The US-based Bittrex exchange has filed for bankruptcy; Bank of Canada consults citizens for CBDC; Ethereum whales are panic selling.

Cryptocurrency exchange Bittrex has filed for Chapter 11 bankruptcy, Bloomberg reported.

The cryptocurrency exchange, which was accused of violating securities laws by the US Securities and Exchange Commission (SEC), filed for bankruptcy about a month after this development.

In its section 11 petition, the exchange documented assets and liabilities totaling $1 billion. According to the documents submitted to the court, the subsidiaries Desolation Holdings LLC, Bittrex Malta Holdings Ltd. and Bittrex Malta Ltd. are also insolvent.

Bittrex, in its statement regarding the bankruptcy filing, emphasized that the development concerns only the USA, and Bittrex Global users will not be affected by this.

Bittrex is on SEC’s target

The SEC stated a few weeks ago that Bittrex broke the law from 2017 to 2022, generating $1.3 billion in revenue. The regulator claimed that the cryptocurrency exchange violated the law more than once by not registering as a broker and exchange. Bittrex opposed these claims of the SEC

The company had previously announced that it would end its operations in the United States.

Gary Gensler, head of the Securities and Exchange Commission, used the following statements regarding the lawsuit filed against Bittrex:

“Our action today demonstrates once again that the crypto industry suffers not from a lack of regulatory clarity, but from a lack of regulatory compliance.

As we reported in our complaint, Bittrex and its employees knew the rules that applied to it. However, the exchange has taken extra effort to evade the rules by directing companies applying to list their tokens to examine these assets.”

Bank of Canada consults citizens for CBDC

The Bank of Canada (BoC) has launched public consultations on the availability of the potential digital Canadian dollar.

Public consultations initiated by the central bank are expected to continue until May 19.

Carolyn Rogers, Deputy Governor of the Bank of Canada, made statements on the subject. Rogers stated that it will also allow the holding of elections with security and reliability. The priority of the public consultation that will take place will be to look at what Canadians care most about in the creation of the digital dollar.

However, the bank stated that it has not yet started work on a central bank digital currency (CBDC).

“A digital Canadian dollar is not needed at this time. The decision to issue a digital currency rests with Parliament and the Government of Canada.”

The bank also added that if a CBDC is issued, physical notes will be available to those who want it.

Canadian citizens surveyed for potential CBDC

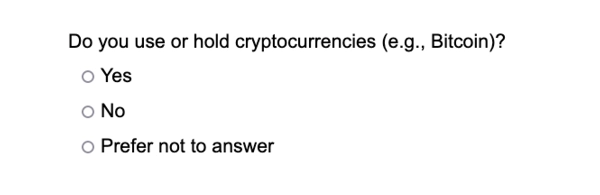

In the surveys, Canadian citizens were asked about the payment methods they used in the last month. Canadians also answered questions about how often CBDC would potentially be used and what features they would like to see in the survey.

In addition, the survey included a series of demographic questions about the gender, age, education and income of the citizens.

Finally, the BoC announced that it will publish the report of the survey results this year.

Ethereum whales are panic selling

Ethereum whales are showing signs of panic following the sale of key assets by both Vitalik Buterin and the Ethereum Foundation. Recently, two notable Ethereum whales sent a total of 19,090 ETH worth approximately $35.7 million to Uniswap after the Ethereum Foundation sent 15,000 ETH ($29.7 million) to Kraken. These significant sales have created shock waves throughout the Ethereum community and are causing concern among investors.

Whales selling Ethereum and its impact on ETH price

The increasing selling pressure had a significant impact on Ethereum’s price, dropping from $1,900 to $1,850 within hours after the surge in selling activity. As a result, ETH is currently consolidating around the 50-day moving average, causing uncertainty and speculation among investors.

The recent actions of Vitalik Buterin and the Ethereum Foundation have raised questions about the future of Ethereum and the effects of such large-scale sales on the market.

Some analysts argue that the sell-off could be a response to the recent rally of memecoins in the cryptocurrency market. In any case, the panic among Ethereum whales reveals the vulnerability of the market to the actions of influential individuals and organizations.

It’s not the first time that the Ethereum Foundation’s actions have caused market volatility. The last time the Ethereum Foundation sold its assets, the industry entered a protracted bear market that it hasn’t been able to get out until now.