Bitcoin ETFs Experience $76 Million Net Outflows on Seventh Day of Trading; FTX Estate Sells Majority of Grayscale Bitcoin Trust Shares After Spot ETF Conversion; SEC Confirms “SIM Swap” Attack as Cause of Hacked X Account Ahead of Bitcoin ETF Approval

New data from Bloomberg ETF analyst James Seyffart reveals that spot Bitcoin exchange-traded funds (ETFs) witnessed $76 million in net outflows on the seventh day of trading. Seyffart referred to it as a “bad day” overall for Bitcoin ETFs in the “Cointucky Derby,” with Grayscale still leading in net outflows.

Despite the setback, Seyffart mentioned that the overall flows into spot Bitcoin ETFs remained positive, with BlackRock experiencing its third-largest day of positive flows, totaling $272 million in inflows. He noted that the net inflows into spot Bitcoin ETFs exceeded $1.1 billion, even after accounting for the outflows from Grayscale’s Bitcoin Trust (GBTC).

While acknowledging the continuous outflows from GBTC, Seyffart anticipates that the selling pressure from GBTC will likely ease in the coming weeks. The significant outflows from Grayscale’s recently converted GBTC fund have been linked to substantial selling by the FTX estate, which reportedly offloaded about two-thirds of its 22.8 million GBTC shares.

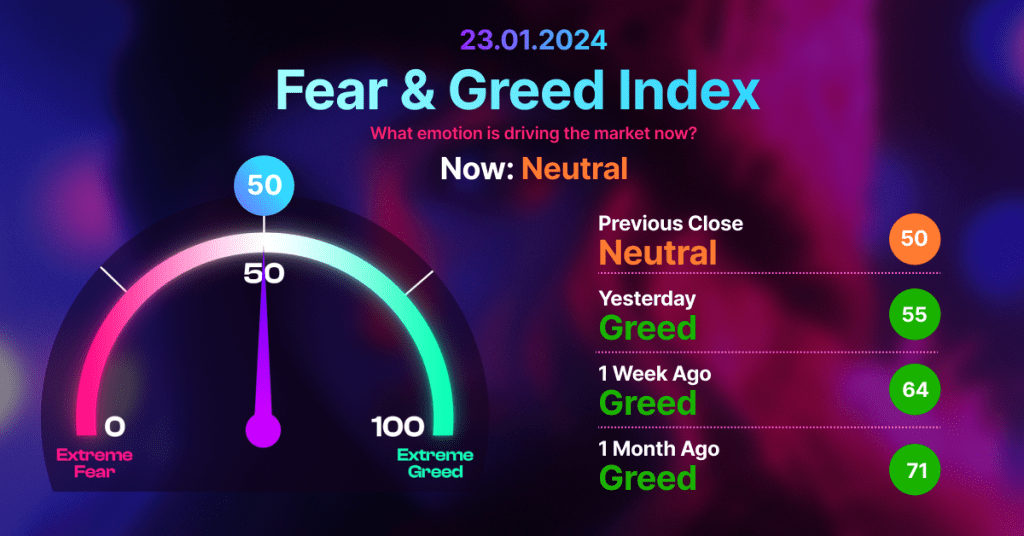

The price of Bitcoin has seen a notable decline since the approval of ten spot ETFs on January 10, dropping from $49,100 to as low as $39,500 on January 23. Currently hovering just above $40,000, Bitcoin’s downward movement coincides with a sharp decrease in open interest on Bitcoin futures on the Chicago Mercantile Exchange (CME). This decline suggests waning enthusiasm among institutional investors for leveraged exposure to Bitcoin.

Data from CoinGlass indicates a significant drop in open interest on CME, falling from nearly $6.4 billion on January 12 to $4.4 billion at the time of the report. The evolving market dynamics will be closely monitored for further insights into Bitcoin’s price and institutional sentiment.

FTX Estate Sells Majority of Grayscale Bitcoin Trust Shares After Spot ETF Conversion

According to a January 22 report from Bloomberg, the FTX estate, linked to the failed crypto exchange FTX and hedge fund Alameda Research, has sold over two-thirds of its Grayscale Bitcoin Trust (GBTC) shares. The FTX estate, which initially held 22.28 million GBTC shares, worth $902 million, reportedly sold a significant portion of its holdings in the first three days of spot ETF trading, potentially raising at least $600 million.

Before the conversion of GBTC into a spot exchange-traded fund (ETF) on January 11, the FTX estate held a considerable amount of GBTC shares. The reported sale implies that the estate now holds less than 8 million shares, valued at approximately $281 million. Alameda Research had previously sued Grayscale in March, alleging excessive fees and claiming that the firm enforced a “self-imposed redemption ban.”

The redemption process for authorized participants opened on January 11 after the United States Securities and Exchange Commission (SEC) approved the conversion of the Grayscale Trust into an ETF. As a result, the discount of GBTC shares versus net asset value narrowed, making the share price align more closely with the value of the underlying Bitcoin. Since January 11, the Grayscale Bitcoin Trust has reportedly sold over $700 million worth of Bitcoin.

Analysts suggest that investors may be leaving the Grayscale Bitcoin Trust due to perceived high fees. Despite the lawsuit against Grayscale being dropped by Alameda on January 22, the dynamics of the evolving market will be closely monitored for further insights into institutional movements and fund flows.

SEC Confirms “SIM Swap” Attack as Cause of Hacked X Account Ahead of Bitcoin ETF Approval

The United States Securities and Exchange Commission (SEC) has acknowledged falling victim to a “SIM swap” attack, leading to the unauthorized X post on January 9 falsely claiming the approval of spot Bitcoin exchange-traded funds (ETFs).

According to an SEC spokesperson on January 22, two days after the incident, it was determined that an unauthorized party gained control of the SEC cell phone number associated with the account through a “SIM swap” attack. Once in control of the phone number, the attacker reset the password for the @SECGov account.

The SEC mentioned that law enforcement is currently investigating how the unauthorized party persuaded the telecom carrier to change the SIM for the account and how they knew which phone number was linked to the SEC’s X account.

Additionally, the SEC revealed that six months before the attack, a staff member removed multifactor authentication as an extra layer of protection due to difficulties accessing the account. This security measure was only reinstated after the January 9 attack.

The SEC emphasized that there is no evidence suggesting the unauthorized party gained access to other SEC systems, data, or social media accounts. The incident occurred just a day before the SEC officially approved multiple spot Bitcoin ETF applications, with most of them commencing trading on January 11.