In Todays Headline TV CryptoDaily News:

USDT stablecoin market share rises to highest in 15 months.

The dominance of Tether’s USDT is rising among stablecoins amid an ongoing shakeup of the $136 billion stablecoin market. USDT’s market share among stablecoins surpassed 54%, making it the largest market share Tether’s stablecoin has reached since late November 2021.

Internal documents reveal Australia’s potential timeline for crypto legislation.

Crypto legislation in Australia could be dragged out past 2024 and beyond, with the government seemingly wanting to take its time in order to get a full picture of the industry, internal documents from the government have revealed.

TeraWulf starts nuclear-powered Bitcoin mining.

TeraWulf has begun operations at its Nautilus Cryptomine facility – the first nuclear-powered bitcoin mining facility in the U.S. – with nearly 8,000 mining rigs online representing computing power, or hashrate, of about 1.0 exahash per second.

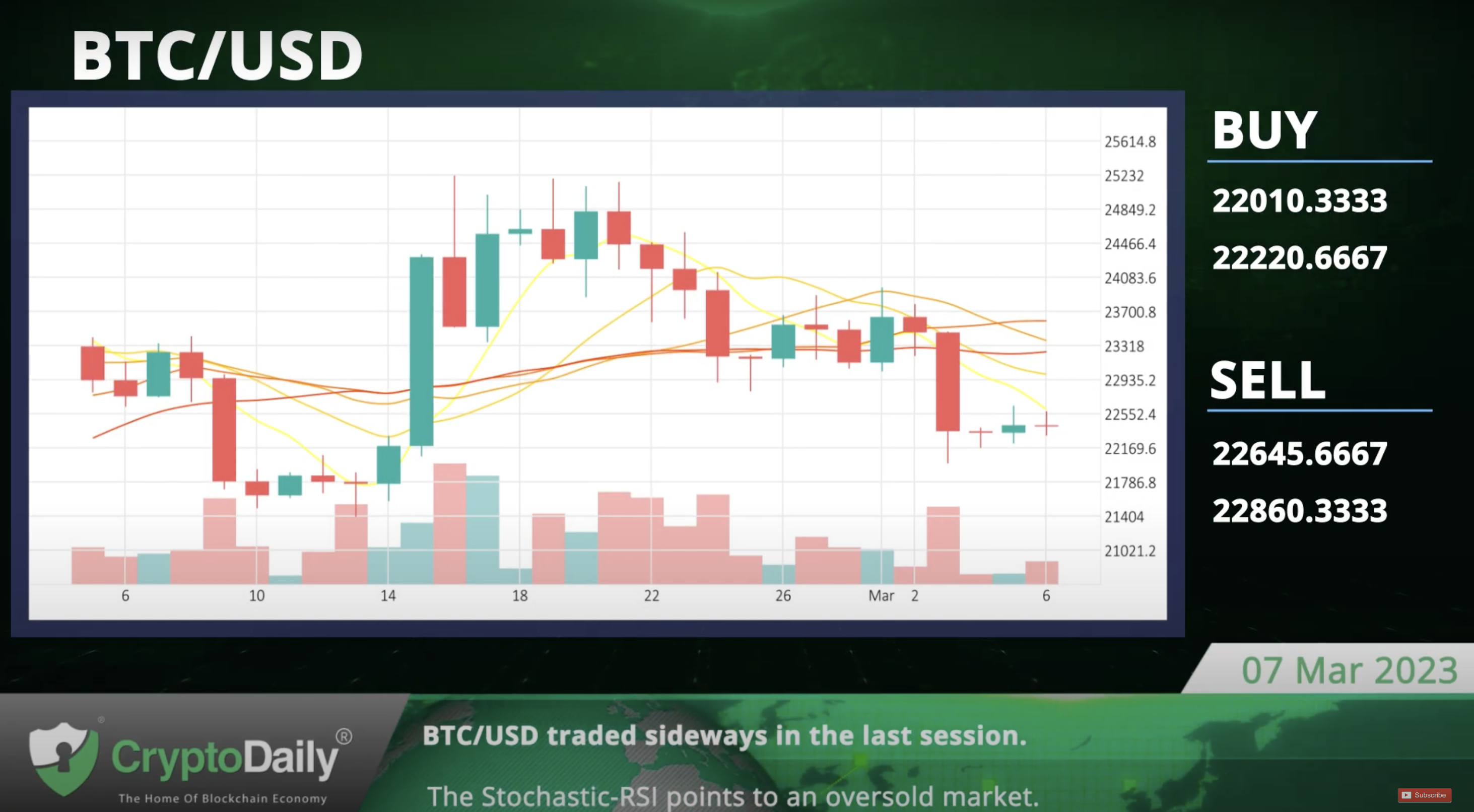

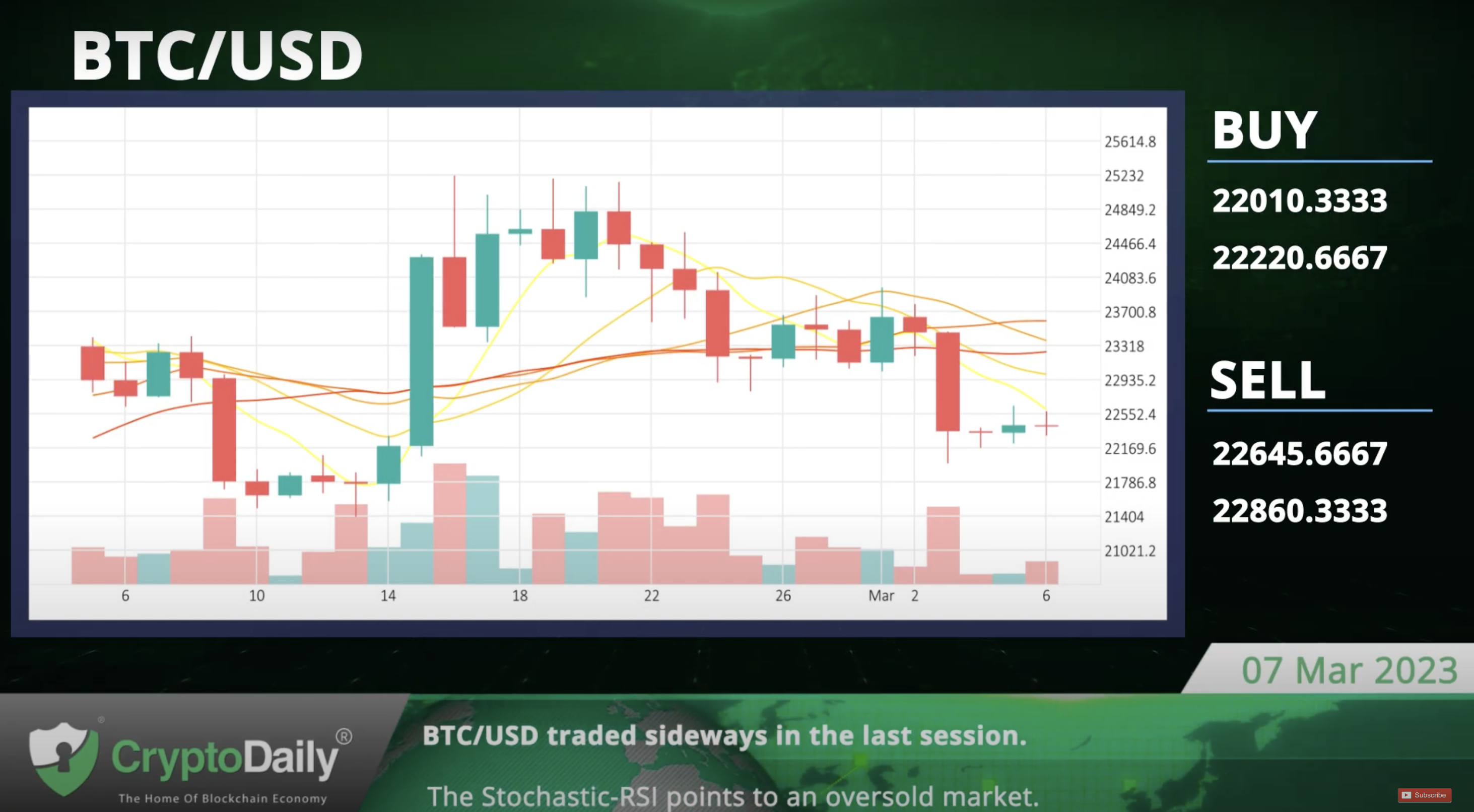

BTC/USD traded sideways in the last session.

The Bitcoin-Dollar pair traded sideways in the last session. According to the Stochastic-RSI, we are in an oversold market. Support is at 22010.3333 and resistance at 22860.3333.

The Stochastic-RSI points to an oversold market.

ETH/USD saw a minor rise of 0.2% in the last session.

The Ethereum-Dollar pair rose 0.2% in the last session after gaining as much as 1.0% during the session. The MACD is giving a negative signal. Support is at 1538.6067 and resistance at 1600.8667.

The MACD is currently in the negative zone.

XRP/USD exploded 1.2% in the last session.

The Ripple-Dollar pair skyrocketed 1.2% in the last session. The Williams indicator is giving a positive signal. Support is at 0.358 and resistance at 0.3816.

