- Solana’s Jupiter has risen to the top of the list of DEXes by trading volume.

- Uniswap founder Hayden Adams has disputed Jupiter’s claim to the top.

- Jupiter’s rise follows fresh capital injection into the Solana ecosystem and airdrop incentives.

Following Solana‘s blistering run in 2023, competition between the Layer 1 blockchain and Ethereum, widely regarded as the DeFi king, is heating up. As the competition intensifies, Jupiter, a liquidity aggregator handling the bulk of Solana’s DEX volumes, has risen to the top of the list of DEXes by 24-hour volume, seemingly surpassing Ethereum’s Uniswap.

Jupiter’s rise has elicited a flurry of reactions from crypto community members, including Uniswap founder Hayden Adams, who has disputed the competing protocol’s claim to the top.

Uniswap’s Adams Throws Shade

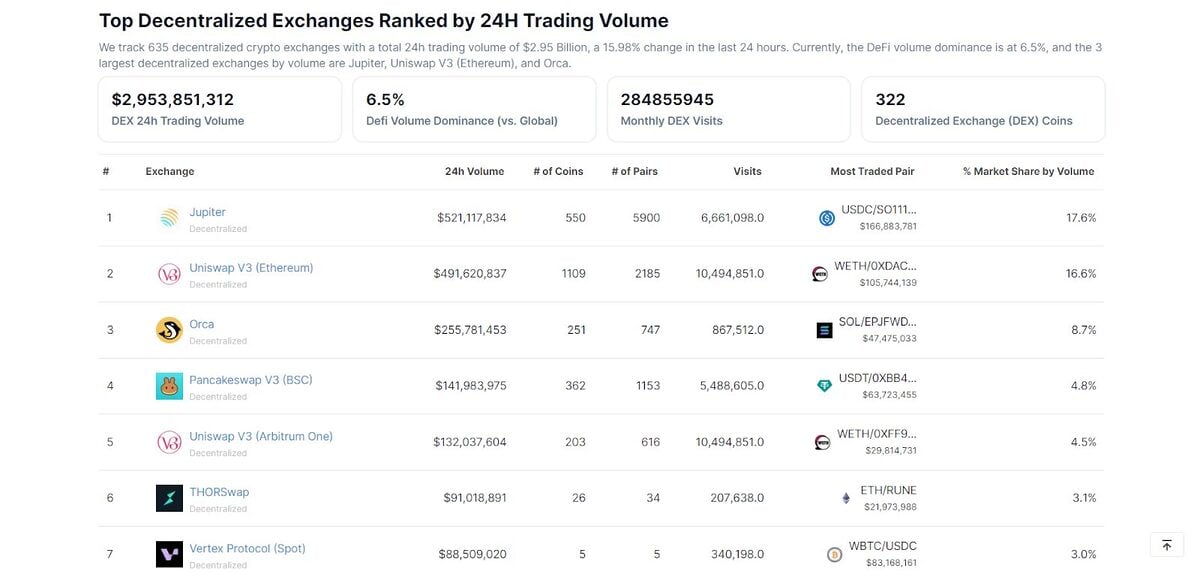

Over the past 24 hours, Jupiter has risen to the top spot in CoinGecko‘s ranking of DEXes by volume. At the time of writing, the platform continues to hold this position with over $521 million.

DEXes ranking by 24-hour volume. Source: CoinGecko

DEXes ranking by 24-hour volume. Source: CoinGecko

Unsurprisingly, Jupiter’s achievement has caught headlines, especially as it appears to sit atop Uniswap, Ethereum’s largest DEX. This narrative, however, has faced resistance from Uniswap’s Hayden Adams.

Responding to reports of Jupiter flipping Uniswap, Adams contended that Uniswap’s 24-hour volume was around $700 million, including its version 2 deployment on Ethereum and its deployments across Ethereum scaling solutions like Arbitrum One, Polygon, and Optimism. He implied that Jupiter’s claim to the top was only temporary and fueled by airdrop speculation.

“Have seen this tweet from many protocols over the years often around an airdrop. The real challenge is being #2 in these screenshots every damn time,” he wrote.

