Binance’s top strategist resigned; Bitcoin mining revenues this year are better than 2022; Genesis’ feud with FTX puts creditor payments at risk!

As it is known, there has been news in the industry recently that several Binance executives have left the stock market after CEO Changpeng Zhao’s response to the US Department of Justice (DOJ) investigation.

While the news in question was still hot, another breakup news came from Hillmann. Binance chief strategy officer Patrick Hillmann has confirmed that he is leaving the company.

Patrick Hillmann, who shared on his official Twitter account the other day, announced that he left Binance, but that he did so on good terms.

Stating that he has been with Binance for two years, Hillmann said that he is currently expecting his second child and that it is time to step aside.

In addition, general counsel Han Ng and senior vice president Steven Christie have reportedly left the stock market.

The statement from Binance CEO was not delayed

However, the news of his resignation was quick to respond from Binance CEO Changpeng Zhao. Binance CEO described the situation as “FUD” in his statement. While Zhao pointed out that there can always be layoffs, he emphasized that the reasons for leaving were completely wrong.

According to a source from Bloomberg, Binance’s APAC and MENA head of law Eleanor Hughes will replace Ng as the new general counsel, while Noah Perlamn, who joined in February as chief compliance officer, will remain with the company.

Bitcoin mining revenues this year are better than 2022!

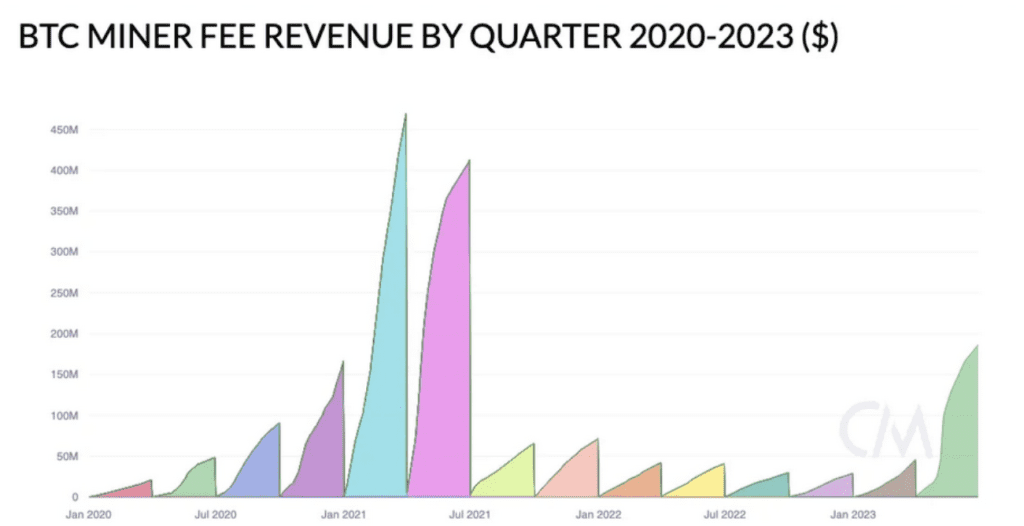

Bitcoin (BTC) miners made more profits in Q2 2023 alone than in the year 2022 combined. The fact that the BRC-20 token frenzy marked 2023 and the recent significant developments in the BTC price made the miners smile.

Cryptocurrency miners pocketed $184 million in earnings in Q2 of 2023.

According to a report from cryptocurrency analytics platform Coin Metrics, earnings of $184 million were up more than 270 percent compared to the first quarter of 2023. It was the first quarter to exceed the $100 million mark in crypto mining since Q2 of 2021.

Mining revenues set a record in the second quarter of 2023

Coin Metrics attributed this increase in mining revenues to two main reasons. The research company stated that the two main reasons are the successful price performance of Bitcoin in the recent periods and the emergence of the BRC-20 standard last March.

However, it is worth noting that transaction fees represent only 7.7 percent of the total $2.4 billion raised by miners during Q2.

As it is known, last May, the Bitcoin mining industry achieved a great victory with the prevention of the Digital Asset Mining Energy (DAME) tax proposed by the Biden Administration.

However, Coin Metrics noted that Bitcoin miners also benefited from easier macroeconomic conditions this quarter, with diminishing inflation pressures turning into lower electricity prices for US-based miners.

Genesis’ feud with FTX puts creditor payments at risk

The quarrel between two bankrupt companies in the crypto industry puts creditors’ payments at risk. The $2 billion fight between Genesis and FTX could delay court consideration of payments to creditors.

FTX claims Genesis, which is owned by Digital Currency Group, owes it about $2 billion. At the hearing, Genesis and FTX offered to engage in a duel process to settle the claim.

Genesis is asking US Bankruptcy Judge Sean Lane to set up a hearing to decide whether the alleged debt is legitimate and, if so, how large. FTX, on the other hand, is asking Lane to allow Genesis to sue the company in Wilmington, Delaware, where the bankruptcy case is being held by a different federal judge.

However, the judge denied both requests from the two companies. Instead, Judge Lane suggested that both parties exchange information about the dispute. Also, as requested by Genesis, the judge may schedule a hearing to decide FTX’s request. A final decision has not yet been made on whether FTX can sue Genesis.

Meanwhile, Genesis, a group of its creditors, and DCG, together with a court-appointed mediator, continue to work on a revised payment proposal. The deal is expected to determine the fate of hundreds of thousands of Genesis creditors.

Later in July, Judge Lane will consider giving Genesis permission to hold a vote among creditors on the payment plan. Lane will then take these votes into account when deciding whether to approve the proposal.

However, Genesis claims that it does not owe any debt to FTX. Genesis is asking the judge to rule that FTX has no claim.

FTX, on the other hand, has been trying to salvage its assets to pay off the millions of potential creditors it owes since its bankruptcy last year.