In Todays Headline TV CryptoDaily News:

Sam Bankman-Fried seeks to keep Robinhood shares.

Ex-CEO of FTX, Sam Bankman-Fried, aka SBF, argued in his 5th January court filing that he should retain control of his Robinhood shares worth around $450 million.

U.S. subpoenas hedge funds in probe of Binance.

Federal prosecutors are examining American hedge funds’ dealings with cryptocurrency exchange Binance as part of a long-running investigation into potential violations of money-laundering rules at one of the world’s leading crypto companies.

Crypto bank Juno chooses Zero Hash as new custodian.

Crypto bank Juno has chosen Zero Hash to serve as its new crypto custodian, the company announced in a blog post. The news follows Juno’s warning last week advising clients to self-custody or sell their own crypto amid reports of its former custodian Wyre’s turmoil.

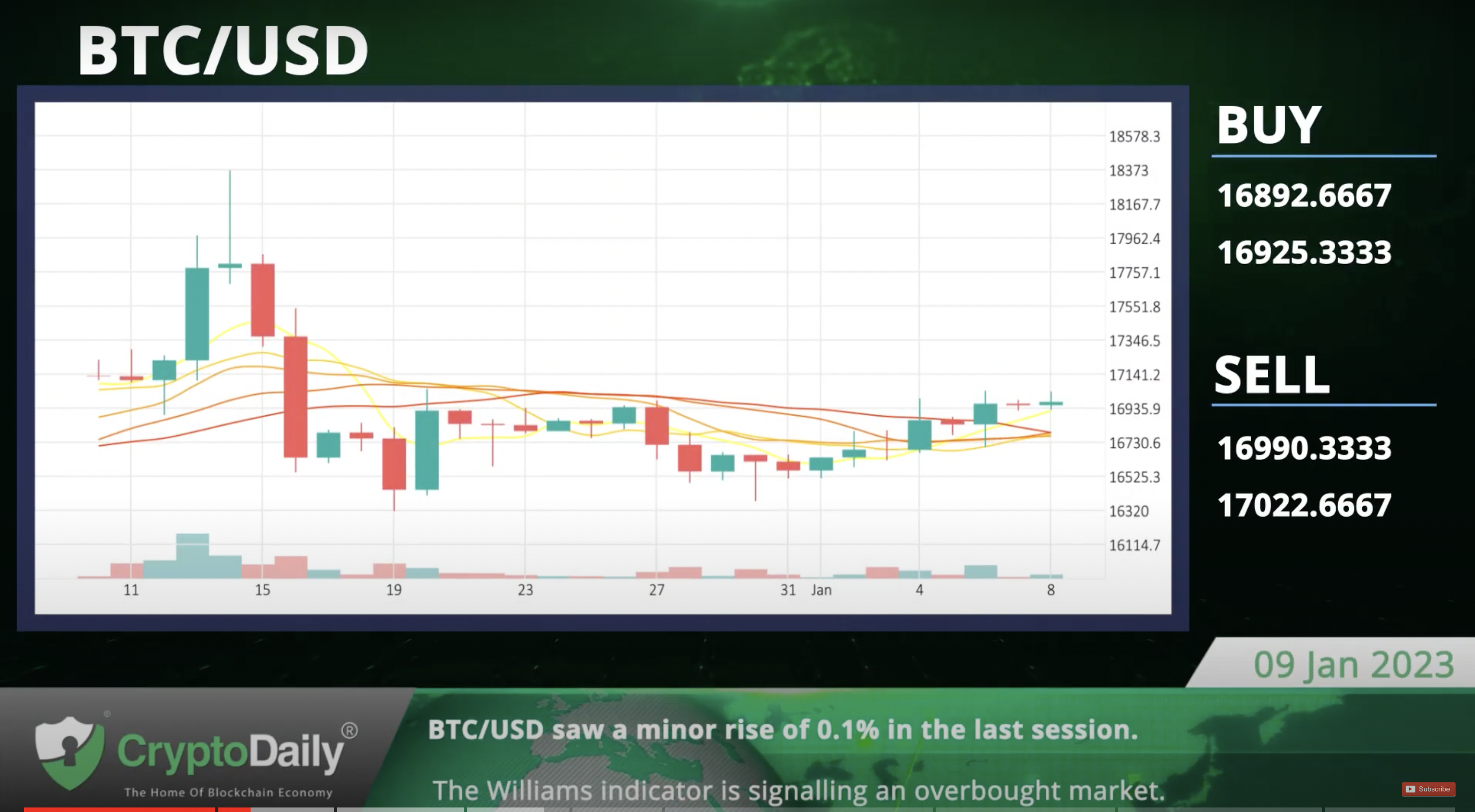

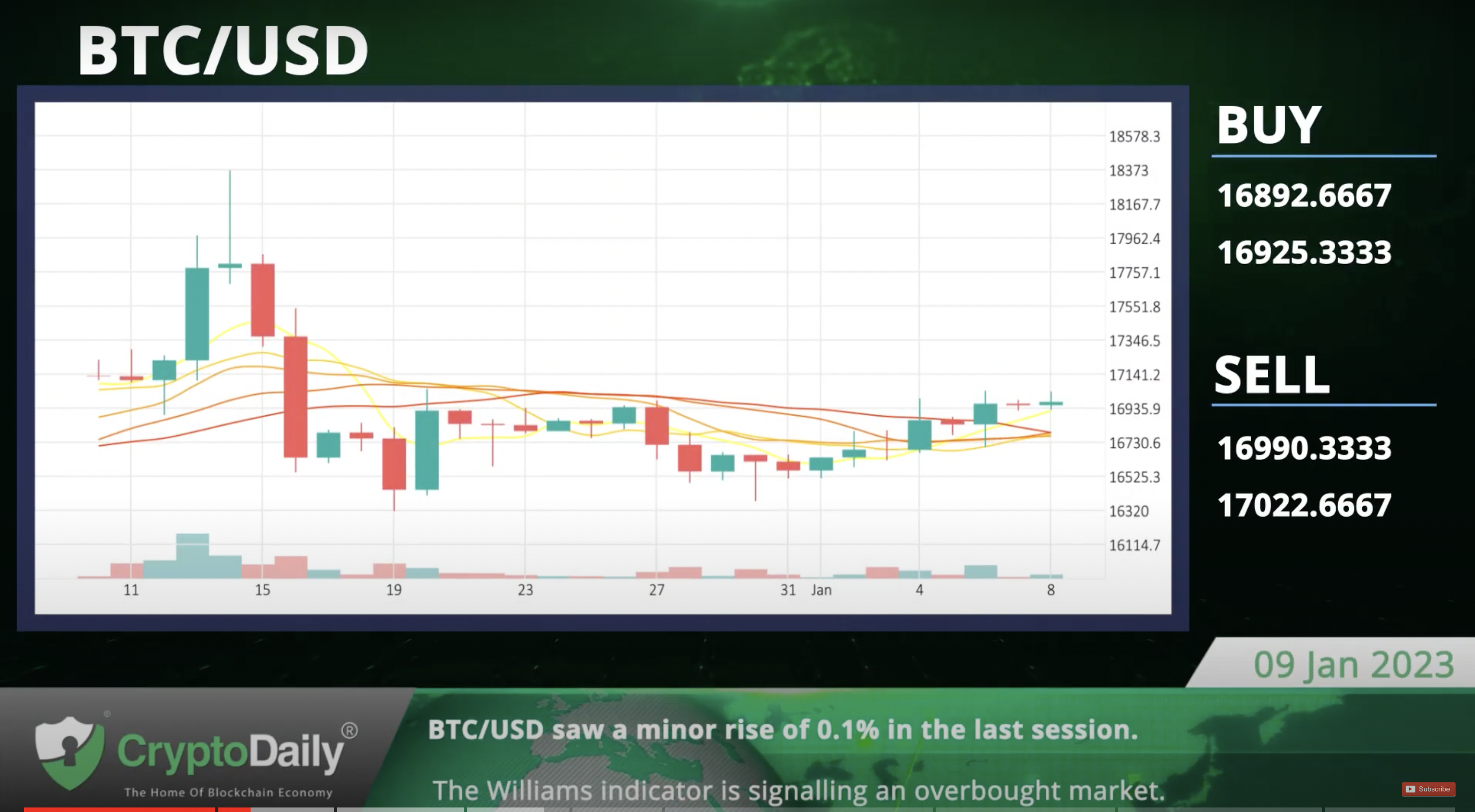

BTC/USD saw a minor rise of 0.1% in the last session.

The Bitcoin-Dollar pair made a minor upwards correction in the last session, rising 0.1%. The Williams indicator indicates an overbought market. Support is at 16892.6667 and resistance at 17022.6667.

The Williams indicator is signalling an overbought market.

ETH/USD rose 0.5% in the last session.

The last session saw the Ethereum rise 0.5% against the Dollar. The MACD is giving a positive signal, which matches our overall technical analysis. Support is at 1255.8867 and resistance at 1274.9667.

The MACD is currently in the positive zone.

The last session saw XRP drop 0.8% against USD.

The Ripple-Dollar pair fell 0.8% in the last session. The Stochastic indicator is giving a positive signal. Support is at 0.3397 and resistance at 0.3478.

The Stochastic indicator is currently in the positive zone.

