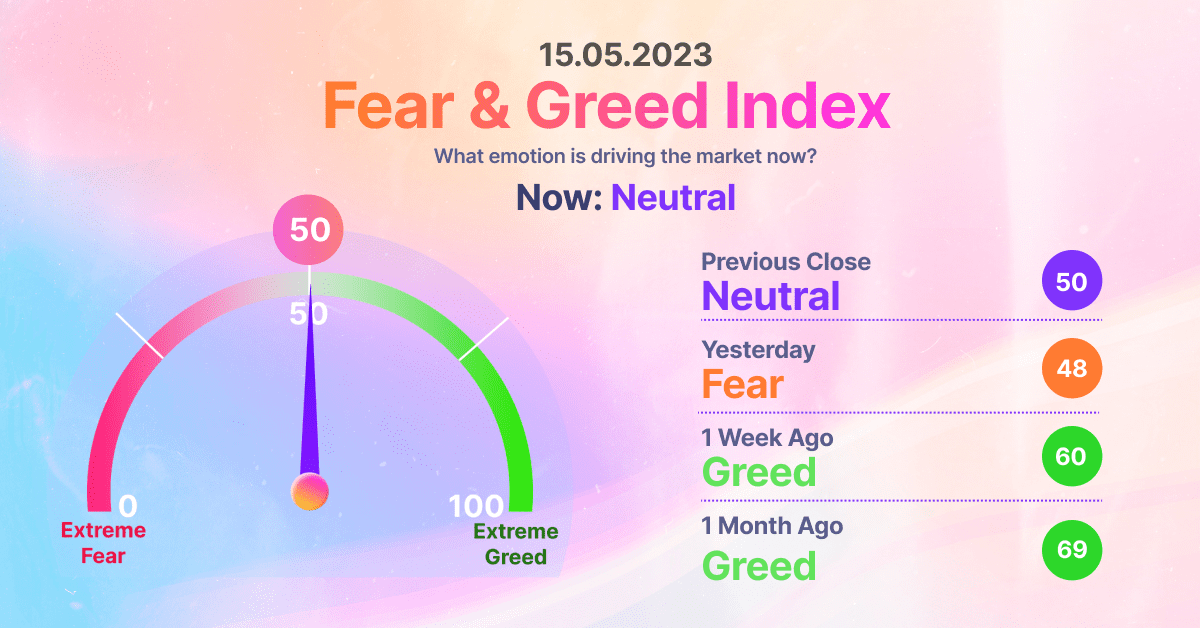

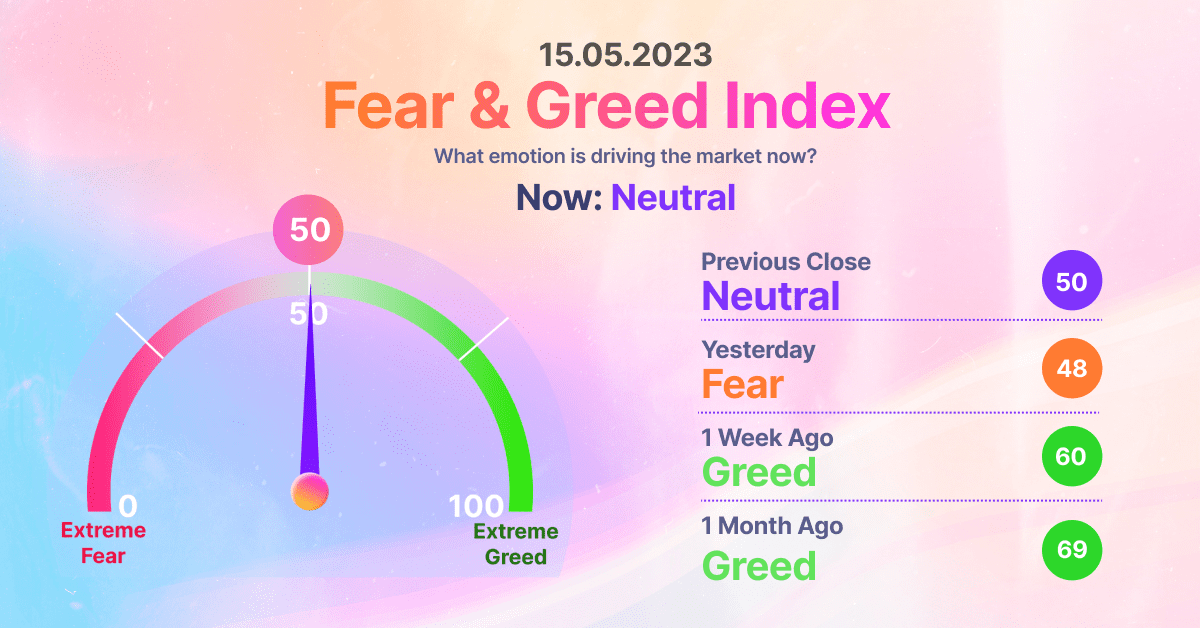

The number of BTC wallets holding 1 Bitcoin has reached one million; Binance’s market share volume fell, while its rivals OKX and Huobi increased trading volumes; LG Electronics files patent for TV with NFT content

The number of Bitcoin wallet addresses holding exactly 1 Bitcoin (BTC) and more has exceeded one million.

