In Todays Headline TV CryptoDaily News:

Binance introduces function for API users to prevent self trading.

“Cryptocurrency exchange Binance has introduced a new function to help its API users prevent self-trading on their platform. The service will be available to Binance’s API users starting January 26th. Users of the exchange’s website and app will not be affected.”

Gemini becomes the latest victim of crypto winter.

The Winklevoss twins’ brainchild, Gemini, is bleeding employees left and right due to its exposure to the now-bankrupt crypto lending platform Genesis. The exchange is laying off 10% of its workforce, citing reasons of ‘bad actors’ in the crypto industry.

Cardano-based overcollateralized stablecoin Djed to launch next week

Cardano-based decentralized stablecoin Djed is on track for a launch next week, one of the developers behind the token said. The highly-anticipated Djed stablecoin has been jointly developed by Cardano code maintainer IOG and Coti, a layer 1 blockchain.

BTC/USD exploded 4.8% in the last session.

The Bitcoin-Dollar pair gained 4.8% in the last session after rising as much as 5.2% during the session. The Ultimate Oscillator indicates an overbought market. Support is at 22078.3333 and resistance at 23428.3333.

The Ultimate Oscillator is signalling an overbought market.

ETH/USD skyrocketed 5.4% in the last session.

The Ethereum-Dollar pair skyrocketed 5.4% in the last session. The Stochastic-RSI is giving a negative signal. Support is at 1477.3233 and resistance at 1680.5233.

The Stochastic-RSI is currently in negative territory.

