Although people usually associate the crypto market solely with Bitcoin and, perhaps, Ethereum, there are many cryptocurrency types.

NFTs, or non-fungible tokens, have become the most popular coin class since 2020. Let’s examine the basics of NFTs step-by-step:

- What is a non-fungible token, and how is it used?

- What are the top NFTs, and how much are they worth?

- Where can one buy and store non-fungible tokens?

- How can one make money by creating and selling NFTs?

Non-Fungible Tokens, Explained

NFT, or non-fungible tokens, are crypto assets issued on a blockchain with unique identification codes and metadata that distinguish them from each other. In simple terms, each NFT token is unique and cannot be exchanged for the same value. Thus, non-fungible tokens cannot be used as a payment means, similar to ETH, BTC, or USDT. NFT is a technology that can be applied across various industries, yet the tokens usually find their use in digitalizing various art forms, including paintings and music.

Despite many critics in the crypto community, the NFT industry continues to strengthen its position. Considering the current protracted bear cycle, its market cap exceeds $2 billion.

| Total Market Cap | Daily Sales Volume | Daily Total Sales |

| $2,355,654,303 | $2,984,183 | 1,096 |

How do NFTs work?

Most non-fungible tokens are issued on the Ethereum blockchain via smart contract technology. The ecosystem has developed a special NFT standard, ERC-721, which defines the minimum interface, including ownership details, security details, and metadata.

Even though the Ethereum standard offers liquidity and convenience, since most crypto platforms support it, it comes with a price. Gas fees during high network loads tend to skyrocket, making it hard for NFT buyers and sellers to transact. As a result, the industry started turning to Ethereum competitors with more favorable fee terms. Alternative blockchains for NFT include Solana, BNB, ImmutableX, and Tezos.

| Ethereum | Solana | ImmutableX | Ronin | BNB | Tezos | |

| Daily Sales Volume | ~$10 million | ~$1,3 million | ~$760 thousand | ~$150 thousand | ~$130 thousand | ~$55 thousand |

Ethereum standards

The most popular Ethereum network standards for non-fungible tokens are ERC-721 and ERC-1155. The former is usually used for NFT collections, while the latter is designed for issuing single tokens.

Since Ethereum developers rolled out ERC-721 in 2017 specifically for NFTs, it is aimed at registering copyright ownership. Another important feature is its ability to facilitate royalty payments associated with each token resale since the blockchain can record transaction history.

ERC-1155, on the other hand, is a universal token standard, which makes it compatible with both fungible and non-fungible assets. Moreover, it allows you to manage and transfer multiple tokens of different standards in a single transaction. There is a downside, though: ERC-1155 doesn’t allow recording transaction history. Moreover, the Ethereum blockchain is famous for its high, to say the least, gas fees during network congestion.

BNB Smart Chain standards

Binance blockchain offers two standards for issuing non-fungible tokens — BEP-721 and BEP-1155. Since the platform has a built-in Ethereum Virtual Machine, it makes BNB tokens interoperable with Ethereum. The only significant difference between ERC and BEP standards are fees and speed. With BNB, there is no need to wait for the block added to complete the transaction. As a result, BEP is usually faster and cheaper: the average fee is 20 cents.

Solana standard

Solana is often considered Ethereum’s competitor, as it brings lower fees and higher throughput. The ecosystem uses stateless smart contracts that allow nodes to confirm their validity without needing the storage of local validations. Solana supports on-chain governance, which is usually associated with a higher level of security. Moreover, it offers permanent decentralized storage for NFTs.

What about copyright and ownership?

Let’s start with the copyright, as this is crucial for NFT creators. Please note that copyright for the artwork does not usually apply to its digital form, as it is a piece of information on the blockchain. The law does not interpret this asset as an art piece.

As for the ownership side, it is most often managed through the unique ID and metadata of the token itself. Thus, transferring an asset to another wallet would equal giving ownership rights to another participant.

Still, most experts recommend creating an additional agreement to guarantee copyrights if such is needed. As for the ownership proof, the issue is often solved via special NFT licenses. Depending on the specifics of the NFT license agreement, the creator can prohibit certain actions, such as copying and distributing the artwork for further profit. Multiple online services can help you get a license for your non-fungible token, which is usually required to sell on popular marketplaces.

Why Do We Need NFTs, Exactly?