However, most of the Solana faithful have shared a different view from Adams. For example, responding to Adams’ post, Solana co-founder Anatoly Yakovenko quipped, “only a matter of time,” likely expressing the view that Jupiter will eventually surpass Uniswap.

Understanding Jupiter’s Rise

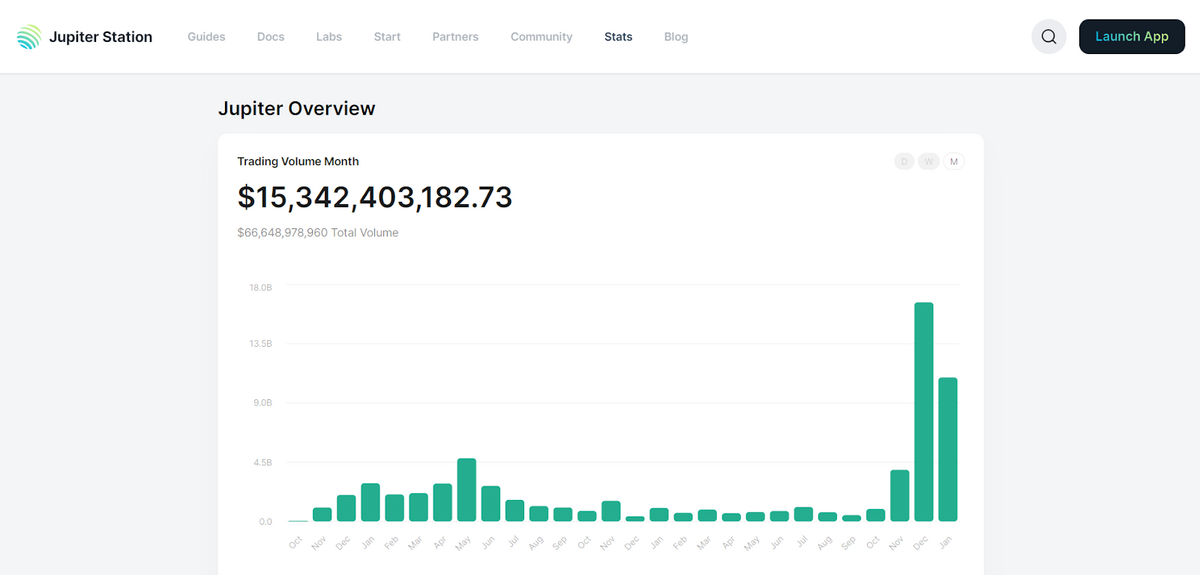

Over the past two months, Jupiter’s trading volume has been on a tear, peaking at $16.6 billion in December 2023 from $3.9 billion the month before. This month, the trading volume on the platform has already exceeded $15.3 billion, with many anticipating that it would exceed the December peak.

The platform’s rise has been heavily linked to the inflow of fresh capital into the Solana ecosystem through airdrops from projects like Jito and Pyth. In addition to this capital inflow, Jupiter has incentivized activity by promising its airdrop of JUP tokens to active users. Distribution of this airdrop is scheduled to start on January 31.

On the Flipside

- CoinMarketCap‘s DEX ranking, at the time of writing, places Jupiter in sixth place with $278 million in 24-hour trading volume, far below Uniswap v3 on Ethereum in the top spot with over $466 million.

- Uniswap remains the largest DEX by TVL with an impressive $4.1 billion, per Defi Llama data at the time of writing.

Why This Matters

Uniswap’s Hayden Adams reaction to Jupiter’s rise highlights the growing intensity of the competition between Ethereum and Solana.

Read this for more on the Ethereum-Solana rivalry:

Can Solana Stablecoin Volume Threaten Ethereum’s Dominance?

Find out how to stay safe from Ondo Finance honeypot scams:

Beware of Ondo Finance Honeypot Tokens: How to Stay Safe

Related articles

Uniswap Charges Accessibility with Rootstock Integration

Uniswap CEO Burns 99.9% HayCoin Supply, Sparking $3.6M Price