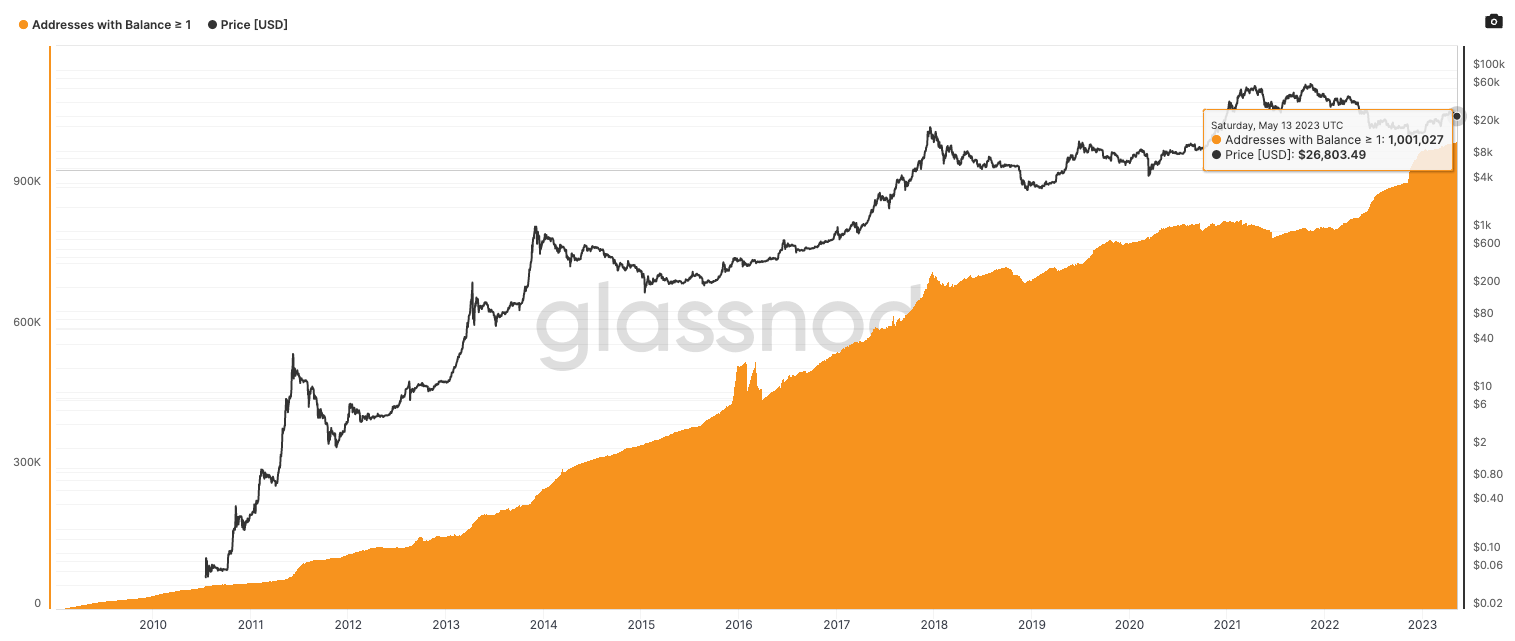

According to data from on-chain analytics company Glassnode, the number of Bitcoin addresses holding at least one full BTC reached 1 million as of May 13.

The BTC price has lost more than 65 percent over the past year. This has led to an increase in Bitcoin wallet addresses holding at least 1 BTC. The number of wallet addresses holding 1 or more BTC occurred mostly in June 2022 and when the FTX exchange crashed.

As it is known, Bitcoin reached its all-time high in November 2021. Starting to decline from this level, BTC reached a total of 190,000 wholecoins as of early February 2022.

The number of Bitcoin wallets holding at least 1 BTC reached 1 million, breaking records. However, a Bitcoin wallet address does not always represent a single person.

Many crypto investors have multiple Bitcoin addresses, and other addresses are owned by large institutions such as cryptocurrency exchanges and investment companies that often hold large amounts of Bitcoin.