Non-fungible tokens primarily function as digitalized art, including collectibles, music, videos, etc. Although anyone can access and copy the art, NFTs offer individual ownership rights. For instance, anyone with a smartphone and internet access can download Claude Monet’s Pond with Water Lilies worth $80 million. Famous gallerists Josse and Gaston Bernheim will still own the picture, so downloading it won’t change a thing. Since NFTs have become a hyped trend, the technology started to spread across various industries:

Metaverses and blockchain gaming

In this case, non-fungible tokens are used to represent and provide ownership rights of almost any item in virtual reality — from real estate to boots and jeans. Did you know that the world-famous investment bank JP Morgan has already invested in the in-works metaverse Decentralend? The institution opened its first virtual branch, “Onyx Lounge.” You can also buy land on Decentraland via an NFT purchase on the OpenSea platform.

Non-fungible tokens are also widely used in blockchain gaming to represent game characters, their clothes, accessories, etc. For example, to start playing Axie Infinity, the most popular blockchain game, you first need to buy an Axie — a virtual character in the shape of an adorable pet.

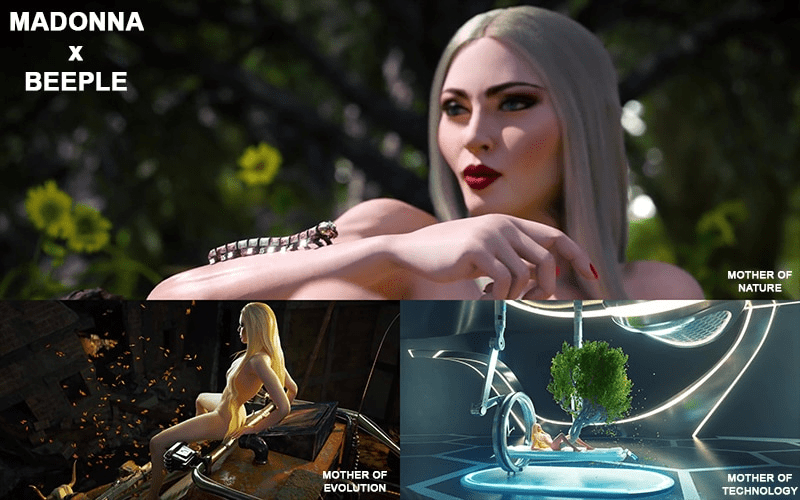

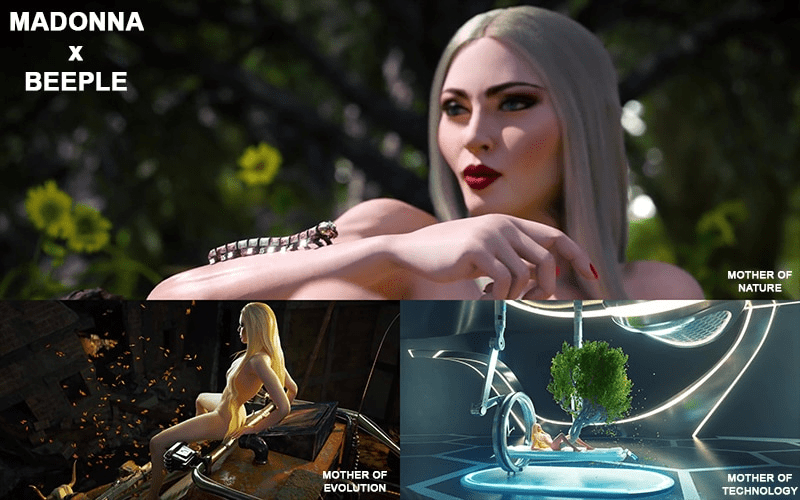

Celebrities and brands

One of the main reasons the NFT industry gets some backlash from crypto oldies is the influx of celebs and brands wishing to make a profit on their fans via non-fungible tokens. We have probably seen it all: Madonna’s NFT collection with her naked self to symbolize “Mother of Nature” or digital toilet paper with flowers worth $4,200 by Charmin.

The list of brands with their own NFT collections will be endless, but here are the loudest ones.

Adidas

In just 18 days, the NFT collection of Adidas, created in collaboration with Bored Ape Yacht Club, raised more than $22 million in sales. The total transaction volume is estimated at $175 million.

