Binance US halts many trading pairs due to SEC lawsuit; Gary Gensler: There are parallels between FTX and Binance; Coinbase CEO says staking program will not be terminated

Binance US announced on June 7 that it is removing trading services for some cryptocurrencies. The lawsuit filed by the SEC forced Binance US to take such a decision.

Binance US said in a statement, “After careful consideration, Binance US will remove selected trading pairs at 09:00 PDT / 12:00 EDT on June 8, 2023. We have also decided to modernize our buy, sell and convert options on our OTC trading portal. We paused it,” he said.

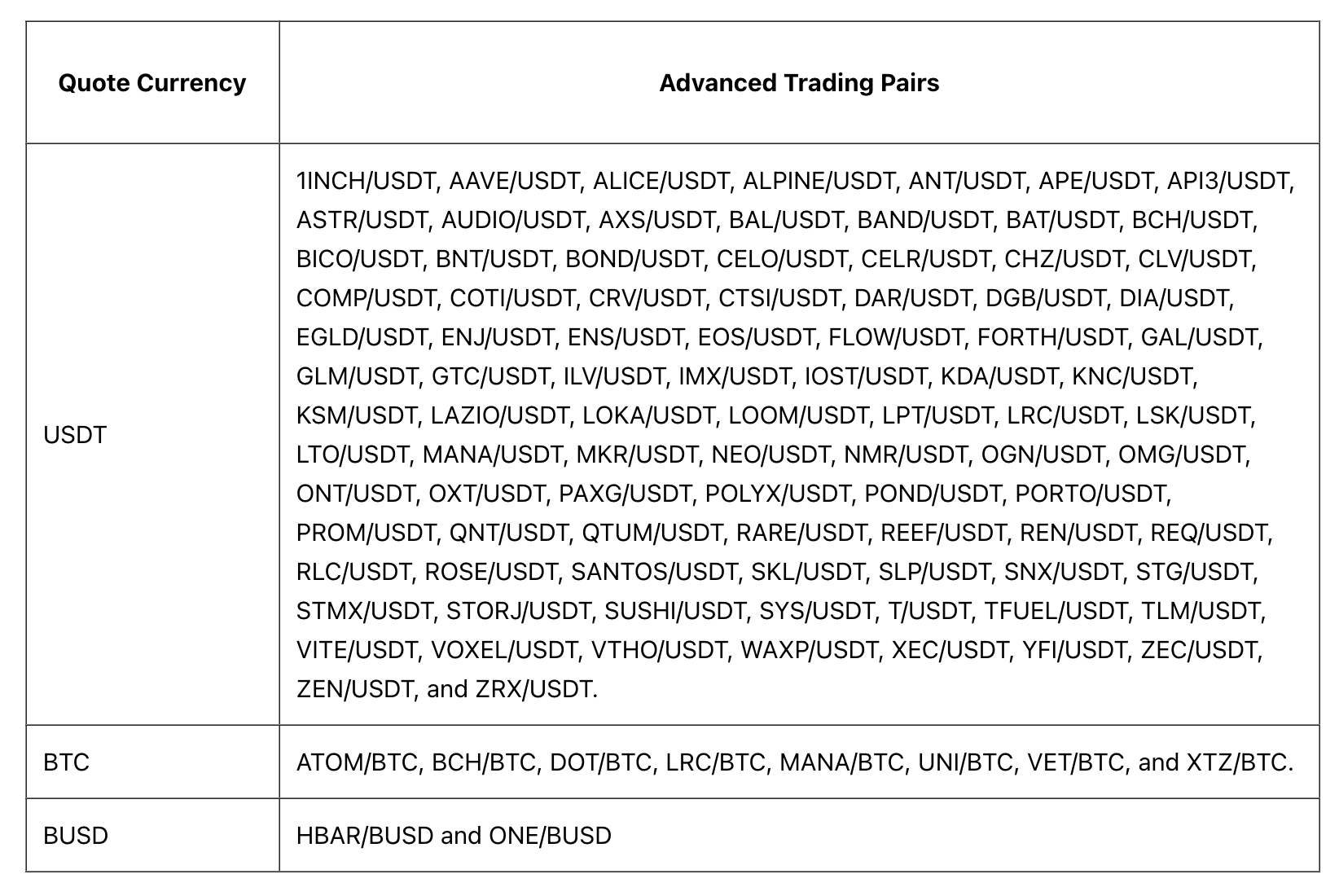

The pause will affect eight Bitcoin pairs, two BUSD pairs and over 90 USDT pairs. According to Binance US, deposits and withdrawals will be available.

