It is now possible to purchase Ether via PayPal using MetaMask; BIS has published comprehensive document for offline CBDC payments; Crypto exchanges take action on BTC transaction fees

Crypto wallet and DApp provider MetaMask has started offering US users the ability to purchase Ether via PayPal. The company stated that it is the first web3 wallet to offer the possibility to purchase Ether via PayPal.

Thanks to this collaboration, US users will be able to choose PayPal as the payment method when purchasing Ether using MetaMask. With Integration, Ethers can also be transferred from PayPal to Metamask.

Last December, PayPal teamed up with MetaMask’s parent company, ConsenSys, to claim that the partnership would allow users to seamlessly buy cryptocurrencies and explore the web3 ecosystem.

PayPal has a total of $943 million in crypto assets as of March 31, 2023, according to the report submitted to the US Securities and Exchange Commission. This marks a 56% increase over the company’s previously reported $604 million.

The new integration comes after MetaMask announced a new feature for users to buy crypto with fiat currency directly from a Portfolio Dapp.

Supporting more than 90 cryptocurrencies across eight networks, including Ethereum, Polygon, Arbitrum, BNB Smart Chain, Avalanche, Fantom, Optimis and Celo, the service will cover more than 189 countries. The feature considers the region and regulations of users to provide a specific quote for each purchase.

MetaMask continues to make new integrations and partnerships to expand reach and offer on-ramps for its customers.

BIS has published comprehensive document for offline CBDC payments

The Bank for International Settlements (BIS) is actively exploring offline payment options for CBDC.

The BIS Innovation Hub Nordic Center published a comprehensive handbook on May 11 that explores how CBDCs can work for offline payments.

Written in collaboration with Consult Hyperion, the handbook touched upon many aspects of CBDC.

The article titled “The Polaris Project” highlights potential risks from offline CBDC payments, including fraud and privacy concerns.

According to the BIS and Hyperion, offline CBDC payments pose a threat to privacy as they support anonymous transactions and can expose privacy by design.

In some cases, it can be crucial for offline CBDC payers to be able to identify the counterparty.

The payer may want to ensure that the payee is identified and that the information provided to them is valid. Phishing scams are an area of risk that central banks should consider regarding privacy.

Offline functionality is a key feature of CBDC projects currently under development by global central banks. Countries like Australia, India, and Russia are working on offline CBDC payment technology.

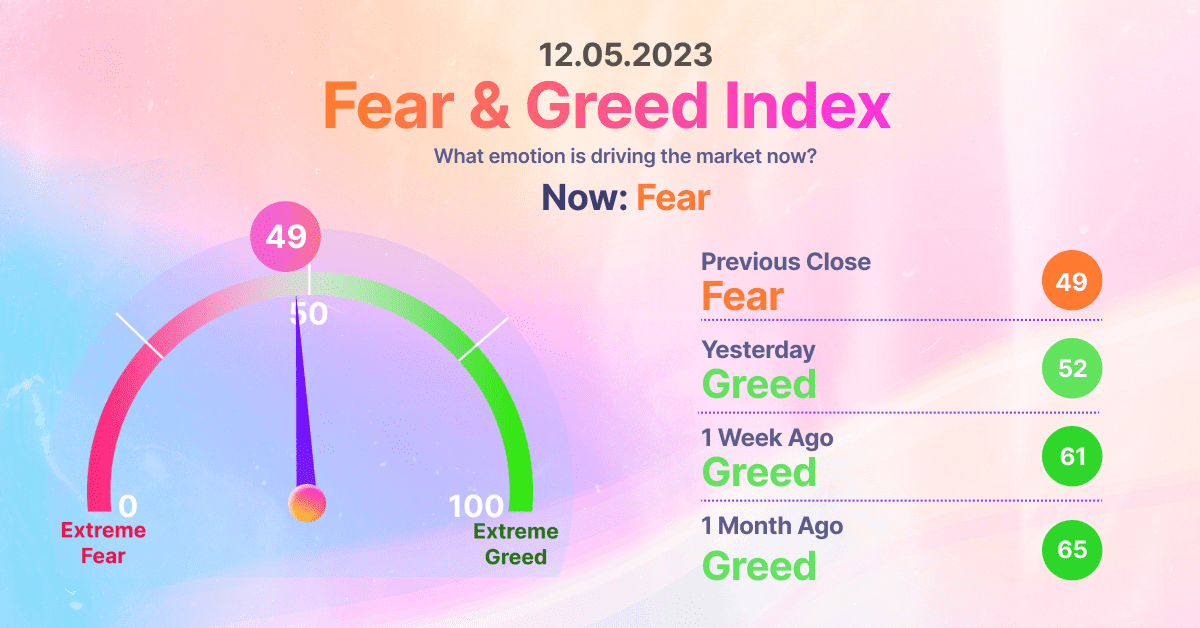

Crypto exchanges take action on BTC transaction fees

Bitcoin (BTC) transaction fees have increased significantly in recent times. The intense interest in BRC-20 tokens, which entered our lives almost two months ago, turned into a frenzy. BRC-20 tokens, which reached a market value of billions of dollars in a short time, started to put Bitcoin in a difficult situation.

With massive increases in Bitcoin transaction fees, cryptocurrency exchanges took action to adjust the cost of withdrawing BTC from their platforms.

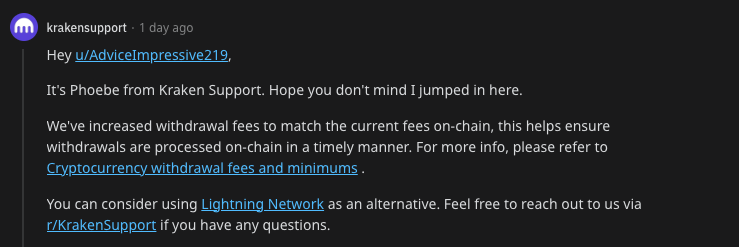

US-based cryptocurrency exchange Kraken has increased its Bitcoin withdrawal fees to match existing on-chain fees. The customer support manager of the stock market made statements on the subject the other day. The executive said that the platform-developed solution will help ensure that withdrawals are processed on-chain in a timely manner.

Kraken exchange charges 0.00035 BTC, or around $10, for a Bitcoin withdrawal, and the minimum amount is 0.0005 BTC ($13).

The minimum withdrawal amount of BTC in the Lightning Network (LN) also differs significantly from non-Lightning BTCs. These, too, start at 0.00001 BTC, i.e. less than $1.

OKX exchange charges between 0.00096 BTC ($26) and 0.00192 BTC ($53) for BTC withdrawals. The minimum withdrawal amount was 0.001 BTC ($27).

KuCoin exchange announced that the withdrawal fee is between 0.00002 and 0.001 BTC. He mentioned that the minimum withdrawal amount is 0.0005 BTC.

A Huobi spokesperson informed Cointelegraph that the current withdrawal fee has been reduced to 0.001 BTC. The Huobi exchange also noted that current transactions were settled at 0.0004 BTC ($11) before lowering the transaction fee prices.