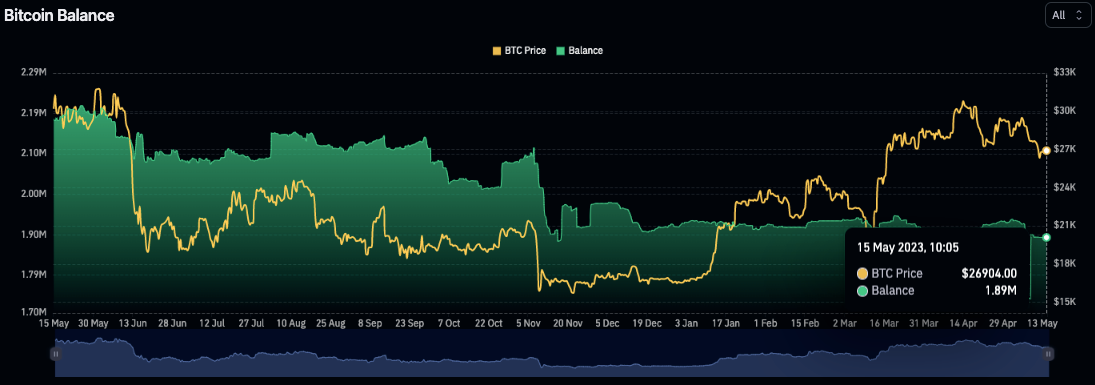

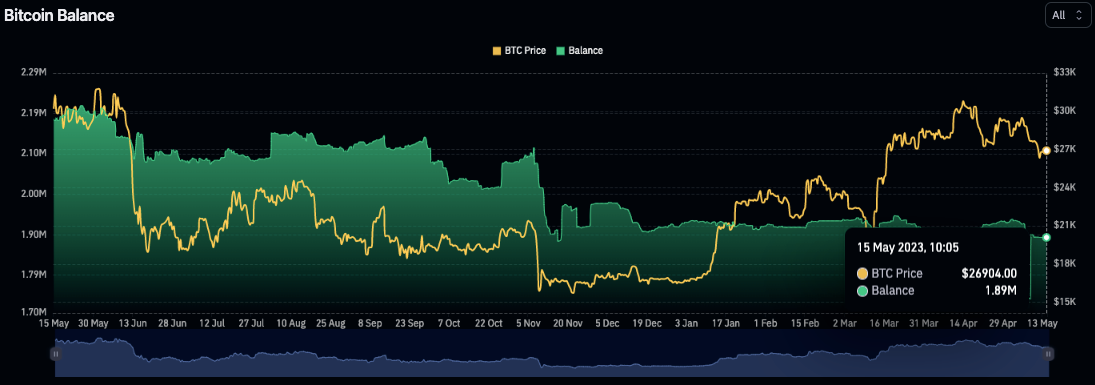

According to data from crypto analytics company CoinGlass, of the approximately 19 million Bitcoins currently in circulation, 1.89 million worth $50.7 billion are held on major centralized exchanges such as Binance and Coinbase.

On the other hand, according to Glassnode’s estimates, 3 million BTC, worth $80.4 and making up 17 percent of the total circulating supply, are also lost forever.

Binance’s market share volume fell, while its rivals OKX and Huobi increased trading volumes

Binance’s recent problems with the US Securities and Exchange Commission (SEC) cause it to lose own reputation. Binance, the world’s largest crypto exchange in terms of trading volume, has begun to lose its crypto dominance.

As it is known, Binance has recently removed the zero transaction fee application applied in transactions. According to data released by research firm Kaiko, crypto exchanges Huobi and OKX have taken a step forward as Binance continues to lose crypto dominance.

As is known, Binance’s share of spot trading volumes was around 73 percent. With the stock market officially removing the zero transaction fee application on March 22, this rate decreased as of May 6 and retreated to 51 percent.

Meanwhile, Huobi’s spot trading volumes increased from 2 percent to 10 percent, while OKX’s volumes increased from 2 percent to 9 percent. According to Kaiko data, the share of South Korean platforms also increased from 8 percent to almost 14 percent.

Crypto exchange Binance and its CEO, Changpeng Zhao, are going through tough times due to regulatory pressures in the US.

As it is known, Binance CEO made statements that customer funds are safe after every trouble the stock market faced. However, it can be said that the trust in the crypto money market is still not restored with the collapse of the FTX exchange last year.

LG Electronics files patent for TV with NFT content

South Korean tech company LG Electronics has filed a patent for a blockchain-based Smart TV that will allow users to trade NFT.

According to LG’s statement, this technology allows devices to connect to a crypto wallet and NFT marketplace to enable transactions. Users can process transactions through a cryptocurrency wallet when the device is connected to an NFT server.

The app follows the launch of LG’s own NFT platform last September. Based on Hedera, LG Art Lab Marketplace will enable NFT trading on TVs running WebOS 5.0 or later.

It is also unclear whether the TV will integrate with different wallets or be limited to LG’s smartphone crypto wallet Wallypto, which is also present on the Art Lab Marketplace.

LG uses a number of Web3 solutions on its devices. In January, the company announced a partnership with cloud-based technology platforms Oorbit and Pixelynx to bring the metaverse directly to audiences’ living rooms. The collaboration will allow customers to explore interconnected virtual worlds, concerts and multiplayer games through their LG TVs.

LG isn’t the only big tech company working to integrate Web3 products. Last year, Samsung also announced a smart TV series with NFT integration. The company also actively invests in NFT and metaverse projects.