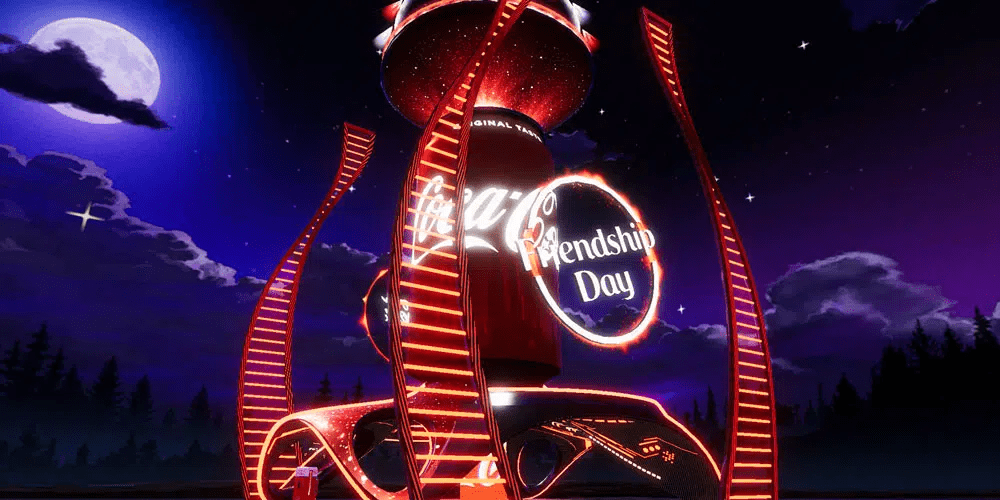

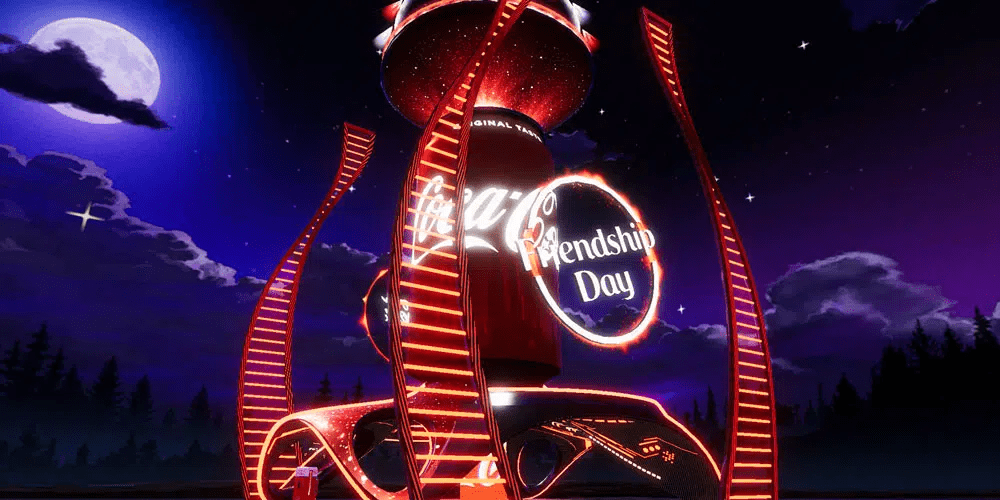

Coca-Cola

The NFT project of Coca-Cola, held in 2021 on OpenSea, fetched over $500,0000, while the proceeds were given to Special Olympics International. The auction was live for only 72 hours, and the company used the NFT collection for marketing purposes rather than profits.

Nike

Nike has made $185 million on NFTs, according to the latest estimates, which makes their non-fungible experience very successful. Brand fans can buy virtual sneakers as an NFT with various price tags. For instance, one pair of digital Nike’s was sold for $134,000. Currently, the brand’s virtual collections are available on the OpenSea platform.

| Total Transactions | Secondary Volume | Total Revenue | |

| Nike | 67, 251 | $1,3 billion | $185 million |

| Adidas | 51,449 | $175 million | $10,9 million |

| Coca-Cola | over 30,000 | $575 thousand |

Art and collectibles

Non-fungible tokens are the most convenient way of digitizing art that has gained immense popularity. Mike Winkelmann, the digital artist known as Beeple, has sold his collage Everydays: The First 5000 Days in the form of NFT for $69 million at Christie’s.

Snoop Dog went even further and created the first NFT music label, The Death Row Records that releases songs via non-fungible token technology.

Generative art NFT

This is a new but popular approach that involves creating an art piece as a non-fungible token with the help of programming algorithms. Typically, a creator generates a set of images and adds specific rules to the code. Then, the computer algorithm automatically creates the artwork by randomly combining the images or patterns by the pre-defined rules.

