According to a new report from blockchain analytics firm Chainalysis, the US accounted for over $1 trillion in crypto value received from July 2022 to June 2023.

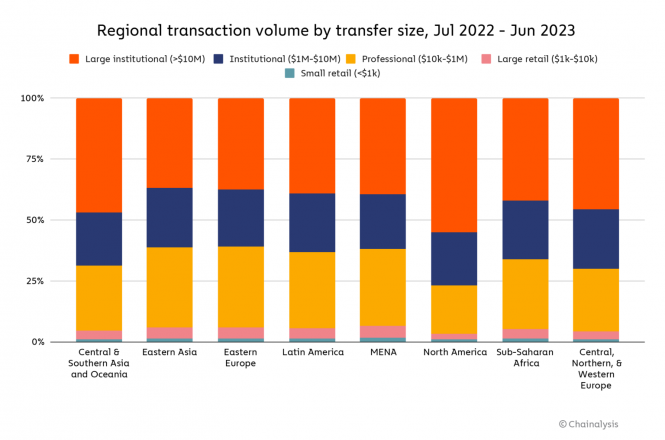

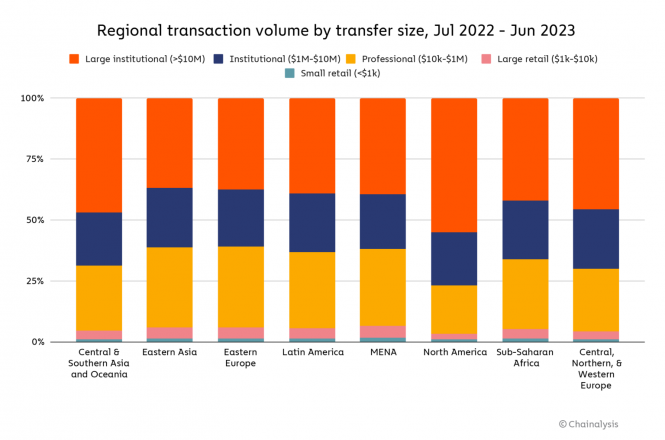

North America accounts for roughly 25% of all global crypto transaction volume from July 2022 to June 2023 – the most of any region studied. This equates to an estimated $1.2 trillion worth of crypto received over the past year.

“Most of this activity is driven by the United States, which ranks first overall worldwide,”

The Chainalysis team.

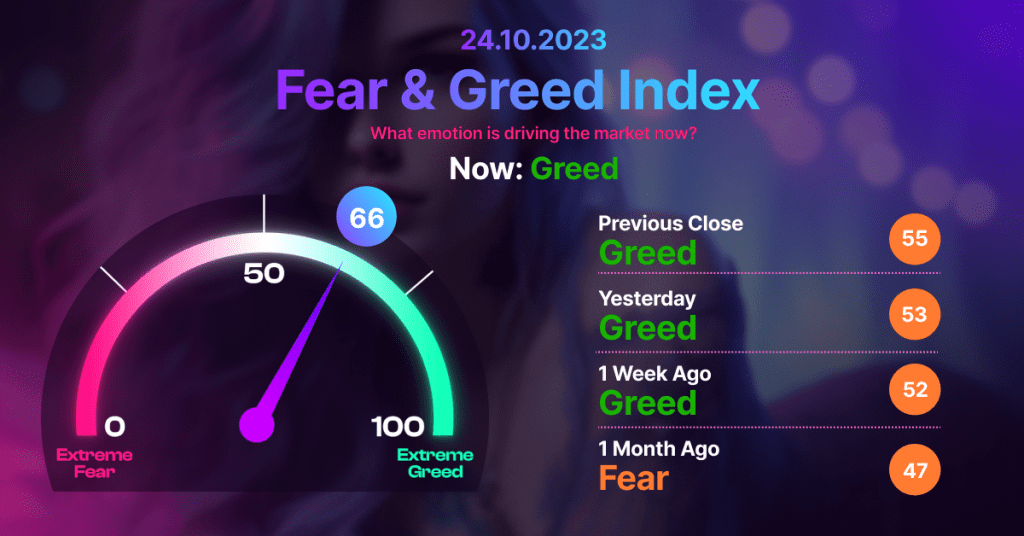

According to Chainalysis, North America’s crypto market is more institutional than other regions. Over 75% of crypto transfers in North America are valued at over $1 million, versus other regions that see more retail participation.

At the same time, the report showed that US dominance has relatively declined over the past year amid the crypto winter. Transaction volumes and stablecoin usage are down across North America and much of the world following the collapse of Silicon Valley Bank in March.

While adoption has slowed, Chainalysis believes comprehensive regulation can help recreate favorable conditions for growth in the US. The analytics firm advises policymakers to balance protecting consumers and encouraging further innovation.

Worldcoin Foundation Will Start Paying Orb Operators in WLD Instead of USDC

The Worldcoin Foundation has disclosed plans to compensate orb operators with WLD tokens rather than USDC stablecoins for scanning individuals into the Worldcoin network.

According to the Worldcoin Foundation, “more than 800,000 new and existing Orb-verified users have claimed around 34M WLD in free user grants.” The switch is expected to be completed by next month.

The foundation also provided an update on the WLD token circulation supply, which has topped 1% of the total supply of 10 billion tokens. Out of the approximately 134 million WLD tokens released, 100 million were given as loans to market makers, while the remaining 34.3 million were distributed as grants to users and orb operators. With the initial loan to market makers set to expire, the foundation has extended the loan to Dec. 15, 2023 while reducing the loan amount to 75M WLD.

Despite initial operational difficulties, Worldcoin’s token grants are growing steadily after an initial phase of enthusiastic adoption.

Safereum Devs Reportedly Unlock and Dump Native Token

The crypto community has been left fearing the worst after seeing huge sums of liquidity drained from the cryptocurrency project Safereum just hours after its team finalized a massive $600,000 fundraising.

According to blockchain security firm CertiK and other analysts, the developers of Safereum — use the token deployment address “safereum.eth” — unlocked the supply of the token and dumped more than 600 Ether worth of its holdings, causing the price of the Safereum (SAFEREUM) token to plunge more than 94%.

The so-called rug pull came after the team finalized a fund raise of approximately $600,000 for a derivative token called “Safepad.” These funds are understood to have constituted part of the total stolen sum, which totaled roughly 720 ETH, worth $1.27 million at current prices.