SEC sues Coinbase; SEC Chairman speaks after Coinbase lawsuit; $780 million outflow in the last 24 hours on Binance!

The US Securities and Exchange Commission (SEC) filed a lawsuit against Binance, one of the world’s largest cryptocurrency exchanges, yesterday. After this news, less than 24 hours later, a move from the SEC came for Coinbase. The Coinbase lawsuit filed by the SEC has left its mark on the cryptocurrency ecosystem.

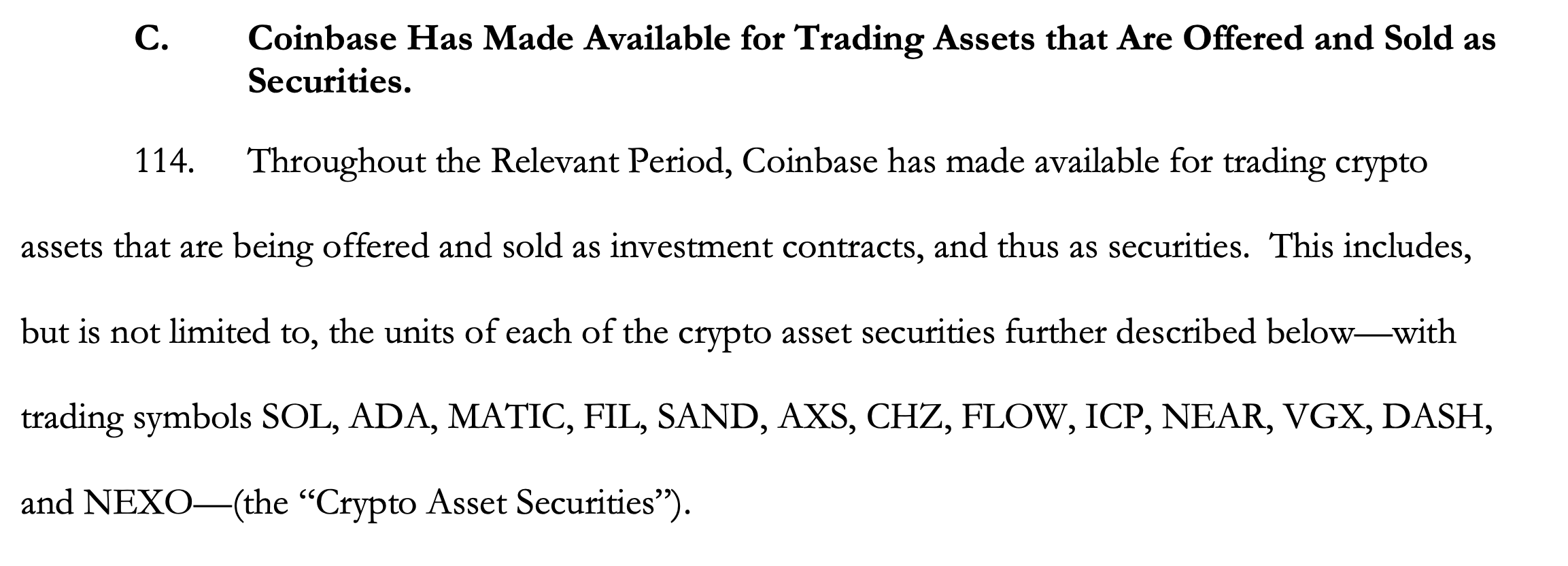

According to the SEC’s claim, Coinbase is acting as an unregistered broker and exchange.

After Binance, SEC targets Coinbase

After Binance, the SEC chose Coinbase as the target and sued. The report stated that the US-based crypto exchange Coinbase operates as an unregistered brokerage firm. The commission demanded that the company be permanently banned.

According to the report, coins such as SOL, ADA, MATIC, FIL, SAND, AXS, CHZ, FLOW, ICP, NEAR, VGX, DASH, NEXO are considered securities.

SEC Chairman Gary Gensler said in a statement on the subject:

While subject to Coinbase’s securities laws, in a confused and illegal manner; We claim to offer exchange, broker-dealer and trading functions.

In the lawsuit, it is said that staking services are made available to investors through Google and social media ads. According to the commission, the company generates income from it. Allegedly, the company did all this work without notifying the SEC.

SEC Chairman speaks after Coinbase lawsuit

The fact that the SEC sued Binance was a bombshell in the cryptocurrency ecosystem. The SEC has made its next move to Coinbase. The report stated that the US-based crypto exchange Coinbase operates as an unregistered brokerage firm. Right after that, SEC Chairman Gary Gensler made some statements on the subject in a live broadcast on CNBC.

Gensler: We don’t need any more digital currencies

SEC Chairman Gary Gensler attended the CNBC live broadcast. Gensler, who came to the fore with his negative comments about cryptocurrencies, touched on similar points in the broadcast. Noting that there are too many cryptocurrencies, Gensler underlined that there is no need for more digital money. Also, Gensler said the platforms have a network of people trying to evade the law. Gensler gave the following words in his speech:

If there really is any value in crypto, SEC compliance creates a trust.

Gensler added that the SEC is ready to work with the crypto industry for compliance.

Another issue Gensler touched on in the broadcast was the Binance case. In its Binance filing, it stated that companies claim to be trading largely against their own customers.

Shares of Coinbase also fell 20 percent with the news of the lawsuit.

$780 million outflow in the last 24 hours on Binance!

Data firm Nansen announced on Tuesday that approximately $780 million has been exited from Binance, the world’s largest cryptocurrency exchange.

One day after Binance was sued by the U.S. Securities and Exchange Commission (SEC), investors reportedly pulled approximately $780 million from Binance in the past 24 hours.

Nansen said the US arm of Binance recorded a net outflow of $13 million over the same period. Neither Binance nor Binance.US have made a statement yet.

In particular, a drop in asset supply on stock markets is often seen as a bullish sign for a variety of reasons. One of the most important reasons behind this is that there are fewer coins that can be sold on exchanges. This limited supply can create a supply-demand imbalance, potentially driving up the price of assets.

Binance and SEC

The SEC’s recently tightened stance on crypto includes $115 billion in cryptocurrencies, following a lawsuit filed against Binance on Monday. Binance’s $44 billion market cap BNB, its stablecoin BUSD, Cardano’s ADA, Solana’s SOL, Polygon’s MATIC, Filecoin’s FIL, and Algorand’s ALGO ‘su was among those named in the lawsuit. Adding other tokens such as XRP targeted by the SEC to the list, the agency currently categorizes over $115 billion in coins as unregistered securities.