The crypto market spreads way beyond Bitcoin and Ethereum —- since 2008, new financial instruments and features have flooded the industry, making cryptocurrencies more convenient for the end user. One such tool is wrapped tokens that enable the seamless inter-blockchain trading of popular assets. Let’s discover:

- what is the technology behind wrapped tokens;

- how are they used in the current market;

- what are the potential risks of such assets;

What Are Wrapped Tokens?

A wrapped token is a “copy” of a crypto asset issued on another blockchain on the security of the original coin. This type of token is backed by the underlying asset in a ratio of 1:1, has the same price, and allows you to expand the transaction possibilities.

For example, you want to trade Bitcoin on the Ethereum network, but the original coins do not provide such a possibility. The two blockchains cannot simply communicate with each other, as these are two separate blockchains. Only the Bitcoin network knows how much BTC an address holds and vice versa.

That’s where wrapped tokens come in, enabling effective transfers of the value of a native asset from one blockchain to another blockchain. To some extent, we can compare such tokens to stablecoins, as their price is also pegged 1-to-1 to a base asset.

Take Wrapped Bitcoin (WBTC) —- its price is the same as Bitcoin’s, but the token is issued on multiple blockchains, including Ethereum and Tron. As a result, it becomes easier to move WBTC than the original coin, provided that the liquidity is sufficient.

How Wrapped Tokens Work?

