FTX sues ByBit to recover nearly $1 billion in funds; Bithumb to become first crypto exchange listed on Korean stock exchange; Bitcoin continues to get a boost from ETFs!

Bankruptcy advisors appointed to the FTX crypto exchange sued Bybit Fintech Ltd. to recover $953 million worth of digital assets and cash. The advisors claim that ByBit withdrew all funds just before FTX filed for Chapter 11 bankruptcy last November.

The 10 November 2023 filing, filed with a Delaware court, alleged that Bybit’s investment arm, Mirana Corp, enjoyed special “VIP” benefits not available to most FTX customers. Mirana is accused of taking advantage of these privileges to move most of its assets out of FTX before the platform’s collapse in November 2022.

The complaint alleges that Mirana pressured FTX employees to expedite withdrawal requests, while regular customers faced delays. The lawsuit seeks to recover a total of approximately $953 million in assets, including over $327 million allegedly withdrawn by Mirana during the period when the exchange stopped withdrawals on 8 November 2022.

Chapter 11 generally provides distressed companies with the opportunity to recover their funds in the months preceding a bankruptcy filing. This authorization prevents certain creditors from gaining an unfair advantage simply because they were able to withdraw their funds from a failing business and others were unable to do so.

Bithumb to become first crypto exchange listed on Korean stock exchange

Crypto exchange Bithumb plans to become the first digital asset company to go public on the South Korean stock exchange.

Local news source Edaily reported on 12 November that Bithumb is preparing for an initial public offering (IPO) on KOSDAQ, South Korea’s version of the US Nasdaq, with the expected listing date set for the second half of 2025.

Although Bithumb did not provide any information on whether the IPO will take place, the firm has selected Samsung Securities as a potential IPO underwriter to ensure the company’s security before going public.

According to sources familiar with the matter, Bithumb’s former chairman Lee Jeong-hoon has returned to Bithumb as its registered director.

Another reason for Bithumb’s move to go public may be that it does not want to give more market share to Upbit, the largest crypto exchange in South Korea.

Bithumb is currently the second largest crypto exchange in South Korea by daily trading volume and ranks second after Upbit. In July, Upbit’s monthly trading volume surpassed Coinbase and Binance for the first time.

In February, Kang Jong-hyun, one of Bithumb’s largest shareholders and suspected “real owner”, was arrested on embezzlement charges following a lengthy police investigation into his allegedly illegal behaviour.

Jong-hyun, 41, is the older brother of Kang Ji-yeon, chairman of Bithumb subsidiary Inbiogen. The firm has the largest stake in Vidente Vidente, Bithumb’s largest shareholder with a 34.2 per cent stake.

Bithumb was founded in 2014 and had a 24-hour trading volume of about $580 million at the time of publication, according to CoinGecko data

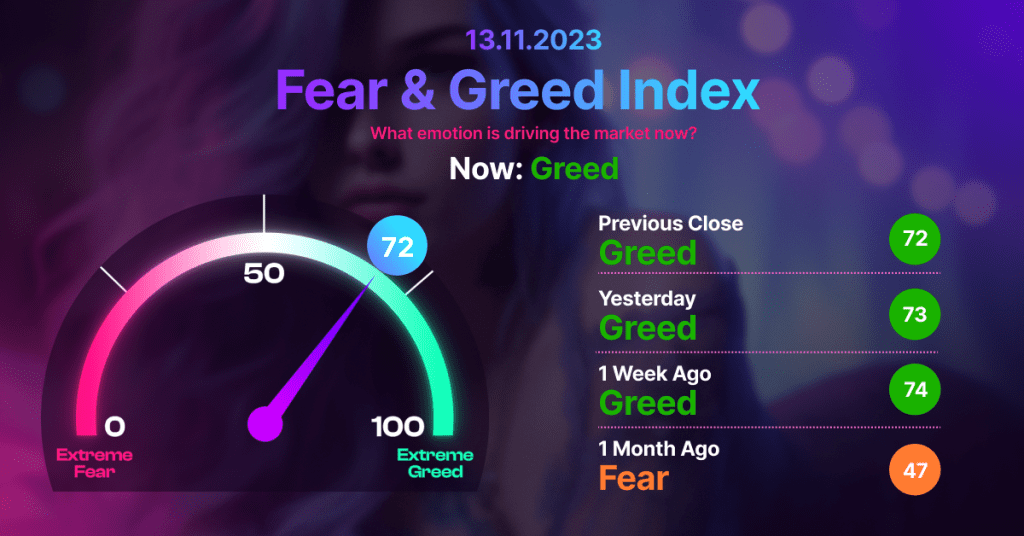

Bitcoin continues to get a boost from ETFs

BTC price continues to climb as investors remain hopeful that the spot Bitcoin ETF will be approved.

According to Bloomberg’s report, the leading cryptocurrency has managed to rise for the fourth consecutive week, getting very close to $ 38,000, the highest level in the last 18 months.

Bitcoin suffered a huge drop with the collapse of TerraUSD and then FTX, and the industry was plunged into a deep crisis.

ETF hope grows

Bloomberg’s ETF analyst James Seyffart stated that the SEC is 90 percent likely to approve a spot Bitcoin ETF by January 10.

Bitcoin has experienced an increase of nearly 40 per cent in the last four weeks as expectations for ETF approval have increased.

The rise was not limited to Bitcoin alone. Terra, which was a big disappointment, increased by 66 per cent, while FTX’s native token FTT also increased by 79.8 per cent.

The improving economic outlook was also an important factor in the rise of BTC. While bond yields fell, the appetite for stocks and cryptocurrencies increased.

Despite this bullish momentum, Bitcoin continued to trade well below the $69,000 ATH level in November 2021.

Matt Hougan, investment officer of Bitwise Asset Management, also spoke assertively about BTC:

“Looking ahead to next year, it’s hard not to be optimistic about crypto and Bticoin. We will see all-time highs.”

.