What makes generative art NFTs attractive is the level of uniqueness in each minted token. It also involves an element of surprise, as the creator does not know what the result will look like. This means the algorithm can randomly produce colors, patterns, and shapes that transform into artistically pleasing digital artwork.

Even though such pieces have no famous artist’s name behind them, their cost sometimes reaches hundreds of thousands of dollars. Take a look at the NFTs by Art Works, one of the most successful projects in the industry, with a total sales volume of over $994 million. The tokens are created on the Ethereum blockchain and look like abstract art pieces.

Another example of a thriving generative NFT project is an independent artist Zancan, who creates his works using a self-made “Grass.js” algorithm. It generates an image from dozens of simple elements: flowers, blades of grass, and monoliths. Then the program superimposes them on top of each other while the rendering process is visible during the animation.

Zancan releases his NFT tokens on the Tezos blockchain, which is often considered a cheaper Ethereum alternative. The total transaction volume with the artist’s collections amounted to 1.16 million XTZ or $1,5 million at the current exchange rate.

Social Media Platforms Join the NFT Rush: Meta, Twitter, Spotify

Since social media platforms are used by millions of content creators worldwide, it is only natural that industry giants have committed to integrating NFT features into their systems.

Instagram, being a part of the Meta ecosystem, first rolled out the NFT functionality in May 2022 to the US users, allowing them to connect their crypto wallets to the account and showcase their collection of tokens. The project was then expanded to 100 countries across Africa, Asia-Pacific, and the Middle East. In September 2022, Facebook also added the ability to share NFT tokens in the feed.

Twitter also integrated NFTs in January 2022 with the new profile-picture feature. Users can now link their Ethereum-based wallets to Twitter accounts and display non-fungible tokens as their profile pictures. This feature comes with a $2.99 fee, though.

Spotify, the music streaming giant, has recently joined the NFT rush and began the closed testing of new features in May 2022. Spotify users should be able to display their digital artworks via their profiles soon.

How to Get NFTs: Top Marketplaces

Modern NFT platforms allow users worldwide to buy, sell, and even create nun-fungible tokens. We have prepared a list of top marketplaces worth considering.

All platforms require a crypto wallet to store your NFT tokens. There are plenty of options, the most popular being MetaMask, Ronin, Trust Wallet, and Coinbase Wallet.

OpenSea

Created in 2017, OpenSea has grown to become the largest NFT platform with over 2 million collections and over 80 million non-fungible tokens. The most used cryptocurrencies are ETH, SOL, and USDC. OpenSea offers an intuitive interface, making it quite convenient for beginners. Moreover, the website features extensive guides on all platform’s features, including the creation of NFT tokens.

Rarible

This platform offers collectibles as non-fungible tokens, including paintings and video game assets. Its significant advantage is a fiat gateway, which allows you to buy tokens via a bank card. Rarible also provides functionality for creating your own NFTs on various blockchains: Ethereum, Solana, Tezos, Flow, and Polygon.

Larva Labs/CryptoPunks

This is an NFT-platform slash collection, as it only allows you to buy one collection — CryptoPunks. LarvaLabs ecosystem offers 10,000 unique collectible characters with proof of ownership stored on the Ethereum blockchain. The current price floor of CryptoPunks is 65 ETH or over $70 thousand. The most expensive CryptoPunk #7523 was sold for $11,8 million.

objkt.com

Objkt NFT marketplace was designed to facilitate sales of the digital art created on the Tezos blockchain. Users can always find top deals and top sellers’ info on the project’s main page, updated in real-time. The price of top Tezos NFT digital art reaches 7,000 XTZ or over $9,000 at the current rate. The platform supports multiple Tezos wallets, including Naan, Kukai, and Spire. As for fees, Objkt only charges a successful transaction fee of 2,5% for NFT auctions.

Can one make money on NFTs?

Yes. Content creators from all over the globe digitalize their artworks and sell them in the form of NFTs. In this regard, the opportunities are limitless — just choose one of the platforms listed above, create the NFT and bid it on the marketplace. Yet, while the competition is very high, you would need to promote your brand and artwork via media and social networks to make a substantial profit.

You can also use non-fungible tokens as an investment tool: you buy a promising token, wait several years and then sell it at a higher price. Yet, this would require fundamental analysis in case you want to buy a platform NFT or an understanding of the art world to identify good collectibles.