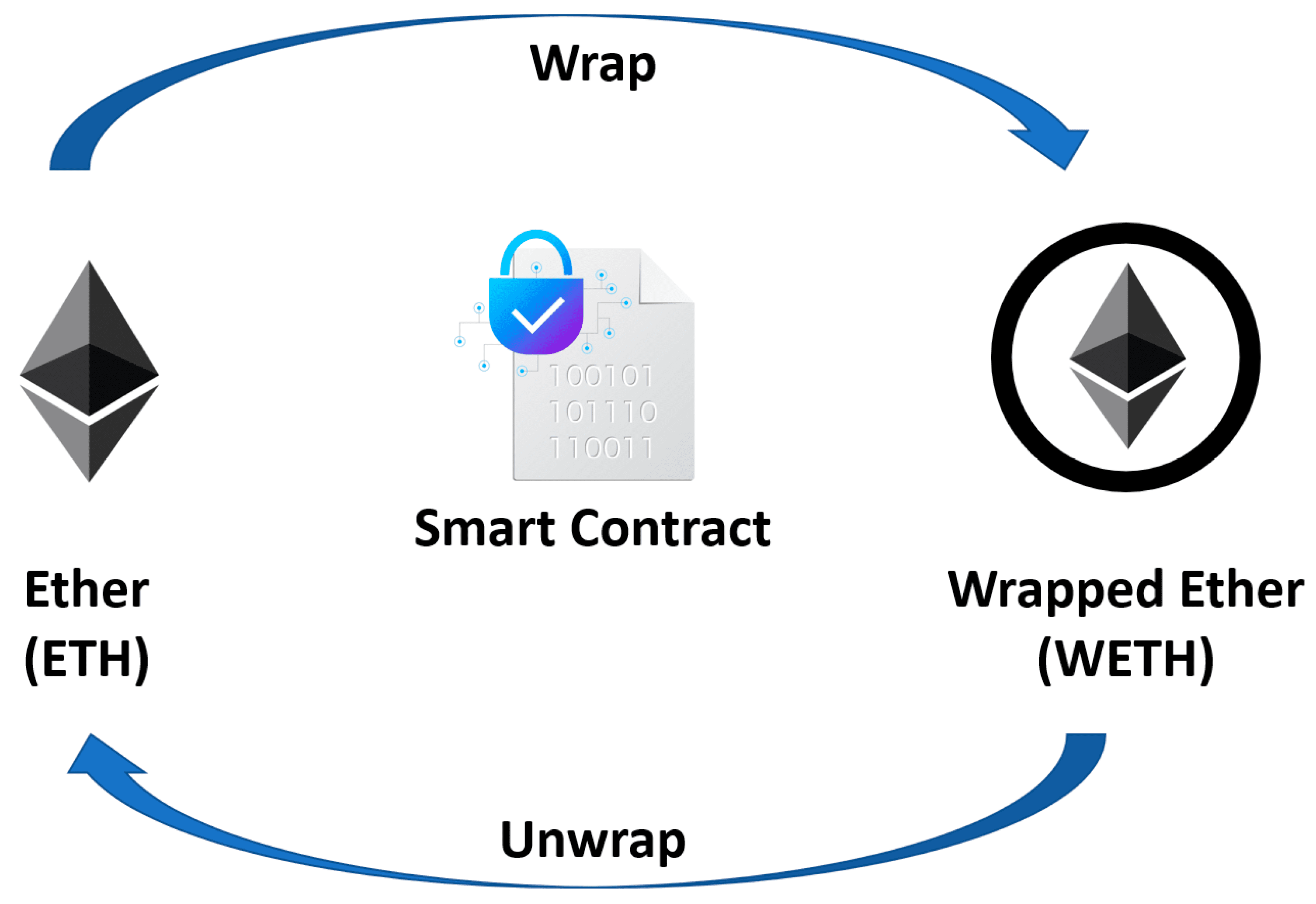

It’s not only the peg to the base asset that makes wrapped tokens efficient. It’s the technology behind it. When it comes to the emission and circulation of such assets, the “minting” and “burning” processes apply.

Minting or Wrapping:

- The original asset is sent to the custodian’s crypto vault.

- Once the coins are locked, an equivalent amount of wrapped tokens are created.

Burning or Unwrapping:

- The wrapped tokens are removed from circulation.

- The equivalent amount of the original asset is released into the market.

As you can see, the functioning of such assets usually requires a custodian — a crypto platform that stores the underlying coins and issues wrapped tokens. Find a visual representation of how the process works below on the example of Wrapped Ether.

Why Do We Need Wrapped Tokens?

The main benefit of WT technology is cross-chain communication. It allows the market participants to move crypto assets between different blockchains quickly and, as a result, facilitates the connection of otherwise isolated liquidity.

Moreover, it allows one to trade such cryptocurrencies as Bitcoin faster and cheaper —- as you know, the confirmation time in the BTC network can reach hours, while fees tend to skyrocket during the high load. In addition, wrapped tokens can be used as s security for crypto loans: this mechanic is often used by lending platforms across the industry.

Are There Any Risks to Wrapped Tokens?

Investing in the wrapped tokens requires placing trust in the chosen custodian, as it will store and manage your original coins. We urge you to do your own research and choose only time-proven, reliable platforms.

You also need to be aware that DeFi platforms have recently experienced a few significant hacks, meaning you have to pay extra attention to security. For instance, the Wormhole bridge, which uses wrapped tokens technology to facilitate cross-chain communication, lost $323 million due to the hack.

Top Wrapped Tokens

| Cryptocurrency | Market Cap | Daily volume |

| Wrapped Bitcoin (WBTC) | ~$4 billion | ~$160 million |

| renBTC (RENBTC) | ~$40 million | ~$7 million |

Due to the current protracted bear cycle, the trading volumes in the crypto sector have significantly decreased, which also impacted the most popular wrapped tokens. Still, two main assets maintained their user base despite the drawdowns.

Wrapped Bitcoin (WBTC)

WBTC is an ERC-20 token backed by the first cryptocurrency in a 1:1 ratio. The project was launched by Kyber Network, Ren, and BitGo, with dozens of partners, including Compound, Maker, Blockfolio, Uniswap, CoinGecko, Aave, and 0x. The companies above are certified merchants who can issue WBTC for verified users and burn tokens.

The user requests tokens from the merchant to get Wrapped Bitcoin, while the latter verifies their identity under KYC/AML procedures. After that, the custodian receives the original coins, while the user gets his WBTC.

The tokens are available on various exchanges, including Uniswap, providing liquidity to the ecosystem and allowing community members to move and exchange their wrapped cryptocurrencies quickly. Anyone can also check the info on the WBTC reserves via the Proof of Assets page on the project website.

renBTC (RENBTC)

RenBTC is an ERC-20 token that is part of the Ren Protocol project, allowing market participants to trade BTC on Ethereum in a more decentralized manner than WBTC. It uses the open RenVM protocol, enabling the exchange of assets on various blockchains using RenBridge. In addition to Bitcoin, the protocol supports Bitcoin Cash, Zcash, and other coins.

RenVM is based on a network of decentralized nodes (Darknodes) and the Byzantine Fault Tolerance algorithm. The system does not require AML/KYC procedures for issuing tokens. renBTC is available on multiple platforms, such as Curve Finance, Uniswap, Solidity, etc.

Are Wrapped Tokens Good Investment?

As you know, we don’t give trading advice and urge you to DYOR before investing in any asset. Still, it is worth noting that wrapped tokens have gained quite a popularity during the last bull run, proving an efficient way of exchanging top assets while saving on time and costs. Check out this asset class if you are building up your crypto portfolio.