Uniswap is an iconic decentralized exchange built on the Ethereum blockchain. The automated market maker (AMM) represents a pivotal turning point for DeFi, and cryptocurrency revolutionized how traders navigate the digital asset industry.

Despite being a household name in the crypto market, the Uniswap protocol hasn’t rested on its laurels. After pioneering the technology behind 90% of all DEXes, Uniswap has expanded its offering to include an NFT aggregator and crypto wallet.

What exactly is Uniswap, and how does the forefather of decentralized, on-chain trading work? What are liquidity pools, and does this legendary dApp pose any risks to users?

What Is Uniswap?

Uniswap is a decentralized exchange that allows traders to buy and sell ERC-20 tokens directly on the blockchain. By executing trades via smart contracts, users don’t need to rely on central authorities and intermediaries to buy and sell cryptocurrency. Uniswap also protects users’ privacy, meaning you can stay anonymous while trading online.

Source: Uniswap Labs

Source: Uniswap Labs

Bypassing centralized cryptocurrency exchanges provides a wealth of benefits. Traders are always in full custody of their crypto assets while trading on Uniswap and have access to a limitless range of tokens stored on the blockchain. They also avoid paying potentially extortionate crypto exchange fees, with trading fees distributed to Uniswap liquidity providers.

How Does Uniswap Work?