The Williams indicator is currently in the positive zone.

LTC/USD dove 2.4% in the last session.

The Litecoin-Dollar pair dove 2.4% in the last session. The Stochastic indicator is giving a positive signal. Support is at 87.7433 and resistance at 92.8233.

The Stochastic indicator is giving a positive signal.

Daily Economic Calendar:

US 3-Year Note Auction

The note auction sets the yield on the notes auctioned off by US Department of Treasury. The yield on the notes represents the return an investor will receive by holding the bond until maturity. The US 3-Year Note Auction will be released at 18:00 GMT, the US Redbook Index at 13:55 GMT, Australia’s RBA Interest Rate Decision at 03:30 GMT.

US Redbook Index

The Johnson Redbook Index measures the year-over-year same-store sales growth from a sample of large general merchandise retailers.

AU RBA Interest Rate Decision

The RBA Interest Rate Decision is announced by the Reserve Bank of Australia. The interest rates are a key mechanism through which the central bank influences inflation.

JP Trade Balance

The Trade Balance is the total difference between exports and imports of goods and services. A positive value shows a trade surplus, while a negative value represents a trade deficit. Japan’s Trade Balance will be released at 23:50 GMT, the UK’s BRC Like-For-Like Retail Sales at 00:01 GMT, and Germany’s Factory Orders at 07:00 GMT.

UK BRC Like-For-Like Retail Sales

The British Retail Consortium Like-For-Like Retail Sales measures changes in the actual value of retail sales from participating companies with invaluable management information on a regular and reliable basis.

DE Factory Orders

The Factory Orders is a measure of the total orders of durable and non durable goods which can offer insight into inflation and growth in the manufacturing sector.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.