LTC/USD traded sideways in the last session.

The Litecoin-Dollar price remained largely unchanged in the last session. The ROC is giving a negative signal. Support is at 75.0667 and resistance at 77.3067.

The ROC is giving a negative signal.

Daily Economic Calendar:

US 6-Month Bill Auction

The auction sets the average yield on the bills auctioned by US Department of Treasury. Treasury bills are short-term securities maturing in one year or less. The yield on the bills represents the return an investor will receive. The US 6-Month Bill Auction will be released at 16:30 GMT, the Eurozone’s Unemployment Rate at 10:00 GMT, Japan’s Tokyo Consumer Price Index at 23:30 GMT.

EMU Unemployment Rate

The Unemployment Rate measures the percentage of unemployed people in the country. A high percentage indicates weakness in the labor market.

JP Tokyo Consumer Price Index

The Tokyo Consumer Price Index released by the Statistics Bureau is a measure of price movements obtained from the retail prices of a representative shopping basket of goods and services.

JP Overall Household Spending

The Overall Household Spending is an indicator that measures the total expenditures of households. The level of spending can be used as an indicator of consumer optimism. Japan’s Overall Household Spending will be released at 23:30 GMT, the French Current Account at 07:45 GMT, and the US 3-Month Bill Auction at 16:30 GMT.

FR Current Account

The Current Account measures net flow of current transactions, including goods, services and interest payments into and out of the local economy.

US 3-Month Bill Auction

Treasury bills are short-term securities maturing in one year or less. The yield on the bills represents the return an investor will receive by holding the bond until maturity.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.