017-2020 boom. Conduct a fundamental coin analysis before investing, and trust your skills and knowledge.