Kucoin could reduce the workforce by 30%; Bitget users exceeded 20 million; Avalanche Foundation to create incentive program

Cryptocurrency exchange KuCoin plans to reduce its workforce by 30%, according to anonymous sources.

According to the news of Crypto Potato, although the stock market describes this move as a “normal performance evaluation”, it is thought that the reason for the dismissals is the new KYC policy.

Chinese journalist Coin Wu, who is also known for giving bad news in the crypto money industry, said that KuCoin will lay off 30% of its staff, according to information from three employees at the company.

Wu stated that after the cryptocurrency exchange activated KYC measures, there was a decrease in their business. The implementation of KYC caused some users to move away from the platform, which paved the way for a decrease in the company’s profit rate.

Kucoin has not made an official statement

The exchange has not yet made an official statement. However, sources have agreed that the exchange will launch it as a performance evaluation. Although it was claimed that KuCoin would make layoffs in July 2022, the stock market denied these rumors shortly after.

Another cryptocurrency exchange, Binance’s US arm, Binance US, has decided to lay off some of its employees before getting involved in a lengthy and costly legal process with the US Securities and Exchange Commission.

Since the start of the bear market, many companies have had to reduce their workforce. For this reason, KuCoin’s signing of such a move is not a surprising development considering the current dynamics of the industry.

Bitget users exceeded 20 million!

Cryptocurrency exchange Bitget has entered a period of rebranding with its acquisition of Bitkeep. Sailing to new areas, the stock market has achieved more than one success, especially in 2023. With its successful work, Bitget has increased its trading volumes significantly, placing it in the fourth place among the top five crypto currency exchanges.

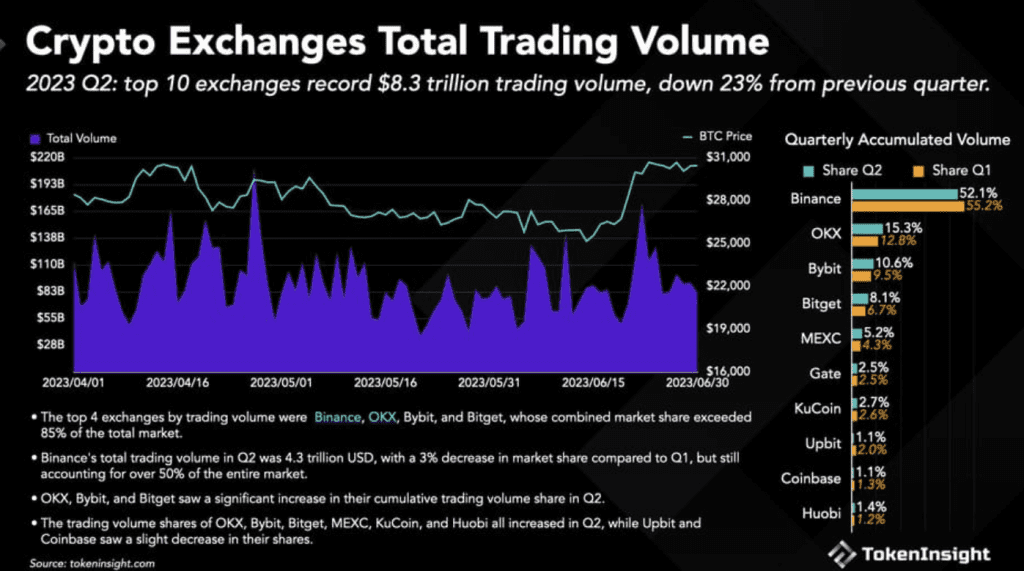

The top four exchanges dominate 58% of the total market trading volume, according to second-quarter data from TokenInsight. While Binance alone has a share of 52%, OKX managed to rise to the top four with a trading volume of 15.13%, Bybit 10.6% and Bitget 8.1%.

Bitget also released its second quarter report last week. According to the stock market’s report dated July 18, Bitget determined its spot trading volume to be over $60 billion and its futures volume to be $606 billion in its second quarter report.

The report also included a study by blockchain analysis company Nansen. According to this research, Bitget was the only exchange that increased its futures volumes in the six-month timeframe following the collapse of Sam Bankman-Fried’s FTX.

The exchange also notes that the launch of copy trading, its feature that allows users to emulate the trading strategies of certain traders, impacted its performance in the second quarter. Bitget said it attracted 29,700 new elite investors and 169,800 new followers, resulting in a profit of $33 million by mid-2023.

On the other hand, Bitget acquired virtual asset service provider registration in Poland and Lithuania in 2023 as it expands its services to Europe. He stated that the exchange plans to establish a regional hub for its operations in Dubai.

Seychelles-based cryptocurrency derivatives exchange Bitget recorded prolific growth in key metrics in the first half of 2023, thanks to the integration of its recently purchased individual custodian wallet service.

Avalanche Foundation to create incentive program

The Avalanche Foundation has rolled up its sleeves to create a $50 million incentive program.

To demonstrate the benefits of tokenized assets, the foundation has allocated a $50 million budget to purchase tokenized assets on the Avalanche network.

The new program, called Avalanche Vista, will evaluate equity, loans, real estate and miscellaneous commodities.

John Wu, president of Ava Labs, said:

“Asset tokenization is a key driver not only for the future of capital markets, but for today as well. The momentum of institutions continuing to build on the chain is incredible, and the Avalanche Foundation is taking a big step forward with this initiative.”

The Avalanche Foundation recently tokenized a stake in Securitze’s KKR fund, demonstrating how serious it is in its current policy.

The foundation made the following statements regarding the new incentive program:

“The $50 million allocation is a demonstration of the Avalanche Foundation’s commitment to advancing a new consensus mechanism, unique network architecture, technical innovation, and an efficient and cost-effective financial system.”

The foundation also emphasized that it aims to accelerate its role in on-chain financing by demonstrating the benefits of tokenization.

Avalanche announced that it will launch a $180 million DeFi investment program with Aave and Curve in 2021 to move blockchain technology forward.