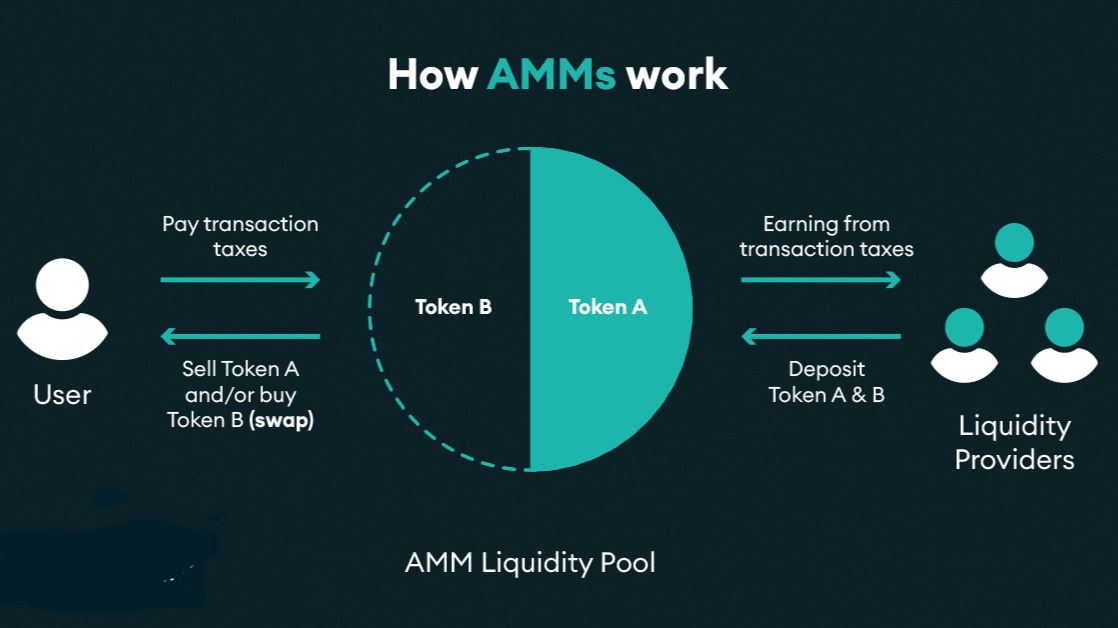

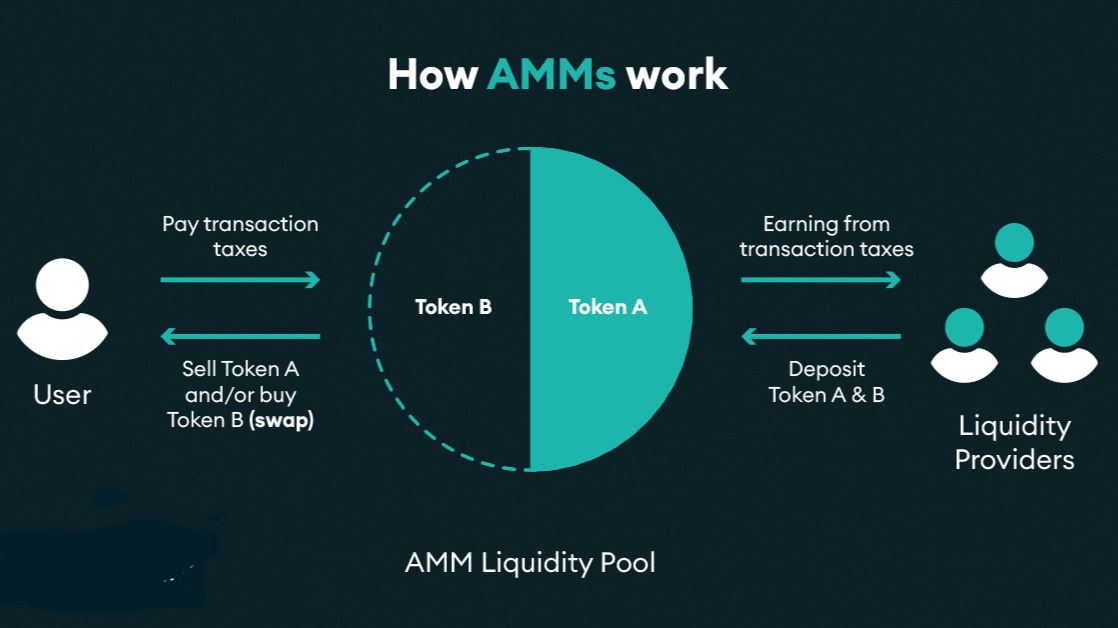

While it might sound technical and complicated, Uniswap’s functions are quite simple. While traditional exchanges like Binance use an order book, Uniswap operates as an automated market maker, or AMM.

In an AMM, liquidity providers create trading pools by depositing two or more different cryptocurrencies into a smart contract. In exchange for providing assets, users receive LP tokens that represent their contribution to a liquidity pool. Once a pool has been created, traders can swap tokens directly with the liquidity pool instantly.

Being fully decentralized, Uniswap doesn’t discriminate. Liquidity pools on Uniswap can be created from any ERC-20 token. This includes stablecoins like USDC, meme coins like SHIB, and tokens like wBTC, the wrapped version of Bitcoin (BTC).

The price of each crypto asset in a trading pair is calculated by the ratio of tokens in the liquidity pool. Arbitrageurs constantly add and remove tokens to ensure asset prices in each pool are consistent with the broader crypto market.

A small percentage of each swap is collected as a trading fee and distributed to reward liquidity providers. For example, creating a liquidity pool with ETH and USDT will help providers accumulate these assets simply by allowing traders to use the pool.

Uniswap was initially launched on the Ethereum network. As the crypto market expands and emerging blockchains grow in popularity, Uniswap has extended support to a variety of other networks, including Arbitrum, Optimism, and Polygon.

What Is Uniswap V3?

One of the biggest issues with Uniswap and other AMMs is impermanent loss. Impermanent loss occurs when the prices of two separate assets in a liquidity pool diverge from their respective prices when the liquidity pair is created.

The Uniswap V3 upgrade reduces the risk of liquidity providers suffering impermanent loss. Instead of allowing the value of assets in a pool to diverge too far, Uniswap V3 allows liquidity providers to stick within a concentrated range of liquidity.

This limits dramatic price change from affecting the value of a provider’s LP tokens and protects them from impermanent loss. This original feature makes Uniswap one of the safest places to provide liquidity in DeFi.