Currently, buy, sell and convert options are only available for USDT, USDC, BNB, Ether, BTC, Fetch.ai, Cosmos, Aptos, MATIC, LTC, DOGE, SHIB, Fantom, ApeCoin, Solana, LINK, ADA, DOT, GALA and Limited to AVAX.

The exchange said that conversions for USD will continue to be available. However, the maximum transaction amount for trading and conversion options has been updated to $10,000.

On June 5, the SEC sued Binance for the sale of unregistered securities. The regulator has filed 13 charges against the exchange, including unregistered sales of BNB and BUSD tokens, Simple Earn and BNB Vault products, and staking programs.

The regulator also claimed that Binance did not register Binance.com with the agency as an exchange. Following Binance, the SEC also targeted Coinbase with similar accusations.

Gary Gensler: There are parallels between FTX and Binance

Gary Gensler, Chairman of the US Securities and Exchange Commission (SEC), noted that there are parallels between Binance and the bankrupt FTX. Gensler implied that sister companies were used to move funds.

The SEC chairman cited alleged fraud and manipulation related to its sister company, Alameda Research, including the alleged role played by Sam Bankman-Fried, the former CEO of FTX.

As is known, the SEC filed a complaint against Binance on June 5, covering a total of 13 charges. One of the charges in the lawsuit filed is claiming that funds from Binance and Binance.US were transferred to an account controlled by Merit Peak Limited associated with Changpeng Zhao.

According to another claim, Binance.US traded washes through Sigma Chain, the primary trading company that Zhao is undisclosed to own.

Gensler also noted that companies are trying to enrich themselves and their investors from sister organizations that trade platform-to-platform against customers.

So why didn’t the SEC sue FTX?

Discussions began to flare up on Twitter after SEC Chairman Gary Gensler told Bloomberg. The same question came to many people’s minds: So why didn’t the SEC file the same lawsuit against FTX?

Other community members suggested that FTX’s large donations to political parties and Bankman-Fried’s frequent lobbying in Washington D.C. in the past may also have been a factor.

Fixing or stopping crypto lines was not a priority in the beginning. People realized after FTX that it really is billions of dollars.

On the other hand, although the SEC has not filed a lawsuit against FTX, it was stated that the regulator has filed charges against Bankman-Fried and its former executives.

Executives facing a number of accusations include FTX CEO Sam Bankman-Fried, former Alameda Research CEO Caroline Ellison, former FTX co-founder Gary Wang, and former FTX engineering director Nishad Singh.

Coinbase CEO says staking program will not be terminated

Coinbase CEO Brian Armstrong said that they will not be ending their staking program.

Armstrong pointed out that the U.S. Securities and Exchange Commission had changed its “tone” about the company a year before it sued them.

Speaking to Bloomberg, Armstrong used the following statements on the subject:

“We’ve had a lot of discussion over the past year that their tone has started to change. Unfortunately, we were met with silence.”

When asked whether they lost their banking partners after what happened, Armstong said that they have never experienced such a situation before and that their partners have been very considerate.

Shares of Coinbase rose 0.2% to over $53 today after falling 20% with the lawsuit. Cathie Wood’s also increased its holdings in the company the other day.

Expressing that the company’s balance sheet has more than $ 5 billion to continue its operations and cover legal process costs, Armstrong stated that they will not face any problem in going to court.

The SEC said that 13 cryptos on the Coinbase platform are securities. The company allows trading of more than 200 cryptocurrencies.

Following the lawsuit filed by the SEC, California and New Jersey regulators demanded that Coinbase stop staking services.

Coinbase CEO Brian Armstrong said that they will not be ending their staking service:

“We will not be ending our staking services. Once the court process is over, things will continue as they are”