FTX sues Sam Bankman-Fried; Visa uses Ethereum’s Goerli testnet; Ripple launches CBDC platform for CBDCs and stablecoins.

Lawyers for the bankrupt FTX exchange are suing former CEO Sam Bankman-Fried, co-founder Zixiao Wang and senior executive Nishad Singh. The reason is that the stock trading platform Embed is not actually worth $220 million.

According to the filing filed with the court the other day, FTX paid $220 million to acquire Embed through its US arm, and allegedly did almost no due diligence on the platform.

After FTX filed for bankruptcy, the trial judge approved the sale of FTX’s Embed and other assets. However, FTX’s lawyers argued that the highest bidder for the platform only offered $1 million.

Bidders understood what FTX Group and FTX Insiders didn’t bother to evaluate before purchasing Embed: Embed’s boasted software platform was essentially worthless.

According to FTX attorneys, Embed founder and CEO Michael Giles personally received approximately $157 million in connection with the acquisition. But Embed’s latest bid to regain ownership was a meager $1 million, subject to a discount as the company shuts down.

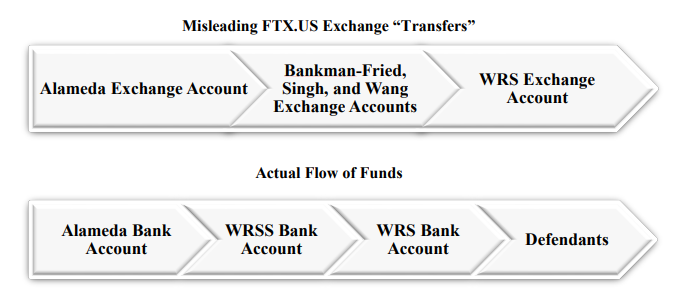

Lawyers accused FTX executives of committing a massive fraud by exploiting FTX Group’s lack of control and record keeping, using embezzled client funds to facilitate the acquisition of Embed. However, it was also stated that the executives were fully aware of the company’s bankruptcy when finalizing the deal.

Visa uses Ethereum’s Goerli testnet

Visa uses Ethereum’s Goerli testnet for experiments. Visa is testing transaction-free payments using the account abstraction technique.

Using a smart contract called Paymaster, Visa aims to take advantage of features such as performing complex tasks on behalf of accounts and managing transaction costs by using account abstraction.

The main purpose of the Paymaster contract is to allow users to pay with any token, eliminating the need for users to hold Ether in their wallets for gas fees. Thus, the use of the Ethereum network is carried out in a simpler way. According to the report by Visa, this method offers a very flexible alternative on the Ethereum network.

The payments giant has previously announced that it is making USDC payments on the Ethereum network. The company had earned the title of the first major payment network to use a stablecoin.

Visa first announced the account abstraction project on its blog in December 2022. But back then, account abstraction was not yet used on the Ethereum network.

Cuy Sheffield, Visa’s head of crypto, announced that the company’s crypto product will be launched shortly. According to the authority, this product has a mission to adopt blockchain networks and stablecoin payments.

Ripple launches CBDC platform for CBDCs and stablecoins

Ripple today announced the Ripple CBDC Platform. Leveraging the power of the same blockchain technology used in the XRP Ledger (XRPL), the platform will now allow its users to make all transactions related to fiat-based central bank digital currencies.

The Ripple CBDC Platform empowers central banks and governments to bring the next level of digitization to their financial services, while incentivizing millions of unbanked people around the world. Surangel Whipps Jr, President of the Republic of Palau, said:

Partnering with Ripple to help create our national digital currency is part of our commitment to lead in financial innovation and technologies that will give Palau citizens greater financial access.

James Wallis, Vice President of Federal Reserve Engagements and CBDCs, said of this development:

As a trusted partner to many central banks, we believe this platform will help solve problems for many central banks and governments that are making plans for CBDC implementations and developing a technology strategy. The innovative capabilities of the platform will help ensure instant settlement of both domestic and international payments, reduce risk, and improve the user experience of quickly sending and receiving digital currency on both sides of a transaction.

Ripple’s CBDC solutions were recently ranked at the top of the competitive leaderboard by Juniper Research. The leaderboard places Ripple at #1 in the field of 15 CBDC technology providers. Ripple’s CBDC solutions have also topped CB Insights’ list of Top Blockchain Cross-Border Payments and CBDC Companies.