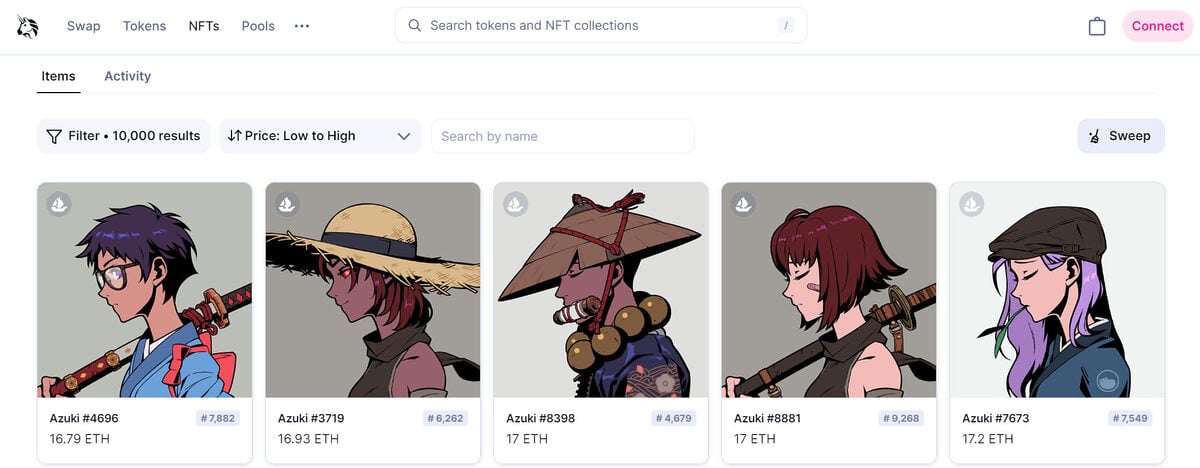

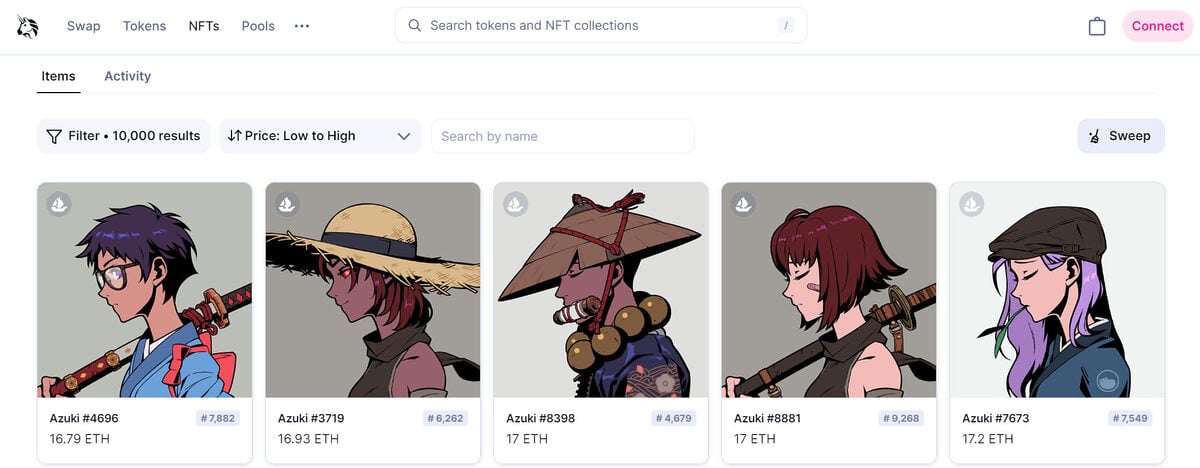

Uniswap NFT Aggregator

To expand its ecosystem and grow the platform, Uniswap successfully launched its own NFT aggregator in November 2022. Uniswap’s aggregator pulls prices from various NFT marketplaces across the Ethereum network, like Opensea, and displays all listings in one convenient place.

