Bitcoin Lightning Network, 100x cheaper than Visa and Mastercard; Ukraine plans to adopt EU’s new crypto regulations; Gemini will open an engineering center in India

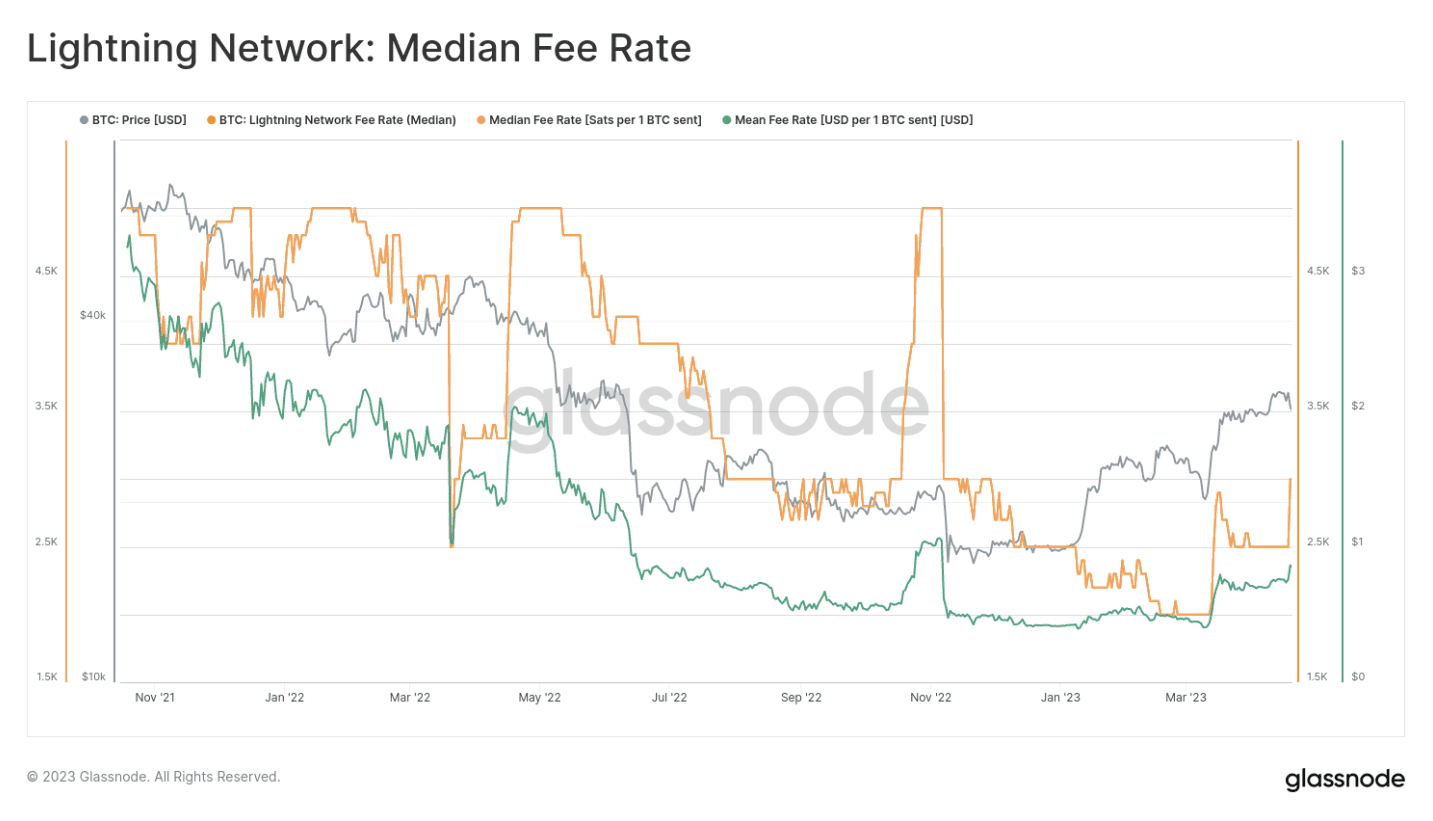

Data from Glassnode revealed that the Lightning Network is significantly cheaper than traditional payment networks.

Transaction costs on the Lightning Network are 100 times cheaper compared to MasterCard and Visa.

To send 1 Bitcoin over the Lightning Network, you need to pay approximately 3000 Satoshi. In summary, it will be enough to pay 0.84 dollars to transfer $ 27,500.

Bitcoin analyst Dylan LeClair said in a post that this rate is many times less than the rates applied by credit card companies.

Lightning Network, a layer-2 solution built on top of the world’s largest cryptocurrency, was originally proposed as a way to make Bitcoin effective as a payment method.

Traditional payment networks like Mastercard and Visa charge merchants a commission fee of around 2%-3% per transaction. This makes traditional networks more expensive for businesses. However, several business owners who accept Bitcoin have revealed that accepting payments with Mastercard and Visa increases the cost by 8%.

Finally, it was stated that Lightning Network is mostly suitable for payments under $ 1000. It was stated that the Bitcoin base chain would be a more logical choice for payments above $1000, especially despite the danger of making mistakes.

Ukraine plans to adopt EU’s new crypto regulations

After the European Parliament approved the MiCA regulation, Ukrainian officials announced that they were considering adopting the regulations in their own countries.

Yaroslav Zheleznyak, Deputy Chairman of the Tax Committee of Ukraine, stated that they want to accept some provisions of MiCA.

“I am confident that Ukraine will be one of the first countries to implement this regulation into its national legislation.”

said Yurir Boyko, member of the National Securities and Exchange Commission (NKCPFR).

The approval of MiCA marks a major advance for the crypto industry within the European Union

MiCA is seen as an extremely important development for companies as crypto companies currently have to comply with 27 different regulatory frameworks within EU member states. EU politicians have long worked to establish uniform regulations and standardized rules for crypto assets.

It is thought that the implementation of MiCA could lead to a large increase in market share compared to non-regulated competitor regions.

The approval of the MiCA legislation by the European Parliament was received extremely positively by the crypto industry.

Ukraine’s move to adopt EU regulations follows the Eastern European country’s acquisition of candidate status for the EU in June 2022. According to the Council of Europe, European regulators acknowledge that Ukraine has made the necessary effort to become an EU member.

Gemini will open an engineering center in India

Cryptocurrency exchange Gemini pressed the button to establish an engineering center in India.

The Winklevoss brothers’ exchange will establish an engineering center in the Asian country and will appoint Pravjit Tiwana, the company’s CTO, as CEO of this new unit.

In a blog post he shared, Tiwana stated that the engineering center planned to be opened in Gurgaon, India will be the largest division of the company after the company’s headquarters in the USA.

The cryptocurrency exchange stated that they will expand their team in Singapore, in line with their goals in Asia, apart from India.

Last year, Coinbase, the largest US cryptocurrency exchange, made a similar move in India. While India is an extremely successful country in raising engineers, it has also been noted for fostering a hostile attitude towards the cryptocurrency industry in recent years.

The winds following the collapse of FTX also took a toll on Gemini. Brothers Tyler and Cameron Winklevoss didn’t hesitate to transfer money from their own assets to Gemini as the stock market faced woes. It was announced that the Winklevoss brothers recently transferred $100 million to Gemini. The stock market was looking for funds from investors after the difficult process it went through.

Gemini fell into a major crisis after DCG’s Genesis froze withdrawals. Gemini’s clients’ assets were locked in Genesis when Genesis, a partner in the company’s Earn program, stopped withdrawals.