Tether announces $1.48 billion net profit; Binance’s crypto market share fell; Bitcoin trading at DBS Bank increased by 80 percent.

Stablecoin issuer Tether has announced a $1.48 billion net profit. This statement of the company shows that there has been a double profit increase compared to the previous quarter.

Tether’s statement included the following statements:

“Tether’s reserves increased by $1.48 billion in the first quarter of 2023, reaching an all-time high of $2.44 billion.”

The company stated that its net profit of $ 1.48 billion was the result of the trust of its customers. Noting that the amount of USDT in circulation increased by 20%, Tether stated that they approached the future with a very optimistic point of view.

Noting that the majority of investments (about 85%) are in cash and similar deposits, Tether emphasized that the company’s reserves continue to be extremely liquid.

Tether stated that only 2% of its reserves are in Bitcoin, while 4% is gold and Tether reported that its consolidated total assets stood at $81 billion.

Tether CTO Paolo Ardoino used the following statements on the subject:

“Our reserves have reached an all-time high of $2.44 billion and we are excited about the tremendous success we achieved in the first quarter of the year.

Our net profit for the quarter was $1.48 billion. We continue to monitor the risk-adjusted returns of all assets in our portfolio on an ongoing basis. As the overall economic environment changes and the market cycle progresses, we expect more changes to be made.”