Uniswap Wallet

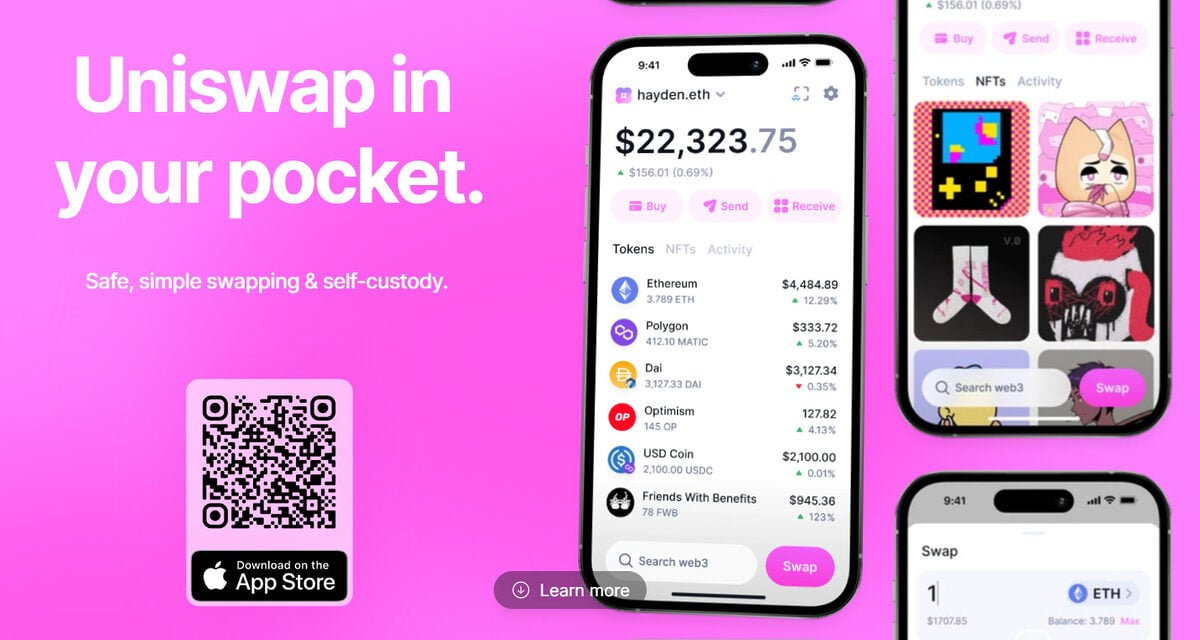

In April 2023, Uniswap Labs added another feather to its cap with the release of the Uniswap Wallet. Available on iOS devices, the Uniswap wallet gives users a simplified user experience. The app makes it easy to buy crypto on-chain from the comfort of a mobile phone and store digital assets like NFTs.

While the Uniswap wallet has a slick UI, existing wallet software like Metamask or Rabby is still more versatile and supports a greater range of dApps and networks. Like the web app, the Uniswap wallet supports scaling solutions like Polygon and Arbitrum.

The UNI Token

Like most DeFi ecosystems in the crypto industry, the Uniswap protocol is supported by a native token that helps to decentralize the platform. UNI is a utility and governance token. Owning UNI gives token holders the right to vote in crucial governance proposals that shape the ecosystem’s future.

Long before airdrop farming became a full-time job, the UNI airdrop made waves in the crypto market. Qualifying Uniswap users who’d interacted with the protocol before September 1st, 2020, could claim at least 400 UNI tokens.

While it might seem small at UNI’s current price compared to recent airdrops like those we saw from Arbitrum and Aptos, this was one of the largest crypto airdrops in history. UNI trading went live on the 17th of September at a price of around $3 per token.

UNI holders with diamond hands were rewarded when UNI’s price reached its all-time high of $44.97 USD just a few months later, in May 2021. Even the smallest UNI airdrops were worth over $16,000.

Uniswap History

When Uniswap founder Hayden Adams was fired from Siemens Engineering in 2017, no one would’ve expected he would go on to build a revolutionary DeFi application. Encouraged by his close friend Karl Floersch, Adams started learning about Ethereum and decentralization.

