We have browsed through dozens of crypto media outlets and singled out the essential news, so you don’t have to.

BTC At 16k Amid FTX Collapse

Bitcoin has partially stabilized in the $16,000 — $16,500 range after a rapid drop due to the news of the FTX exchange collapse. Since November 5th, the first cryptocurrency lost 22% of its value. The overall market has shed $200 billion in capitalization.

According to Coinbase analysts, the FTX bankruptcy has undermined investor confidence and could result in crypto winter lasting up until the end of 2023. The events turned into a deleveraging of short positions and the liquidation of large buyers, which increased the market vulnerability. “Second order effects” that can negatively impact clients and counterparties of FTX and Alameda Research are also not ruled out.

FTX Liquidation In Progress

Meanwhile, the post-collapse legal action is in full swing. The Supreme Court of The Bahamas has granted the Securities Commission’s motion to appoint interim liquidators for FTX Digital Markets (FDM).

According to a press release, Kevin Cambridge and Peter Greaves of the accounting firm PricewaterhouseCoopers has been chosen for the role. Senior partner at Lennox Parton law firm Brian Simms, head of the bankruptcy and restructuring group will carry out oversight.

The investigation will not be limited to Bahama-registered FDM. FTX Trading, Alameda Research, and other affiliated organizations will also be impacted since their management is presumably located in the territory of the jurisdiction.

We recall that on November 11, FTX’s parent company, Alameda Research, and about 130 other affiliated firms filed for bankruptcy. The Commission blocked the FDM assets the same day and suspended the license.

As of now, experts estimate the FTX black hole in the books at $8 billion, while the overall exposure of the company’s investors may exceed $30 billion.

BlockFi May Go Bankrupt, Again

It seems as if the crypto lending platform BlockFi, saved from bankruptcy by the credit line from FTX, is in trouble again. The Wall Street Journal reports that the company is preparing to file for Chapter 11 bankruptcy.

On Nov. 11, the company suspended withdrawals due to the FTX downfall. To address the community, BlockFi denied the information that most of its assets are stored on FTX. However, the platform acknowledged having a credit line provided by the US division of the exchange, as well as outstanding obligations from Alameda Research.

Nike Joins Web 3 Race

Sports brand Nike announced its new Web3 platform. Swoosh. It would serve as a promotion of virtual shoes and other goods for the metaverse. The project is currently in the beta-test stage, while the release of the first collection is planned for next year. According to the company statement, community members will “soon” be able to wear these items in digital and immersive games.

We recall that in December 2021, Nike acquired the NFT studio RTFKT, which specializes in creating collectible items for the metaverse. In April, the companies introduced the first joint collection of non-fungible tokens, earning over $180 million from the sale.

Crypto Funds Continue to Attract Investors

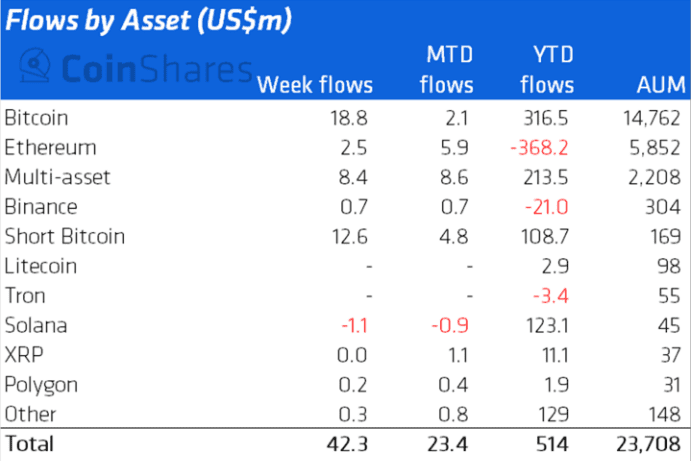

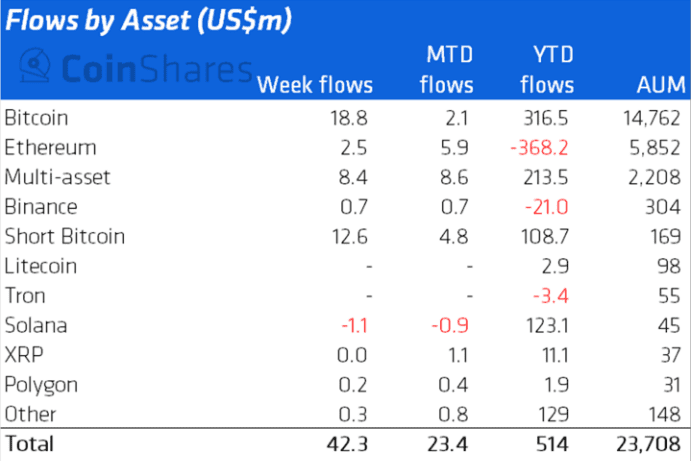

CoinShares reports that the asset inflow into cryptocurrency investment products from the 5th to the 11th of November amounted to $42 million against an outflow of $15.6 million a week earlier.

“Investors see the FTX collapse as an opportunity,” the specialists explained:

- Bitcoin funds saw their most significant inflow of $19 million since August, compared to a $13.2 million outflow a week ago.

- $12.6 million was sent to structures that allow opening short positions.

- The inflow into Ethereum funds amounted to $2.5 million.

What Else to Read/Watch:

- Cristiano Ronaldo launches NFT collection on the Binance cryptocurrency exchange.

- Amazon will lay off 10,000 employees, 3% of the corporate and 1% of the e-commerce giant’s global workforce.

- Grayscale Investments Bitcoin Trust (GBTC) quotes decreased by 42.69% relative to NAV on the 17th of November.

- Regulators in multiple jurisdictions sent requests to Binance concerning its involvement in the collapse of FTX, confirmed by the exchange representative.

- OTC platform Genesis Trading requested a $1 billion credit line, citing a lack of liquidity due to the FTX drawdown.