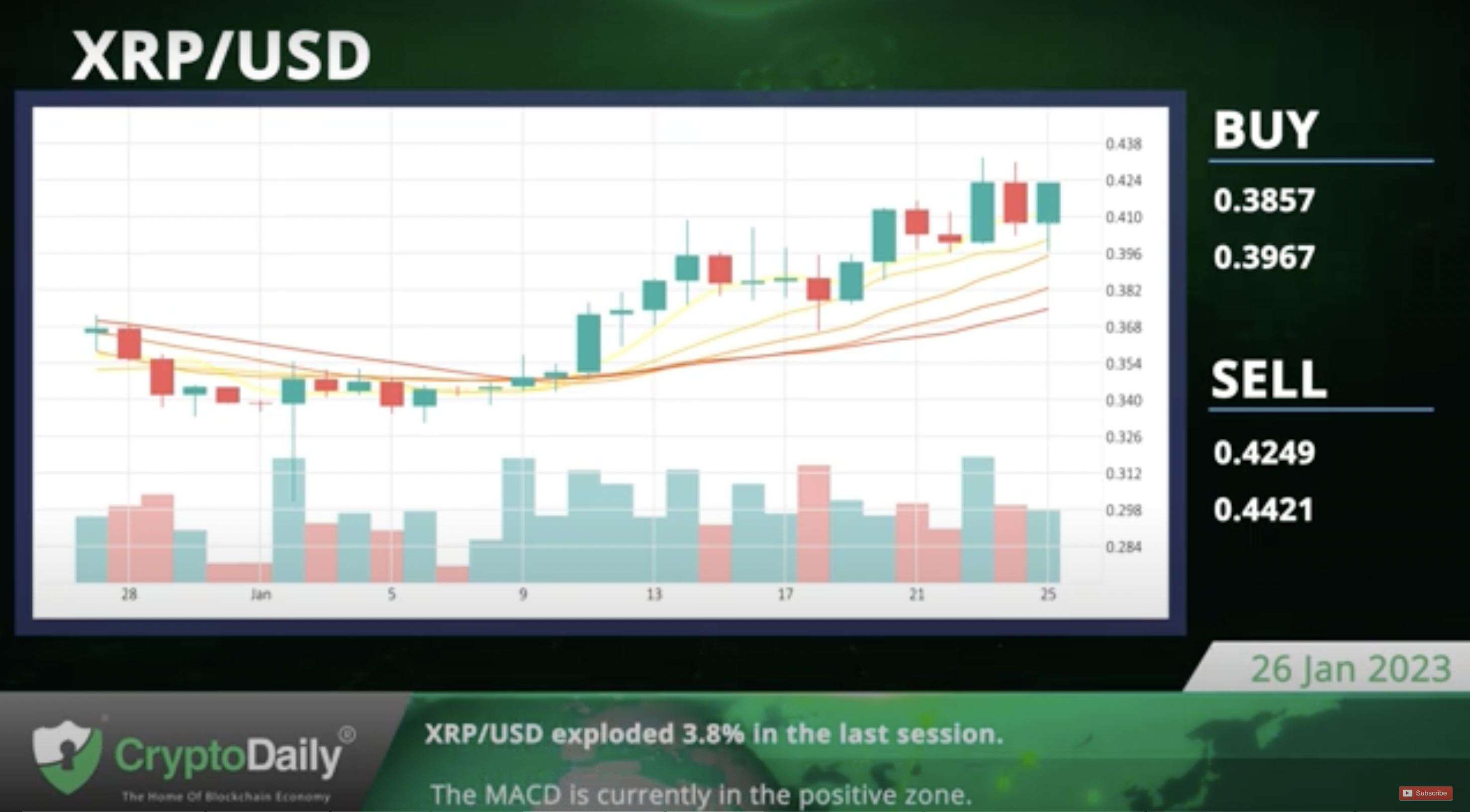

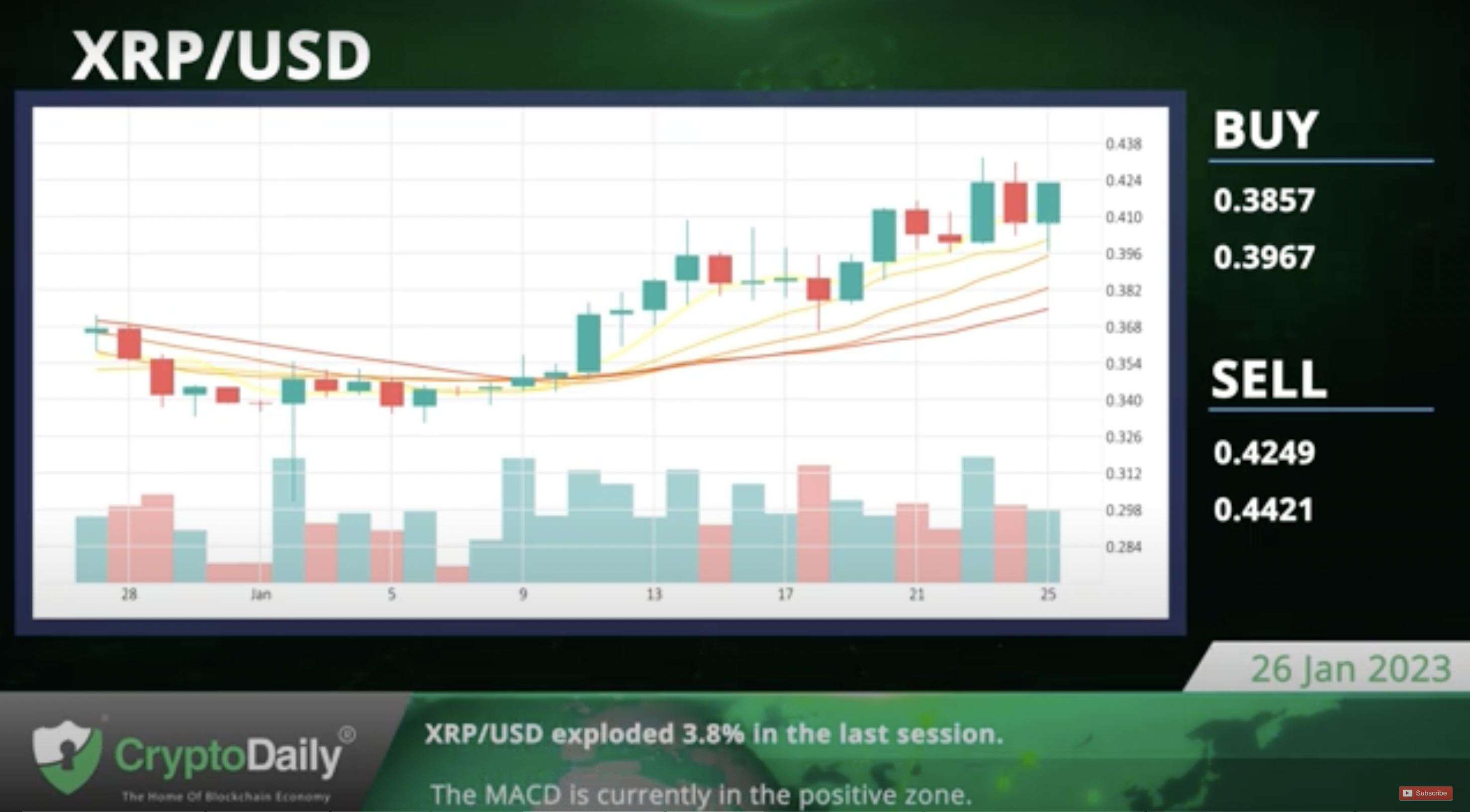

XRP/USD exploded 3.8% in the last session.

The Ripple-Dollar pair exploded 3.8% in the last session. The MACD is giving a positive signal, which matches our overall technical analysis. Support is at 0.3857 and resistance at 0.4421.

The MACD is currently in the positive zone.

LTC/USD skyrocketed 5.0% in the last session.

The Litecoin-Dollar pair gained 5.0% in the last session after rising as much as 5.4% during the session. According to the Williams indicator, we are in an overbought market. Support is at 84.71 and resistance at 93.3833.

The Williams indicator points to an overbought market.

Daily Economic Calendar:

JP Coincident Index

The Coincident Index released by the Cabinet Office is a single summary statistic that tracks the current state of the Japanese economy. The US Durable Goods Orders will be released at 13:30 GMT, the US Gross Domestic Product Annualized at 13:30 GMT, the Irish Consumer Confidence at 00:01 GMT.

DE IFO – Business Climate

The IFO Business Climate index is regarded as an early indicator of current conditions and business expectations. The Institute surveys enterprises on their assessment of the economic situation.

UK PPI Core Output

The Producer Prices Index (PPI) Core Output is a price index of producer prices and excludes volatile items such as food and energy.

US MBA Mortgage Applications

The MBA Mortgage Applications released by the Mortgage Bankers Association presents various mortgage applications. It is considered as a leading indicator of the U.S Housing Market. Spain’s Unemployment Survey will be released at 07:00 GMT, Japan’s Tokyo Consumer Price Index at 23:30 GMT, and Japan’s Tokyo CPI at 23:30 GMT.

UK Producer Price Index

The Producer Price Index measures the average changes in prices in primary markets by producers of commodities in all states of processing.

AU Consumer Price Index

The Consumer Price Index is a measure of price movements made by comparing the retail prices of a representative shopping basket of goods and services.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.