Fascinated by the vision and possibilities of decentralized finance, Adams started working to develop an idea he’d seen on one of Vitalik Buterin’s Reddit posts.

A key breakthrough occurred in April 2018, when Floersch introduced Adams to the Ethereum founder at the Deconomy conference in Seoul. Buterin read over Adam’s source code and advised him to apply for a grant from the Ethereum Foundation.

A few short months later, Uniswap was deployed on the Ethereum mainnet. Uniswap has been a central pillar of the DeFi world ever since. To this day, Uniswap witnesses higher average 24-hour trading volume than any other DEX in the industry and is one of the largest sources of TVL (Total Value Locked) in crypto.

If that wasn’t enough, Uniswap’s source code has been forked to create most other decentralized exchanges in the industry. Top DEXes like Sushiswap, Trader Joe, and Quickswap were all built using Uniswap’s original code.

Uniswap Pros & Cons

Uniswap is a great tool to trade cryptocurrencies on a decentralized exchange. You enjoy a much more comprehensive range of tokens and full custody of your digital assets. However, on-chain trading is not without its risks. Let’s take a look at the pros and cons of Uniswap.

Pros

- Huge range of tokens – Any ERC-20 token can be listed on Uniswap. This gives DEX traders a considerable advantage over traders who only buy tokens on centralized exchanges. For example, traders who found SHIB on Uniswap could buy the meme coin at a much cheaper price than those who bought it on a CEX.

- Full custody – When trading on Uniswap, you have full custody and control of all your assets. Centralized exchanges have been known to block specific trades or close positions on a trader’s behalf without consent.

- Greater privacy and anonymity – Most centralized exchanges require that you go through KYC (Know-Your-Customer) screening before trading crypto. Uniswap is completely anonymous and available to everyone.

Cons

- High frequency of scams – Because anyone can create a liquidity pool using any ERC-20 token, thousands of scams and fake tokens are out there. Always do your due diligence and make sure to get your contracts from an official source before buying crypto on Uniswap.

- Low token liquidity – Despite having some of the deepest liquidity amongst decentralized exchanges, large trades still dramatically alter the ratio of tokens in a liquidity pool. This causes price impact and results in high slippage costs.

- High transaction fees – Blockchain gas fees spike when the network becomes congested. Particularly on Ethereum, these spikes mean it sometimes costs over $100 in transaction fees just to make a simple trade.

On The Flipside

- The DeFi space is constantly evolving, with innovative new protocols and tools being developed constantly. Uniswap may have been one of the first decentralized exchanges in the industry, but today there are hundreds of different platforms, like dYdX and GMX, that arguably offer a greater range of services and better incentives for token holders.

Why This Matters

Uniswap is not only the first AMM in the crypto industry; its source code was used to build most DEXes on EVM-compatible networks. Learning about Uniswap and understanding how it works gives you an excellent overview of basic DeFi primitives across the entire crypto space.

FAQs

Who owns Uniswap?

Hayden Adams is the founder and CEO of Uniswap Labs. That being said, Uniswap also uses a decentralized governance model wherein UNI token holders can vote on proposals regarding its future development.

Is Uniswap risky?

Yes, there are certain risks associated with trading cryptocurrency on Uniswap. These include a high frequency of scam tokens and high price volatility due to low liquidity in trading pools.

Can Uniswap reach $200?

While not impossible, it is unlikely that UNI can reach $200. If Uniswap price were to reach $200, UNI would have a market cap of over 100 billion USD. This would make Uniswap larger than Tether (USDT), the crypto market’s dominant stablecoin.

Where can I buy Uniswap?

You can buy UNI tokens on Uniswap. Alternatively, its also available on crypto exchanges like Coinbase, where it can be purchased using fiat currencies like USD, EUR, and GBP.

What is the circulating supply of UNI?

At the time of writing, the circulating supply of UNI is roughly 577,000,000. This represents approximately 57.7% of the max supply.

Related articles

Polygon MATIC Optimism Returns as It Teases Bank Partnership

DeFi Protocol Gamma Strategies Suffers $3.4 Million Attack