FTX prepares to sell another $744 million in assets; Binance’s market share in crypto is decreasing day by day; London Stock Exchange seeks digital assets director

FTX seeks to sell Grayscale and Bitwise assets for $744 million

FTX, the failed cryptocurrency exchange, has asked a Delaware court to allow it to sell some key funds, including assets worth approximately $744 million from crypto asset manager Grayscale and custodian Bitwise.

In a court filing dated November 3, FTX debtors asked the court to allow the sale of trust funds to pave the way for the company’s repayments to creditors.

The latest request by FTX debtors for the sale of trust funds comes after the court approved the sale of crypto assets worth about $3.4 billion. The court ordered these assets to be sold in batches of $50 million and $100 million to avoid market disruption.

The FTX bankruptcy process continues as former FTX boss Sam Bankman-Fried was found guilty by a jury in his criminal trial in New York on all seven counts he was charged with. The former CEO was found guilty of two counts of wire fraud, two counts of conspiracy to commit wire fraud, one count of securities fraud, one count of conspiracy to commit commodities fraud and one count of conspiracy to commit money laundering. The judge is expected to rule on March 28, 2024.

Binance’s market share in crypto is decreasing day by day!

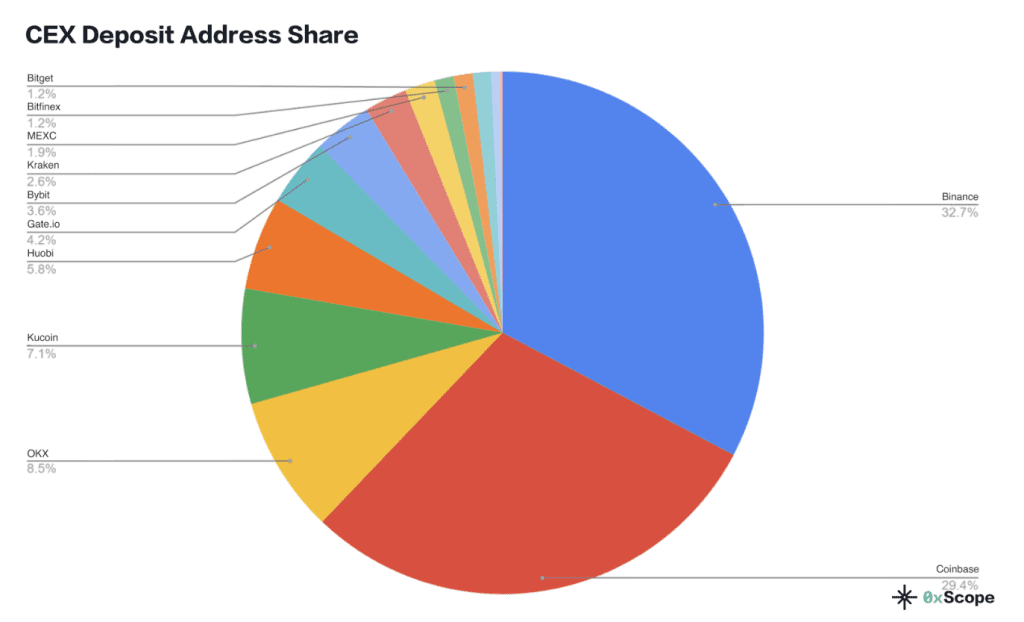

Cryptocurrency exchange Binance’s market share in spot trading fell from 62 percent in the previous year to 40 percent at the end of 2023.

According to a November 6 report by blockchain analysis company 0xScope, Binance has lost a third of its market share in the last year. “Binance’s spot trading volume has seen a significant decline, perhaps due to its listing strategy,” the researchers said.

The researchers also noted that the most popular cryptocurrencies experienced a decline after being listed on Binance. However, the South Korea-based cryptocurrency exchange said Upbit captured 15.3 percent of the spot market share. The company had 5 percent of the market share last year.

Looking at all crypto trading volumes, including both spot and derivatives, Binance’s market share was 51.2 percent in October 2023. Binance was followed by OKX with 13.4 percent, Bybit with 9.6 percent, Bitget with 7 percent and MEXC Global with 6.9 percent.

During the period, Bybit, Bitget and MEXC became second-tier exchanges behind Binance and OKX with a combined market share of 42.3 percent. Huboi, Kucoin, Gate and others made up the third tier, the researchers emphasized.

The 0xScope team noted that website traffic and the number of followers on social media have “little or no correlation” with the exchange’s market performance. It also said that Binance’s share of the number of followers decreased by 5 percent, while OKX increased its number of followers by 200 percent.

London Stock Exchange seeks digital assets director

The London Stock Exchange Group (LSEG), the parent company of the London Stock Exchange and other fintech companies, has announced that it is looking for a digital asset manager.

LSEG said it is looking for candidates with “passion and knowledge of digital assets, cryptocurrencies and distributed ledger technology,” among other skills and requirements.

According to the announcement, LSEG’s future digital asset manager will help the company define and implement a commercial strategy to “develop a range of new infrastructure solutions and capabilities, as well as LSEG’s brand and ecosystem in digital private markets.”

The announcement follows the London Stock Exchange’s announcement that it will create a traditional asset trading platform using blockchain technology. The long-established financial institution said on September 4 that it planned to use the technology to improve efficiency in storing, buying and selling traditional assets.

The UK passed a bill allowing authorities to seize Bitcoins used in illegal activities and announced plans for upcoming stablecoin regulations in October. Following these developments, the local crypto market began to shake.

In September, the UK financial watchdog notified crypto companies of a market harmonization regulation and asked for it to be in place by January 2024.