PayPal to launch its own stablecoin for crypto payments; Justin Sun speaks out on Huobi bankruptcy rumors; UAE signs deal with Venom Foundation to reduce carbon emissions

Payment giant PayPal also included stablecoin in crypto payments. PayPal, which has been providing crypto payment services for a long time, is preparing to issue a stablecoin.

The California-based payment company announced on August 7 that it will issue a stablecoin called PayPal USD (PYUSD). PayPal stated that PayPal USD will be issued by Paxos and will be fully backed by US dollar deposits, short-term treasury bonds and similar cash equivalents.

PayPal is preparing to meet its customers with PYUSD

It was reported that PYSUD, launched as a stablecoin pegged to the dollar, will be gradually made available, primarily to US customers.

PayPal, which is gradually expanding its payment range, is preparing to allow its customers to transfer instantly and at lower costs without a centralized intermediary. In addition, PayPal President Dan Schulman’s addition of a new option to payments is said to be one of the company’s efforts to consolidate its dominance in digital payments.

As it is known, PayPal was planning to launch its stablecoin PYUSD last February. However, due to regulatory sanctions on the crypto industry in the US, the company suspended its stablecoin efforts.

Now, Jose Fernandez da Ponte, the head of PayPal’s blockchain and digital currencies team, said that the regulatory environment in the US has started to gain more clarity. Fernandez da Ponte also pointed out that the crypto market needs an alternative to stablecoins.

Justin Sun speaks out on Huobi bankruptcy rumors

Last weekend, crypto exchange Huobi was rocked by rumors that Chinese regulators were investigating the exchange’s executives and fears of possible bankruptcy.

The rumors about the exchange’s executives and bankruptcy caused huge outflows on Huobi. Huobi recorded a total of $64 million in outflows over the past weekend.

Amid the ongoing rumors, the total value locked (TVL) on the exchange fell from 3.09 last month to $2.5 billion in August.

Rumors have been circulating in the industry recently that Huobi executives were arrested in China on August 4. Speculation was that the exchange was under scrutiny for its association with gambling platforms.

However, there are claims that Huobi may be facing financial problems. Fintech executive and angel investor Adam Cochran pointed out some inconsistencies in the exchange’s Tether (USDT) holdings.

According to published on-chain data, the exchange had less than $90 million in assets on August 5. Merkle Tree Audit, however, claims to hold $630 million in USDT. Cochran argued that this means Huobi may be insolvent. The expert suggested that the exchange may not have enough funds to meet its obligations.

Justin Sun breaks his silence

Following the recent spikes in Huobi and speculation that the exchange is going bankrupt, Justin Sun broke his silence and dismissed the rumors as FUD.

UAE signs deal with Venom Foundation to reduce carbon emissions

The United Arab Emirates Ministry of Climate Change and Environment (MCCE) is developing a carbon credit system with Industrial Innovation Group and Venom Foundation.

Countries are using blockchain to track carbon credits. Because the data recorded on the chain cannot change, the credits are completely transparent for all parties involved.

This allows government organizations, such as the MCCE in the UAE, to issue credits to businesses. Credit holders can spend the credits, which allow them to emit a certain amount of carbon, or sell and swap them to other entities looking to offset their own emissions.

UAE leaders recently announced a shift in policy on climate change. The country’s goal is to achieve carbon neutrality by 2050.

Mariam Al Mheiri, UAE Minister of Climate Change and Environment, says the move is a positive update to reduce carbon emissions.

The UAE believes it can make a difference in this area. With the third update, we have pledged to reduce emissions by 40%. Our previous commitment was 9%.

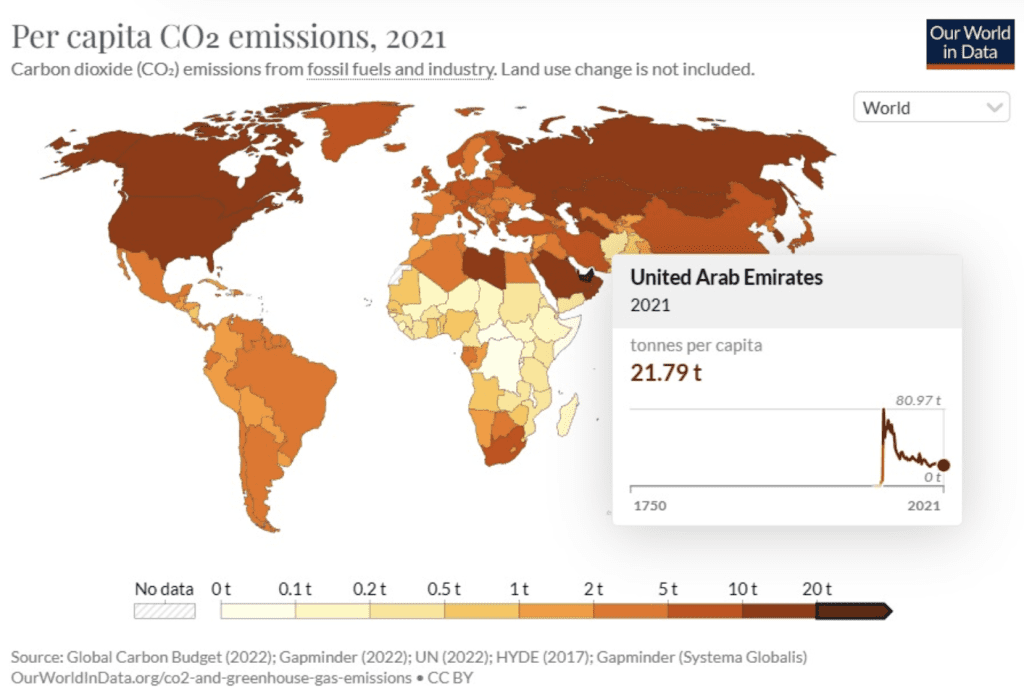

While the UAE ranks 33rd globally in terms of total emissions, analysis from the same report shows it ranks sixth per capita globally based on 2020 data.