The increasing transaction fee crisis on the Ethereum blockchain has become a formidable obstacle to its anticipated exponential growth. Amidst the quest for viable solutions to alleviate congestion and surging fees, Arbitrum technology emerges as a compelling contender.

In the Ethereum ecosystem, transactions are executed through smart contracts, necessitating a fee to compensate network participants storing these dynamic contracts on their machines. As the user base expands, leading to an increased demand for transaction processing, the transaction fee escalates. Furthermore, Ethereum’s mining process mandates every miner to meticulously simulate each step of a contract’s execution, a resource-intensive task that severely constrains scalability. Additionally, Ethereum enforces public accessibility to every contract’s code and data, unless a privacy overlay feature is employed, incurring additional costs.

What is Arbitrum?

Arbitrum, developed by Offchain Labs, a company co-founded in 2018 by Ed Felten, a distinguished computer science and public affairs professor at Princeton, aims to mitigate network congestion and transaction costs. This is achieved by efficiently offloading a significant portion of work and data storage from Ethereum’s mainnet or layer 1 (L1). The innovative approach adopted by Arbitrum, known as the layer 2 (L2) scaling solution, is strategically built atop the Ethereum network, envisioning a more streamlined and cost-effective transaction environment.

Demystifying Arbitrum: Decoding its Operational Framework

Arbitrum functions through the orchestration of four pivotal roles within its ecosystem: verifiers, a virtual machine (VM), a key, and a manager. Each of these roles contributes to the efficient operation of the Arbitrum protocol, as detailed below.

1. Verifiers

Verifiers play a critical role in the Arbitrum ecosystem by overseeing and validating the execution of smart contracts. Rather than burdening every validator with the exhaustive replication of every VM’s execution, verifiers focus on tracking the hash of the VM’s state. This streamlined approach significantly reduces the cost for verifiers, emphasizing efficiency in the Arbitrum network.

2. Virtual Machine (VM)

At the core of Arbitrum lies the concept of the Virtual Machine (VM), where parties can deploy smart contracts by encoding their specific rules. These VMs operate within the Arbitrum Virtual Machine (AVM) Architecture, representing a fundamental building block for executing smart contracts seamlessly.

3. Key and Manager

Designated by the VM’s creator, managers assume a pivotal role in the Arbitrum protocol. Any honest manager possesses the authority to enforce the VM’s behavior according to its encoded rules. Stakeholders with an interest in a VM’s outcome can either trust someone to act as a manager on their behalf or choose to manage directly. The Arbitrum protocol ensures that a single honest manager suffices to ensure compliance with the VM’s code.

4. Operational Overview

To streamline the state modification process without exhaustive replication, managers come to an out-of-band agreement on the VM’s functioning, incentivized by Arbitrum. Verifiers solely keep track of the hash of the VM’s state rather than the entire state, thereby reducing computational overhead. In cases of manager disagreements, a bisection technique is employed, narrowing down disputes to the execution of a single instruction. Both VMs and involved parties can engage in message and currency exchanges within this dynamic framework.

Consensus Process Customization

DApps running on the Arbitrum chain enjoy the flexibility of selecting their group of validators for the consensus process. This localized approach contrasts with Ethereum’s global validator structure, enabling faster transaction processing through reduced node interactions. This tailored consensus mechanism enhances the efficiency and agility of the Arbitrum network.

