US Department of Justice asks Binance for $4 billion; Bitcoin transaction fees overtake Ethereum; Apple sued for blocking crypto payment technology

US Department of Justice seeks $4 billion from Binance

Ongoing negotiations between the U.S. Department of Justice and Binance include the resolution of several charges against Changpeng Zhao, as well as the possibility that he could face criminal charges in the country.

Although CZ currently lives in the United Arab Emirates, which does not have an extradition treaty with the US, this does not prevent him from voluntarily coming to the US.

According to Bloomberg, sources said that although the situation is uncertain at the moment, an announcement could come at the end of the month.

It was claimed that Binance would pay over $ 4 billion under a potential deal.

How this fine will affect the crypto sector?

Sources emphasized that the agreement could have negative consequences for the crypto industry and crypto investors and that the aim is to establish a balance in which Binance can continue its activities.

If Binance and the Department of Justice reach a deferred prosecution agreement, the Ministry will not initiate an investigation as long as the company fulfils conditions, including accepting a detailed statement of facts in which the company admits its wrongdoing.

Another source said the Justice Department is investigating Binance for sanctions violations against Iran and Russia. In addition, it was stated that Binance is under scrutiny due to an issue related to the financing of Hamas.

Whether other Binance executives other than CZ will be prosecuted in the case

Bitcoin transaction fees overtake Ethereum

The average daily transaction fees on the Bitcoin network have taken the throne of the Ethereum network with the Ordinals craze on the Bitcoin network.

According to BitInfoChart data, the average transaction fee on the Bitcoin network was $10.34 on 20 November, while transaction fees on the Ethereum network hovered around $8.43 on average.

The transaction fee on the Bitcoin network reached a six-month high of $18.67 on 16 November, while the transaction fee on the Ethereum network was $7.90.

The spike in Bitcoin transaction fees was driven by the excitement created by the Ordinals Protocol, a tool that allows the creation of nonfungible tokens (NFT)-like assets and BRC-20 tokens on the Bitcoin network.

According to Dune Analytics data, after a lull in activity between 25 September and 23 October, Ordinals-based assets have increased significantly since the end of October.

More than 6 million Ordinal assets have been created since 24 October, resulting in more than 800 BTC in transaction fees paid, with a total value of close to $30 million.

With the listing of ORDI, the second largest BRC-20 token by market capitalization, on Binance on 7 November, the increase in Ordinal writing activities increased further. After the listing, the ORDI token price increased by more than 50 per cent during the day, encouraging investors to buy more BRC-20 tokens.

Apple sued for blocking crypto payment technology

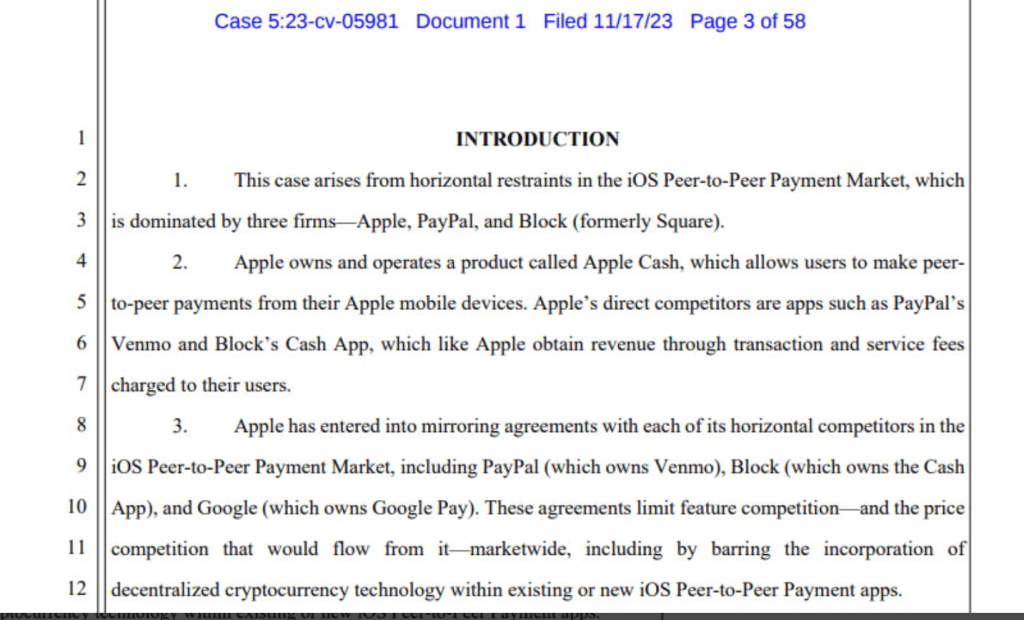

Dissatisfied with the status quo, consumers filed a class action lawsuit against Apple, alleging that the tech giant conspired to limit peer-to-peer payment options on their devices and block crypto payment technology from iOS payment apps.

Filed on 17 November in California District Court, the lawsuit alleged that Apple entered into anti-competitive agreements with PayPal Venmo and Block Cash App to restrict the use of decentralised cryptocurrency technology in payments, causing users to pay “skyrocketing fees”.

“These agreements prevent the inclusion of decentralized cryptocurrency technology in existing or new iOS Peer-to-Peer Payment applications, limiting feature competition and resulting price competition across the market,” the filing said.

The plaintiffs also alleged that Apple imposed:

“technology and contractual restrictions”, including hardware-mandated App Store monopolies and “contractual limitations on web browser technology” to “exert unlimited control over every app installed and run on iPhones and iPads”.

The users emphasised that with these restrictions, Apple could force, and has already forced, newly released iOS P2P payment apps to block crypto as a condition of entry.

The plaintiffs identified themselves as customers who were forced to pay inflated fees due to restrictions in Apple’s iOS P2P payment system.

The plaintiffs sought damages for the inflated fees paid as a result of Apple’s alleged anticompetitive behaviour and injunctions preventing the company from continuing to enter into and enforce anticompetitive agreements that restrict competitors and new entrants in the iOS P2P Payment Market.

In April, the Ninth Circuit Court of Appeals ruled that Apple had violated California competition laws by preventing its users from accessing payment solutions not affiliated with Apple.