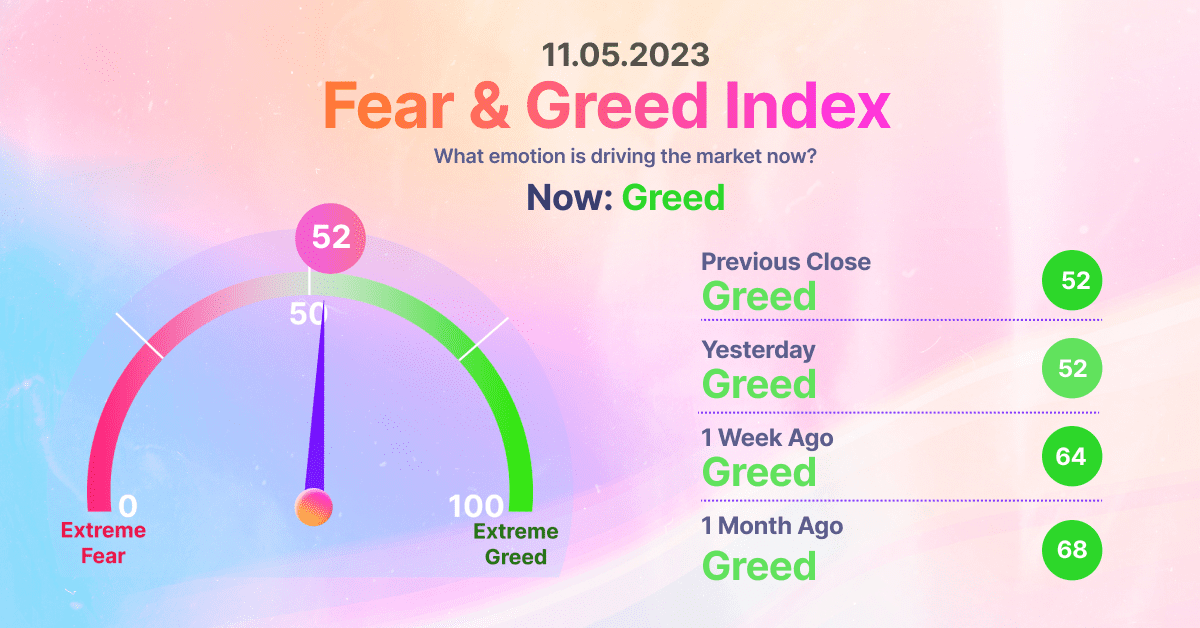

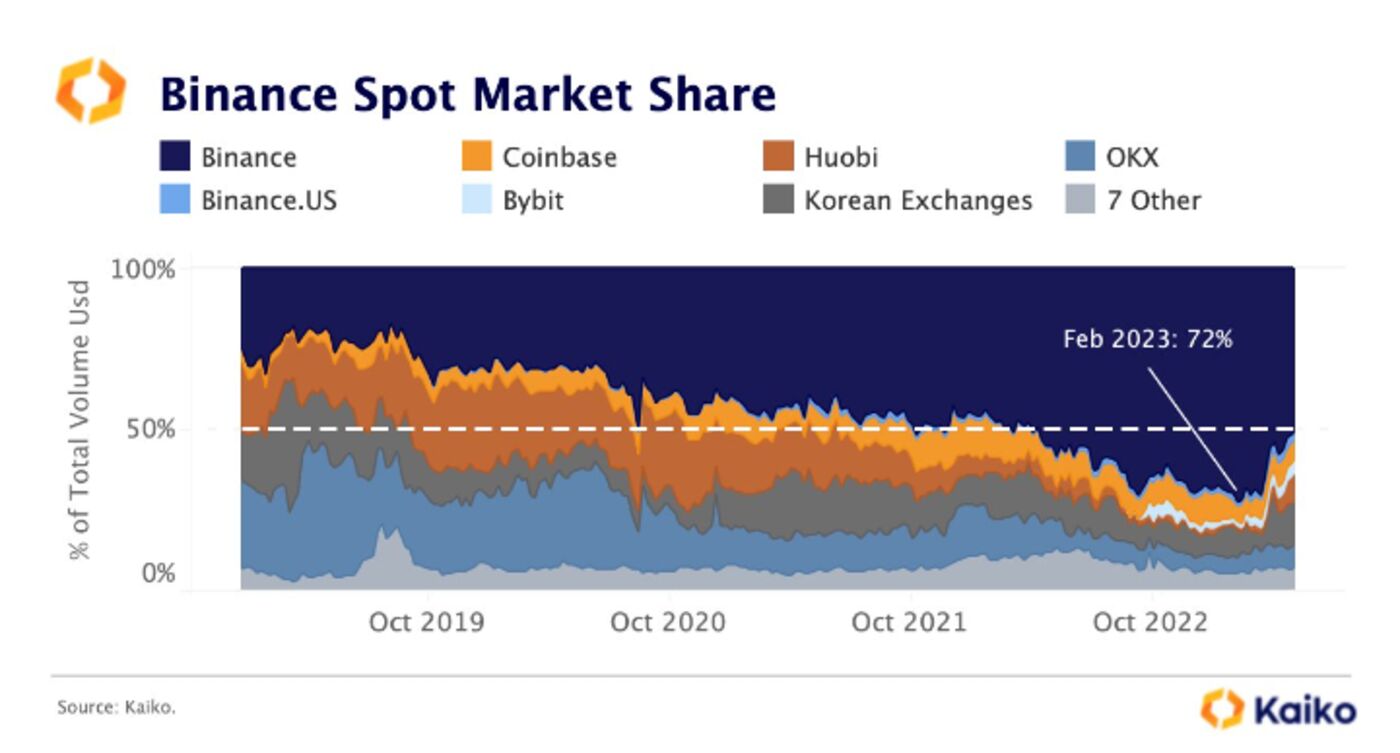

Binance’s crypto market share fell

According to Kaiko analyst Dessislava Ianeva, the world’s largest cryptocurrency exchange currently holds about 50% of the spot market share.

Binance’s market share fell after it removed zero-fee trading on some trading pairs in March.

Spot trading volume dropped

According to data from CCData, Binance’s market share has dropped to levels before FTX’s collapse. Spot trading volume on the stock market also fell by 48% in April and fell to $287 billion. This was recorded as the 2nd lowest monthly trading volume since 2021.

Binance has not made a statement on the matter.

The collapse of FTX last November led some to Binance, while others completely disconnected from centralized cryptocurrency exchanges.

In March, the U.S. Commodity Futures Trading Commission sued Binance for offering derivatives products unregistered to U.S. customers. Binance has denied these claims.

Bitcoin liquidity on Binance has also dropped noticeably in recent months.

Bitcoin trading at DBS Bank increased by 80 percent

Singapore government-owned giant bank DBS is one of the few companies worldwide to benefit significantly from the massive cryptocurrency crashes of 2022.

DBS Digital Exchange, DBS Bank’s institutional crypto trading platform, experienced a significant surge in Bitcoin (BTC) trading volume last year. According to Lionel Lim, CEO of DBS Digital Exchange, the number of crypto clients of DBS doubled in 2022 from the previous year.

Saying that the increase in demand for crypto services on DBS Digital Exchange is a result of the crypto exchange crashes in 2022, Lim noted that DBS continues to see an increasing trend in volumes.

Evy Theunis, head of digital assets at DBS Bank, also said that DBS has received more collaboration requests from digital asset and blockchain companies in recent months.

Launched in 2020, DBS’s cryptocurrency exchange only serves institutional investors. According to Lim, although it planned to serve retail customers last year, DBS continues to serve institutional investors as a members-only exchange as of May 2023.

Lim said that:

“Some of our market makers are looking for new USD banking tracks after the collapse of crypto-friendly US banks,” he said. However, he noted that DBS has no direct impact on the crypto exchange:

“The collapse of the US banks did not affect our product and service pipeline. However, we are following these developments closely and are prepared to change our plans if necessary.”