Ethereum’s Evolution: Unveiling Layer 2 Scaling Solutions

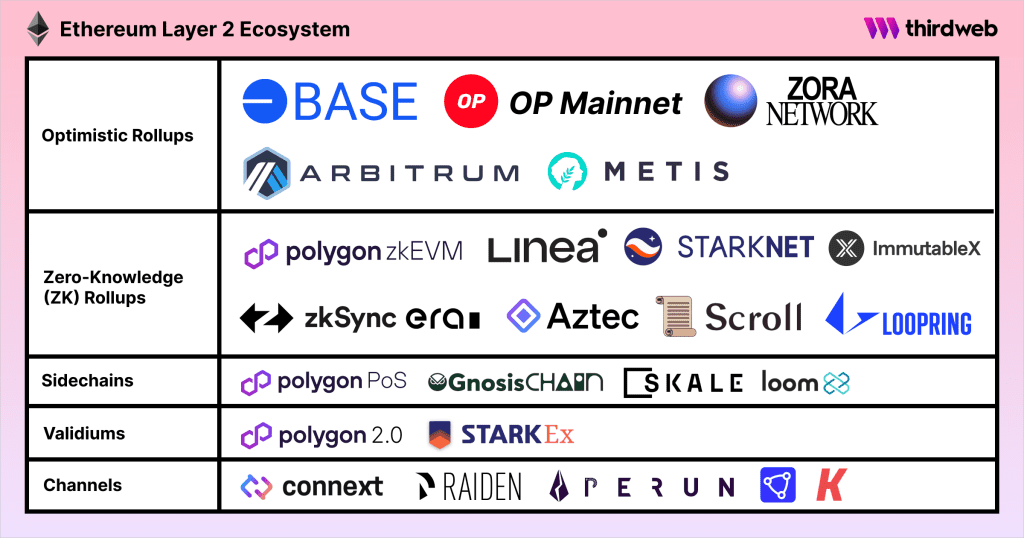

In a bid to alleviate transaction fees and combat network congestion, Ethereum’s architectural landscape is undergoing transformative changes through the introduction of Layer 2 (L2) scaling solutions. These solutions are designed to function atop the Ethereum blockchain, addressing the immediate challenges while maintaining the decentralization and security aspects.

While scalability enhancements on Layer 1 risk compromising decentralization and security, Ethereum’s long-term vision involves the imminent launch of Ethereum 2.0. However, in the interim, Layer 2 scaling solutions like Optimistic Rollups and zk-Rollups are playing a pivotal role. Arbitrum stands out as a noteworthy L2 expansion rollup, specifically an Optimistic Rollup, designed to enhance the Ethereum blockchain’s capabilities.

Understanding Optimistic Rollups and zk-Rollups

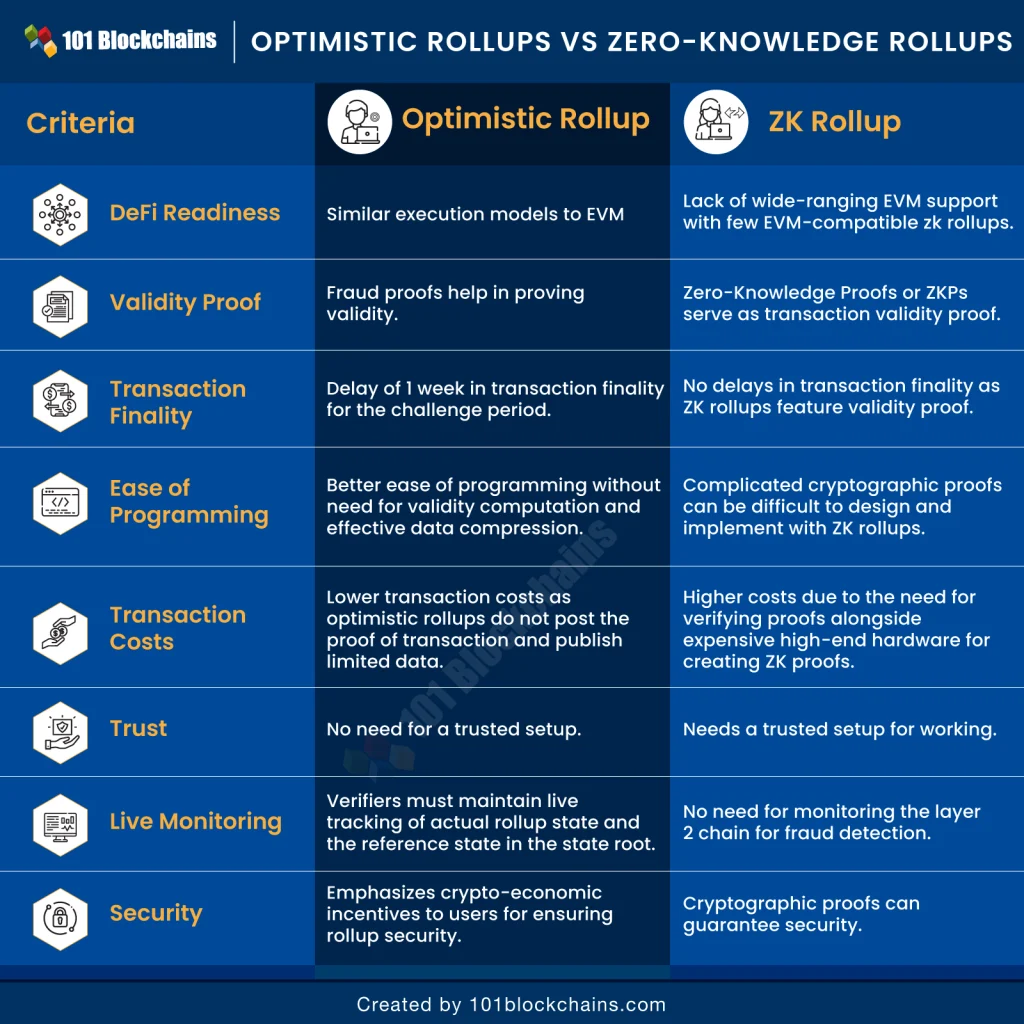

Optimistic Rollups operate on the assumption that all new chain additions are authentic unless contested by a network user within a one-week timeframe. In contrast, zk-Rollups leverage cryptographic proofs to validate each new block, eliminating the need for validators to be inherently trusted. While zk-Rollup technology holds promise as a leading Layer 2 solution in the future, it is a more intricate concept than Optimistic Rollups, necessitating further research and development.

Exploring Projects on Arbitrum

Arbitrum has garnered attention as a preferred platform for various projects seeking to benefit from enhanced scalability and reduced transaction costs. Notable projects, including Sushiswap, Curve, Abracadabra, AnySwap, and Synapse, have embraced Arbitrum’s L2 expansion. Notably, Uniswap, a prominent decentralized exchange (DEX) on the Ethereum network, engaged its governance token holders to decide on porting the platform to Arbitrum One.

Interestingly, despite initial plans to utilize Optimism’s Layer 2 solution, the Uniswap community favored Arbitrum over Optimism in a governance vote. This decision was influenced by Optimism’s delayed full launch, providing Arbitrum with an opportunity to take the lead. However, Uniswap’s implementation of Optimism has not been ruled out entirely, demonstrating the dynamic nature of these developments and the adaptability within the Ethereum ecosystem.

Unlocking the Arbitrum Bridge: Seamless L1 to L2 Token Transfers

The Arbitrum bridge serves as a vital conduit, empowering users to seamlessly transfer ETH and ERC-20 Ethereum tokens between the Ethereum mainnet (Layer 1 or L1) and a Layer 2 scaling solution named Arbitrum One. This bridge acts as a crucial link, facilitating the movement of assets to and from the layer 2 ecosystem.

When users intend to initiate a transaction using Arbitrum, the process involves directing it to one of EthBridge’s Inbox contracts. This mechanism ensures the smooth transition of assets into the Arbitrum layer, enabling users to leverage the benefits of reduced transaction fees and enhanced scalability associated with Layer 2 solutions.

Conversely, the Outbox contract plays a pivotal role in handling data received from Arbitrum, seamlessly integrating it back into the Ethereum blockchain for reverse interaction. The transparency of EthBridge’s inputs and outputs is paramount, ensuring that all off-chain activities are publicly verifiable on the Ethereum mainnet.

If you’re contemplating the process of bridging your ETH tokens from L1 to L2, the following steps serve as a comprehensive guide. It’s essential to ensure that your wallet, whether it’s MetaMask or any other, contains sufficient ETH on the Ethereum mainnet to facilitate the seamless bridging of assets between the two layers.

Why is the Arbitrum gas fee less?

Arbitrum uses ArbGas to keep track of the cost of execution on an Arbitrum chain. Every Arbitrum VM instruction has an ArbGas cost, and the cost of a calculation is the total of the ArbGas fees of the instructions in it compared to Ethereum’s gas limit.

This means that there is no hard ArbGas limit for Arbitrum and it is much cheaper than the ETH gas fee. The fee is usually charged to compensate Arbitrum chain’s validators for their expenses, though it is set to zero by default.

Arbitrum One (Layer 2) Chain uses ETH for gas fee but it can be changed to ARB with a new Ethereum update.

Also, ArbGas is charged for proof-checking every instruction by the AVM. Therefore, it is important to ensure that the EthBridge will never exceed the L1 gas limit by estimating how much L1 gas the EthBridge will require. Furthermore, the estimation of the emulation time is critical for rollup chain throughput because it allows us to safely establish the chain’s speed limit.

ArbGas is different from Ethereum gas in that it tries to estimate emulation on AVM, whereas Ethereum gas serves a similar function on Ethereum. Access to storage, for example, is extremely expensive on Ethereum since a storage right in Ethereum establishes an obligation for all Ethereum miners, perhaps in perpetuity.

What gas does Arbitrum use?

Arbitrum One (Layer 2) Chain uses ETH for gas fee but it can be changed to ARB with a new Ethereum update.

Arbitrum vs. Optimism

Arbitrum and Optimism share similarities in their deployment strategies, activating only when faulty blocks are identified, not with every transaction. Both platforms feature cross-chain bridges, facilitating token movement between Layer 1 and Layer 2.

Notably, they diverge from traditional confirmation sequences, confirming transactions after block creation. This unique approach results in networks with low latency and high throughput, prioritizing efficiency in transaction processing. These shared principles highlight their streamlined operational frameworks and improved network performance.